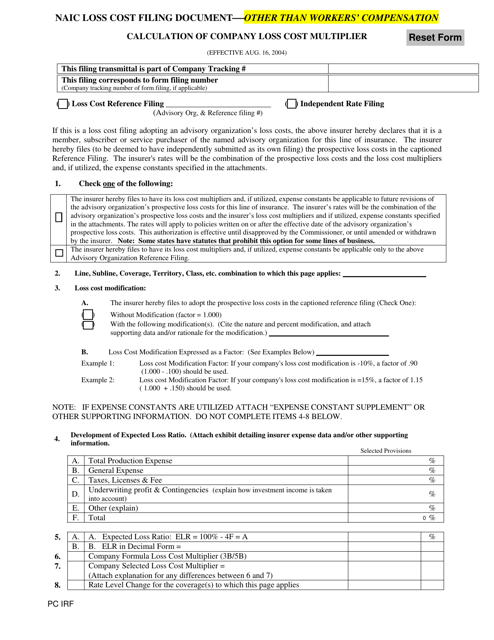

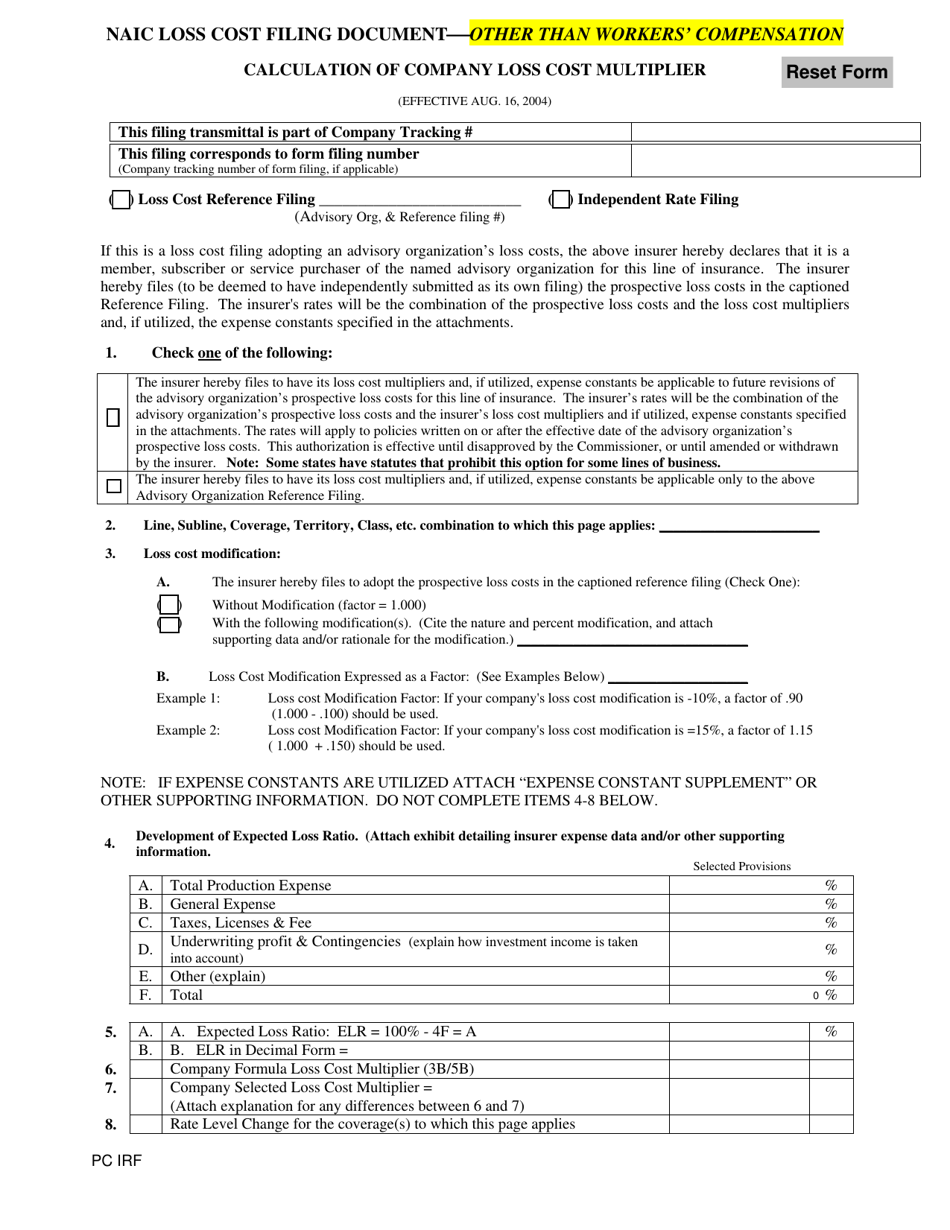

Naic Loss Cost Filing Document - Other Than Workers' Compensation Calculation of Company Loss Cost Multiplier

Naic Loss Cost Filing Document - Other Than Workers' Compensation Calculation of Company Loss Cost Multiplier is a 1-page legal document that was released by the National Association of Insurance Commissioners on August 16, 2004 and used nation-wide.

FAQ

Q: What is a Loss Cost Filing Document?

A: A Loss Cost Filing Document is a document submitted by insurance companies to regulatory authorities that includes information on the calculation of insurance rates.

Q: What does 'Other Than Workers' Compensation' mean?

A: 'Other Than Workers' Compensation' refers to insurance policies that cover risks other than injuries or illnesses that occur in the workplace.

Q: What is the Company Loss Cost Multiplier?

A: The Company Loss Cost Multiplier is a factor applied to the loss costs to determine the final insurance premium. It takes into account the company's historical losses and other risk factors.

Q: How is the Company Loss Cost Multiplier calculated?

A: The Company Loss Cost Multiplier is calculated by dividing the company's actual losses by the expected losses for a given period.

Q: What is the purpose of calculating the Company Loss Cost Multiplier?

A: The purpose of calculating the Company Loss Cost Multiplier is to adjust the loss costs based on the company's specific risk profile and past loss history.

Q: Who reviews the Loss Cost Filing Document?

A: The Loss Cost Filing Document is typically reviewed by regulatory authorities to ensure that the rates are fair and reasonable.

Q: Why is the Loss Cost Filing Document important?

A: The Loss Cost Filing Document is important as it ensures that insurance rates are calculated accurately and fairly for policyholders.

Q: Are Loss Cost Filings specific to the United States and Canada?

A: Yes, Loss Cost Filings are specific to the United States and Canada as insurance regulations vary by country.

Q: Can the Company Loss Cost Multiplier change over time?

A: Yes, the Company Loss Cost Multiplier can change over time based on changes in the company's loss experience and other risk factors.

Q: What are some other factors that may affect insurance rates?

A: Other factors that may affect insurance rates include the type of coverage, policy limits, deductible amounts, and the company's overall financial stability.

Form Details:

- The latest edition currently provided by the National Association of Insurance Commissioners;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.