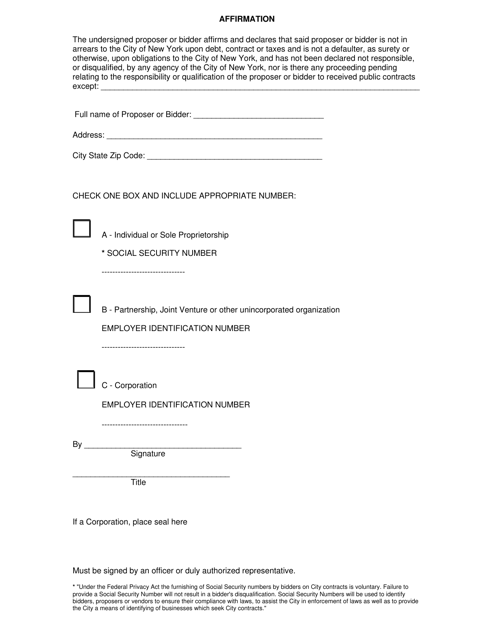

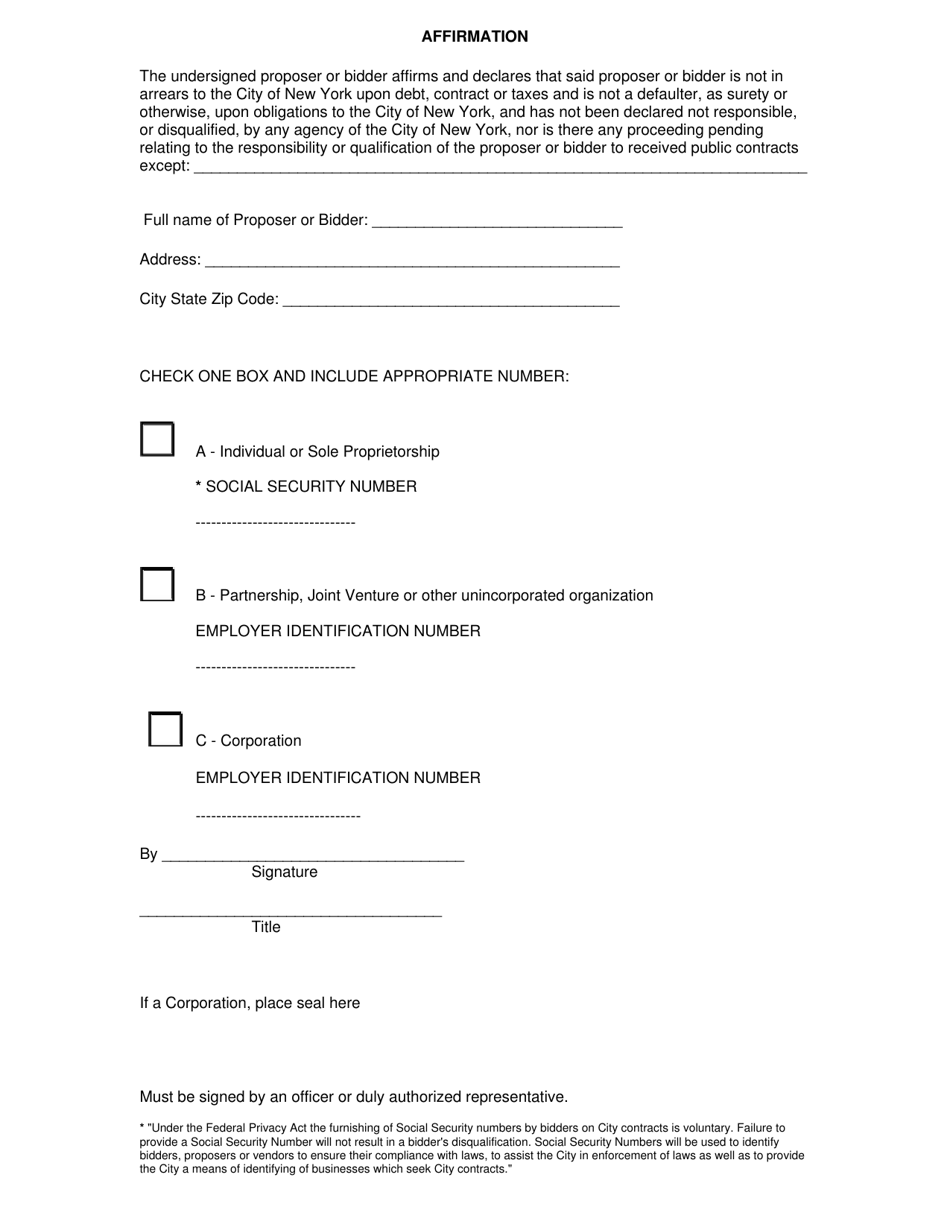

Tax Affirmation - New York City

Tax Affirmation is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

Q: What is Tax Affirmation?

A: Tax Affirmation is a declaration or confirmation of tax status.

Q: Who needs to file Tax Affirmation in New York City?

A: Certain individuals and entities doing business in New York City may need to file Tax Affirmation.

Q: What is the purpose of Tax Affirmation?

A: The purpose of Tax Affirmation is to ensure compliance with local tax laws and regulations in New York City.

Q: How often do I need to file Tax Affirmation?

A: Tax Affirmation needs to be filed annually.

Q: Are there any penalties for not filing Tax Affirmation?

A: Yes, failure to file Tax Affirmation may result in penalties.

Q: What information do I need to provide when filing Tax Affirmation?

A: You may need to provide information about your business, income, and tax obligations.

Q: Is Tax Affirmation separate from filing taxes?

A: Yes, Tax Affirmation is a separate requirement from filing taxes.

Q: Is Tax Affirmation applicable to individuals only?

A: No, both individuals and entities may be required to file Tax Affirmation.

Q: Is Tax Affirmation a one-time filing?

A: No, Tax Affirmation needs to be filed annually.

Form Details:

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.