This version of the form is not currently in use and is provided for reference only. Download this version of

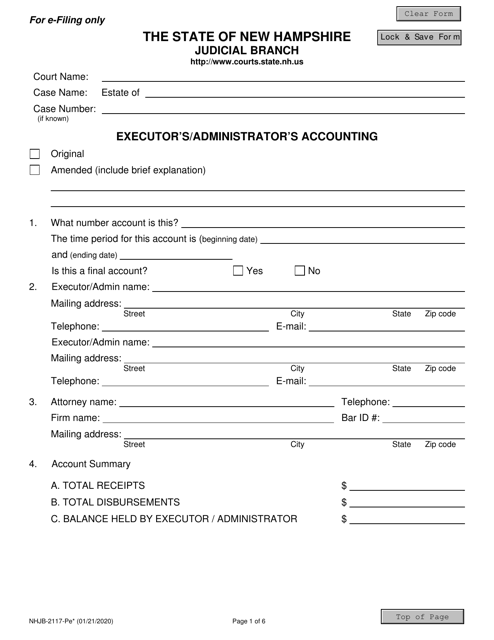

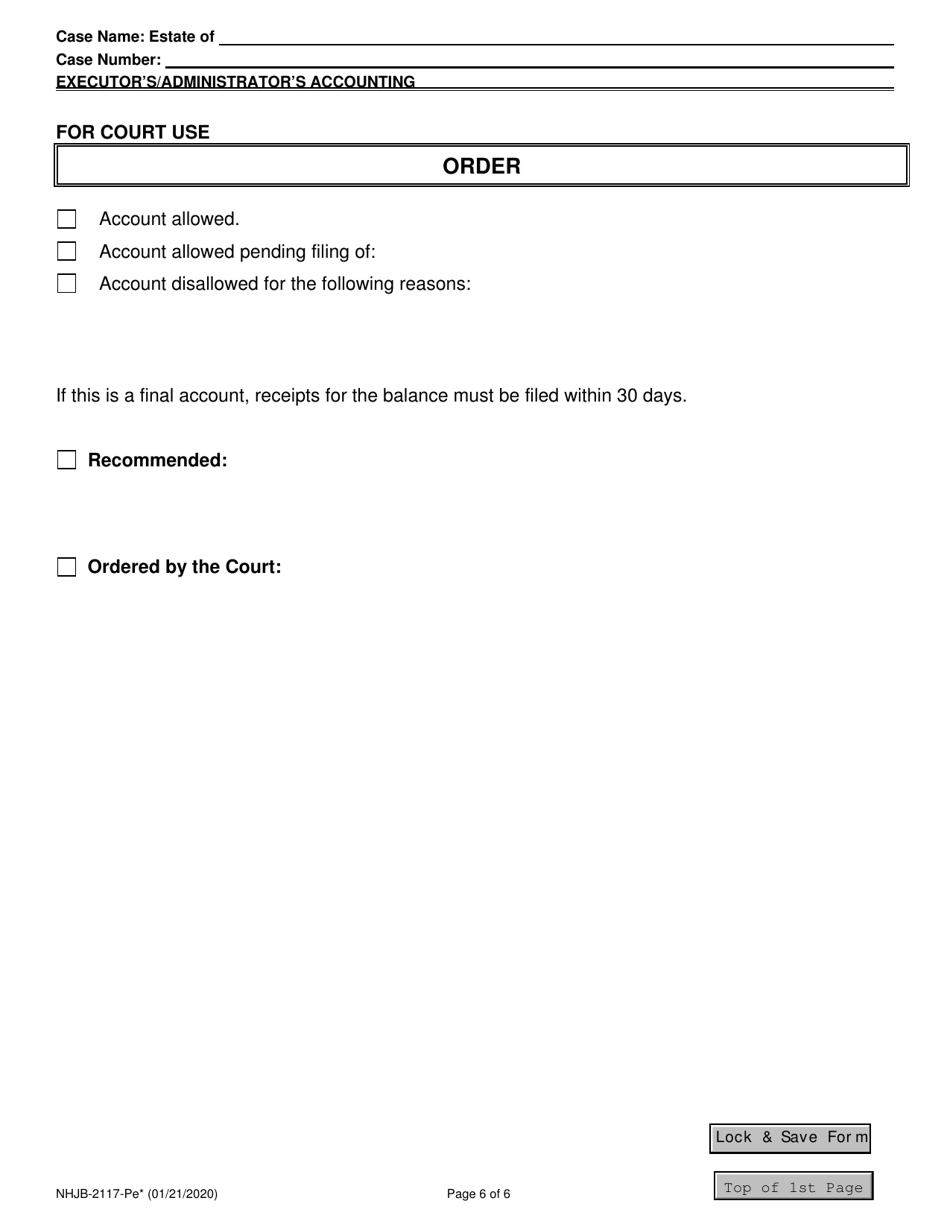

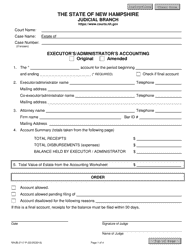

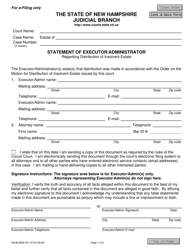

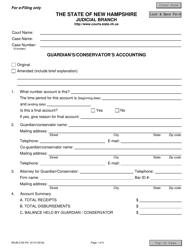

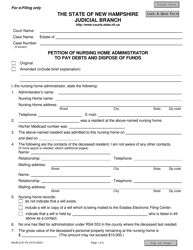

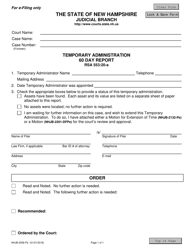

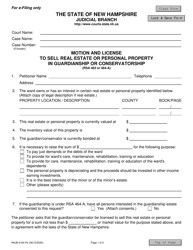

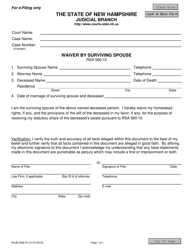

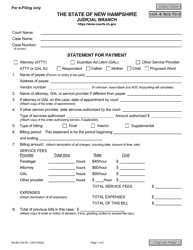

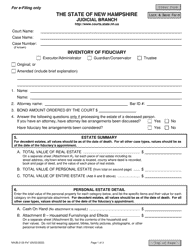

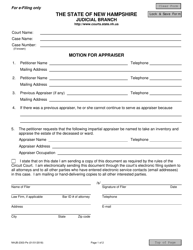

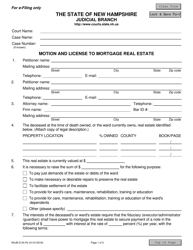

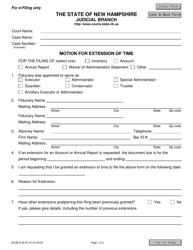

Form NHJB-2117-PE

for the current year.

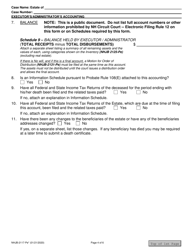

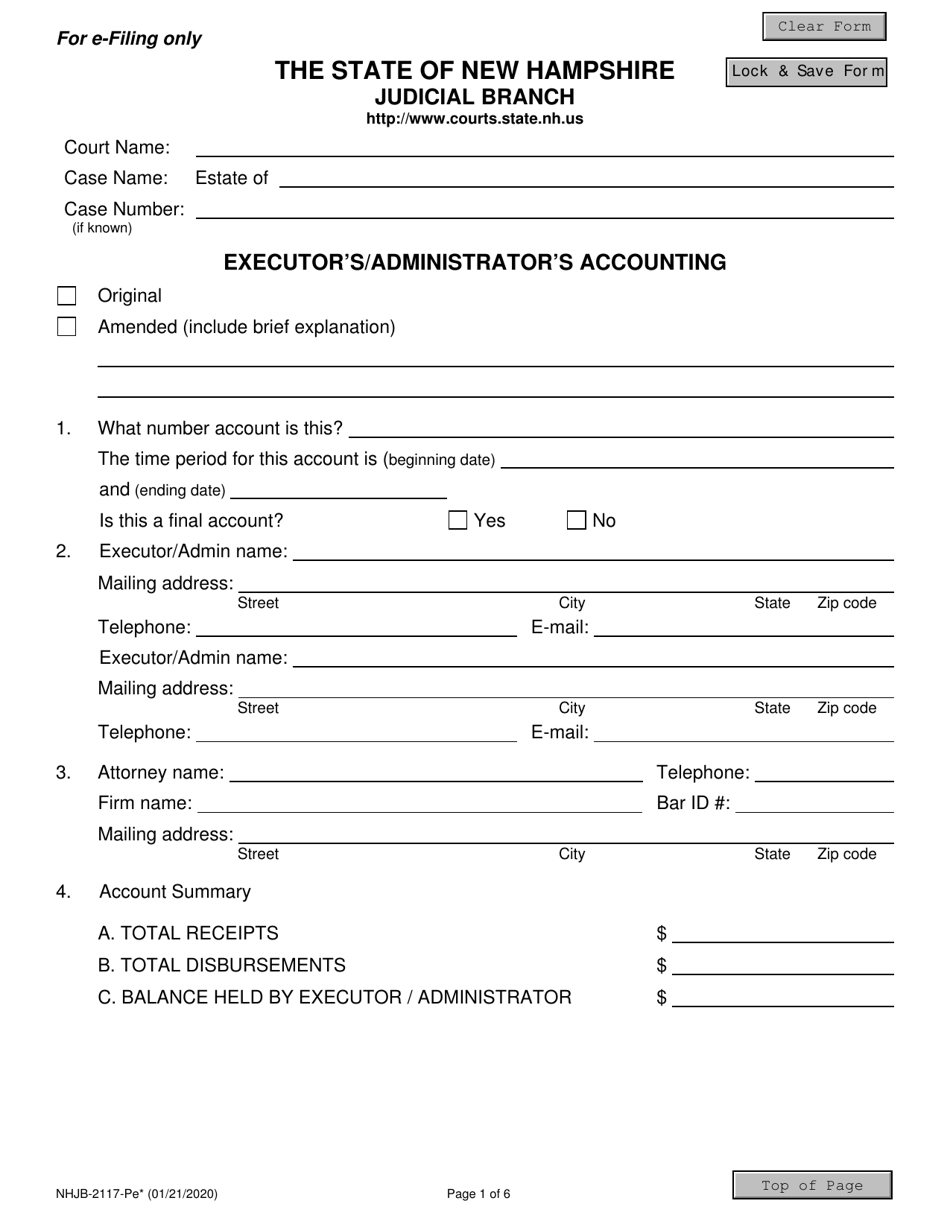

Form NHJB-2117-PE Executor's / Administrator's Accounting - New Hampshire

What Is Form NHJB-2117-PE?

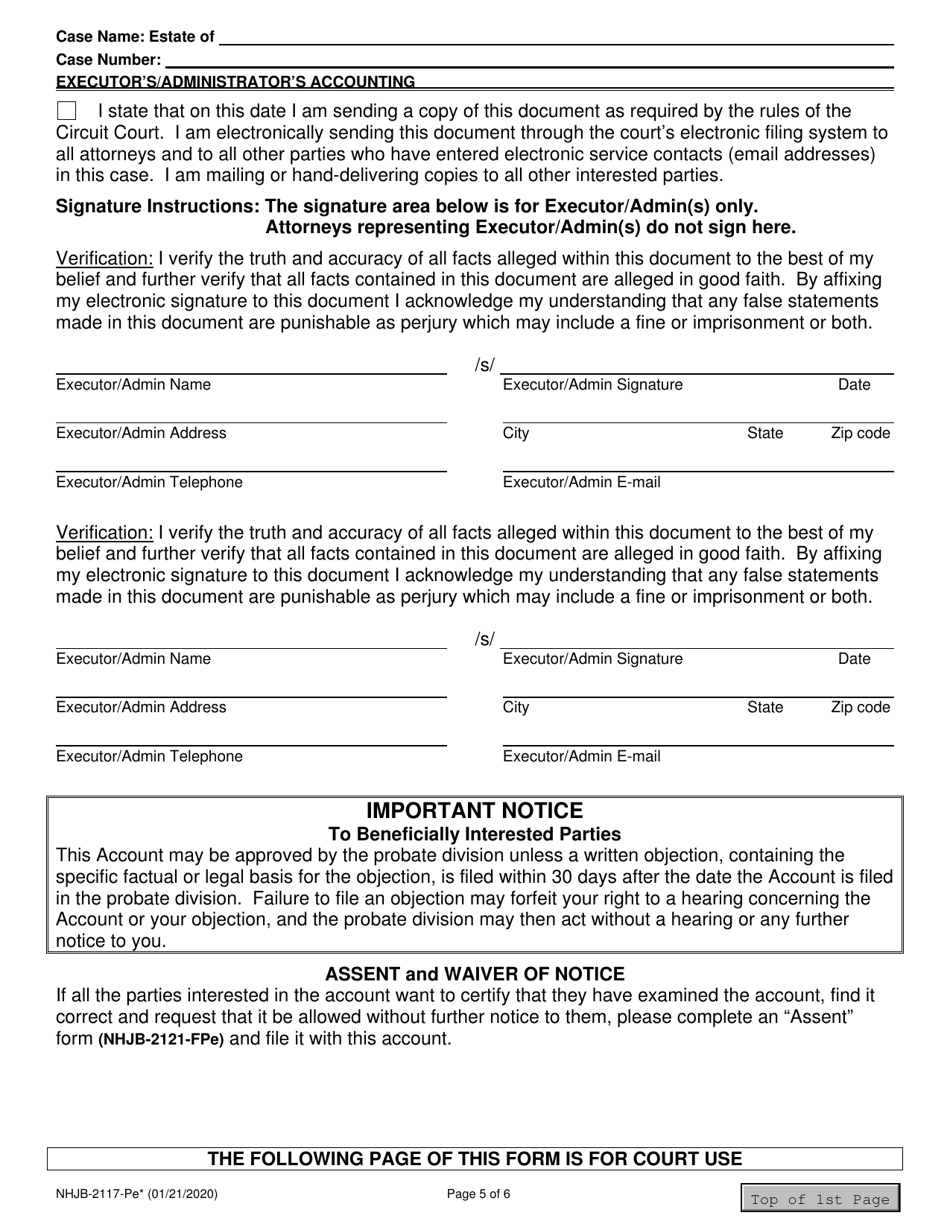

This is a legal form that was released by the New Hampshire Judicial Branch - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

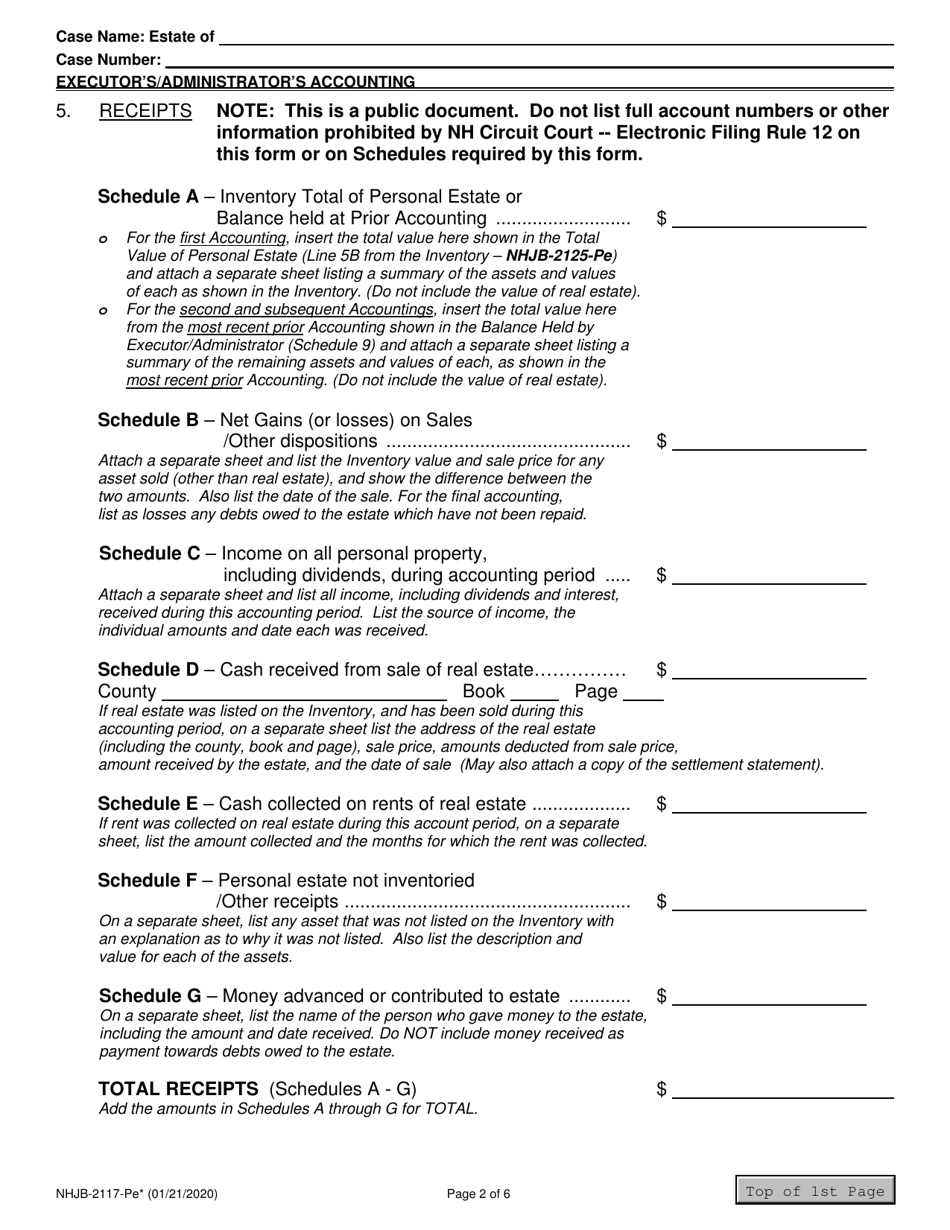

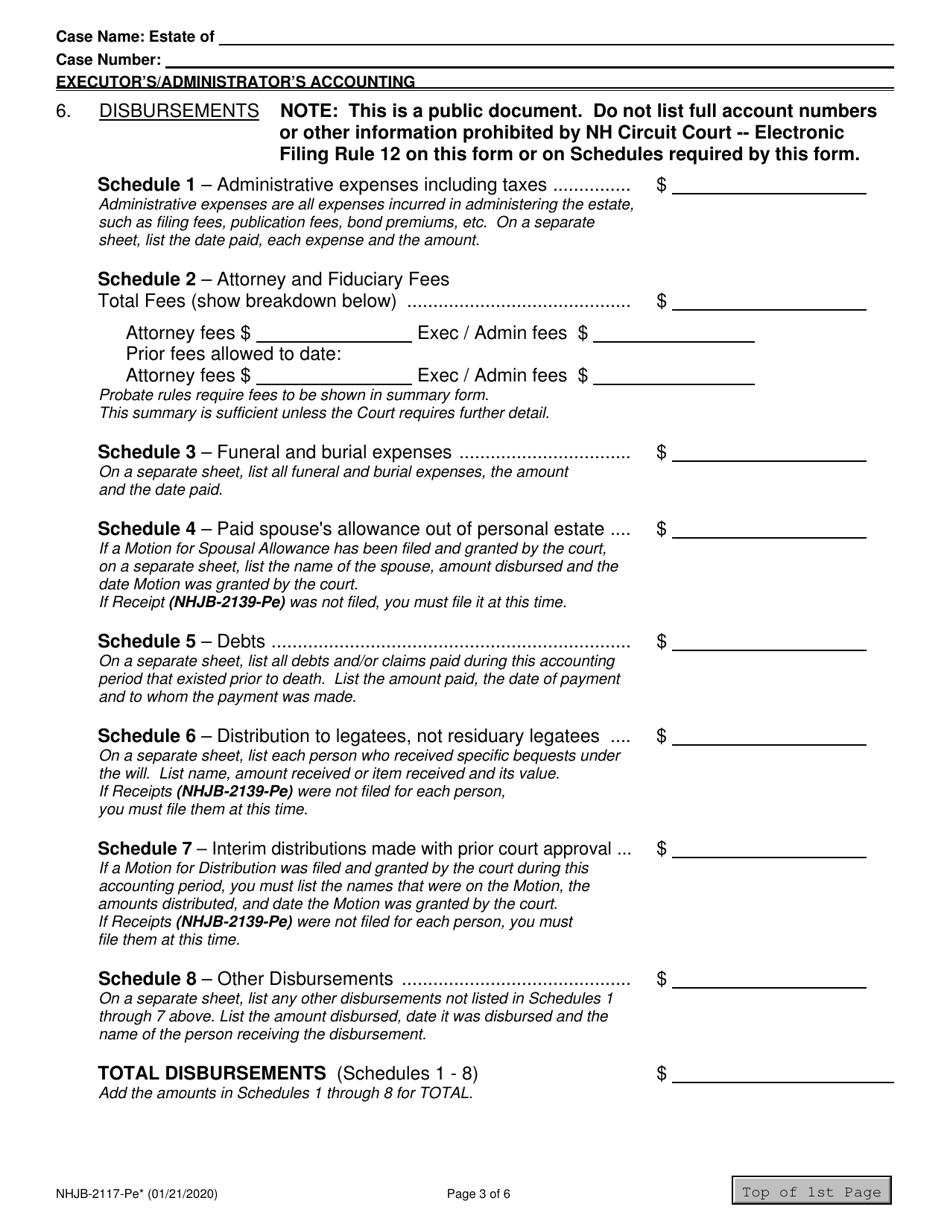

Q: What is NHJB-2117-PE Executor's/Administrator's Accounting?

A: NHJB-2117-PE is a form used in New Hampshire for the accounting of an executor or administrator.

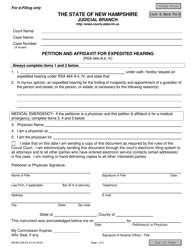

Q: Who uses NHJB-2117-PE Executor's/Administrator's Accounting?

A: NHJB-2117-PE is used by executors or administrators of estates in New Hampshire.

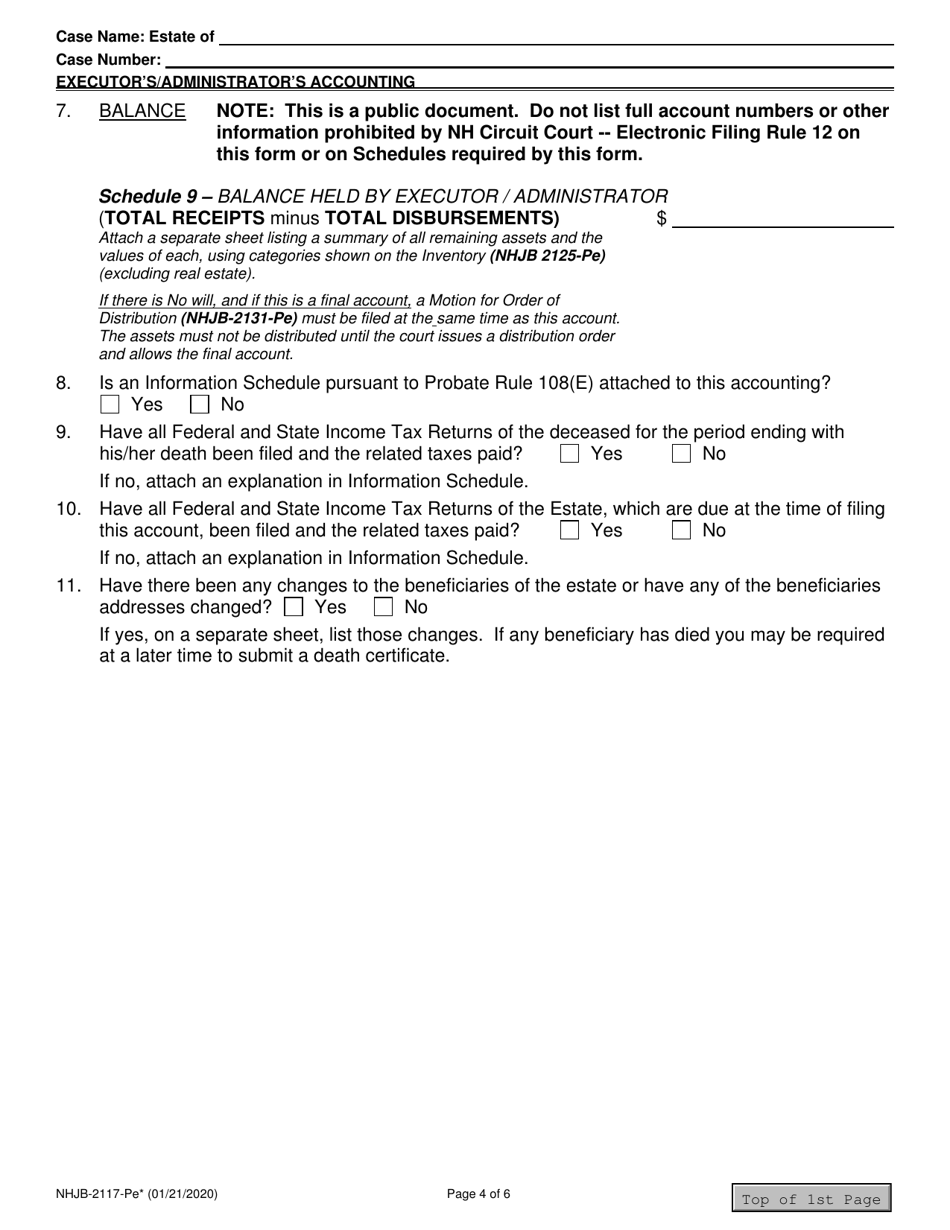

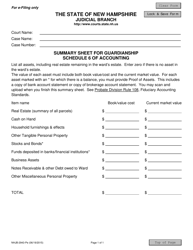

Q: What is the purpose of NHJB-2117-PE Executor's/Administrator's Accounting?

A: The purpose of NHJB-2117-PE is to provide a formal accounting of the estate's assets and expenses.

Q: When is NHJB-2117-PE Executor's/Administrator's Accounting used?

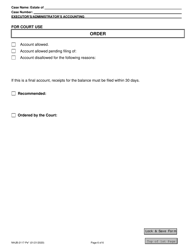

A: NHJB-2117-PE is used when an executor or administrator needs to submit an accounting of the estate to the court.

Q: Are there any fees associated with filing NHJB-2117-PE Executor's/Administrator's Accounting?

A: Fees may apply when filing NHJB-2117-PE Executor's/Administrator's Accounting. Contact the probate court for more information.

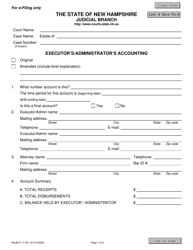

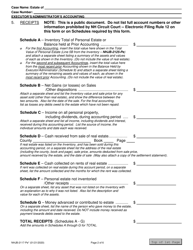

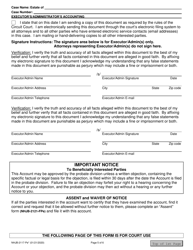

Q: What supporting documents are required with NHJB-2117-PE Executor's/Administrator's Accounting?

A: Supporting documents may include bank statements, receipts, and other financial records related to the estate.

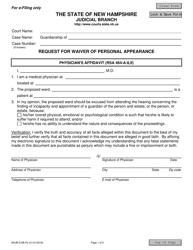

Q: Can an attorney help with completing NHJB-2117-PE Executor's/Administrator's Accounting?

A: Yes, an attorney can provide guidance and assistance with completing NHJB-2117-PE Executor's/Administrator's Accounting.

Form Details:

- Released on January 21, 2020;

- The latest edition provided by the New Hampshire Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NHJB-2117-PE by clicking the link below or browse more documents and templates provided by the New Hampshire Judicial Branch.