This version of the form is not currently in use and is provided for reference only. Download this version of

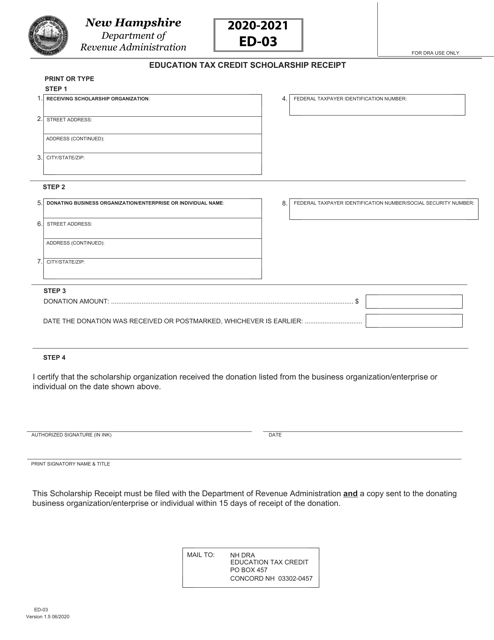

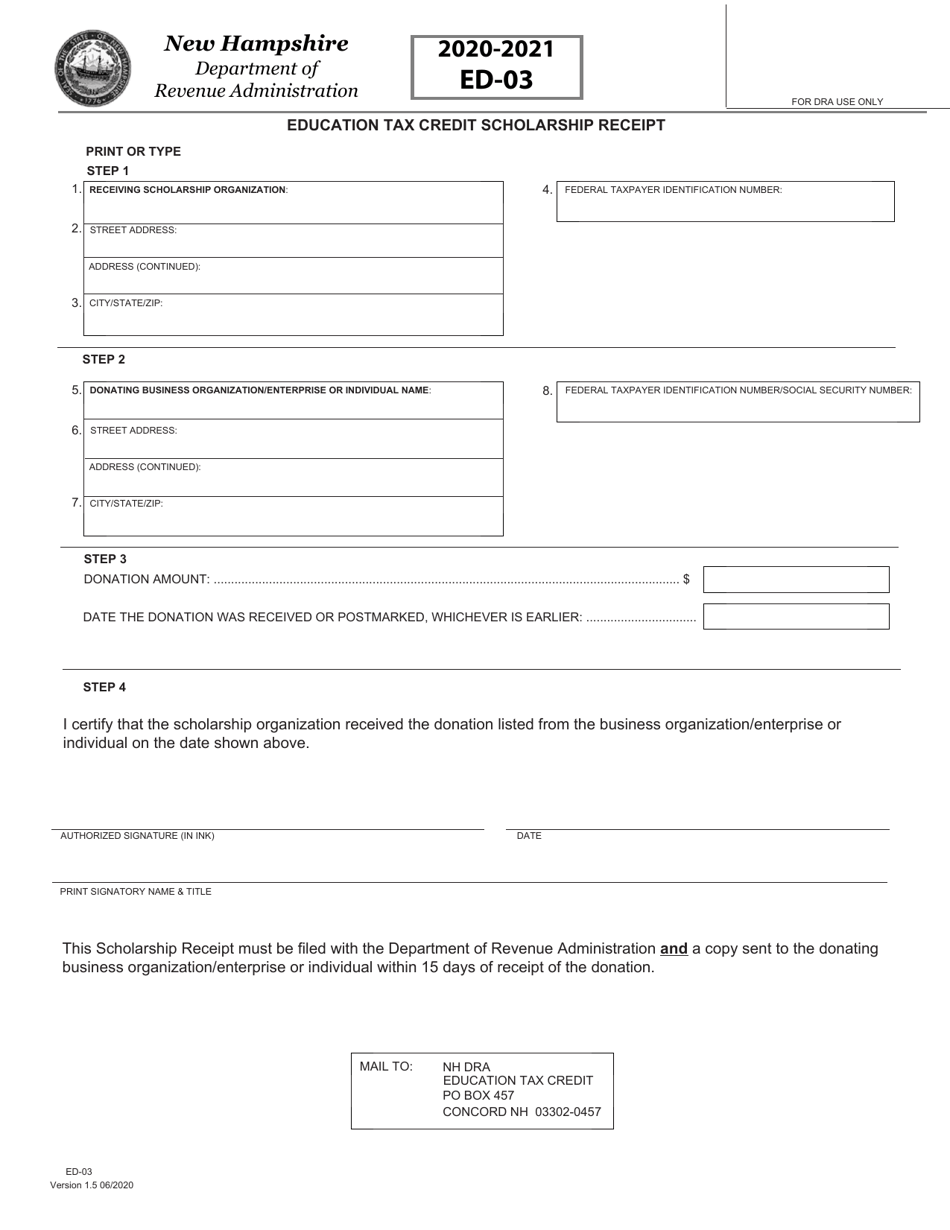

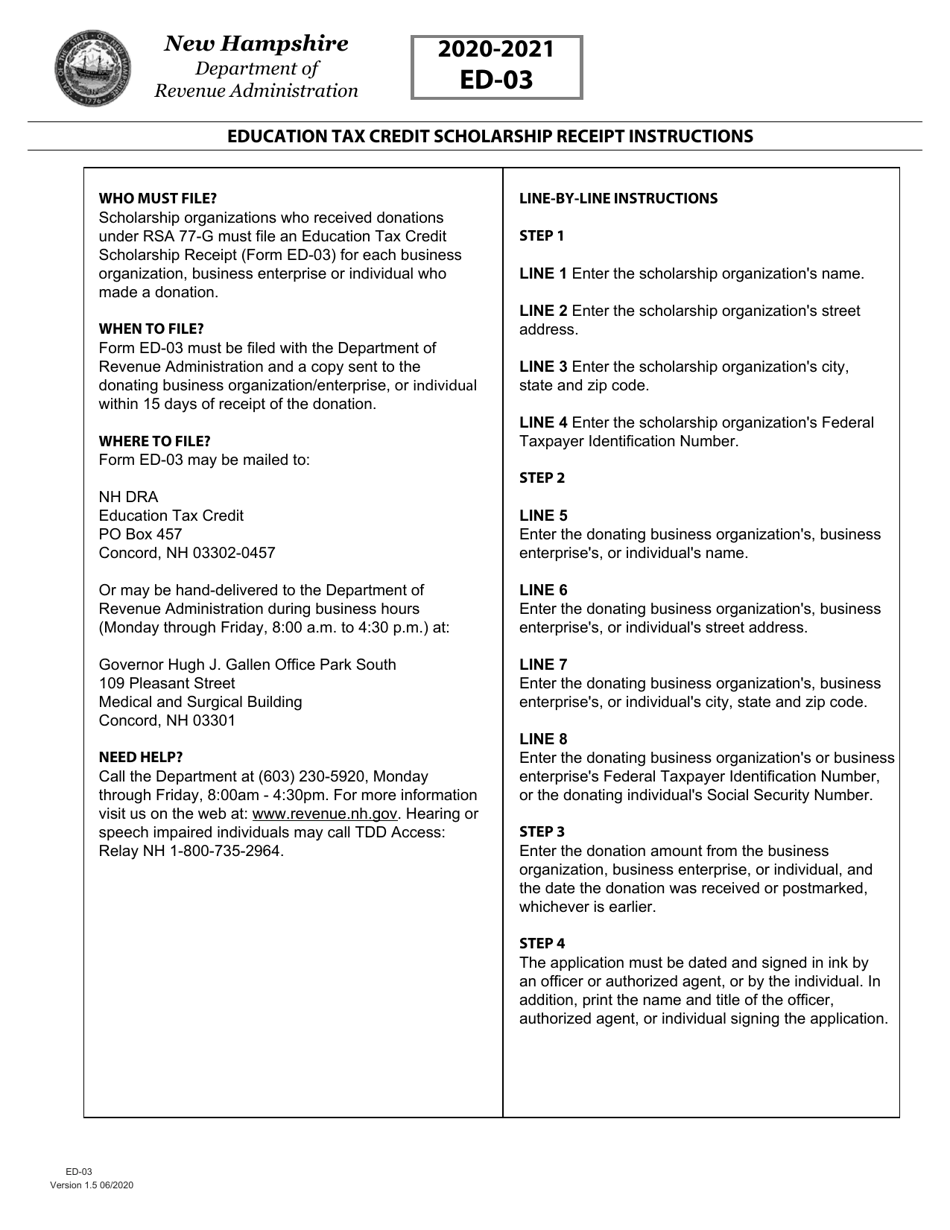

Form ED-03

for the current year.

Form ED-03 Education Tax Credit Scholarship Receipt - New Hampshire

What Is Form ED-03?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

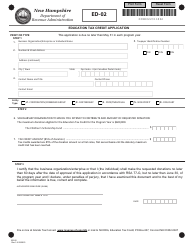

Q: What is Form ED-03?

A: Form ED-03 is an Education Tax Credit Scholarship Receipt for individuals who have received a scholarship from a New Hampshire Scholarship Organization.

Q: What is an Education Tax Credit Scholarship?

A: An Education Tax Credit Scholarship is a scholarship given to eligible students in New Hampshire to help cover the cost of their education.

Q: Who needs to fill out Form ED-03?

A: If you have received an Education Tax Credit Scholarship in New Hampshire, you may need to fill out Form ED-03.

Q: What is the purpose of Form ED-03?

A: The purpose of Form ED-03 is to report the amount of scholarship funds received and to certify that the funds were used for qualified education expenses.

Q: What are qualified education expenses?

A: Qualified education expenses include tuition, fees, and certain other expenses related to attending an eligible school in New Hampshire.

Q: When is the deadline to submit Form ED-03?

A: The deadline to submit Form ED-03 is usually April 15th of the year following the calendar year in which the scholarship funds were received.

Q: Do I need to attach any documents with Form ED-03?

A: It is recommended to attach copies of your scholarship award letters and any other supporting documentation when submitting Form ED-03.

Q: Are there any penalties for not submitting Form ED-03?

A: Failure to submit Form ED-03, when required, may result in the denial of the education tax credit or the recapture of previously claimed credits.

Q: Can I claim both a federal education tax credit and the New Hampshire education tax credit?

A: Yes, you may be eligible to claim both the federal education tax credit and the New Hampshire education tax credit, as long as you meet the respective criteria for each.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ED-03 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.