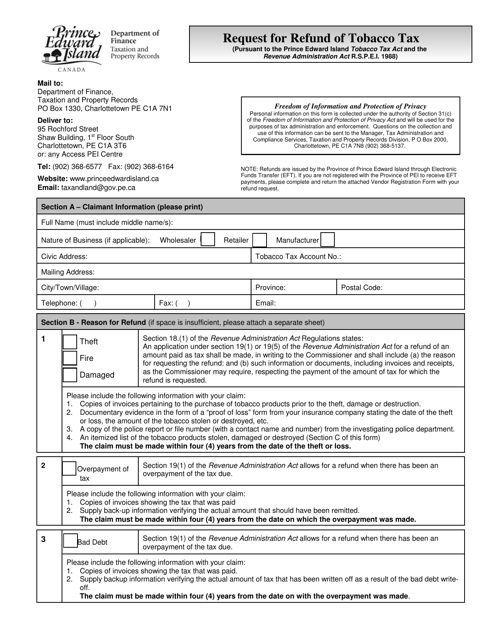

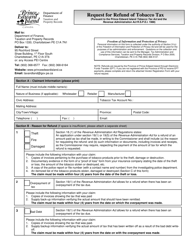

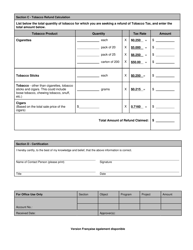

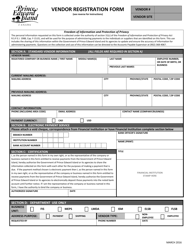

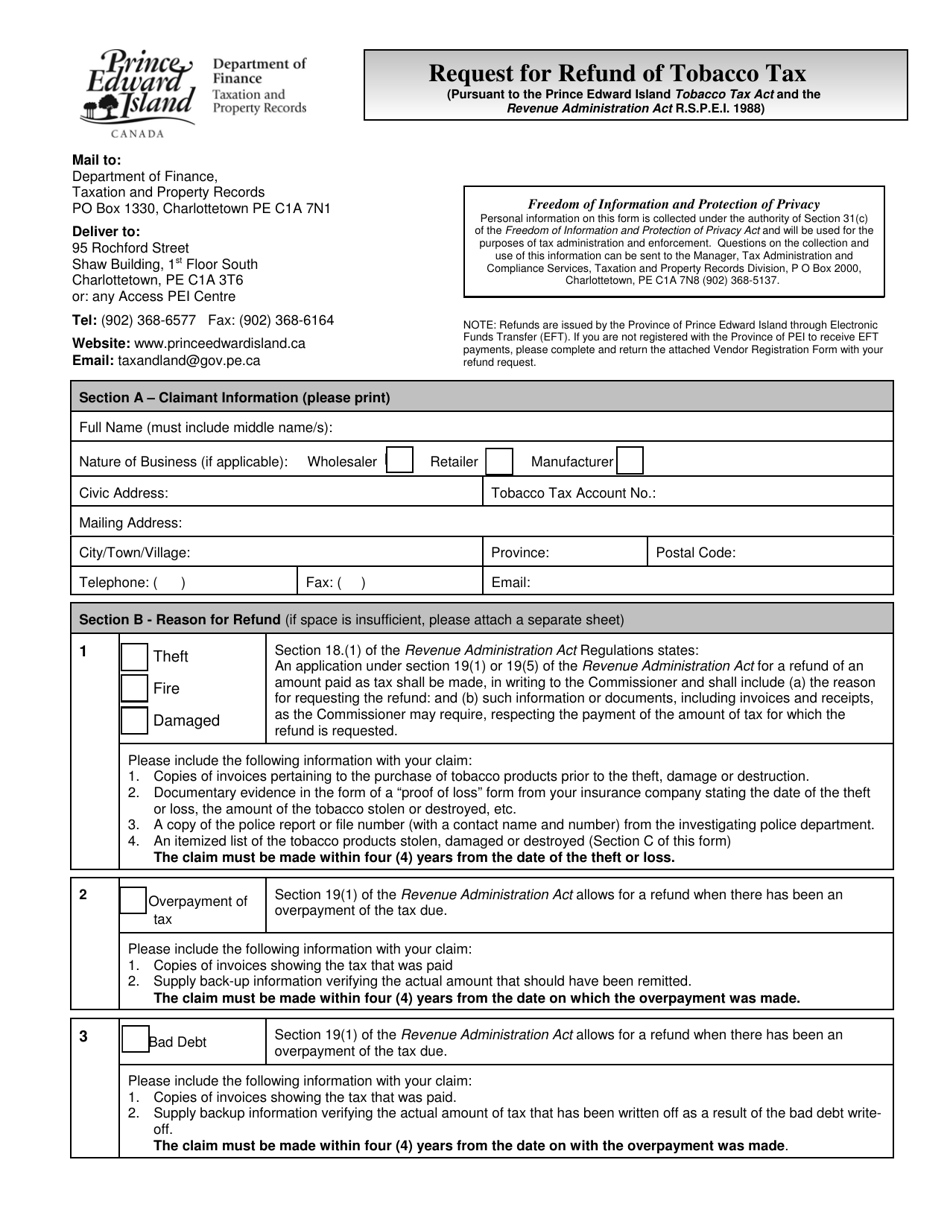

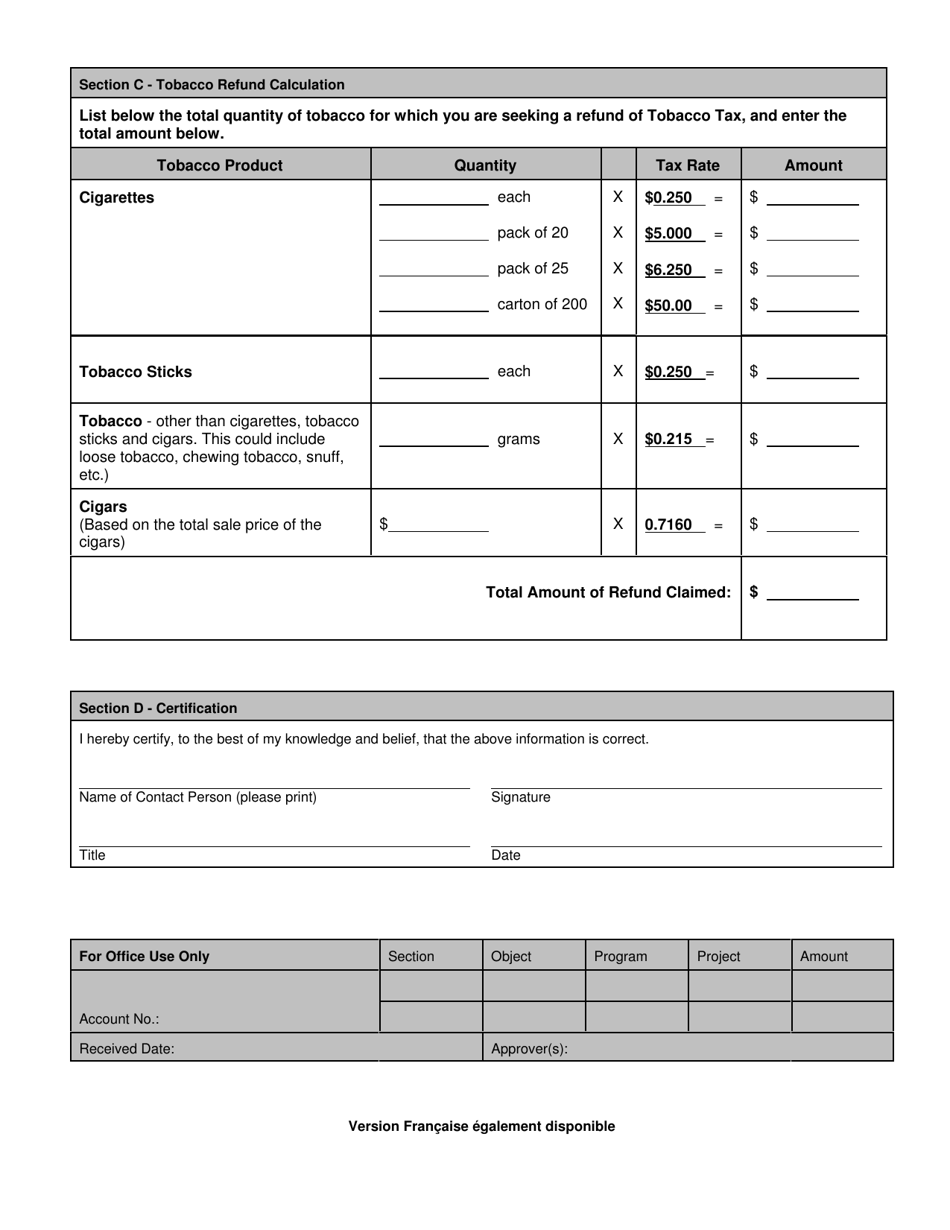

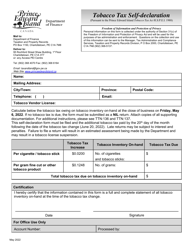

Request for Refund of Tobacco Tax - Prince Edward Island, Canada

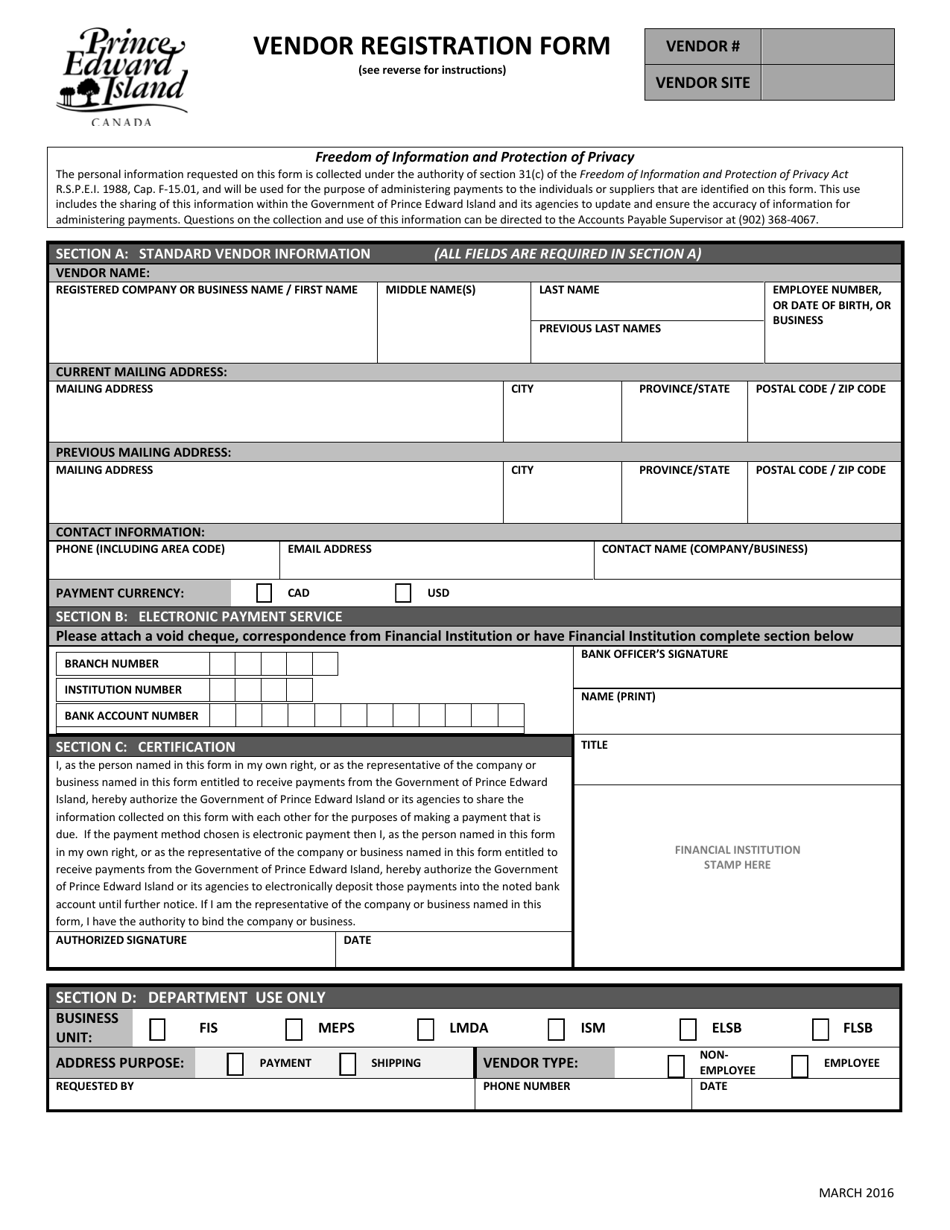

The Request for Refund of Tobacco Tax is for individuals or businesses in Prince Edward Island, Canada who are seeking a refund of the tobacco tax they have paid. This could be due to overpayment or specific circumstances outlined by the government.

In Prince Edward Island, Canada, the request for refund of tobacco tax is usually filed by the tobacco distributor or wholesaler.

FAQ

Q: Who can request a refund of tobacco tax in Prince Edward Island?

A: Individuals who are 19 years of age and older can request a refund of tobacco tax in Prince Edward Island.

Q: What is required to request a refund of tobacco tax in Prince Edward Island?

A: To request a refund of tobacco tax in Prince Edward Island, you need to have purchased tobacco products within the province.

Q: How can I request a refund of tobacco tax in Prince Edward Island?

A: To request a refund of tobacco tax in Prince Edward Island, you need to complete a Refund of Tobacco Tax Application Form and submit it to the PEI Tobacco Tax Office.

Q: What is the deadline to request a refund of tobacco tax in Prince Edward Island?

A: The deadline to request a refund of tobacco tax in Prince Edward Island is one year from the date of purchase.

Q: How long does it take to process a refund of tobacco tax in Prince Edward Island?

A: It typically takes four to six weeks to process a refund of tobacco tax in Prince Edward Island.

Q: What supporting documents are required to request a refund of tobacco tax in Prince Edward Island?

A: To request a refund of tobacco tax in Prince Edward Island, you need to include original receipts and copies of the tobacco product packages.

Q: Can I request a refund of tobacco tax if I purchased tobacco products outside of Prince Edward Island?

A: No, you can only request a refund of tobacco tax in Prince Edward Island if you purchased the products within the province.

Q: What is the contact information for the PEI Tobacco Tax Office?

A: You can contact the PEI Tobacco Tax Office at (902) 368-4070 or toll-free at 1-877-933-9433.