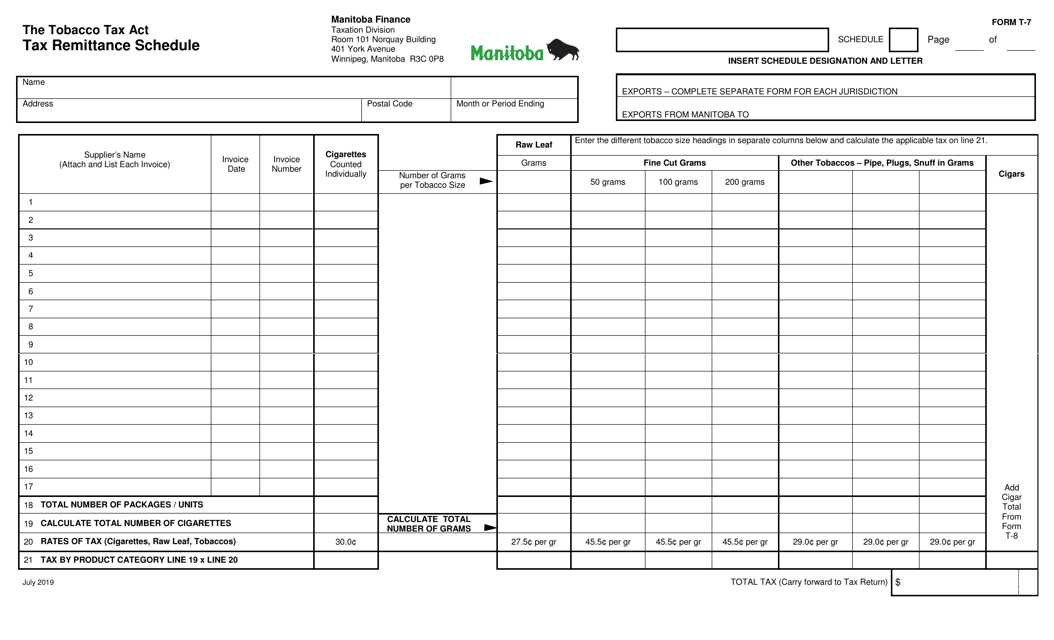

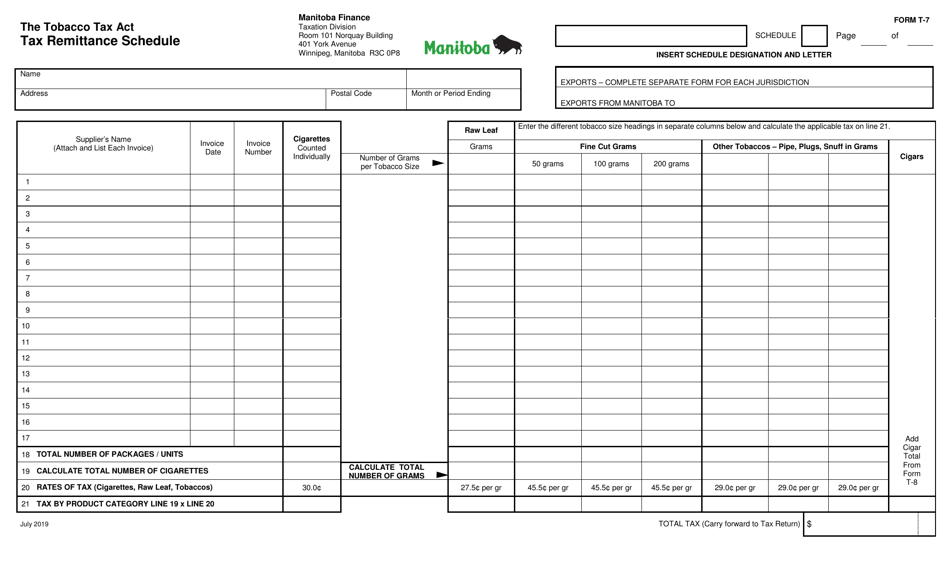

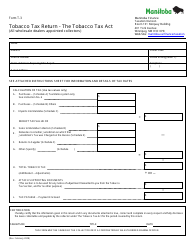

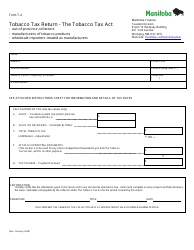

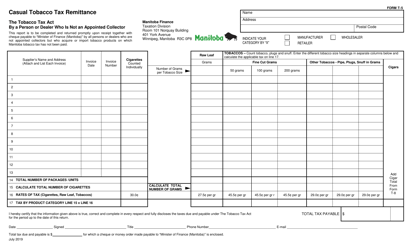

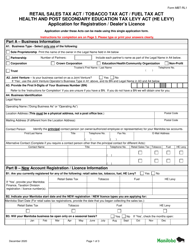

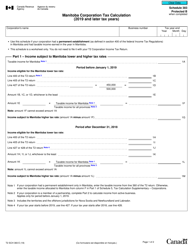

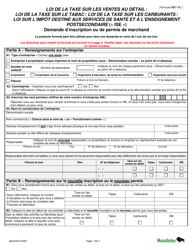

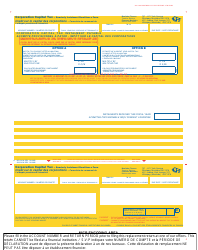

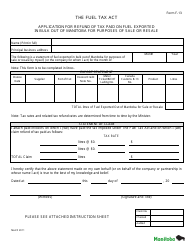

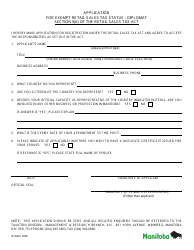

Form T-7 Tax Remittance Schedule - Manitoba, Canada

Form T-7 Tax Remittance Schedule in Manitoba, Canada is used to remit various taxes to the provincial government, such as Retail Sales Tax (RST), Corporation Capital Tax (CCT), Insurance Corporation Tax (ICT), among others.

The Form T-7 Tax Remittance Schedule in Manitoba, Canada is filed by businesses and individuals who have a tax obligation with the Manitoba government.

FAQ

Q: What is Form T-7?

A: Form T-7 is the Tax Remittance Schedule for Manitoba, Canada.

Q: When is Form T-7 used?

A: Form T-7 is used to remit various taxes owed to the government of Manitoba, Canada.

Q: What taxes can be remitted using Form T-7?

A: Form T-7 can be used to remit Retail Sales Tax (RST), Corporation Capital Tax, Insurance Corporations Tax, and Health and Post-Secondary Education Tax Levy (HE Levy).

Q: Do I need to fill out Form T-7 if I don't owe any taxes?

A: No, you do not need to fill out Form T-7 if you do not owe any taxes.

Q: Are there any deadlines for submitting Form T-7?

A: Yes, Form T-7 must be submitted on or before the due date specified by the government of Manitoba.

Q: What happens if I fail to remit taxes using Form T-7?

A: Failure to remit taxes using Form T-7 may result in penalties and interest charges.

Q: Can I make changes to a submitted Form T-7?

A: Yes, changes can be made to a submitted Form T-7 by submitting an amended schedule.

Q: Who should I contact if I have questions about Form T-7?

A: If you have questions about Form T-7, you should contact the Manitoba Taxation Division for assistance.