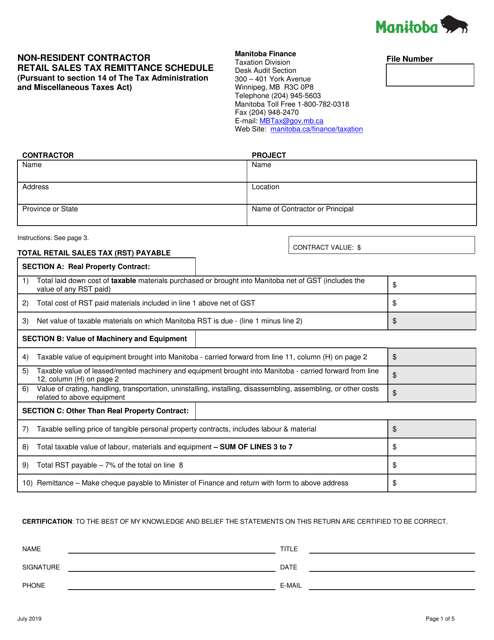

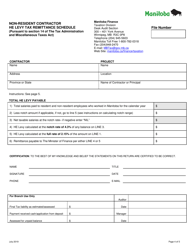

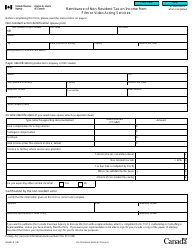

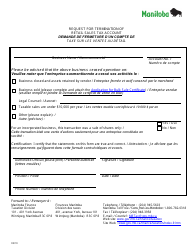

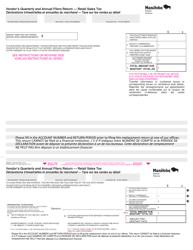

Non-resident Contractor - Retail Sales Tax Remittance Schedule - Manitoba, Canada

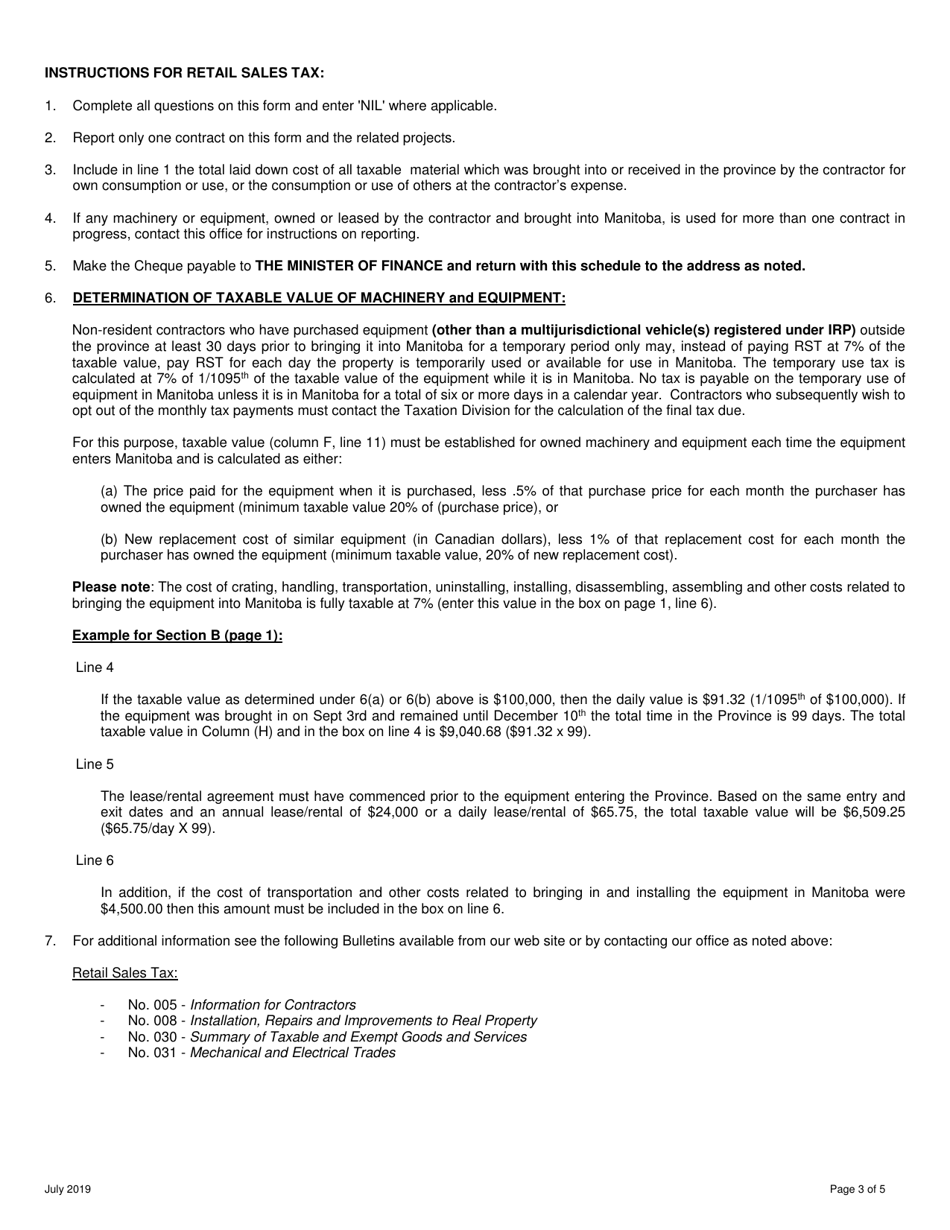

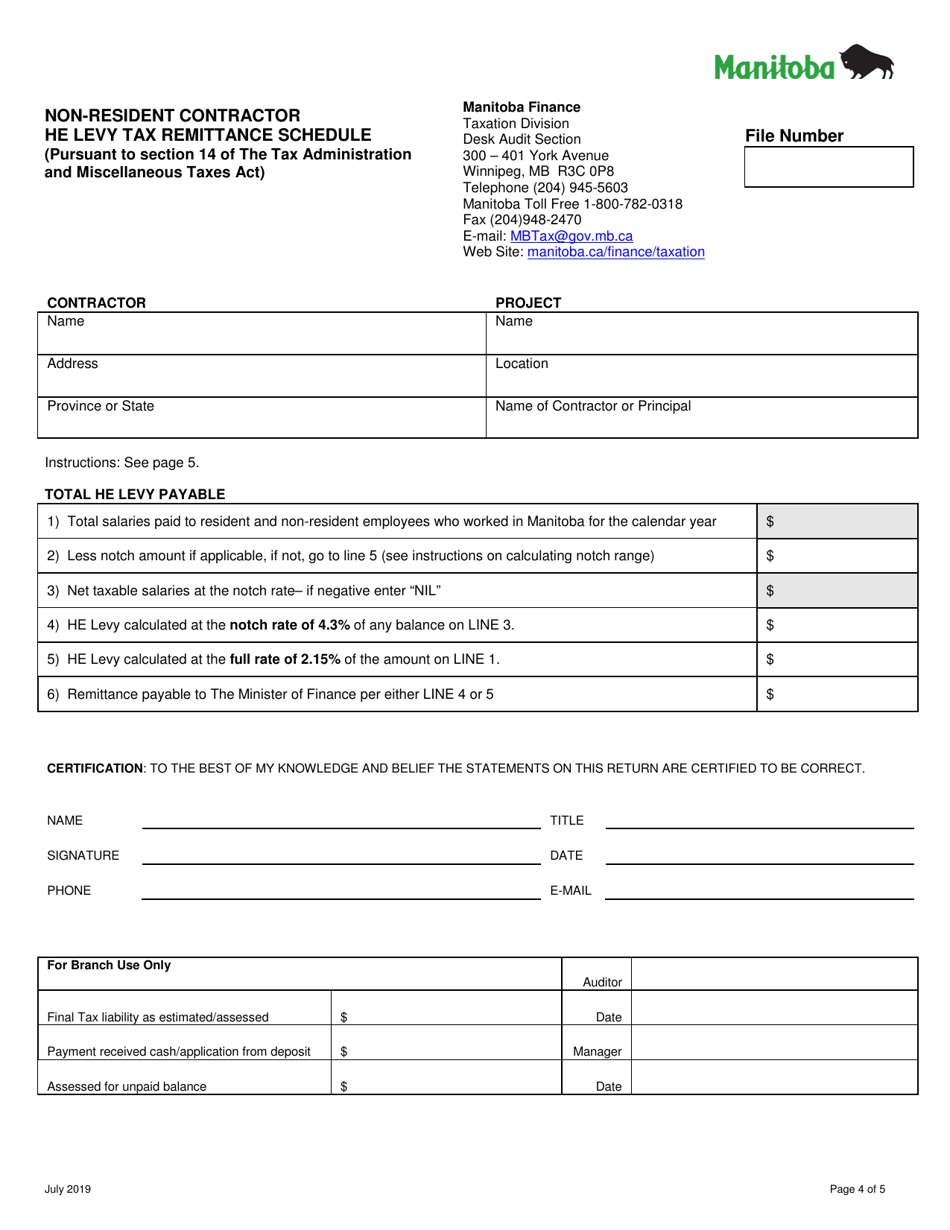

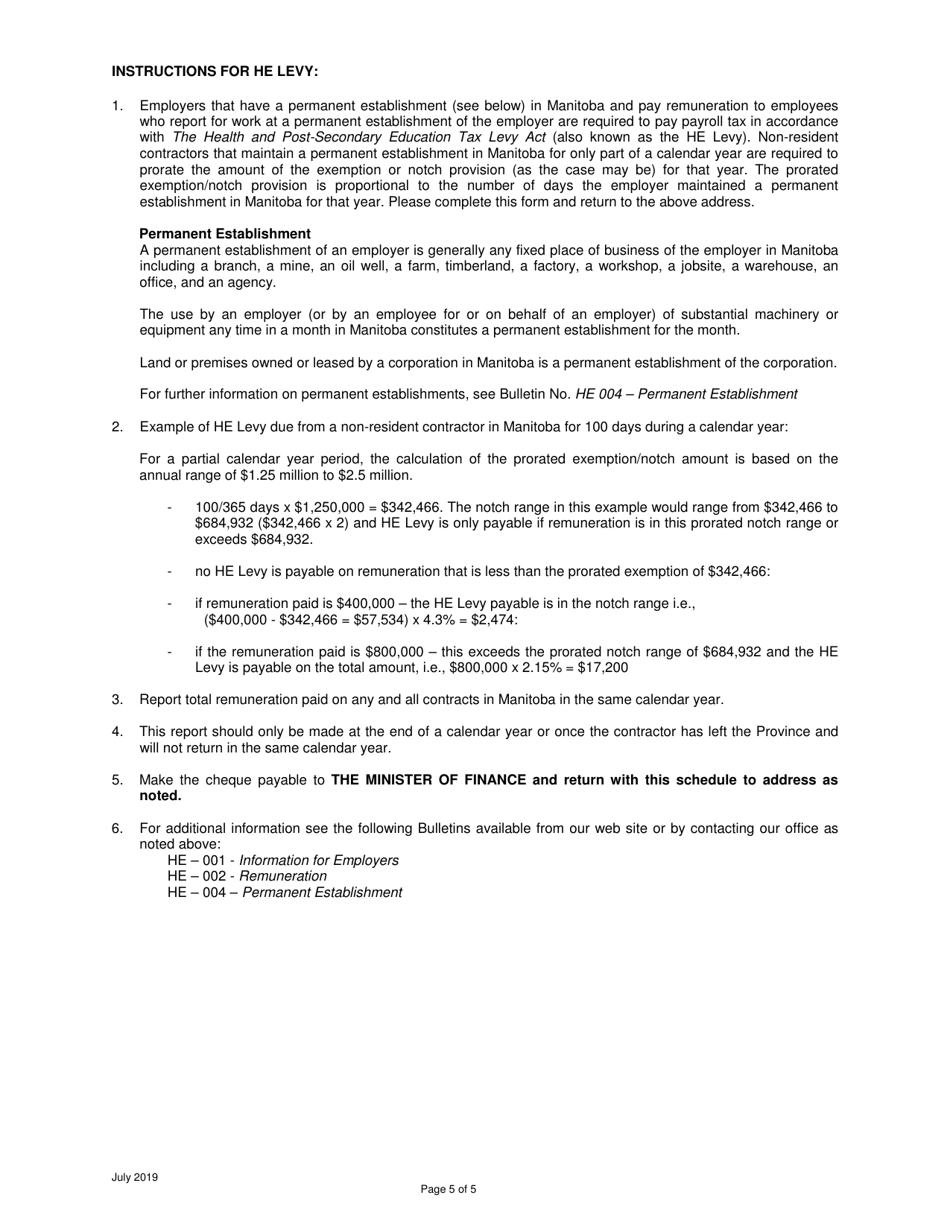

The Non-resident Contractor - Retail SalesTax Remittance Schedule is a document used in Manitoba, Canada for non-resident contractors to remit their retail sales tax. It is a way for these contractors to pay the appropriate amount of tax on the goods and services they provide in the province.

The non-resident contractor who is registered for retail sales tax in Manitoba, Canada is responsible for filing the Non-resident Contractor - Retail Sales Tax Remittance Schedule.

FAQ

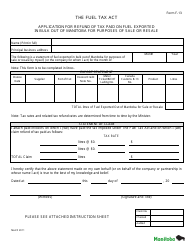

Q: Who is considered a non-resident contractor in Manitoba, Canada?

A: A non-resident contractor is someone who carries out construction or renovation work in Manitoba but does not have a fixed place of business in the province.

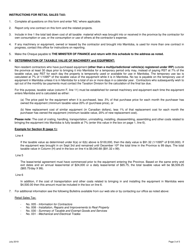

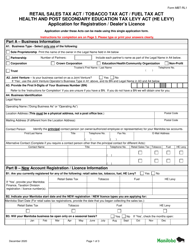

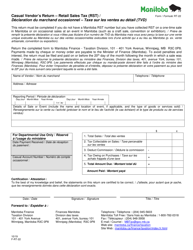

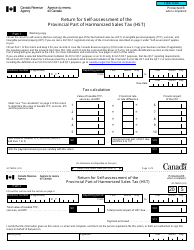

Q: What is the Retail Sales Tax (RST) in Manitoba?

A: The Retail Sales Tax (RST) in Manitoba is a tax on the sale, rental, or leasing of most goods and certain services.

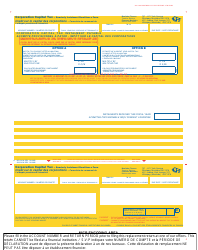

Q: What is the purpose of the Retail Sales Tax (RST) Remittance Schedule?

A: The Retail Sales Tax (RST) Remittance Schedule is used by non-resident contractors to report and remit the RST they have collected on their taxable sales in Manitoba.

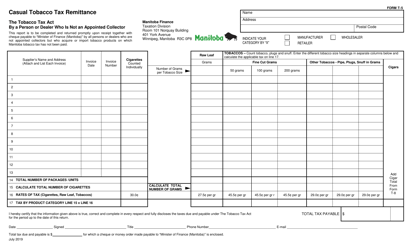

Q: Are all non-resident contractors required to remit RST in Manitoba?

A: Yes, all non-resident contractors who carry out construction or renovation work in Manitoba are required to remit RST, regardless of the contract amount.

Q: How often should a non-resident contractor submit the Retail Sales Tax (RST) Remittance Schedule?

A: A non-resident contractor should submit the RST Remittance Schedule on a monthly basis, even if there were no taxable sales during the month.

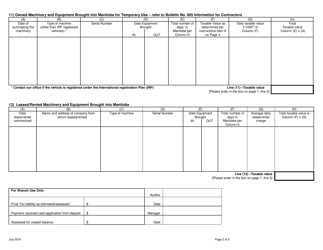

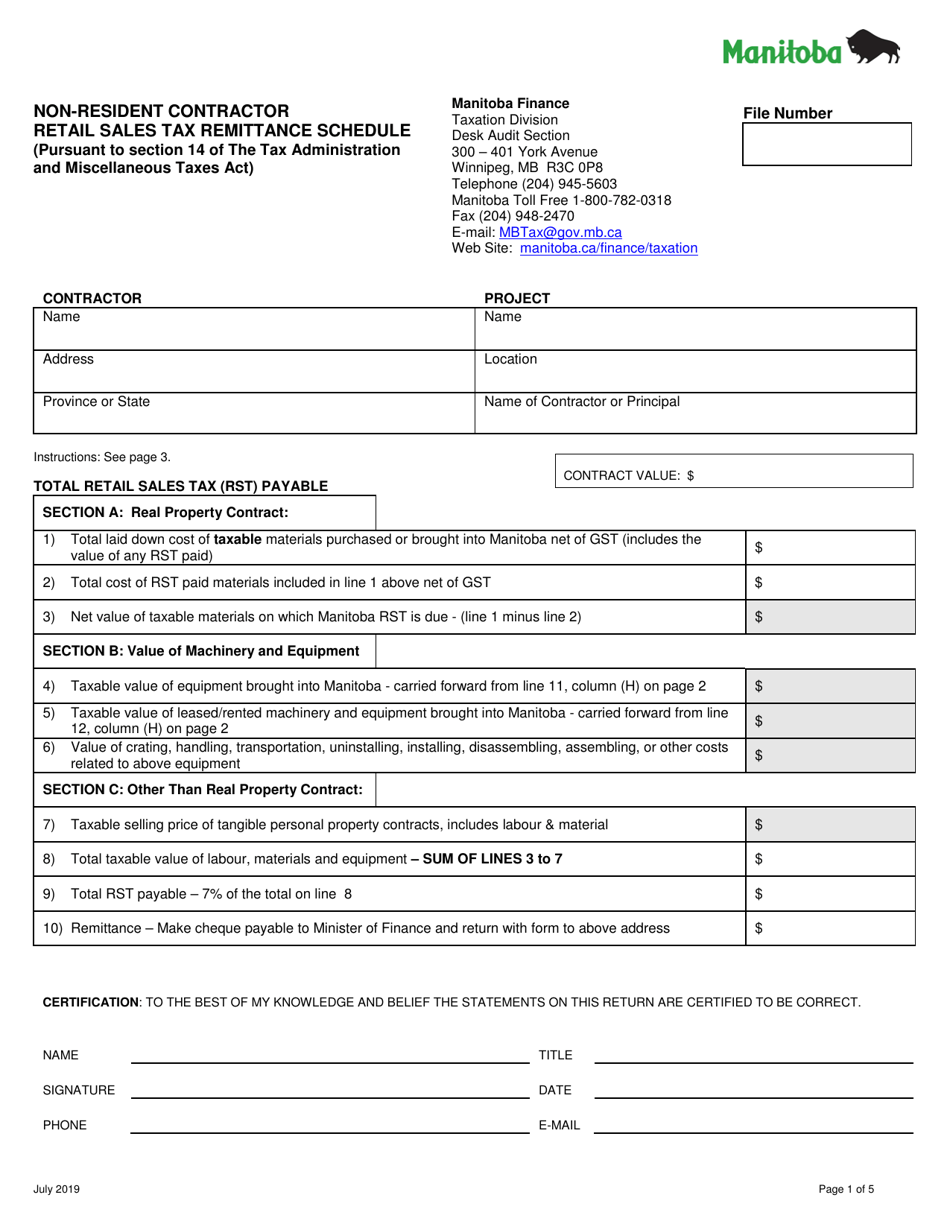

Q: What information is required on the Retail Sales Tax (RST) Remittance Schedule?

A: The RST Remittance Schedule requires the contractor's name, address, contract details, taxable sales amount, and the amount of RST collected.

Q: What happens if a non-resident contractor fails to remit RST on time?

A: If a non-resident contractor fails to remit RST on time, penalties and interest may be assessed on the outstanding amount.

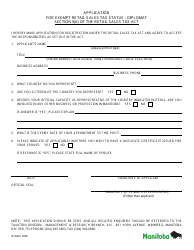

Q: Are there any exemptions or deductions available for non-resident contractors in Manitoba?

A: Yes, there are certain exemptions and deductions available for non-resident contractors, such as the exemption for certain goods and services used exclusively outside of Manitoba and the deduction for certain subcontractors' expenses.