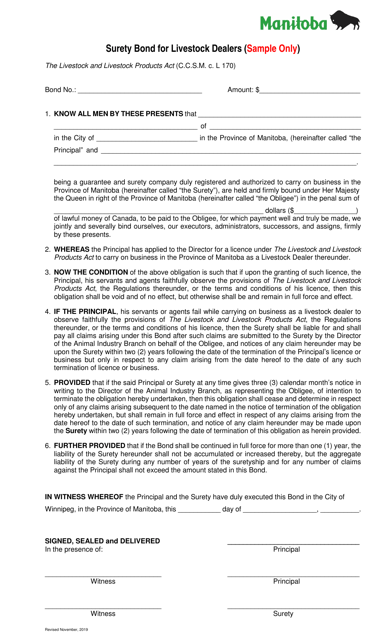

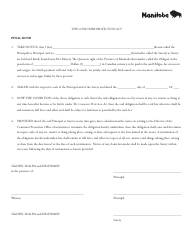

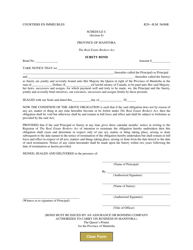

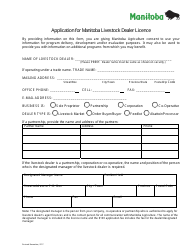

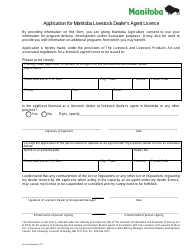

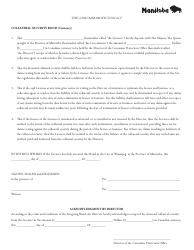

Surety Bond for Livestock Dealers - Sample - Manitoba, Canada

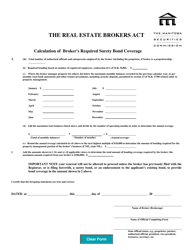

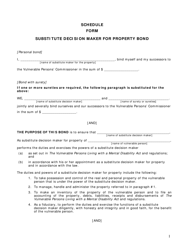

A Surety Bond for Livestock Dealers in Manitoba, Canada is a form of financial protection required by the government. It ensures that livestock dealers fulfill their obligations to livestock sellers, such as payment for the purchased livestock as agreed upon. If a dealer fails to meet their obligations, the bond provides compensation to the seller for their losses.

The livestock dealer would typically file the surety bond in Manitoba, Canada.

FAQ

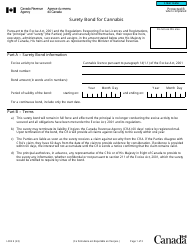

Q: What is a surety bond for livestock dealers?

A: A surety bond for livestock dealers is a type of financial guarantee that ensures the dealer's compliance with laws and regulations.

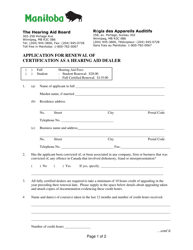

Q: Who requires livestock dealers to have a surety bond?

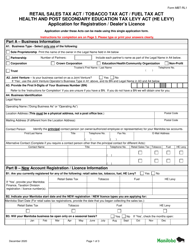

A: The government requires livestock dealers to have a surety bond in order to operate legally.

Q: Why do livestock dealers need a surety bond?

A: Livestock dealers need a surety bond to protect their clients from financial losses resulting from the dealer's non-compliance or misconduct.

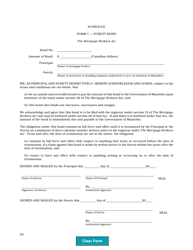

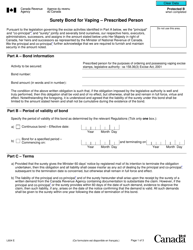

Q: How does a surety bond work?

A: A surety bond is a three-party agreement between the livestock dealer (principal), the surety company (guarantor), and the government (obligee). If the dealer fails to fulfill their obligations, the surety company compensates the affected parties.

Q: How much does a surety bond for livestock dealers cost?

A: The cost of a surety bond for livestock dealers varies depending on factors such as the dealer's financial stability and the bond amount required by the government.