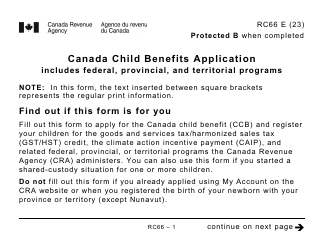

Form RC151 Gst / Hst Credit Application for Individuals Who Become Residents of Canada - Canada

What Is Form RC151?

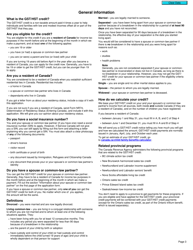

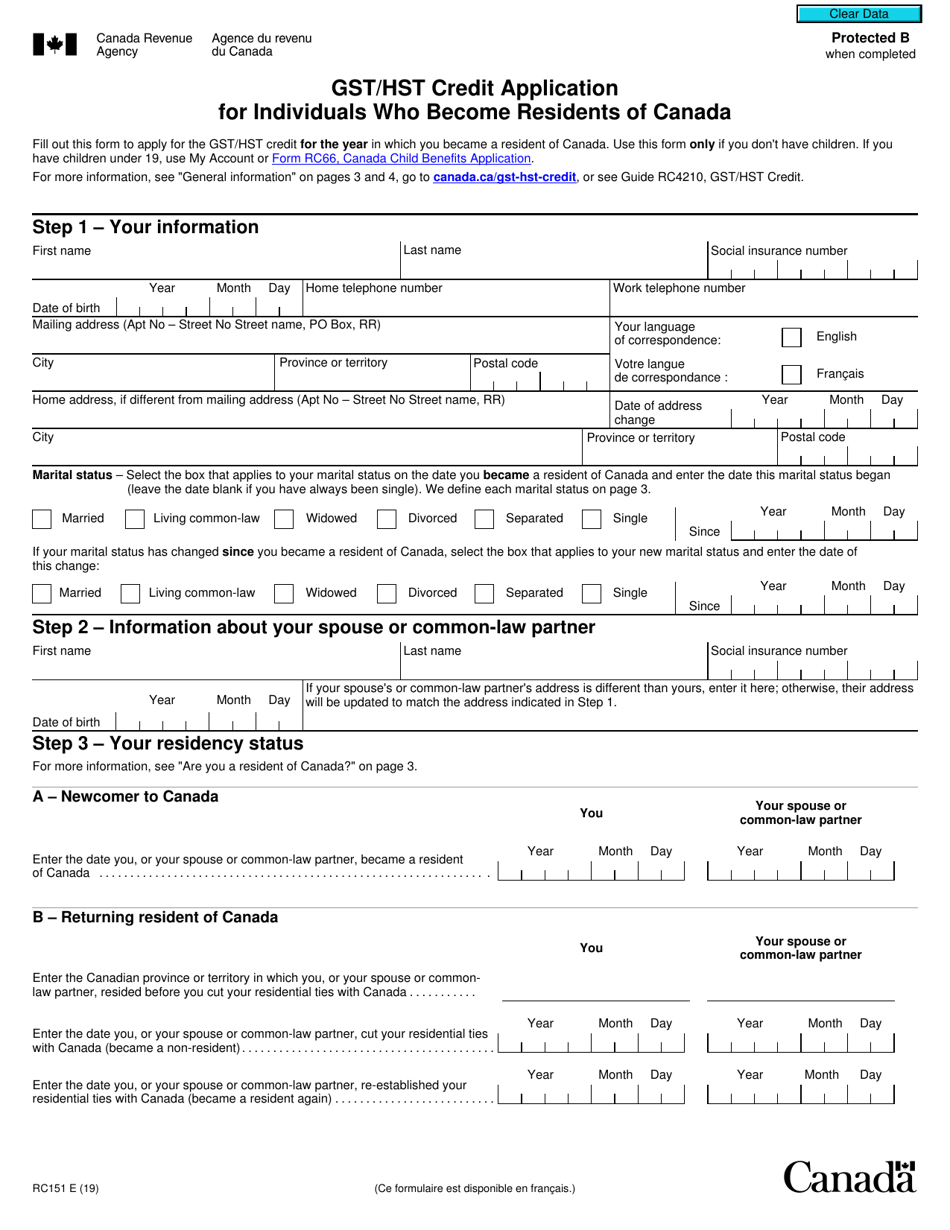

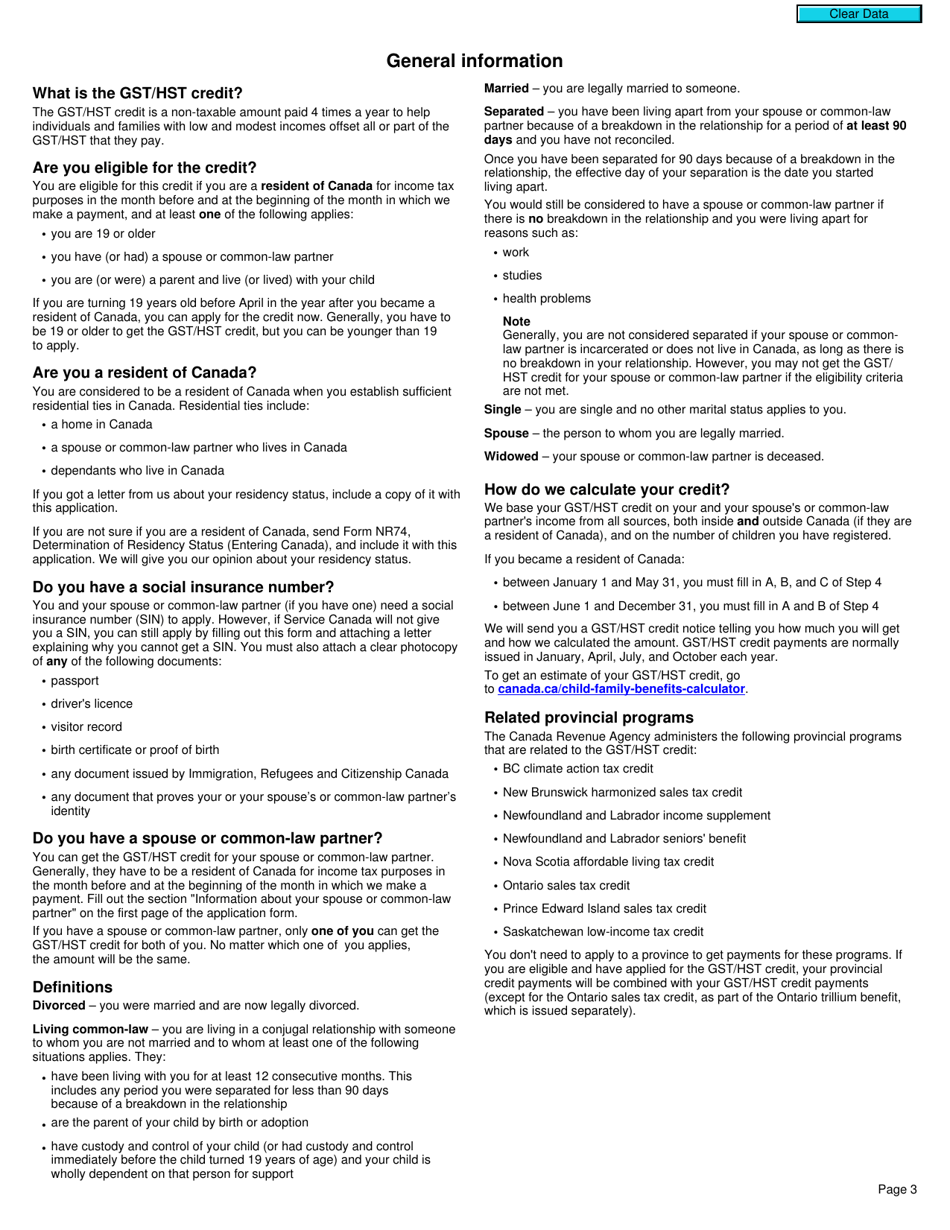

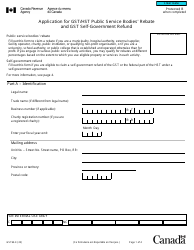

Form RC151, GST/HST Credit Application for Individuals Who Become Residents of Canada , is the document you will need to complete when you apply for residency standing in Canada. You also have the option to have this monetary credit sent via direct deposit online through the government's website. This form is issued by the Canadian Revenue Agency (CRA) and was last updated January 1, 2019 . A fillable RC151 Form is available for download through the link below.

Alternate Names:

- Canada GST Form;

- Canada HST Form.

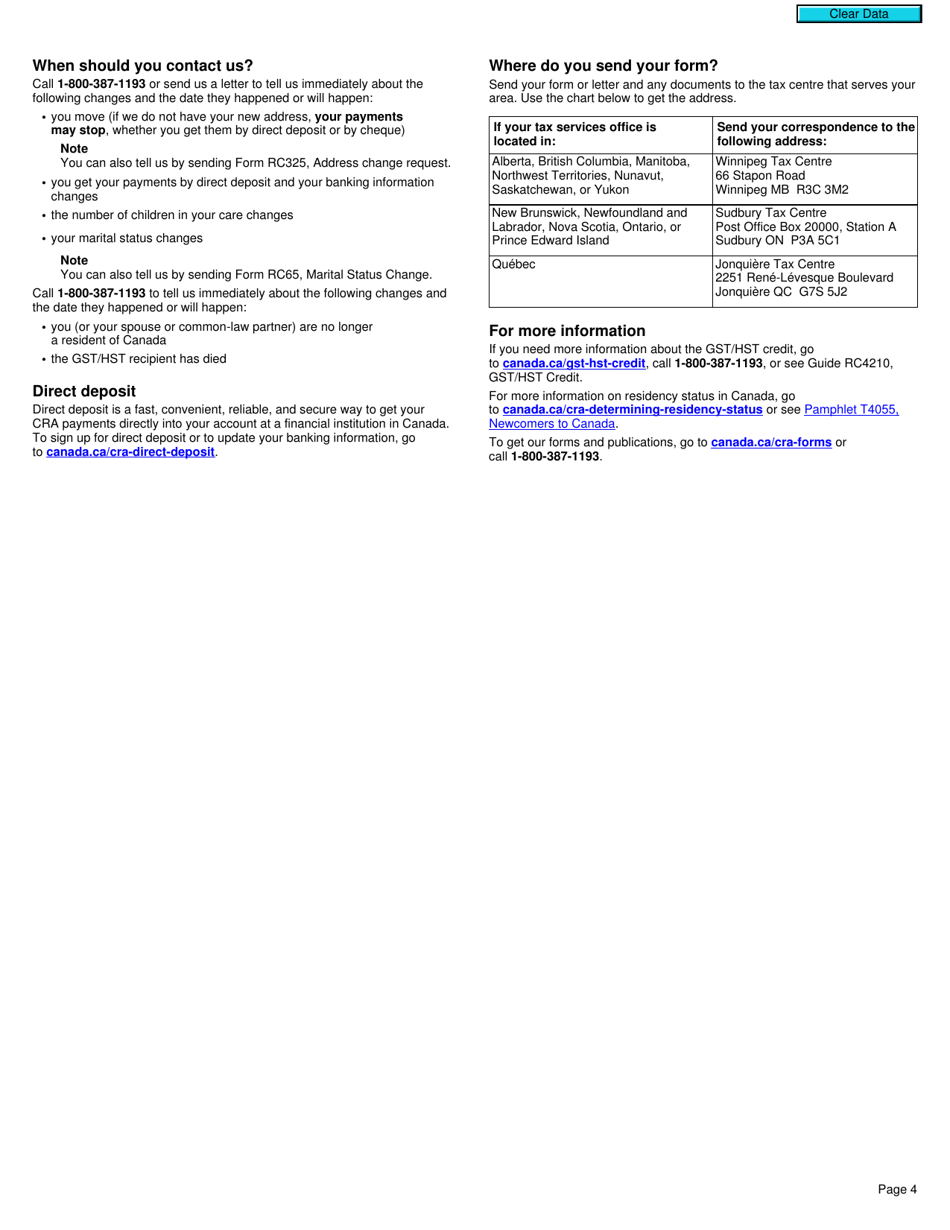

This form is completed within the first twelve months a person qualifies as a resident of Canada, allowing you to formally take part in the GST/HST reimbursement system. Residents then have the ability to take advantage of tax credits for this reimbursement system should their earnings meet the threshold for lower livelihood tiers. The regional postal addresses for this form are listed near the bottom of Form RC151.

How to Fill Out RC151 Form?

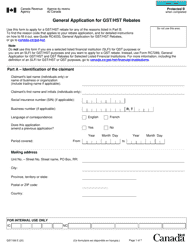

To complete the Canada GST Form, you be asked to provide the following information:

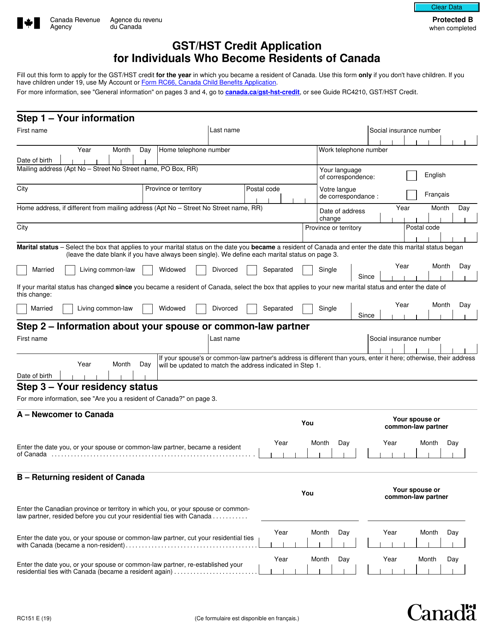

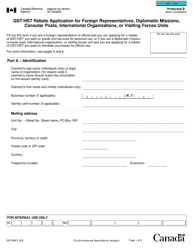

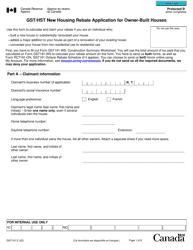

- Part A will ask you to include your basic identification. This includes your full name, Social Insurance Number, birthdate, home and work phone numbers, and full mailing and home address (if these addresses are different). Specify your language preference (either English or French), the most recent change of address and the date it occurred, and your marital and residential status.

- Part B will ask you about your spouse. Specify their full name, birth date, and social insurance number. If you're in a long-term relationship with another individual but are not married, you will have the option to classify the relationship as a common-law marriage.

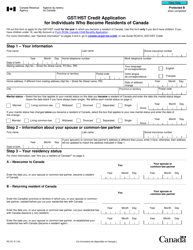

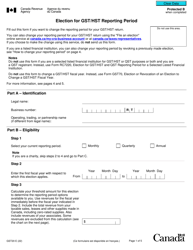

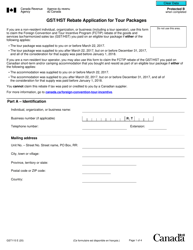

- Part C will request information about the residency standing of both you and your partner. It will also ask if you are considered new residents of Canada or are previous citizens returning to Canada, and will ask for the dates corresponding to these events. The final questions in this section will help you figure out if you meet the legal requirements as a resident of Canada and ways to check with government officials if you are unsure of your residency standing. As part of the final section, you will also locate explanations about the requirements for obtaining a social insurance number should be in need of one and additional financial incentives each province has available to its citizens.

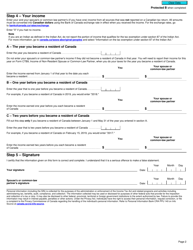

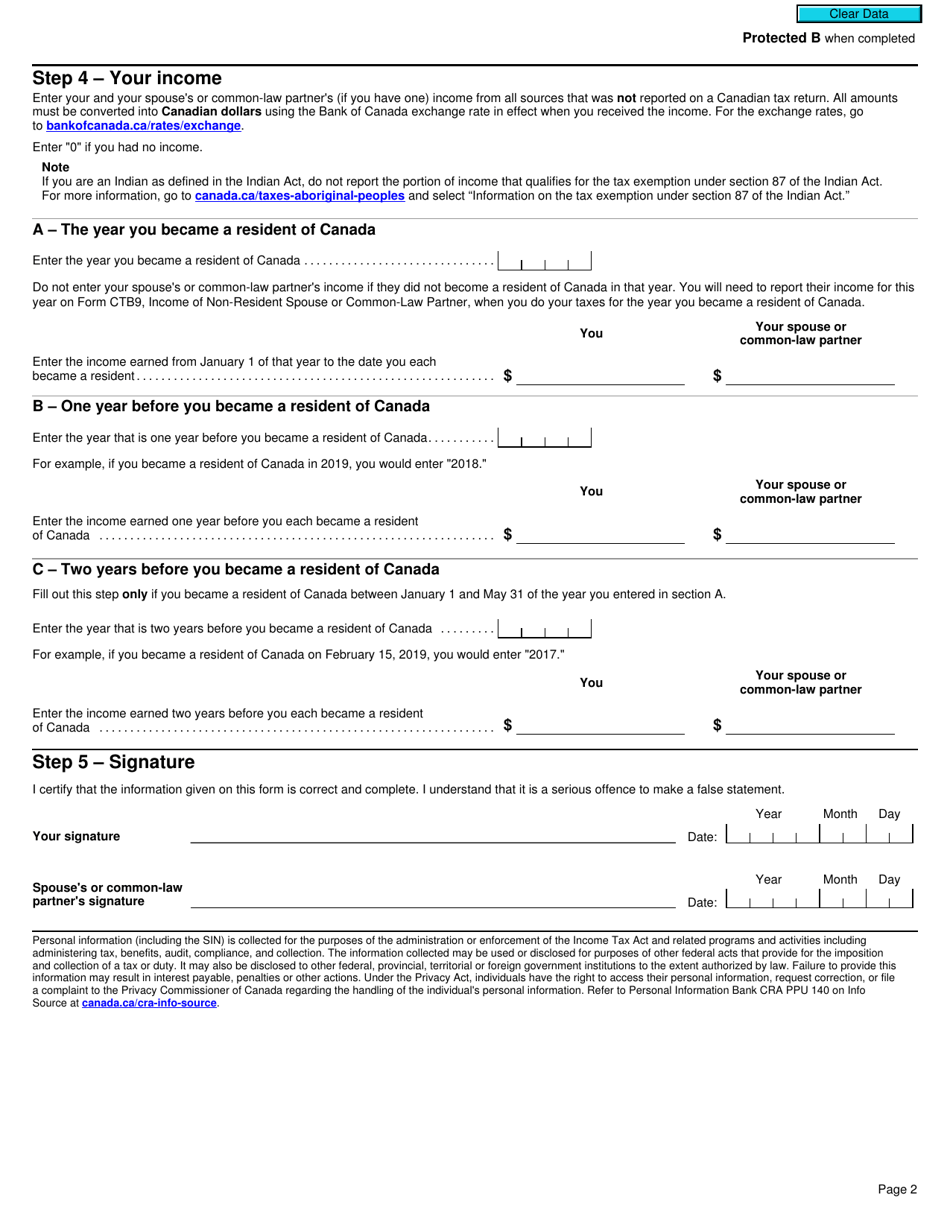

- Part D requests information concerning your household's yearly earnings. The form will ask only for your and your spouse's income (no additional household members' income will be necessary) for the year you became a resident in addition to the two years prior to this date.

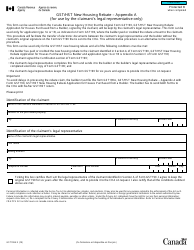

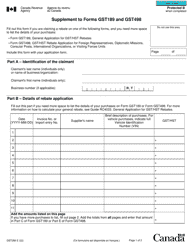

- Part E contains the final certification section where you and your spouse will sign and date the form.