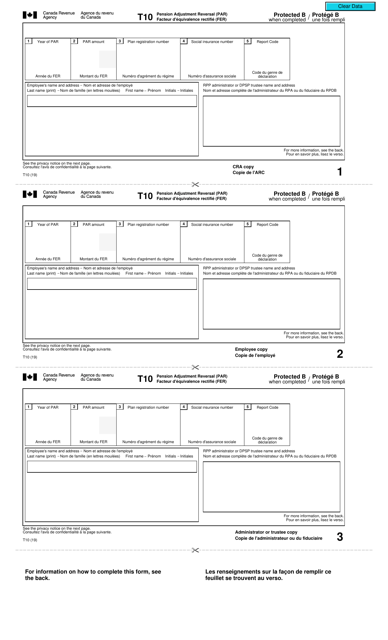

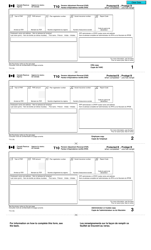

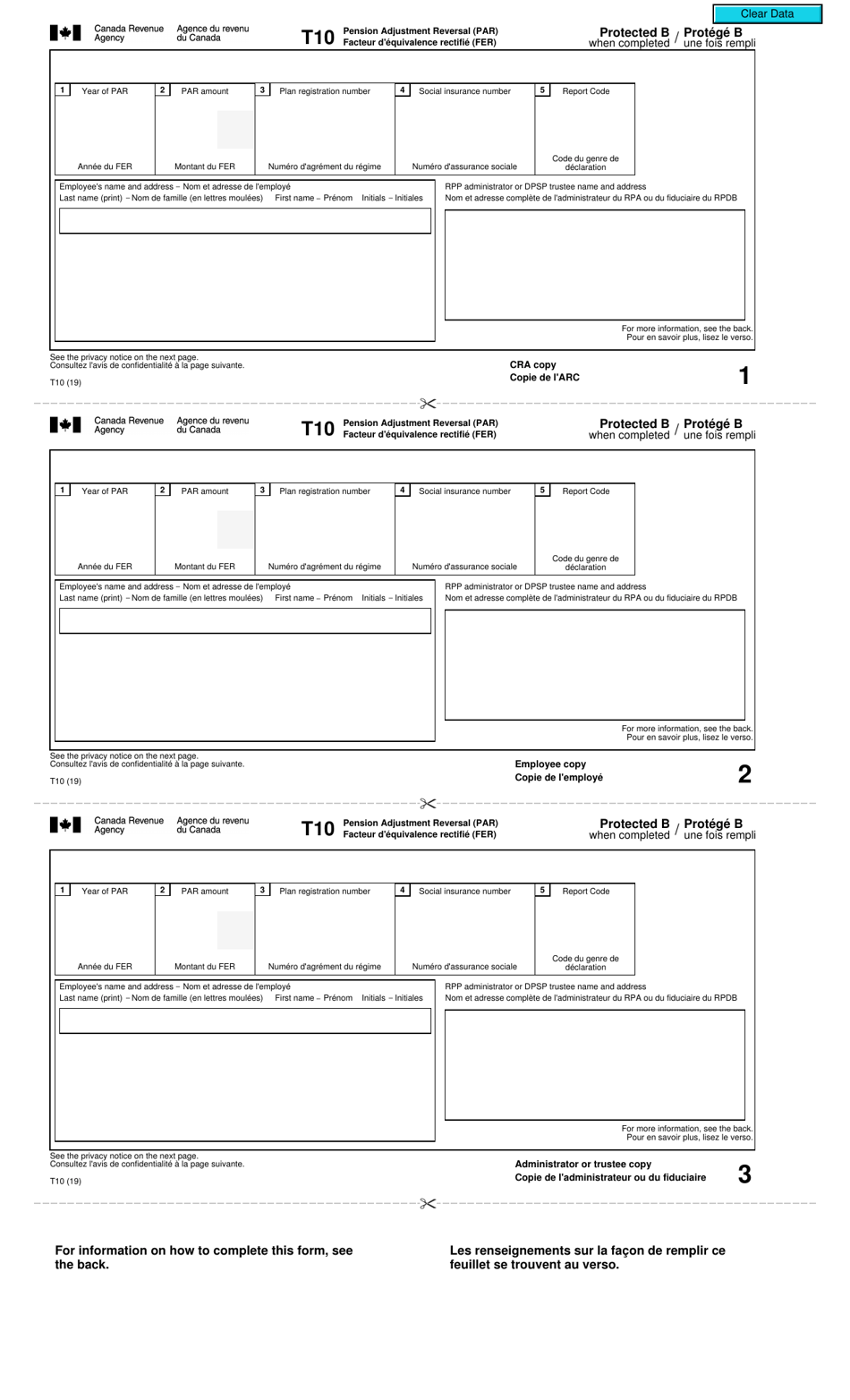

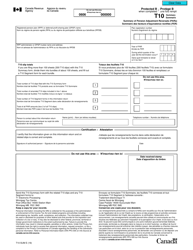

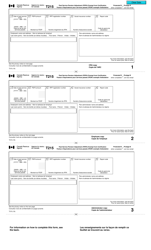

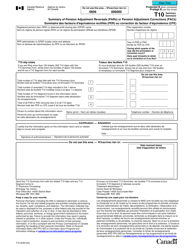

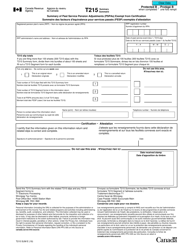

Form T10 Pension Adjustment Reversal (Par) - Canada (English / French)

Form T10 Pension Adjustment Reversal (PAR) in Canada is used to reverse a pension adjustment that was previously made for a registered pension plan. This form allows individuals to adjust their registered retirement savings plan (RRSP) contribution room, as it pertains to previous pension adjustments. It is available in both English and French.

The Form T10 Pension Adjustment Reversal (PAR) in Canada can be filed by the individual taxpayer or their authorized representative.

FAQ

Q: What is Form T10 Pension Adjustment Reversal (PAR)?

A: Form T10 Pension Adjustment Reversal (PAR) is a form used in Canada to reverse a previous pension adjustment made on a taxpayer's registered retirement savings plan (RRSP) or deferred profit sharing plan (DPSP).

Q: Why would I need to use Form T10 Pension Adjustment Reversal (PAR)?

A: You would need to use Form T10 Pension Adjustment Reversal (PAR) if you have over-contributed or made excess contributions to your RRSP or DPSP and want to reverse a previous pension adjustment.

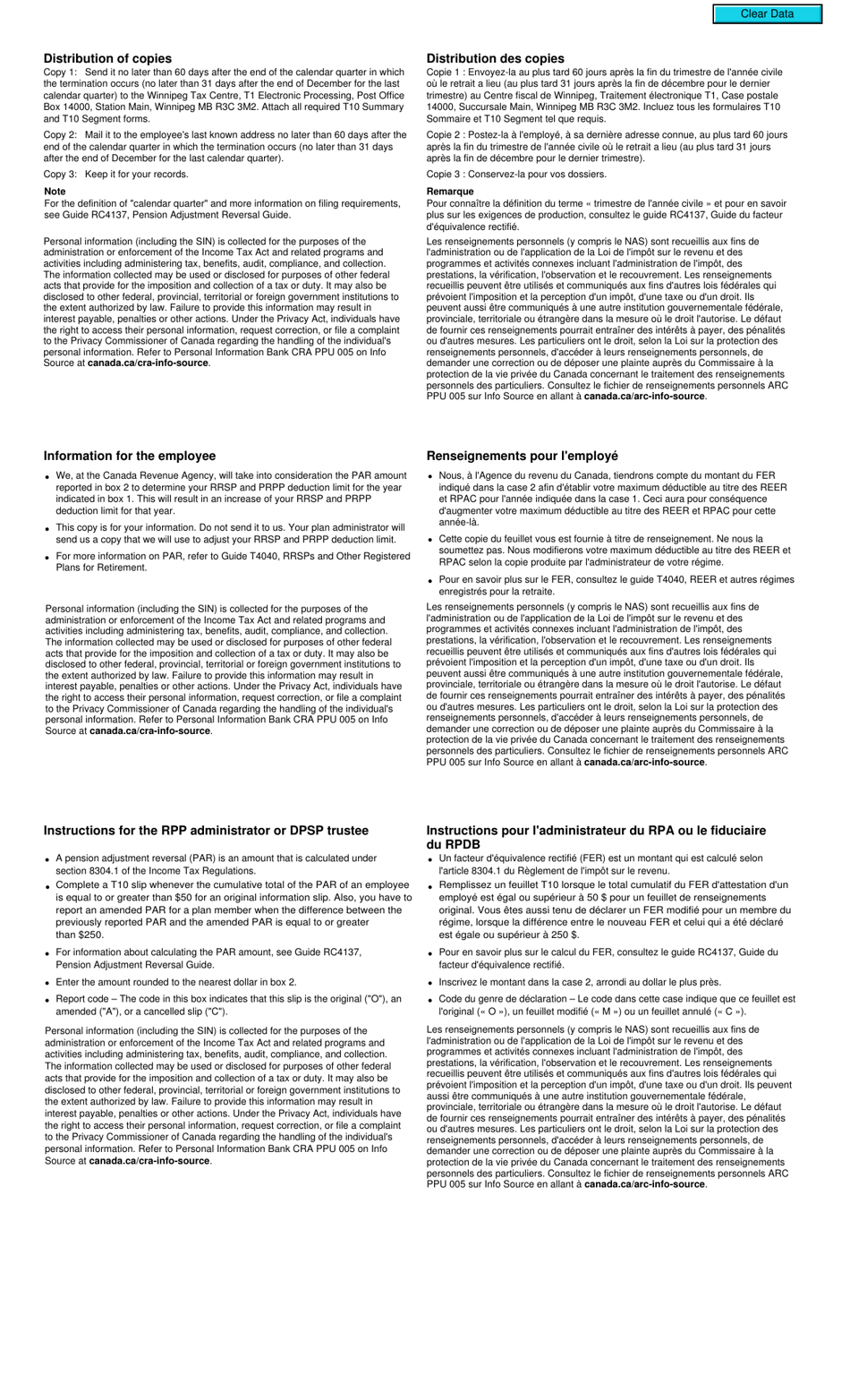

Q: How do I fill out Form T10 Pension Adjustment Reversal (PAR)?

A: You will need to fill out your personal information, including your social insurance number and the year of the reversal. You must also provide details of the original pension adjustment you wish to reverse.

Q: When is the deadline to submit Form T10 Pension Adjustment Reversal (PAR)?

A: The deadline to submit Form T10 Pension Adjustment Reversal (PAR) is 60 days after the end of the year in which the excess contributions were made.

Q: Can I use Form T10 Pension Adjustment Reversal (PAR) to reverse a pension adjustment made in a previous tax year?

A: No, Form T10 Pension Adjustment Reversal (PAR) can only be used to reverse a pension adjustment made in the current tax year.

Q: What are the consequences of not submitting Form T10 Pension Adjustment Reversal (PAR)?

A: If you do not submit Form T10 Pension Adjustment Reversal (PAR) to reverse a pension adjustment, you may face penalties and additional taxes on the excess contributions.