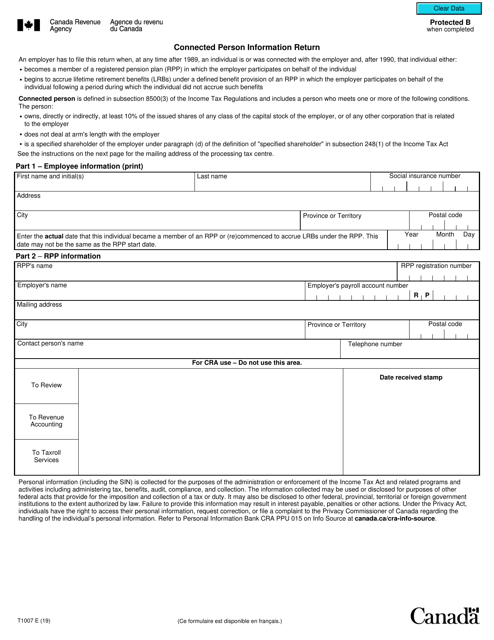

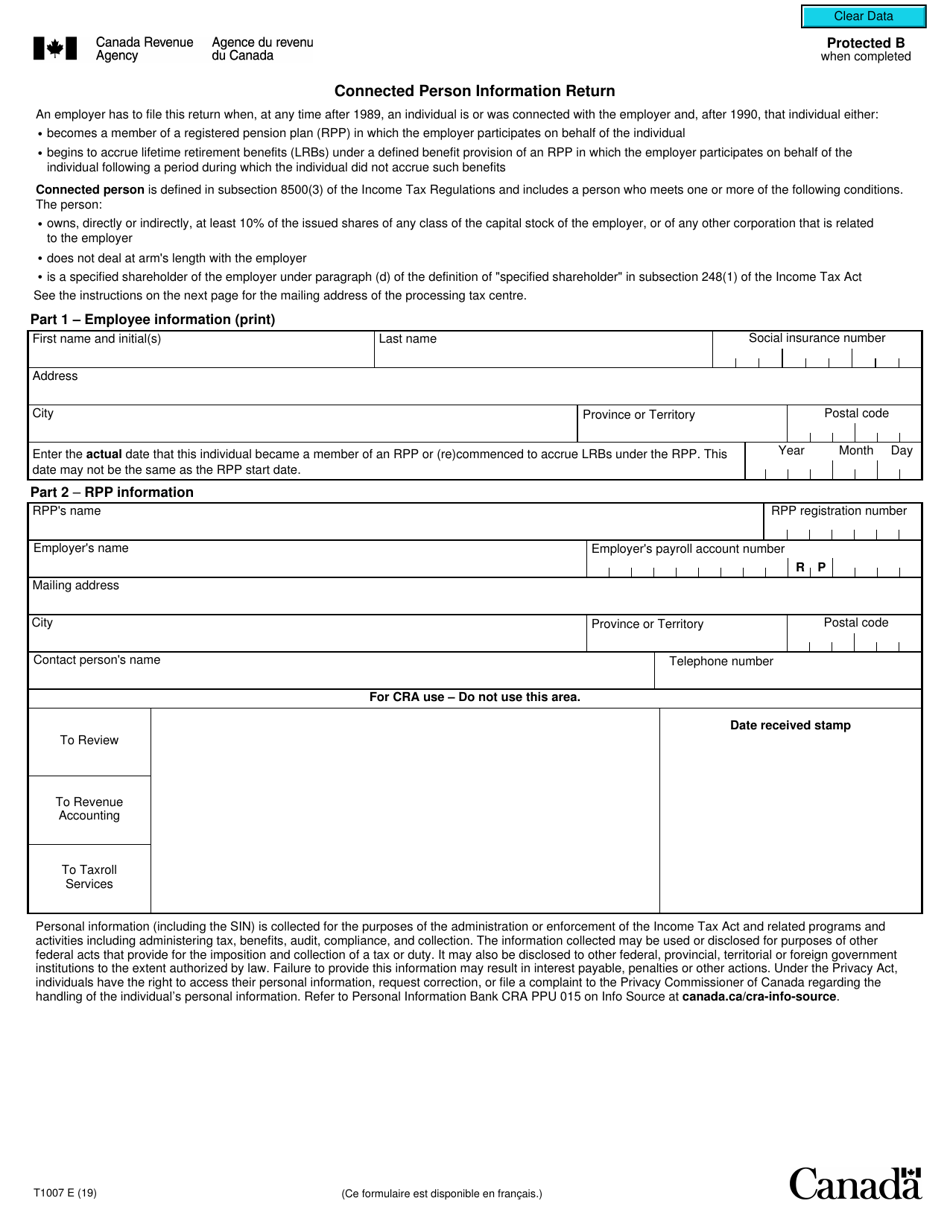

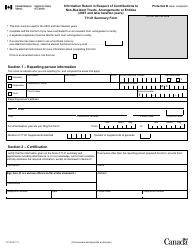

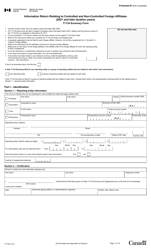

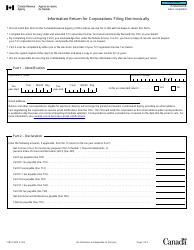

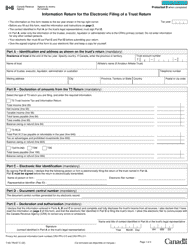

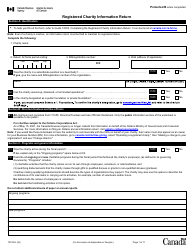

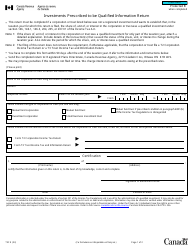

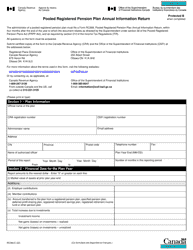

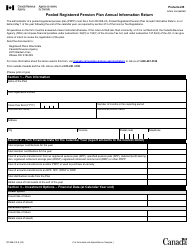

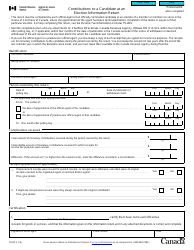

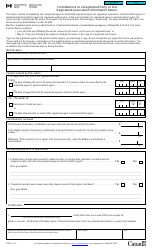

Form T1007 Connected Person Information Return - Canada

Form T1007 Connected Person Information Return - Canada is used to report certain details about a taxpayer's transactions with connected persons. It helps the Canada Revenue Agency (CRA) in assessing a taxpayer's compliance with the tax laws related to connected persons.

The Form T1007 Connected Person Information Return in Canada is filed by taxpayers who have certain transactions or dealings with a connected person as defined by the Canada Revenue Agency (CRA).

FAQ

Q: What is Form T1007?

A: Form T1007 is the Connected Person Information Return in Canada.

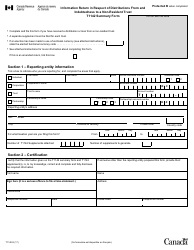

Q: Who needs to file Form T1007?

A: Any taxpayer who is a connected person or affiliated with a connected person in Canada needs to file Form T1007.

Q: What is a connected person?

A: A connected person is someone who has a close relationship with a taxpayer, such as a family member.

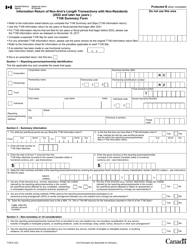

Q: What information is required on Form T1007?

A: Form T1007 requires information about the taxpayer and the connected person, including their names, addresses, and relationship.

Q: When is the deadline to file Form T1007?

A: Form T1007 must be filed by the taxpayer's tax filing deadline, which is usually April 30th of the following year.

Q: Is Form T1007 required for US residents?

A: No, Form T1007 is specific to Canadian taxpayers and does not apply to US residents.