This version of the form is not currently in use and is provided for reference only. Download this version of

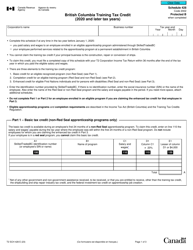

Form T1014

for the current year.

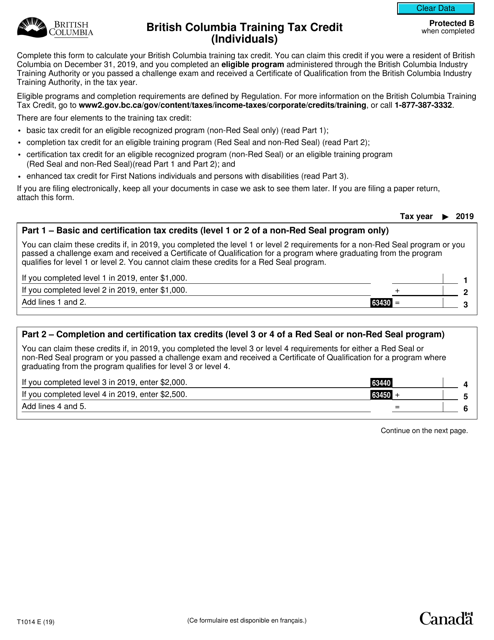

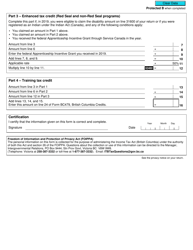

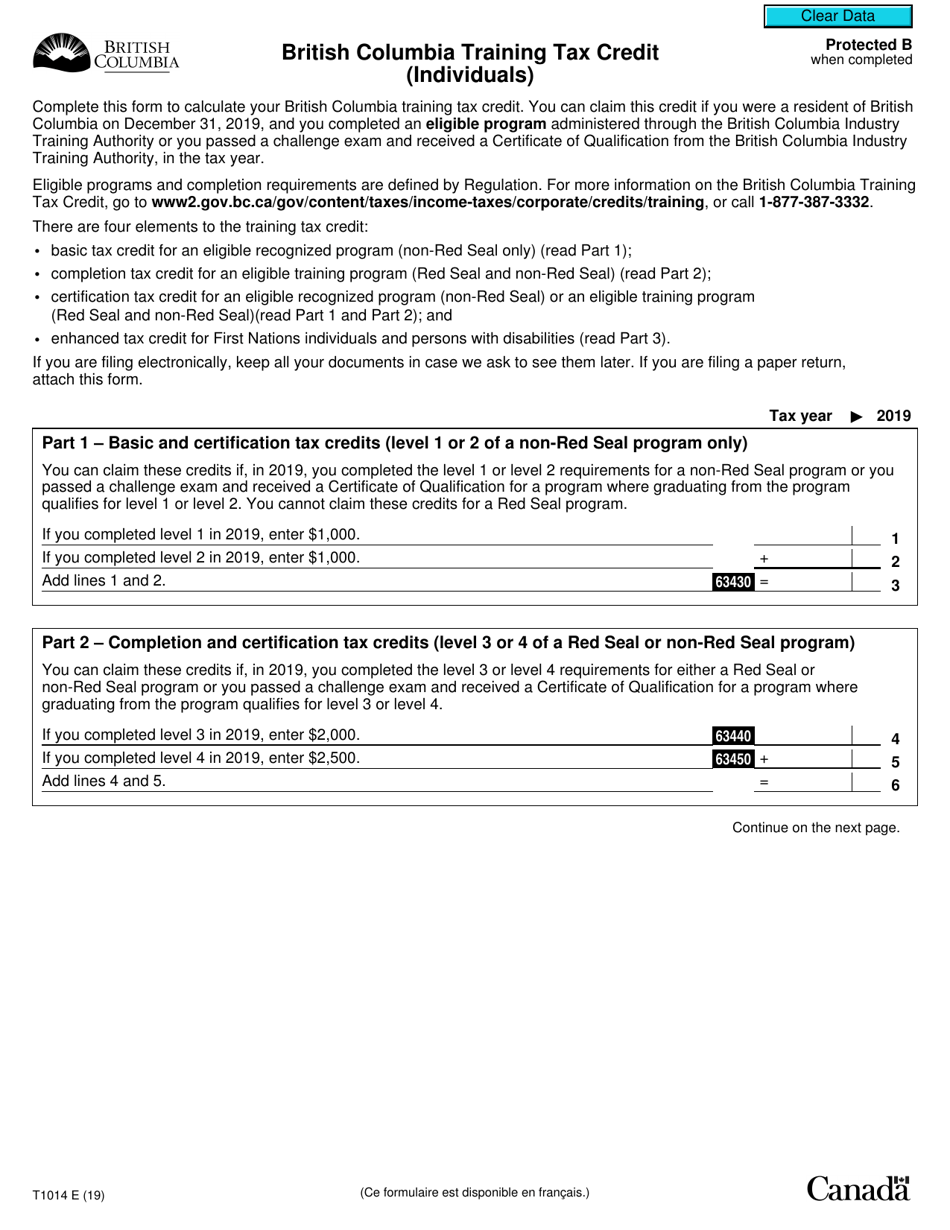

Form T1014 British Columbia Training Tax Credit (Individuals) - Canada

Form T1014, the British Columbia Training Tax Credit (Individuals), is a tax credit in Canada specifically designed to encourage individuals to take eligible training programs in British Columbia. This tax credit allows individuals to claim a percentage of their eligible training expenses, up to a certain limit, thereby reducing their overall tax liability. It is intended to support continuous learning and skill development among individuals in British Columbia.

The Form T1014 British Columbia Training Tax Credit (Individuals) in Canada is filed by individuals who are eligible for this tax credit.

FAQ

Q: What is Form T1014?

A: Form T1014 is a tax form used in British Columbia, Canada.

Q: What is the British Columbia Training Tax Credit?

A: The British Columbia Training Tax Credit is a tax credit available to individuals who have completed eligible training programs in British Columbia.

Q: Who is eligible for the British Columbia Training Tax Credit?

A: Individuals who have completed certain eligible training programs in British Columbia are eligible for the tax credit.

Q: What is the purpose of the British Columbia Training Tax Credit?

A: The purpose of the tax credit is to incentivize individuals to participate in training programs that enhance their skills and knowledge.

Q: How do I claim the British Columbia Training Tax Credit?

A: To claim the tax credit, you need to complete Form T1014 and include it with your annual tax return in Canada.