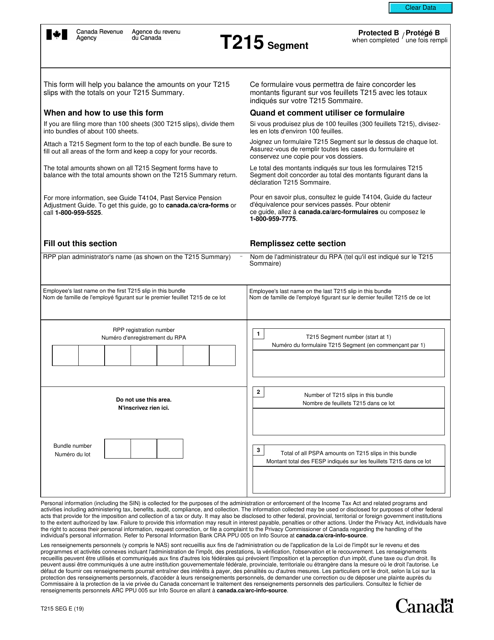

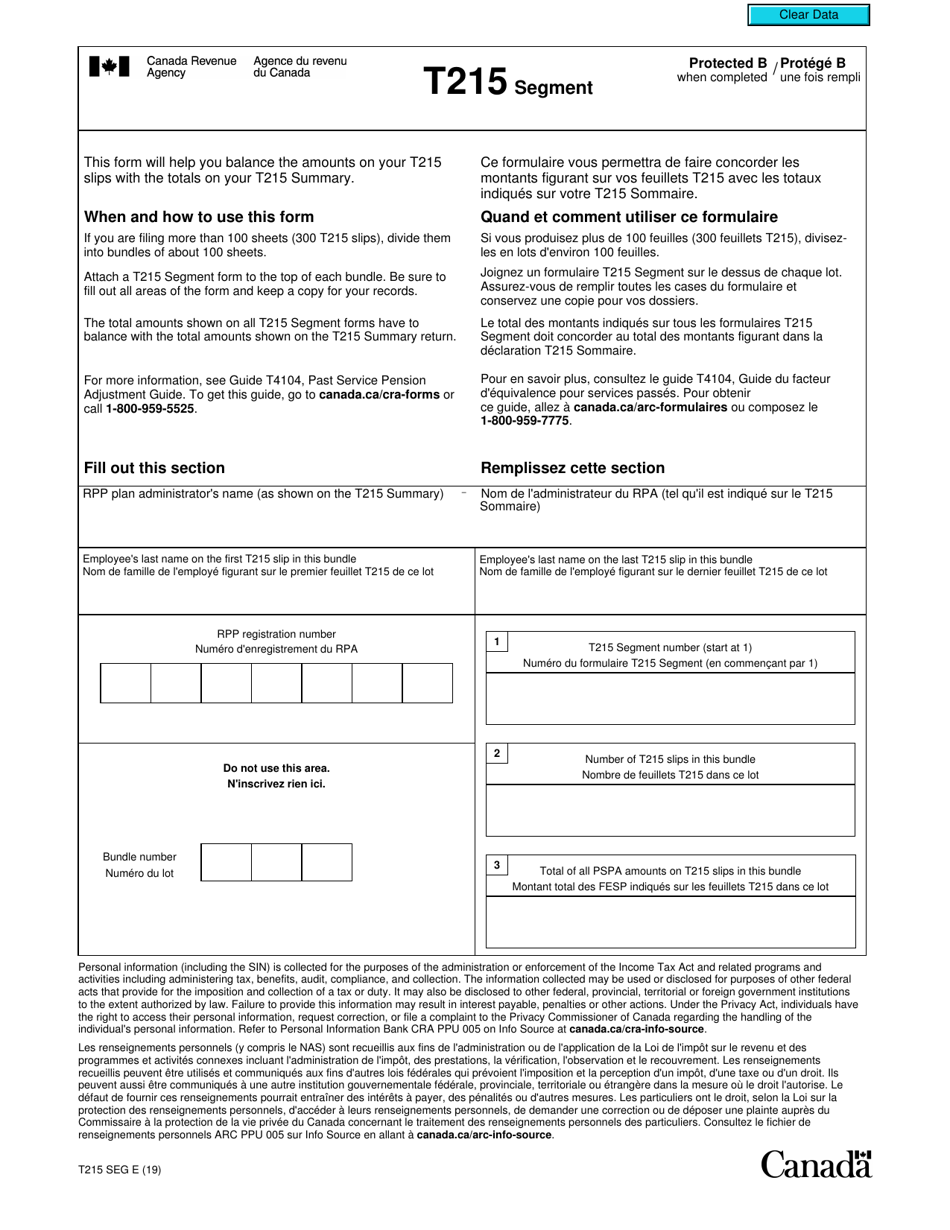

Form T215 SEG Segment - Canada (English / French)

Form T215 SEG Segment is used in Canada for reporting amounts paid or credited to non-residents of Canada for services rendered in Canada. This form is used for both English and French-speaking individuals.

The Form T215 SEG Segment in Canada is filed by individuals who are non-resident in Canada for a temporary period and have employment income from a Canadian source.

FAQ

Q: What is Form T215 SEG Segment?

A: Form T215 SEG Segment is a tax form used in Canada.

Q: Who needs to fill out Form T215 SEG Segment?

A: Form T215 SEG Segment is used by individuals who receive income from a partnership or an S corporation in Canada.

Q: Is Form T215 SEG Segment available in English and French?

A: Yes, Form T215 SEG Segment is available in both English and French.

Q: What information do I need to fill out Form T215 SEG Segment?

A: You will need to provide information about your partnership or S corporation income, as well as your personal information.

Q: Do I need to include Form T215 SEG Segment with my tax return?

A: Yes, you will need to include Form T215 SEG Segment with your tax return if you have partnership or S corporation income in Canada.

Q: Is there a deadline for filing Form T215 SEG Segment?

A: Yes, the deadline for filing Form T215 SEG Segment is the same as the deadline for filing your tax return in Canada.

Q: Do I need to submit Form T215 SEG Segment every year?

A: No, you only need to submit Form T215 SEG Segment for the tax year in which you have partnership or S corporation income in Canada.