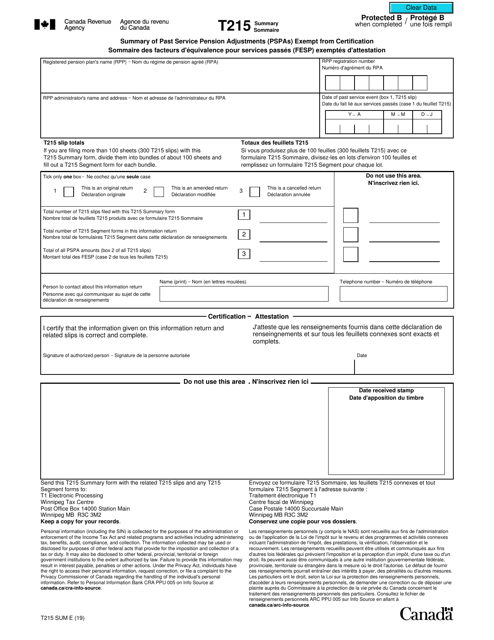

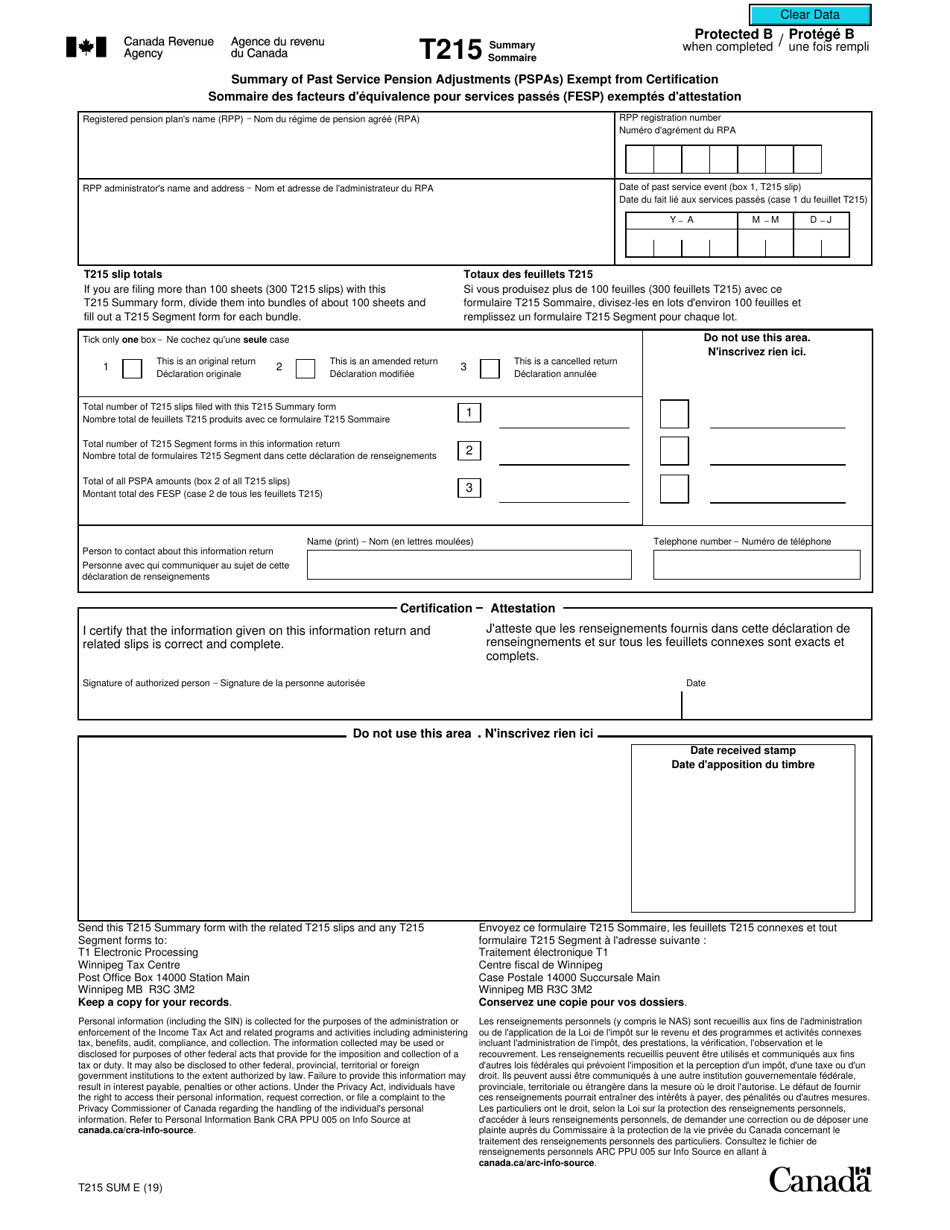

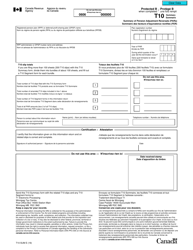

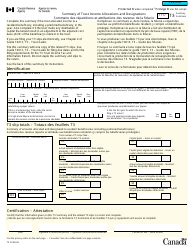

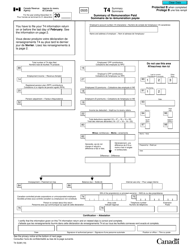

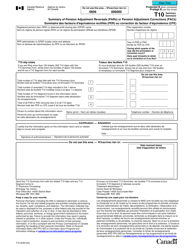

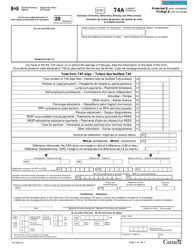

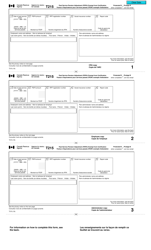

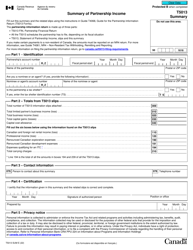

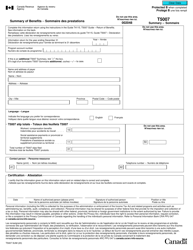

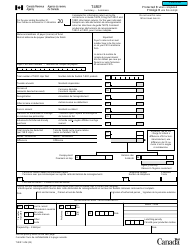

Form T215 SUM Summary of Past Service Pension Adjustments (Pspas) Exempt From Certification - Canada (English / French)

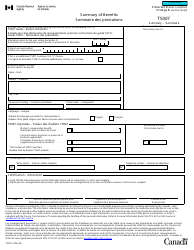

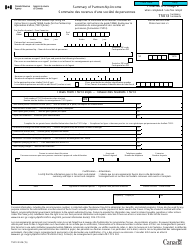

Form T215 SUM Summary of Past Service Pension Adjustments (PSPAs) Exempt From Certification is used in Canada to provide a summary of past service pension adjustments. It is used to report any changes made to an individual's pension plan that may affect their pension benefits. This form is used for exemption purposes and is available in both English and French.

The form T215 SUM Summary of Past Service Pension Adjustments (PSPAs) exempt from certification in Canada can be filed by individuals who have made adjustments to their pension plan prior to a specific date.

FAQ

Q: What is Form T215 SUM?

A: Form T215 SUM is a Summary of Past Service Pension Adjustments (PSPAs) that are exempt from certification in Canada.

Q: What is the purpose of Form T215 SUM?

A: The purpose of Form T215 SUM is to provide a summary of past service pension adjustments (PSPAs) that are exempt from certification.

Q: What is a Past Service Pension Adjustment (PSPA)?

A: A Past Service Pension Adjustment (PSPA) is an adjustment made to a registered pension plan that increases the pension benefits earned in a prior period.

Q: Who needs to complete Form T215 SUM?

A: Individuals who have past service pension adjustments (PSPAs) that are exempt from certification in Canada need to complete Form T215 SUM.

Q: Does Form T215 SUM need to be submitted to the Canada Revenue Agency (CRA)?

A: No, Form T215 SUM does not need to be submitted to the Canada Revenue Agency (CRA). It is for informational purposes only.

Q: Is Form T215 SUM available in both English and French?

A: Yes, Form T215 SUM is available in both English and French.

Q: What should I do if I have questions about completing Form T215 SUM?

A: If you have questions about completing Form T215 SUM, you can contact the Canada Revenue Agency (CRA) for assistance.