This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (9403-S2) Schedule NS(S2)MJ

for the current year.

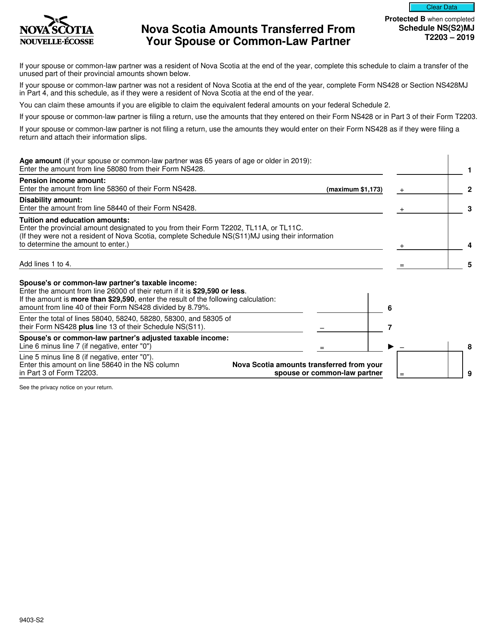

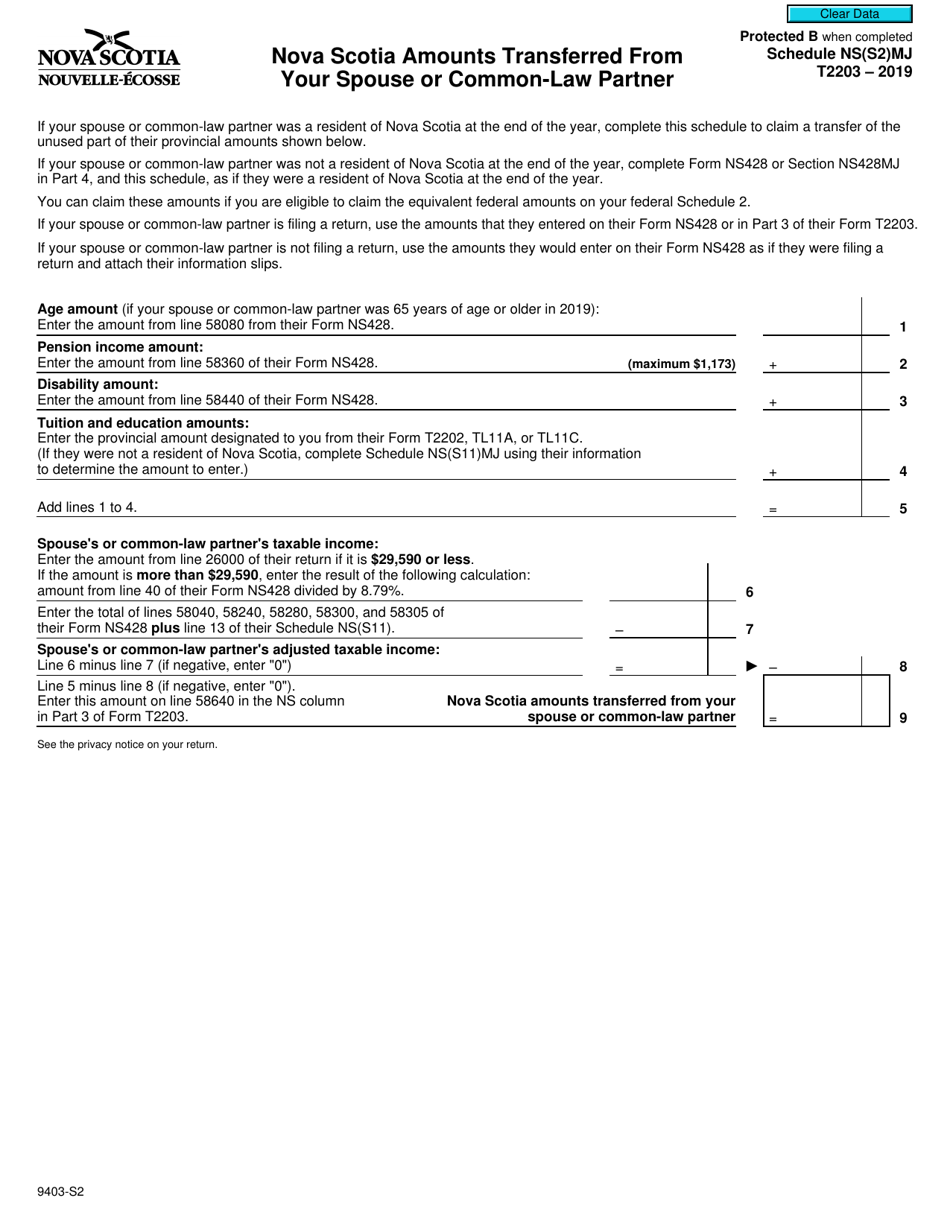

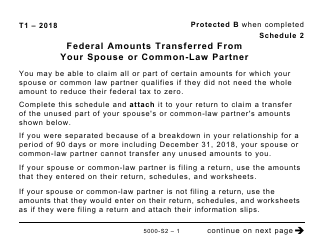

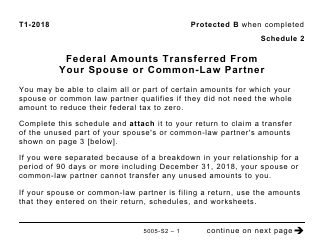

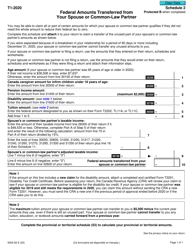

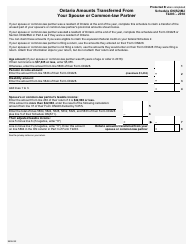

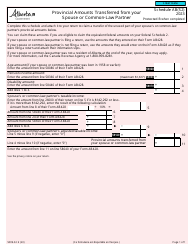

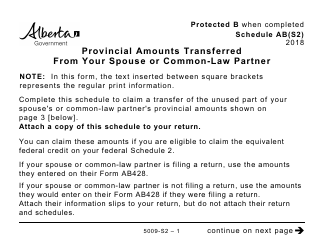

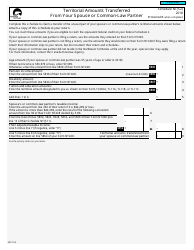

Form T2203 (9403-S2) Schedule NS(S2)MJ Nova Scotia Amounts Transferred From Your Spouse or Common-Law Partner - Canada

Form T2203 (9403-S2) Schedule NS(S2)MJ Nova Scotia Amounts Transferred From Your Spouse or Common-Law Partner - Canada is a tax form used in Canada to report the amounts transferred from a spouse or common-law partner in Nova Scotia for tax purposes. It is used to calculate the provincial tax credits and deductions that can be claimed by individuals in Nova Scotia.

Form T2203 (9403-S2) Schedule NS(S2) is filed by individuals who are residents of Nova Scotia and are claiming amounts transferred from their spouse or common-law partner for the Nova Scotia tax credit programs.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada.

Q: What is Schedule NS(S2)MJ?

A: Schedule NS(S2)MJ is a specific schedule used with Form T2203 in Nova Scotia.

Q: What does Schedule NS(S2)MJ Nova Scotia Amounts Transferred From Your Spouse or Common-Law Partner mean?

A: This schedule is used to report amounts transferred from your spouse or common-law partner for tax purposes in Nova Scotia.

Q: Why do I need to complete Form T2203 and Schedule NS(S2)MJ?

A: You need to complete these forms if you want to transfer tax amounts from your spouse or common-law partner to reduce your tax liability in Nova Scotia.

Q: Is Schedule NS(S2)MJ specific to Nova Scotia?

A: Yes, this schedule is specific to Nova Scotia and is not used in other provinces or territories in Canada.