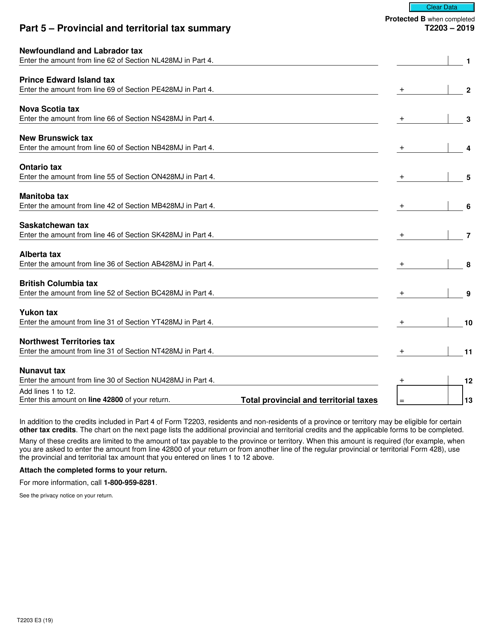

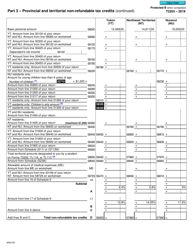

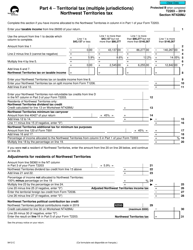

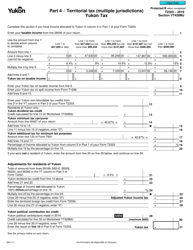

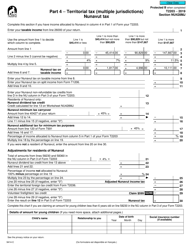

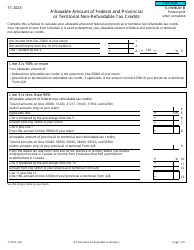

Form T2203 Part 5 Provincial and Territorial Tax Summary - Canada

Form T2203 Part 5 Provincial and Territorial Tax Summary - Canada is used to summarize the provincial and territorial tax payments you have made in Canada. It helps determine if you owe any additional tax or are eligible for a refund.

Form T2203 Part 5 Provincial and Territorial Tax Summary in Canada is typically filed by individuals who are residents of specific provinces or territories and have taxable income in those regions.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada to summarize provincial and territorial tax information.

Q: What is Part 5 of Form T2203?

A: Part 5 of Form T2203 is the section where you provide a summary of your provincial and territorial tax amounts.

Q: What is Provincial and Territorial Tax?

A: Provincial and territorial tax is the additional tax you pay based on your income in a specific province or territory in Canada.

Q: Why is it important to fill out Part 5 of Form T2203?

A: Filling out Part 5 of Form T2203 ensures that you accurately report and calculate your provincial and territorial tax amounts.

Q: Do I need to fill out Form T2203 if I live in the United States?

A: No, Form T2203 is specific to residents of Canada and is not required for individuals living in the United States.

Q: Do I need to submit Form T2203 with my tax return?

A: Yes, you need to submit Form T2203 along with your tax return to the CRA.

Q: Is Form T2203 the same for all provinces and territories?

A: No, the provincial and territorial tax rates and calculations may vary, so there may be differences in Form T2203 for each province or territory.

Q: What if I have questions or need help with Form T2203?

A: If you have questions or need help with Form T2203, you can contact the Canada Revenue Agency or seek assistance from a tax professional.