This version of the form is not currently in use and is provided for reference only. Download this version of

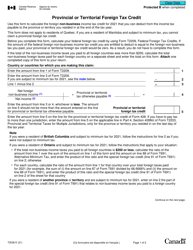

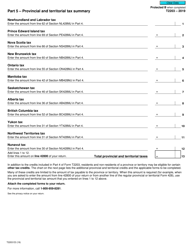

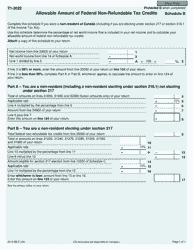

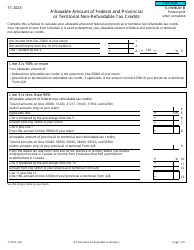

Form T2203 (9400-S3) Part 3

for the current year.

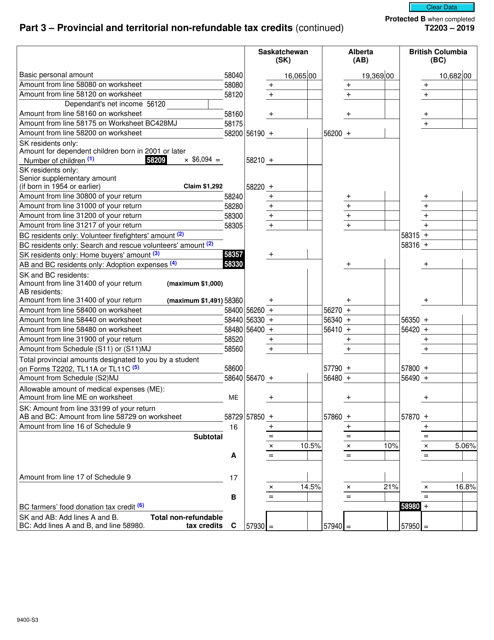

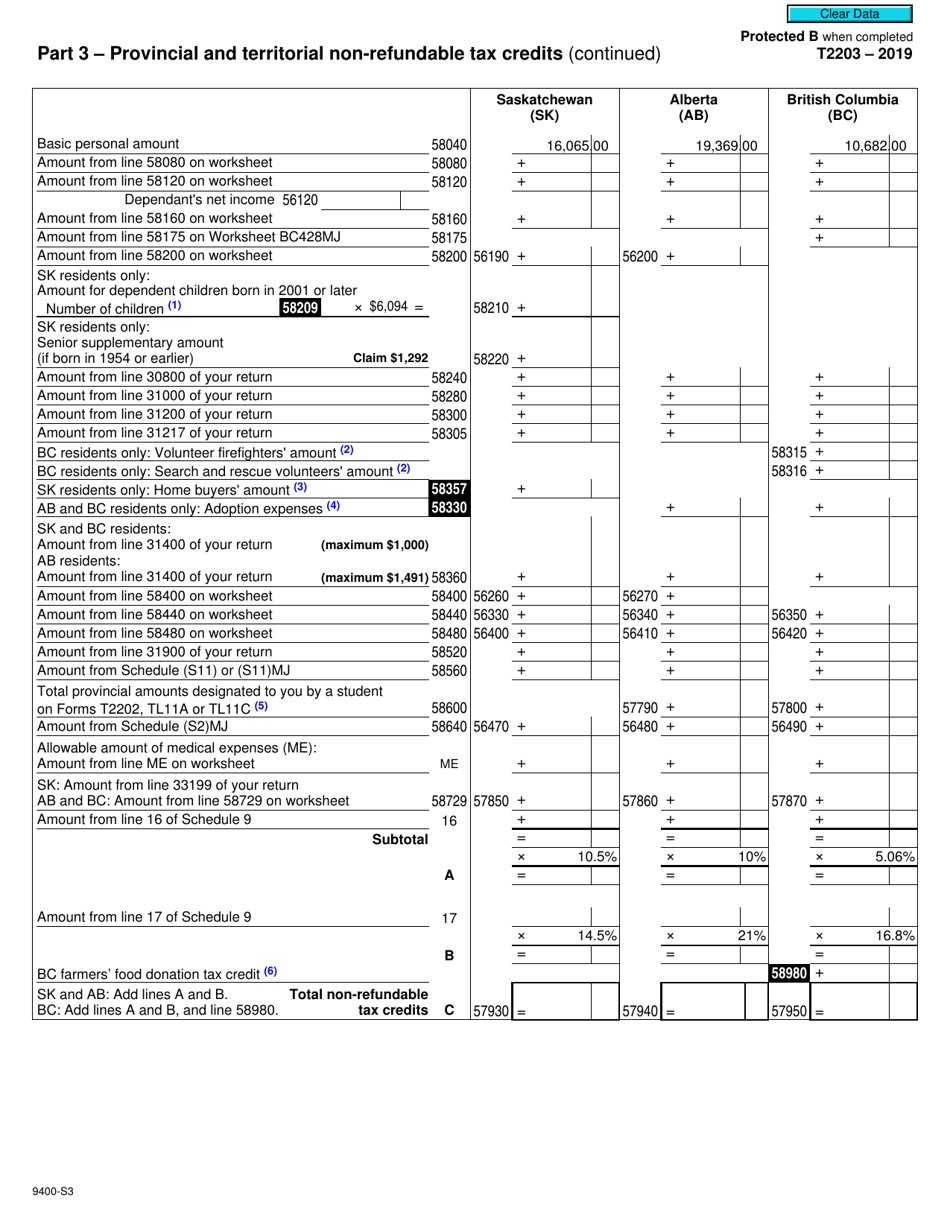

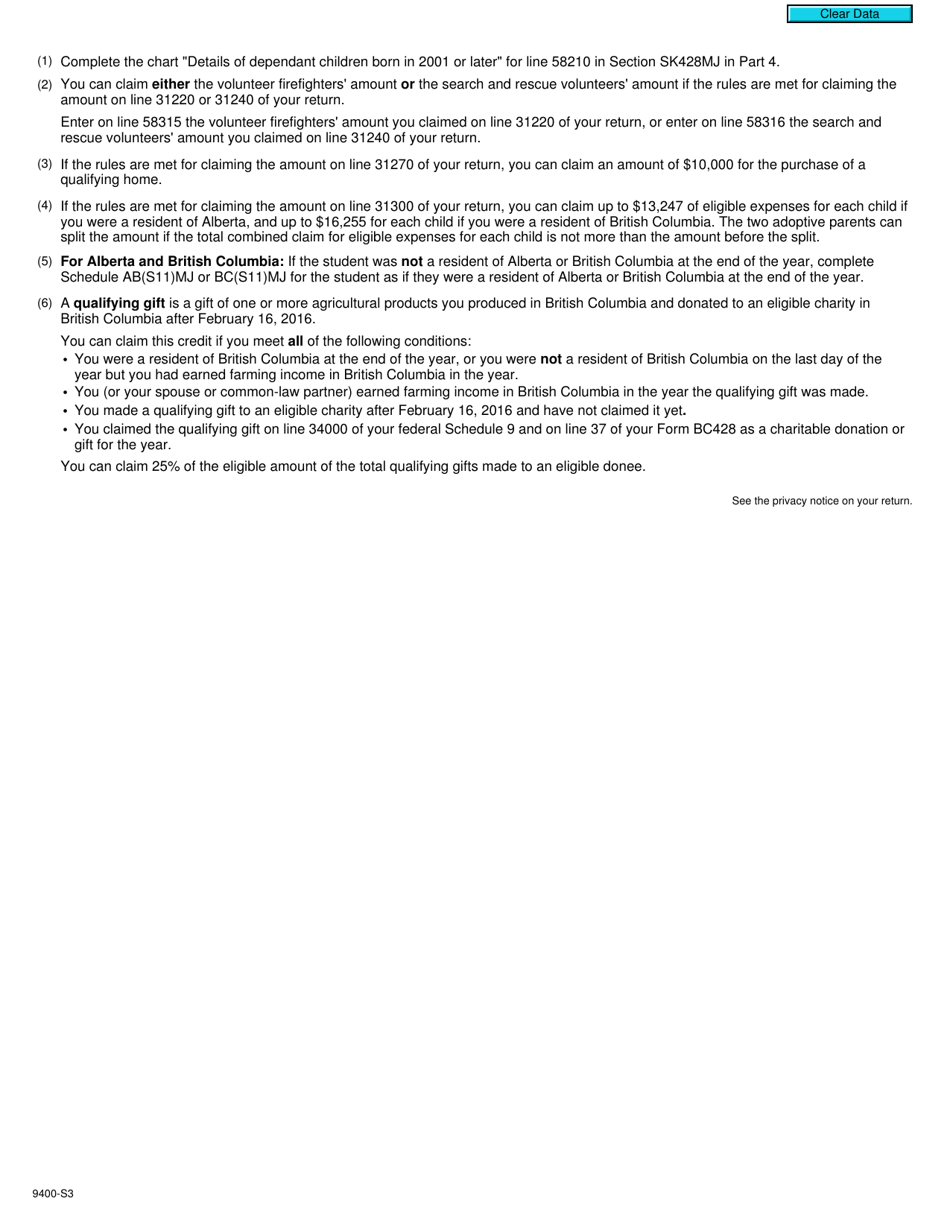

Form T2203 (9400-S3) Part 3 Provincial and Territorial Non-refundable Tax Credits (Sk, AB, Bc) - Canada

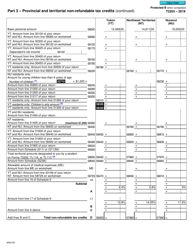

Form T2203 (9400-S3) Part 3 Provincial and Territorial Non-refundable Tax Credits (SK, AB, BC) - Canada is used to calculate and claim non-refundable tax credits specific to the provinces of Saskatchewan, Alberta, and British Columbia. These tax credits can help reduce the amount of provincial income tax you owe.

The Form T2203 (9400-S3) Part 3 Provincial and Territorial Non-refundable Tax Credits (SK, AB, BC) in Canada is filed by individual taxpayers who want to claim non-refundable tax credits in the provinces of Saskatchewan (SK), Alberta (AB), and British Columbia (BC).

FAQ

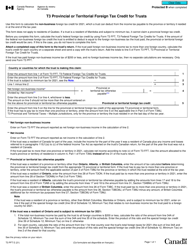

Q: What is Form T2203?

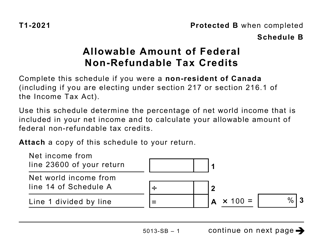

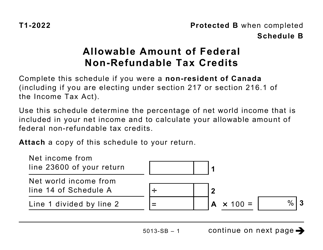

A: Form T2203 is a tax form used in Canada to claim provincial and territorial non-refundable tax credits.

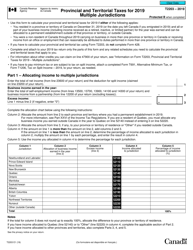

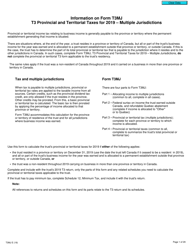

Q: What is Part 3 of Form T2203 for?

A: Part 3 of Form T2203 is specifically for claiming provincial and territorial non-refundable tax credits for the provinces of Saskatchewan (SK), Alberta (AB), and British Columbia (BC).

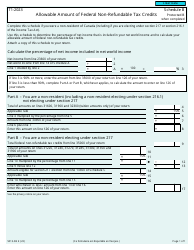

Q: What are non-refundable tax credits?

A: Non-refundable tax credits are deductions that reduce the amount of tax you owe, but cannot result in a refund. They can only be used to reduce your tax liability to zero.

Q: Who can use Form T2203?

A: Residents of Canada who are eligible for provincial and territorial non-refundable tax credits in Saskatchewan (SK), Alberta (AB), and British Columbia (BC) can use Form T2203.

Q: What information is required in Part 3 of Form T2203?

A: Part 3 of Form T2203 requires you to provide specific details about your eligibility for and amounts of provincial and territorial non-refundable tax credits in Saskatchewan (SK), Alberta (AB), and British Columbia (BC).

Q: When is Form T2203 due?

A: Form T2203 is typically due on or before April 30th of the following year for most individuals, or June 15th for self-employed individuals.