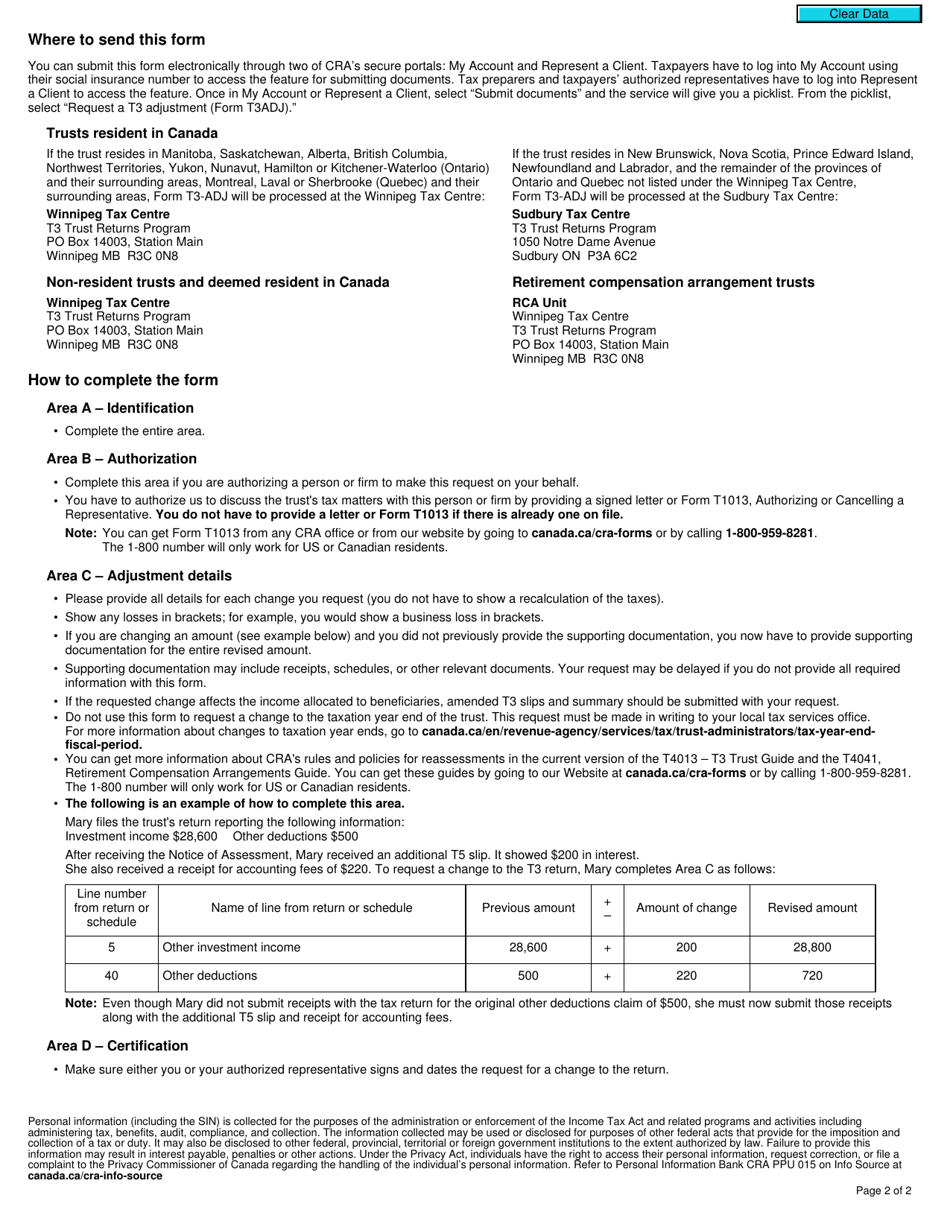

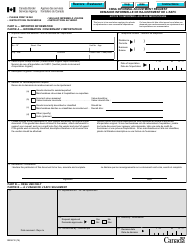

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3-ADJ

for the current year.

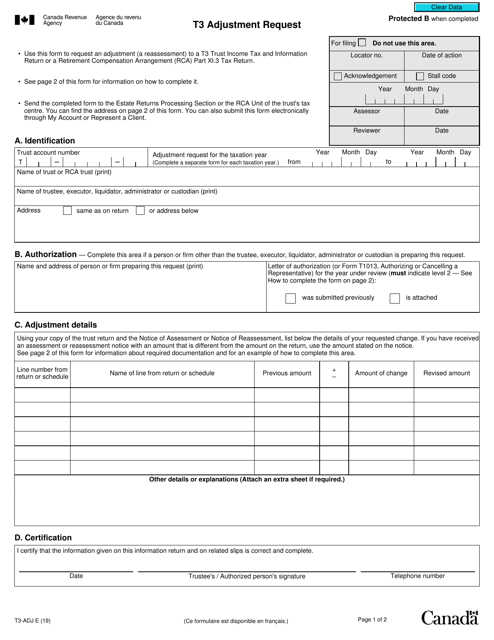

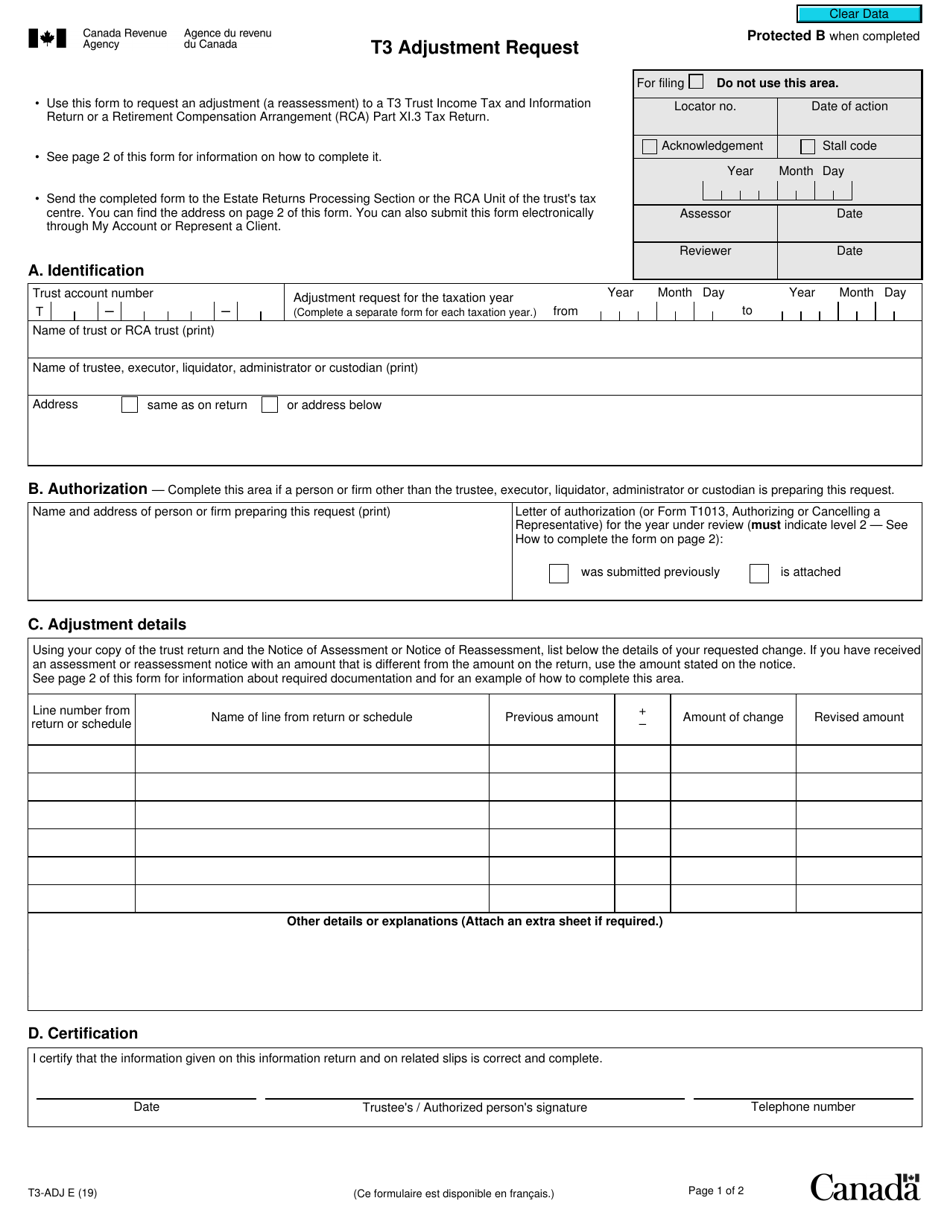

Form T3-ADJ T3 Adjustment Request - Canada

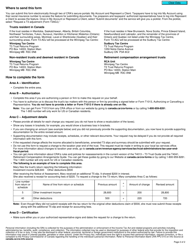

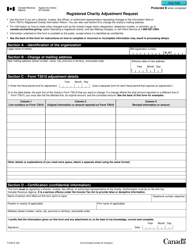

Form T3-ADJ, also known as the T3 Adjustment Request, is used in Canada for making adjustments to a filed T3 Trust Income Tax and Information Return. It is used to correct errors or make changes to the reported income, deductions, and tax credits for a trust.

The Form T3-ADJ T3 Adjustment Request in Canada is usually filed by a taxpayer who wants to make adjustments to their tax return for a T3 Trust income.

FAQ

Q: What is Form T3-ADJ?

A: Form T3-ADJ is a T3 Adjustment Request form used in Canada.

Q: What is a T3 Adjustment Request?

A: A T3 Adjustment Request is a request to make changes or corrections to a T3 tax return filed in Canada.

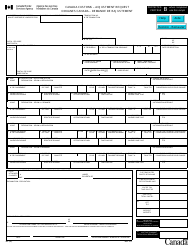

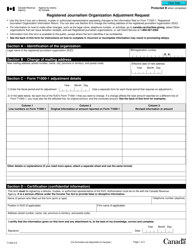

Q: Who needs to file Form T3-ADJ?

A: Individuals or organizations who need to make changes to a previously filed T3 tax return in Canada need to file Form T3-ADJ.

Q: What information is required on Form T3-ADJ?

A: Form T3-ADJ requires information about the taxpayer, the original T3 return, and the changes or corrections being requested.