This version of the form is not currently in use and is provided for reference only. Download this version of

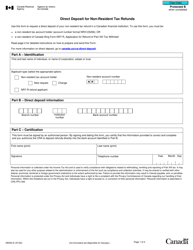

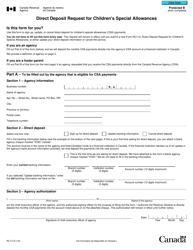

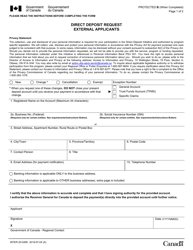

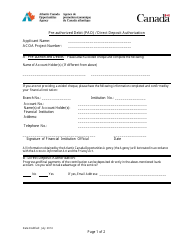

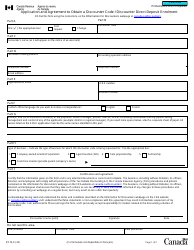

Form T3-DD

for the current year.

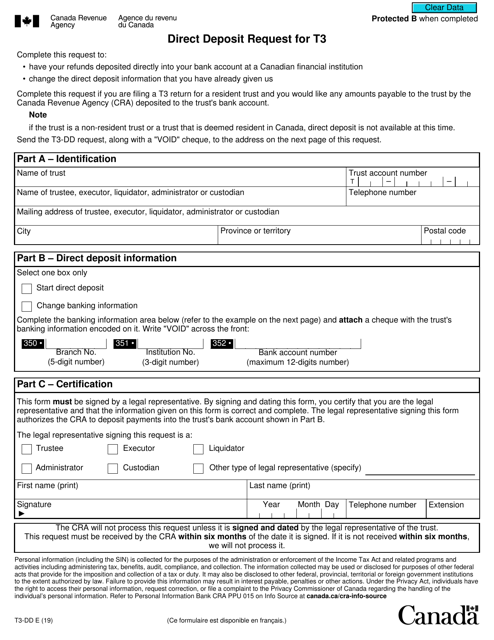

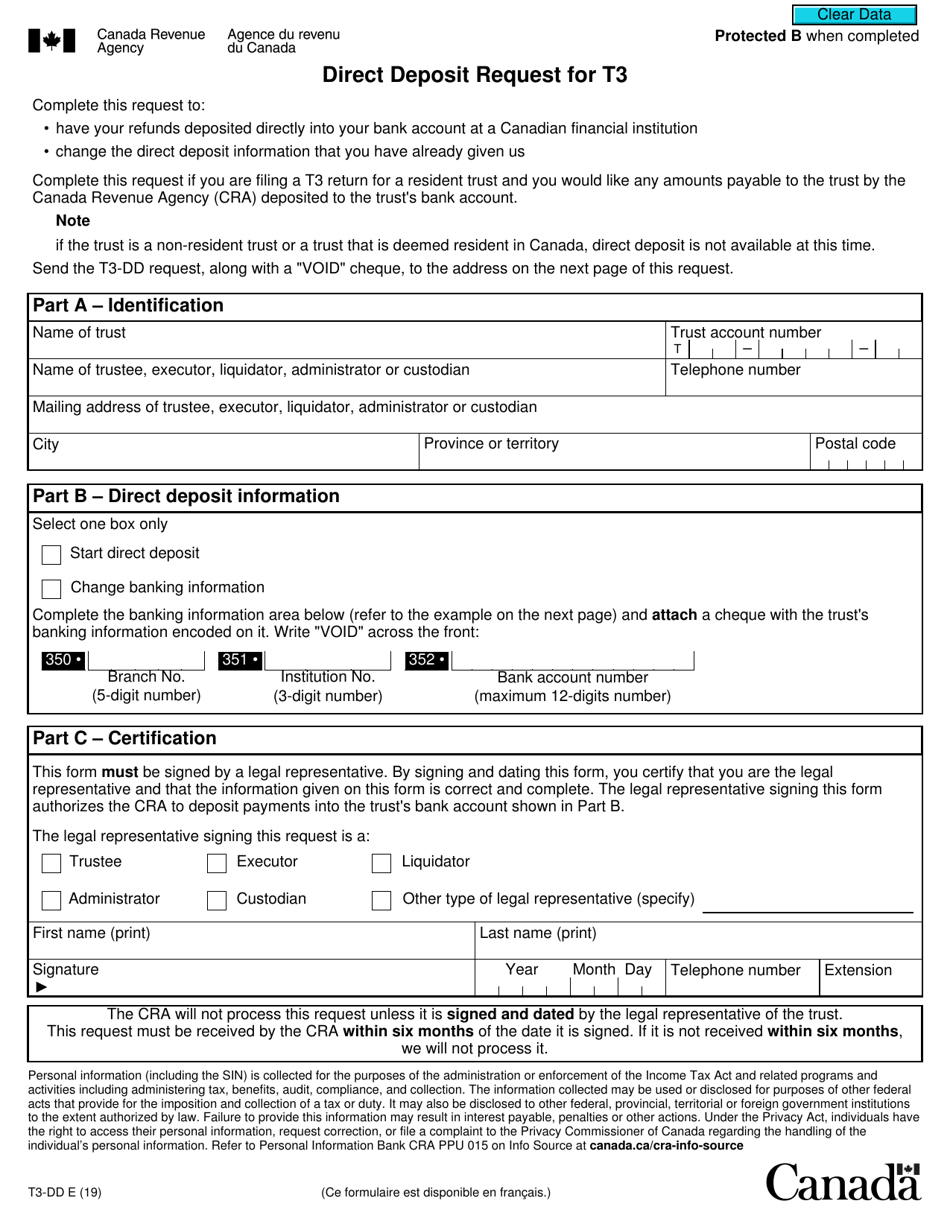

Form T3-DD Direct Deposit Request for T3 - Canada

Form T3-DD, Direct Deposit Request for T3 - Canada, is used to authorize the Canada Revenue Agency (CRA) to deposit your T3 tax refunds, T3 slip payments, and other related payments directly into your bank account. It provides a convenient and secure way to receive your funds electronically.

The form T3-DD Direct Deposit Request for T3 - Canada is filed by the individual or entity who is receiving income from a T3 trust.

FAQ

Q: What is Form T3-DD?

A: Form T3-DD is a Direct Deposit Request form for T3 in Canada.

Q: What is the purpose of Form T3-DD?

A: The purpose of Form T3-DD is to request direct deposit for T3 payments in Canada.

Q: Who should use Form T3-DD?

A: Anyone receiving T3 payments in Canada can use Form T3-DD to request direct deposit.

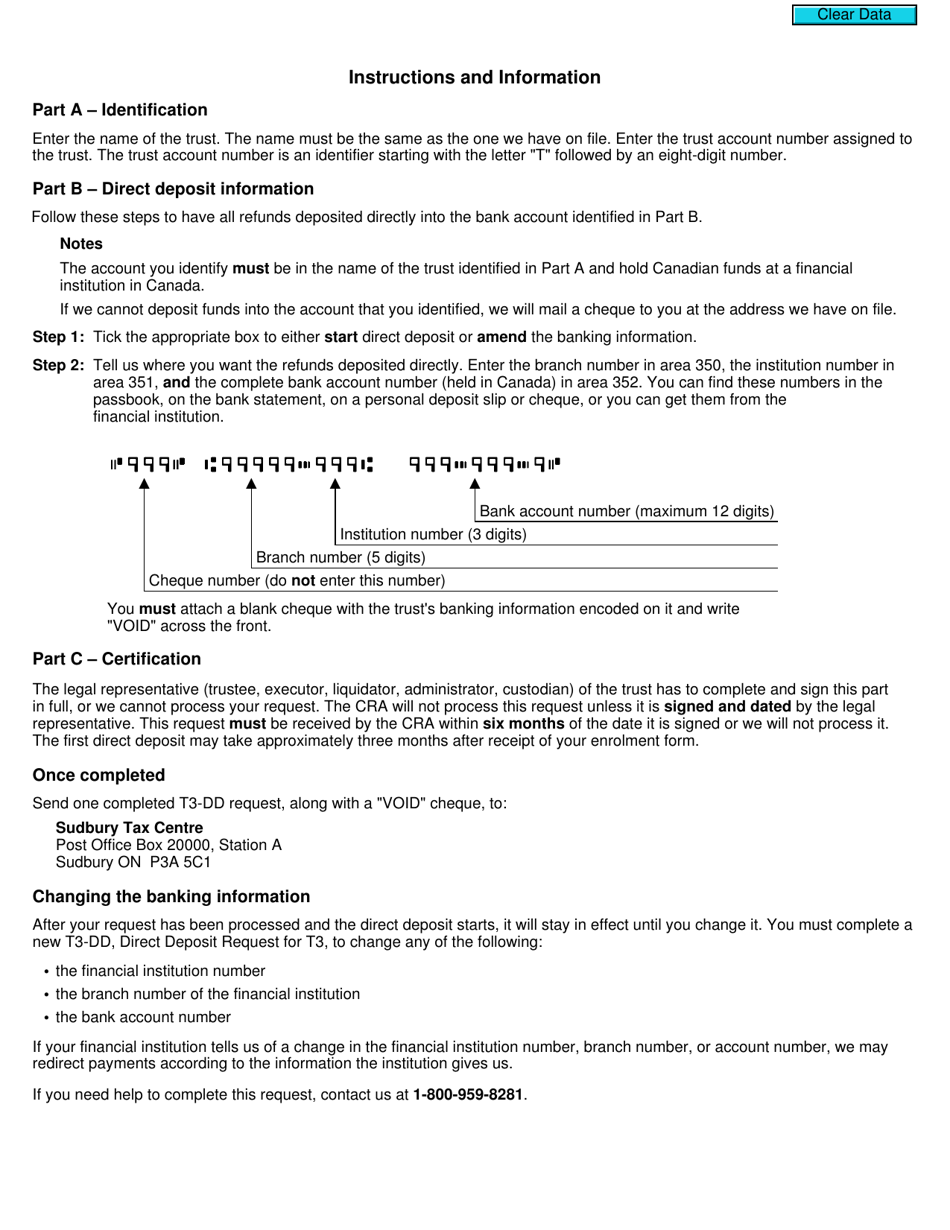

Q: How do I fill out Form T3-DD?

A: You need to provide your personal information and banking details on Form T3-DD to request direct deposit.

Q: Are there any fees for using direct deposit with Form T3-DD?

A: No, there are no fees for using direct deposit with Form T3-DD.

Q: How long does it take for direct deposit to start after submitting Form T3-DD?

A: It can take up to 10 business days for direct deposit to start after submitting Form T3-DD.

Q: Can I cancel direct deposit after submitting Form T3-DD?

A: Yes, you can cancel direct deposit by submitting a new Form T3-DD with the cancellation option selected.

Q: What if I need to update my banking information for direct deposit?

A: You will need to submit a new Form T3-DD with the updated banking information.

Q: Is Form T3-DD available in French?

A: Yes, Form T3-DD is available in both English and French.