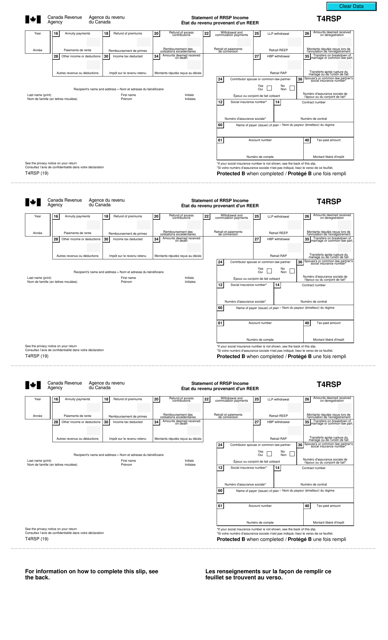

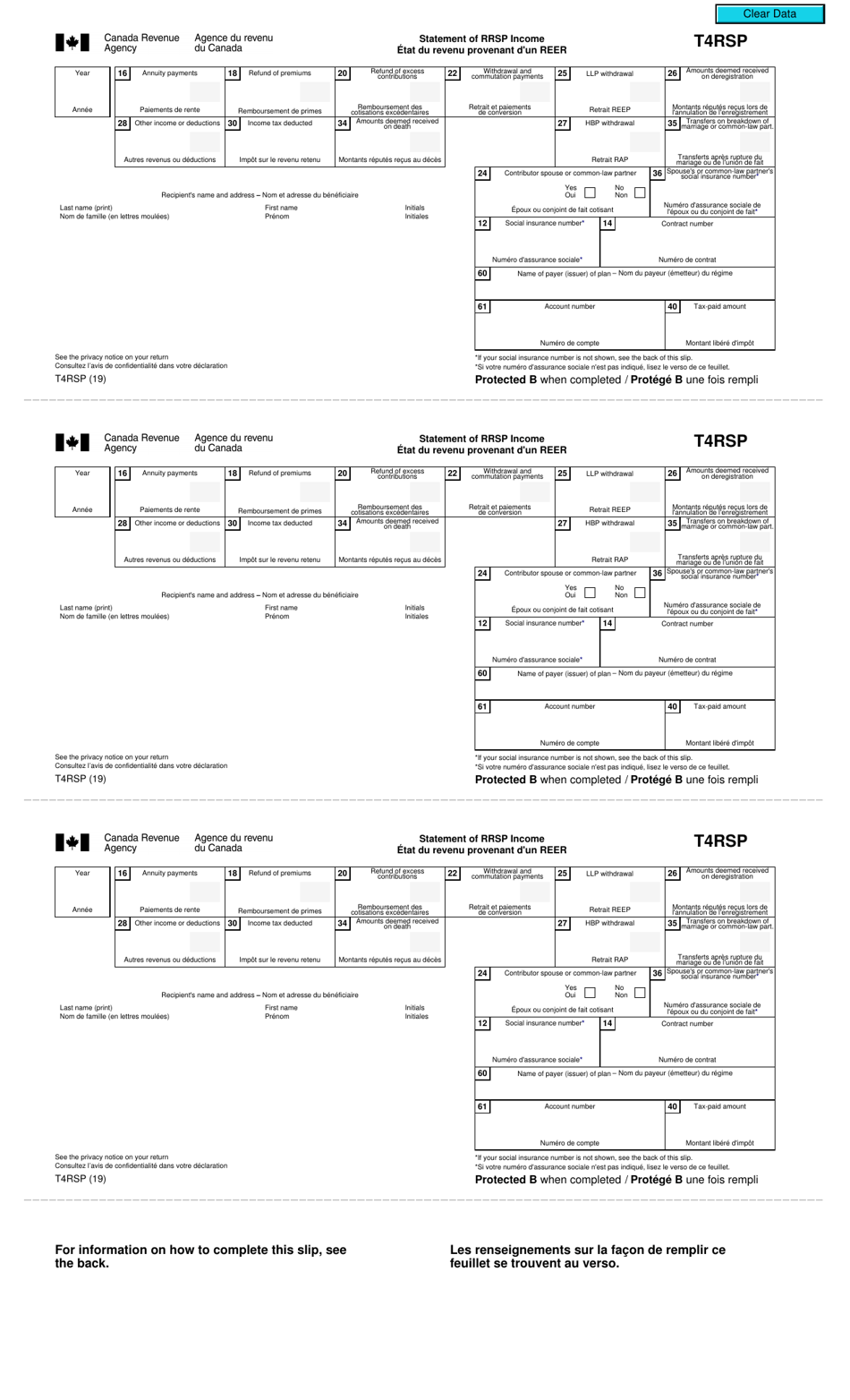

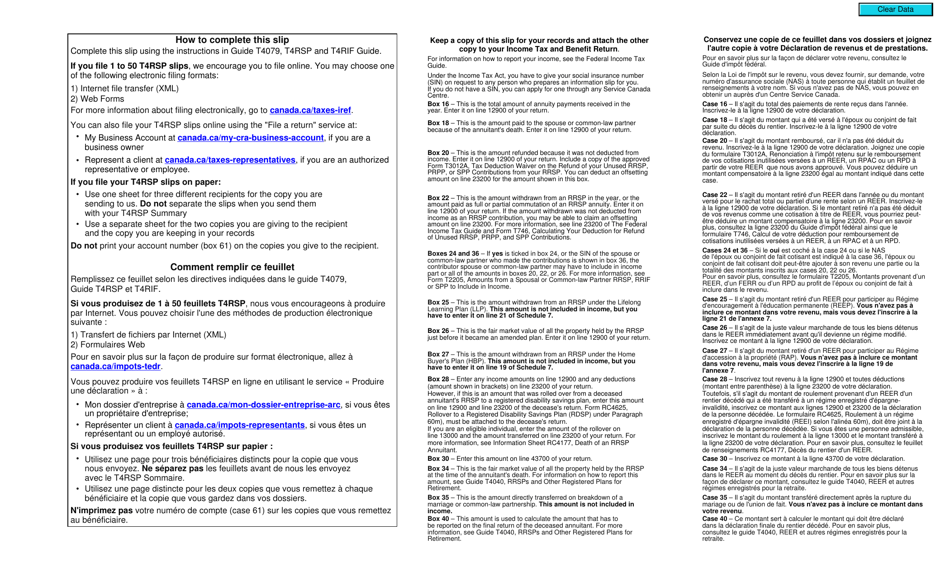

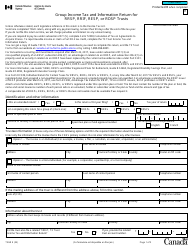

Form T4RSP Statement of Rrsp Income - Canada (English / French)

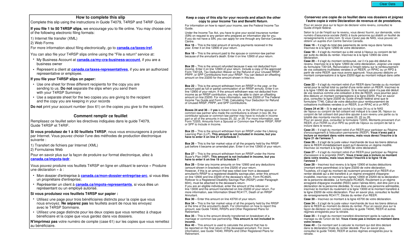

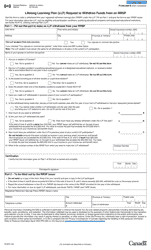

Form T4RSP is a statement of income that is related to Registered Retirement Savings Plans (RRSPs) in Canada. It is used to report the amounts you have withdrawn from your RRSPs in a particular year. The form is available in both English and French.

The individual who receives Retirement Savings Plan (RRSP) income must file the Form T4RSP statement in Canada.

FAQ

Q: What is a T4RSP statement?

A: A T4RSP statement is a document that reports an individual's income from their registered retirement savings plan.

Q: Why is the T4RSP statement important?

A: The T4RSP statement is important for tax purposes as it helps individuals report their RRSP income to the Canada Revenue Agency (CRA).

Q: Who receives a T4RSP statement?

A: Individuals who have withdrawn funds from their registered retirement savings plan (RRSP) during the tax year.

Q: What information is included in a T4RSP statement?

A: The T4RSP statement includes details such as the amount of RRSP income received, the tax withheld, and any applicable tax deductions.

Q: Do I need to include my T4RSP statement when filing my taxes?

A: Yes, you need to include your T4RSP statement when filing your taxes as it provides important information about your RRSP income.