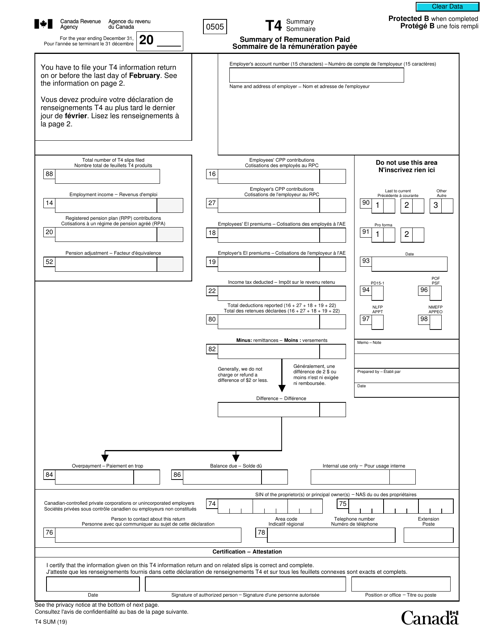

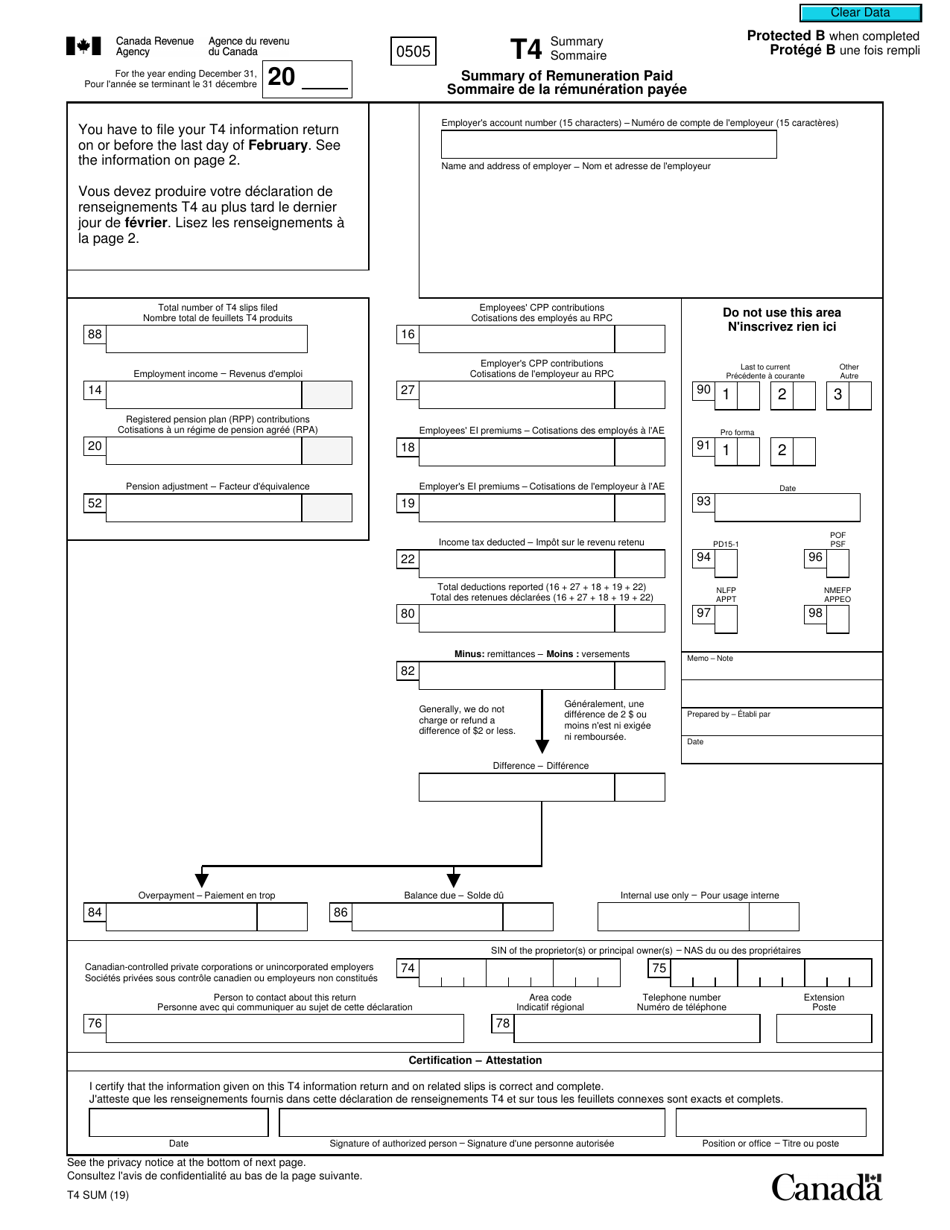

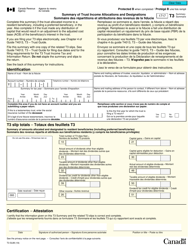

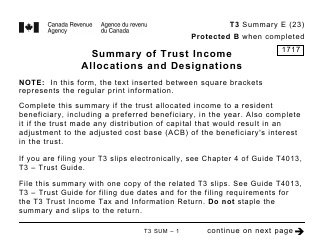

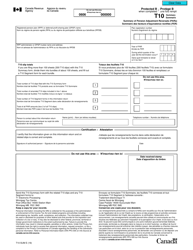

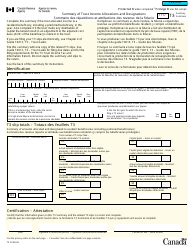

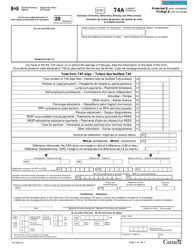

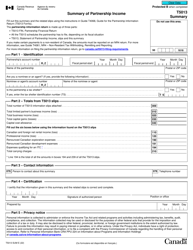

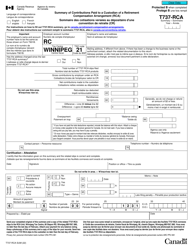

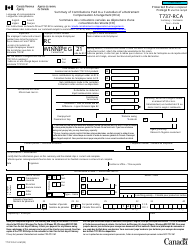

Form T4 SUM Summary of Remuneration Paid - Canada (English / French)

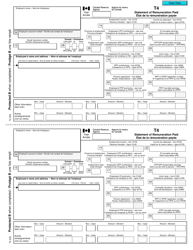

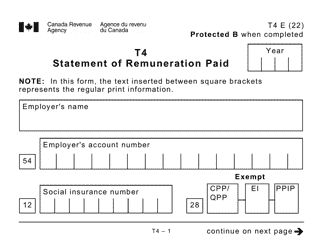

Form T4 SUM (Summary of Remuneration Paid) is used in Canada to provide a summary of the remuneration paid by an employer to their employees during a tax year. It includes information on salary, wages, bonuses, and other benefits. The form is filed by employers to report this information to the Canada Revenue Agency (CRA) and to provide employees with a record of their earnings. The form is available in both English and French to accommodate the bilingual nature of Canada.

The employer files the Form T4 SUM Summary of Remuneration Paid in Canada, both in English and French.

FAQ

Q: What is a T4 SUM?

A: A T4 SUM is a Summary of Remuneration Paid.

Q: Who needs to file a T4 SUM?

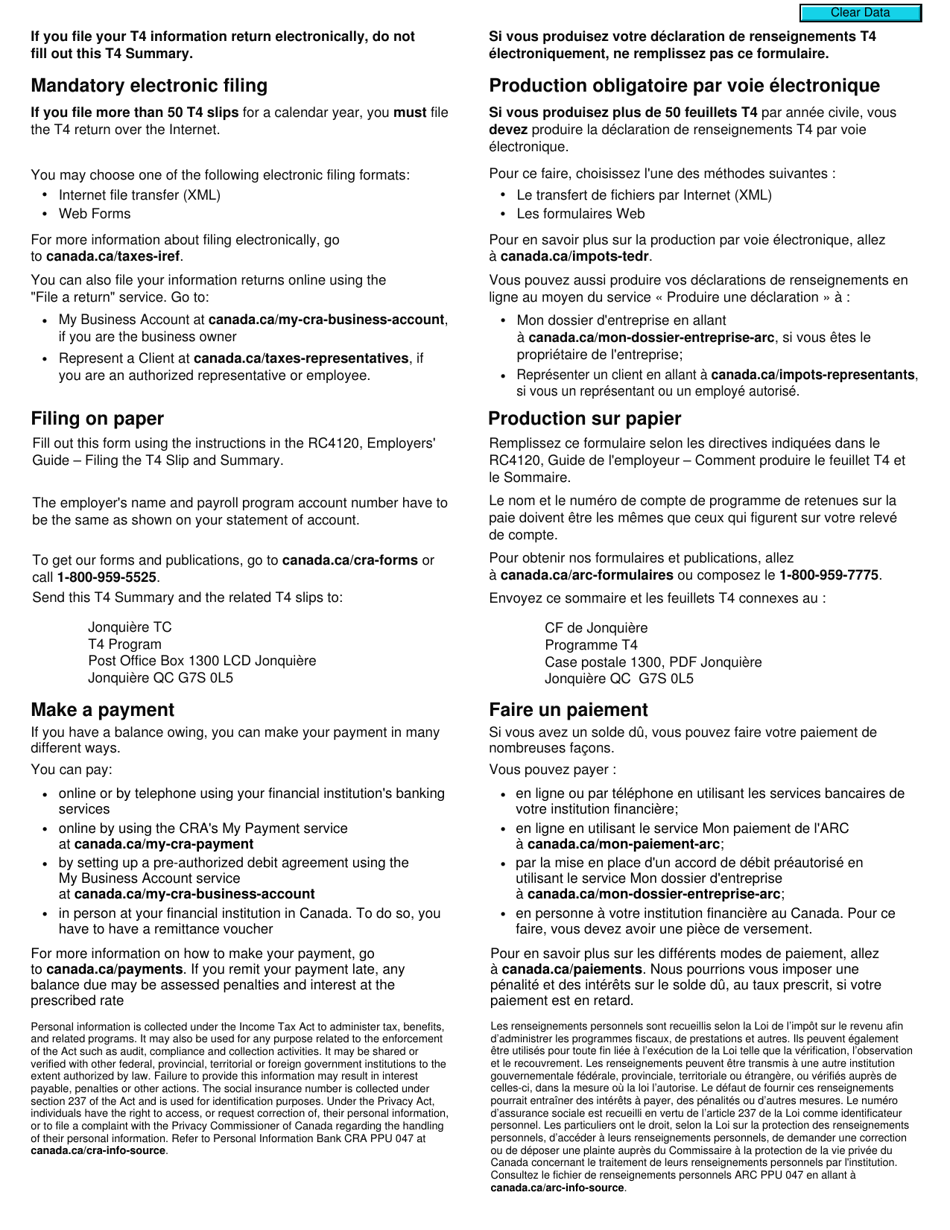

A: Employers in Canada need to file a T4 SUM if they have paid remuneration to employees.

Q: What information is included in a T4 SUM?

A: A T4 SUM includes the total amounts of various types of remuneration paid to employees, such as employment income, taxable allowances, and other benefits.

Q: Can I file a T4 SUM in both English and French?

A: Yes, you can file a T4 SUM in either English or French, depending on your preference.

Q: When is the deadline to file a T4 SUM?

A: The deadline to file a T4 SUM is the last day of February following the calendar year to which the form relates.

Q: What are the consequences of not filing a T4 SUM?

A: Failure to file a T4 SUM can result in penalties and interest charges imposed by the CRA.