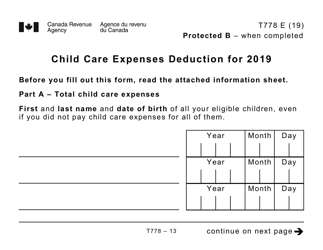

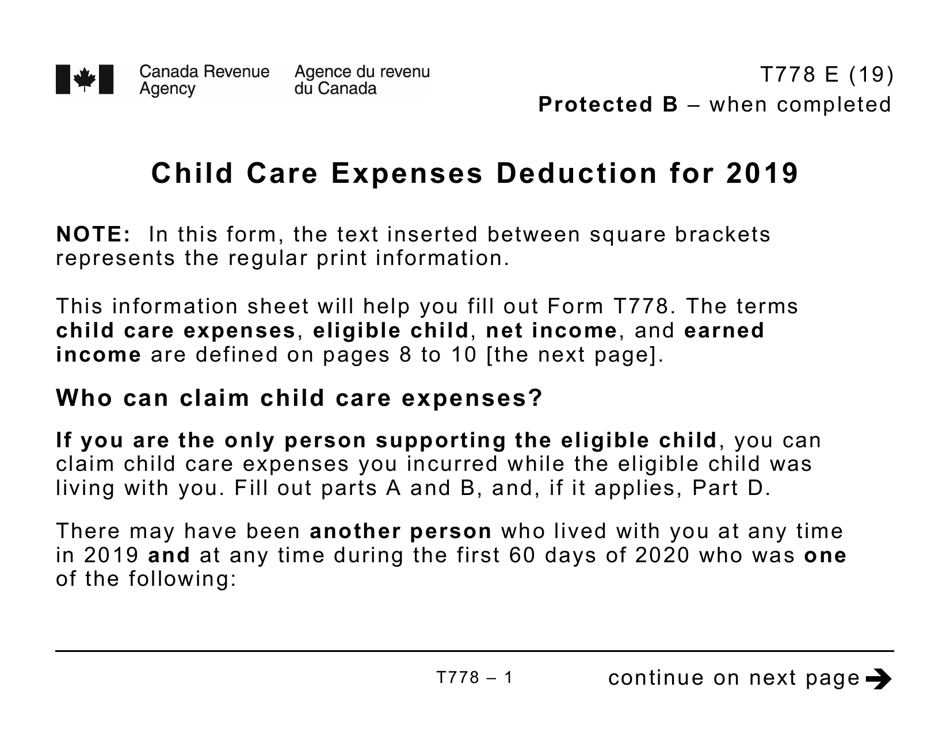

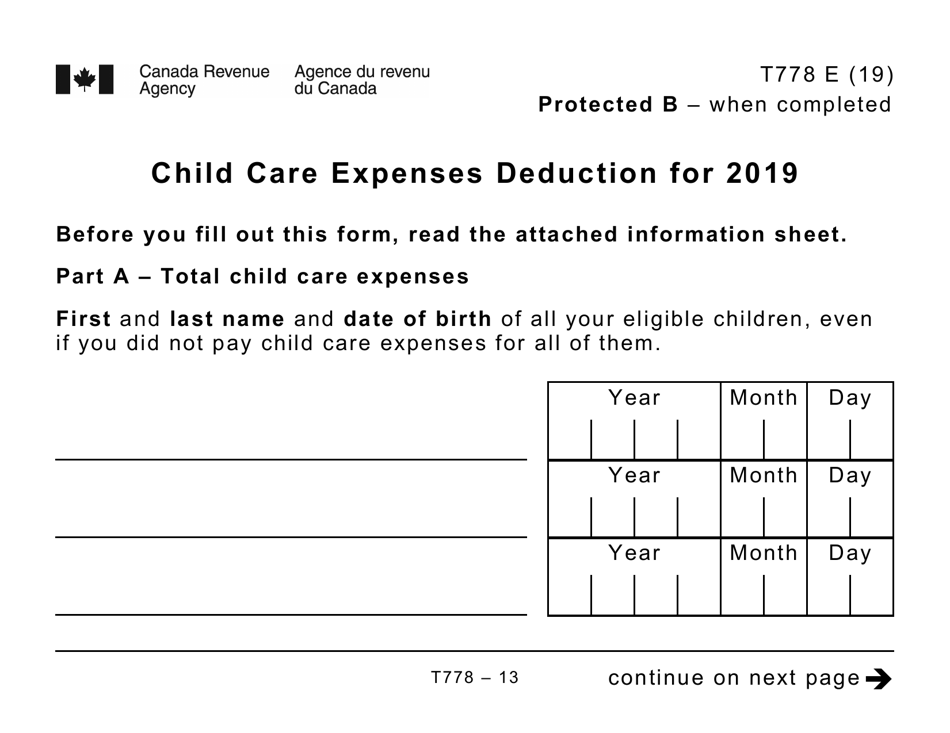

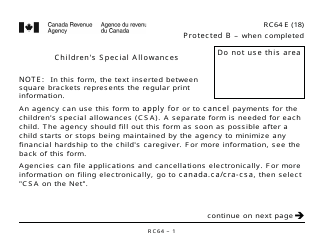

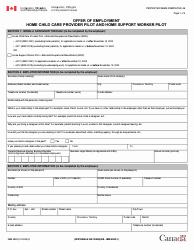

Form T778 Child Care Expenses Deduction - Large Print - Canada

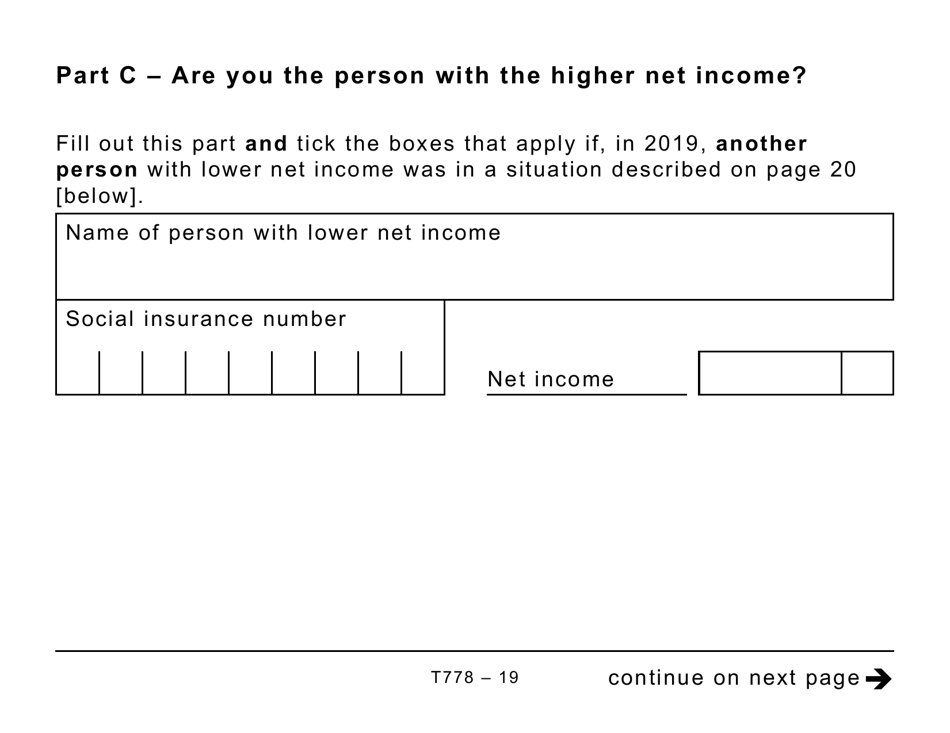

Form T778 Child Care Expenses Deduction - Large Print is a form used in Canada for individuals who have child care expenses and want to claim deductions on their taxes. It is specifically designed for those with visual impairments, as it is in large print format. This form helps individuals minimize their tax liability by deducting eligible child care expenses from their income.

The Form T778 Child Care Expenses Deduction - Large Print in Canada should be filed by individuals who have incurred child care expenses and are eligible to claim this deduction on their income tax return.

FAQ

Q: What is Form T778?

A: Form T778 is used in Canada to claim the Child Care Expenses Deduction.

Q: What is the Child Care Expenses Deduction?

A: The Child Care Expenses Deduction is a tax deduction that allows eligible parents to reduce their taxable income by claiming their child care expenses.

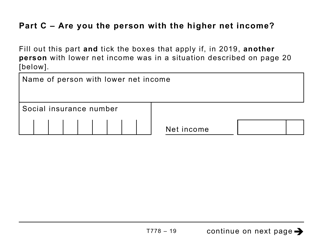

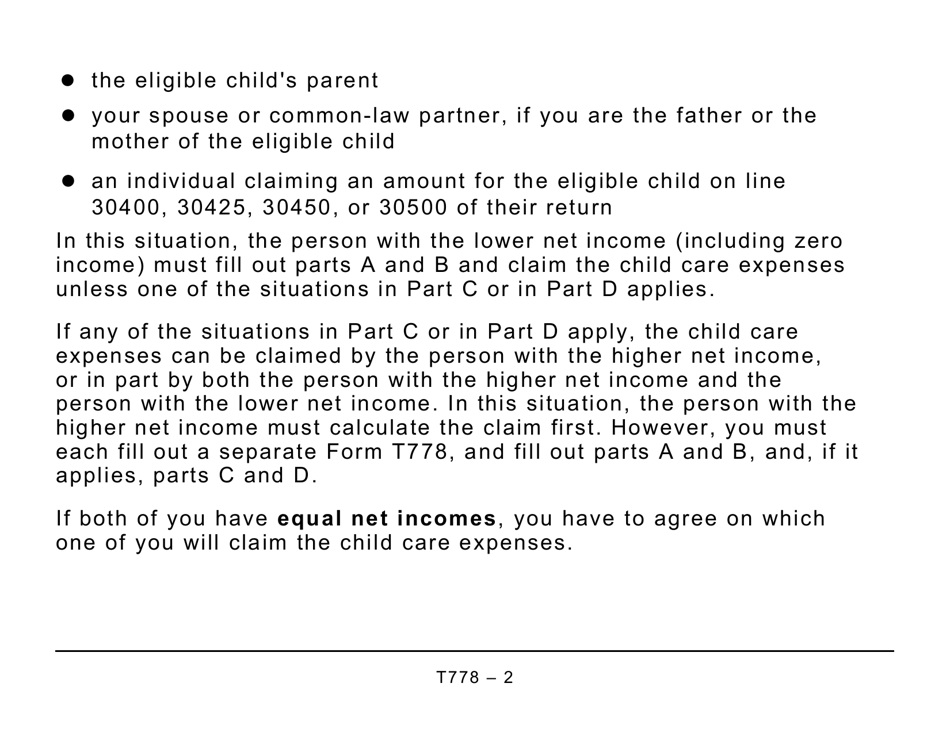

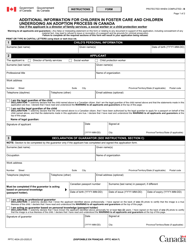

Q: Who can claim the Child Care Expenses Deduction?

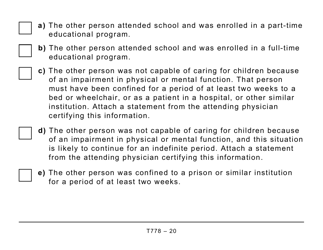

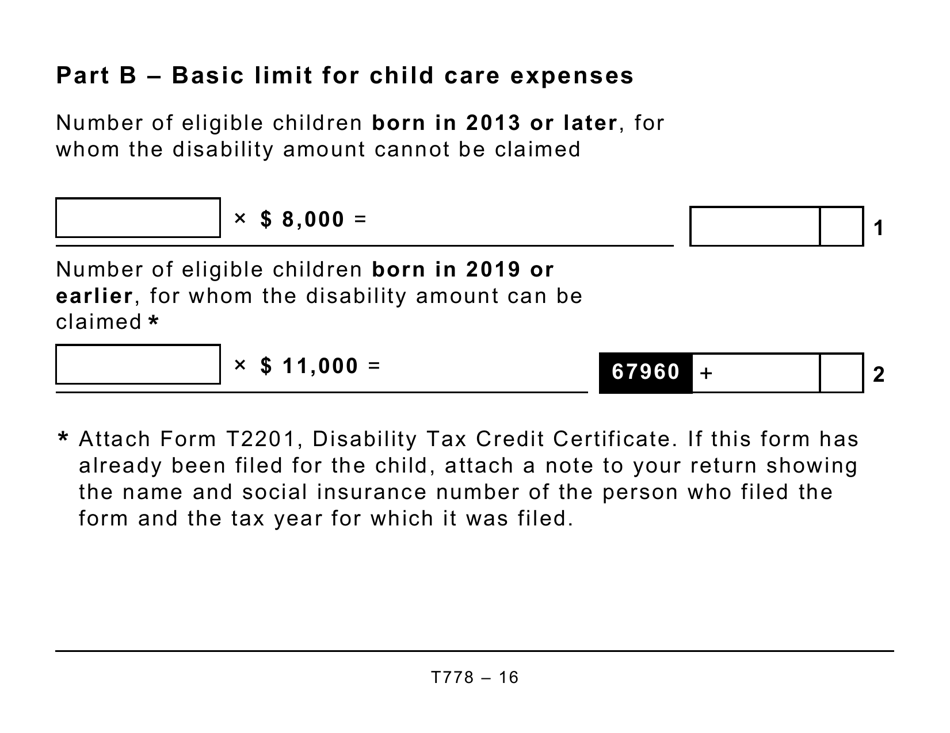

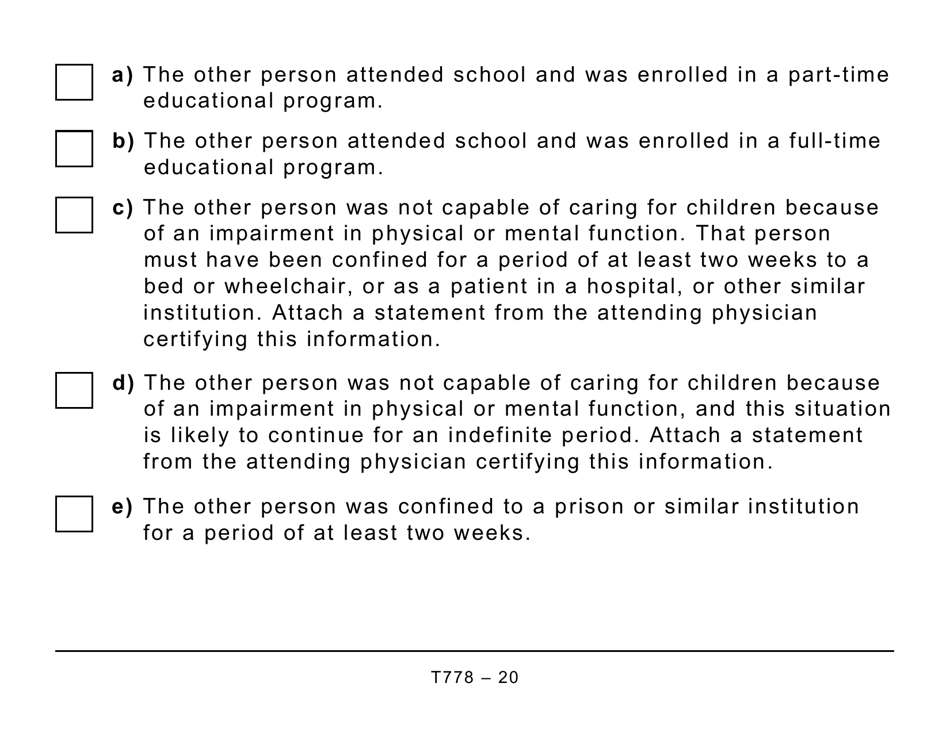

A: Parents who have incurred child care expenses for their children under the age of 16, or children with disabilities under the age of 18, may be eligible to claim this deduction.

Q: What expenses can be claimed under the Child Care Expenses Deduction?

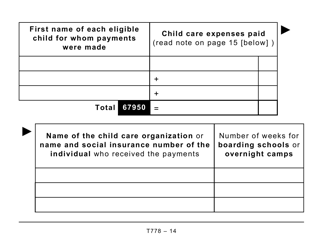

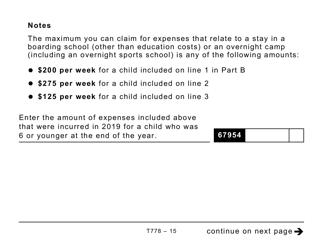

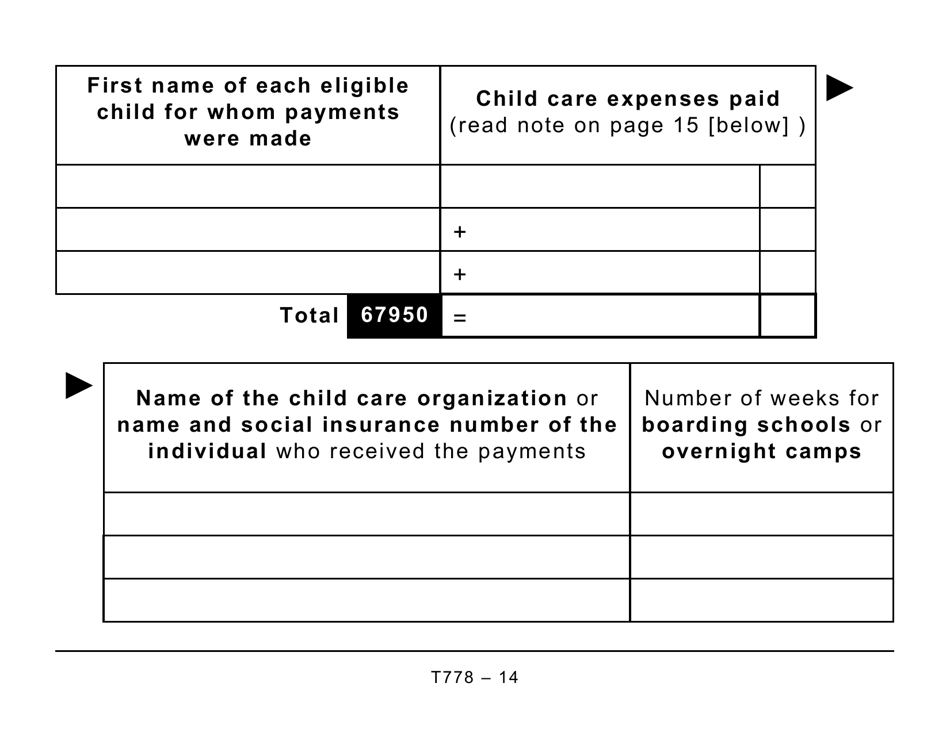

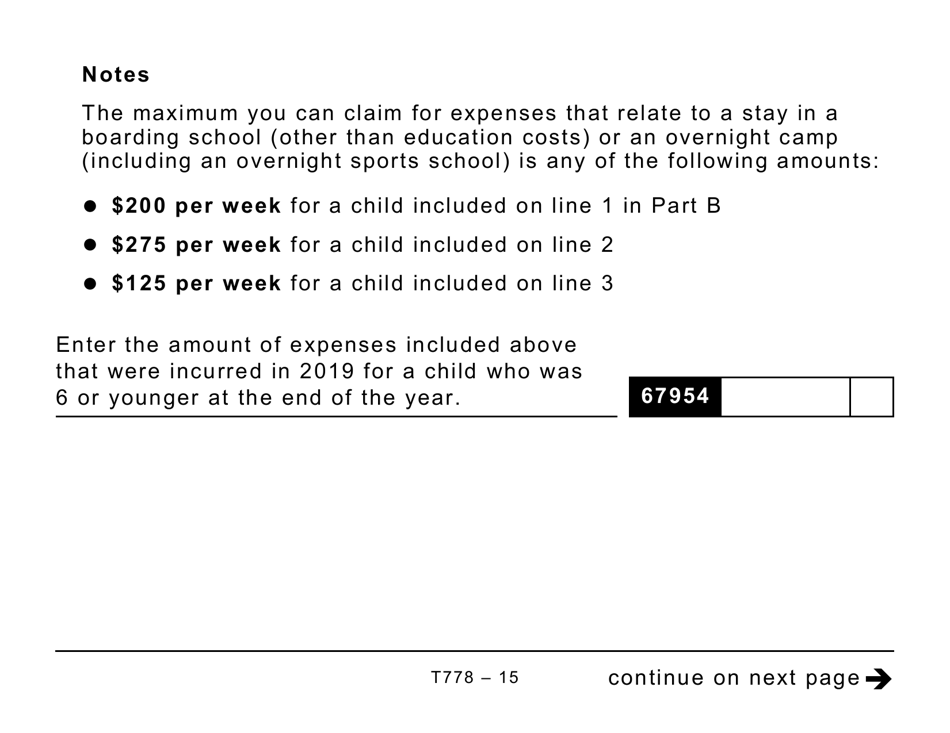

A: Eligible expenses include payments to daycare centers, day camps, and boarding schools, as well as payments to individuals providing child care services.

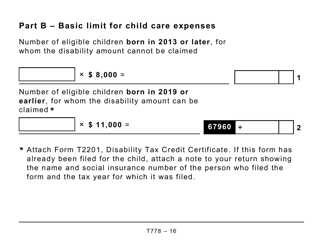

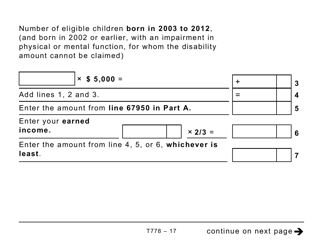

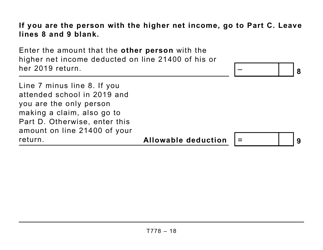

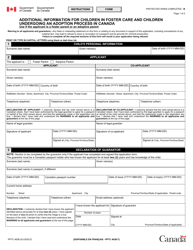

Q: Is there a limit to the amount that can be claimed?

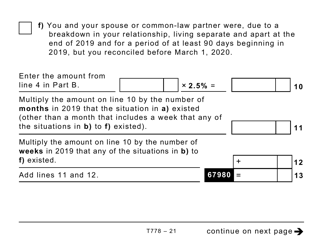

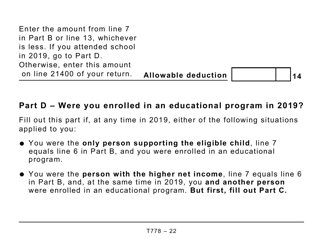

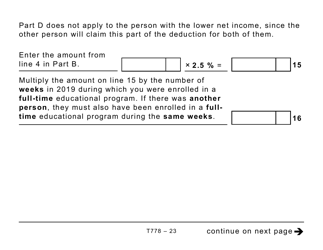

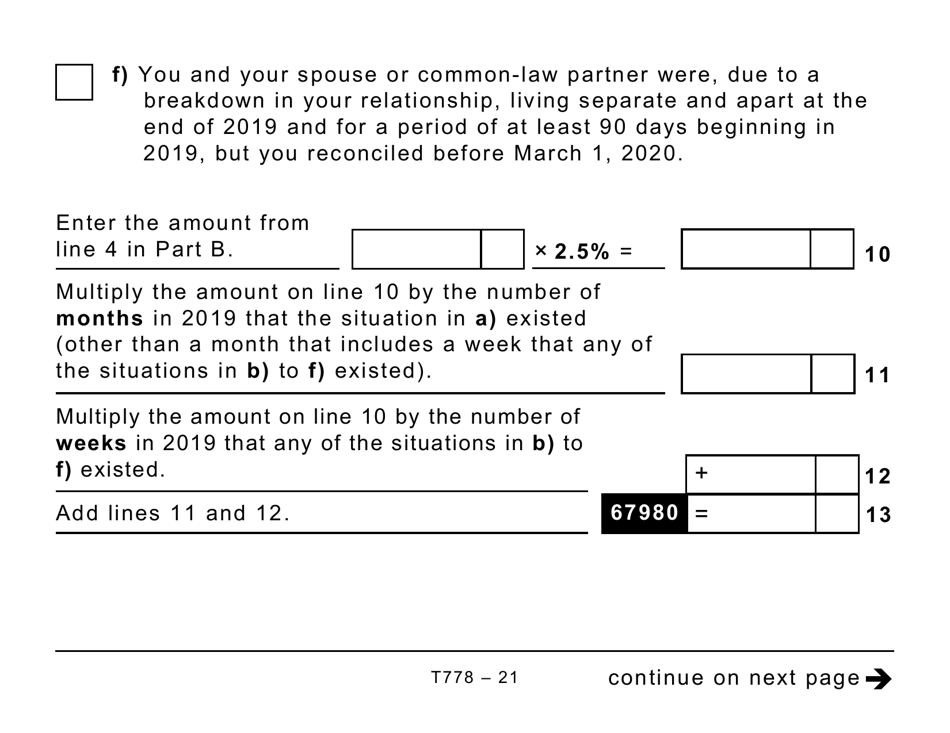

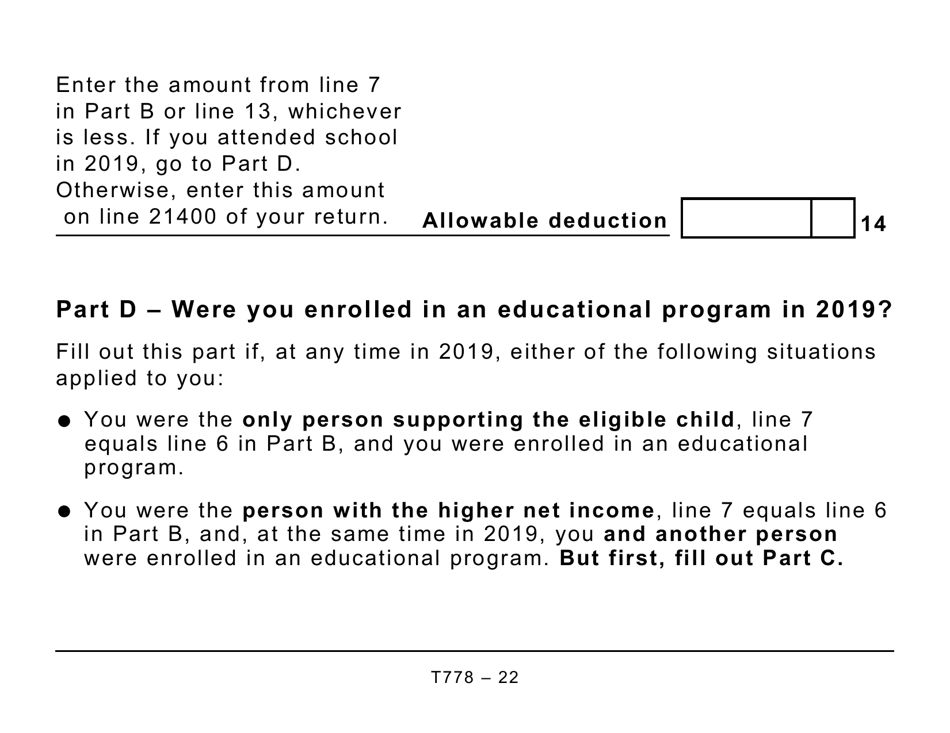

A: Yes, there is a limit to the amount that can be claimed. The maximum expense limit varies depending on the age and type of care of the child, as well as the individual circumstances of the taxpayer.

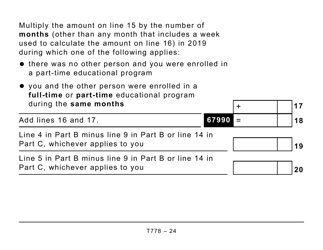

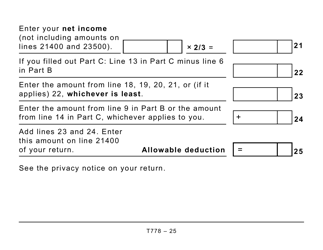

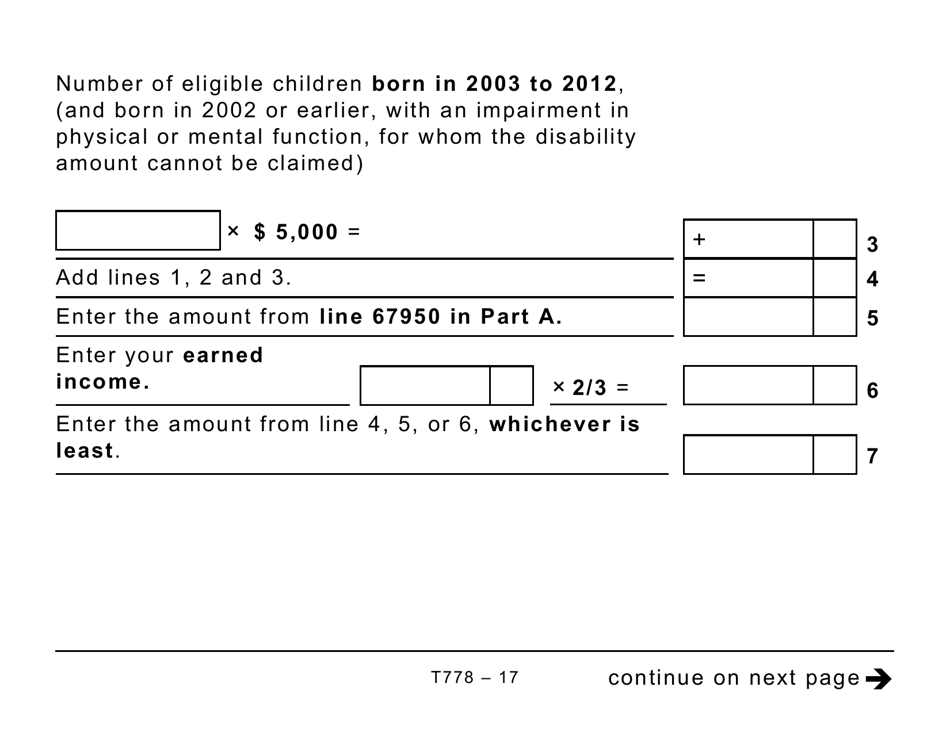

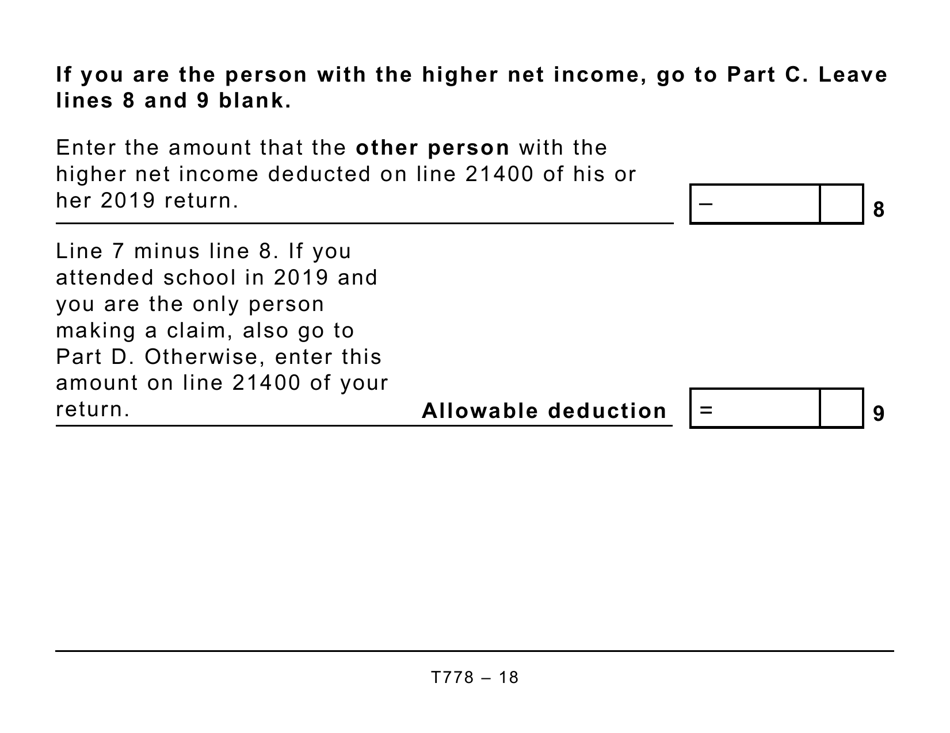

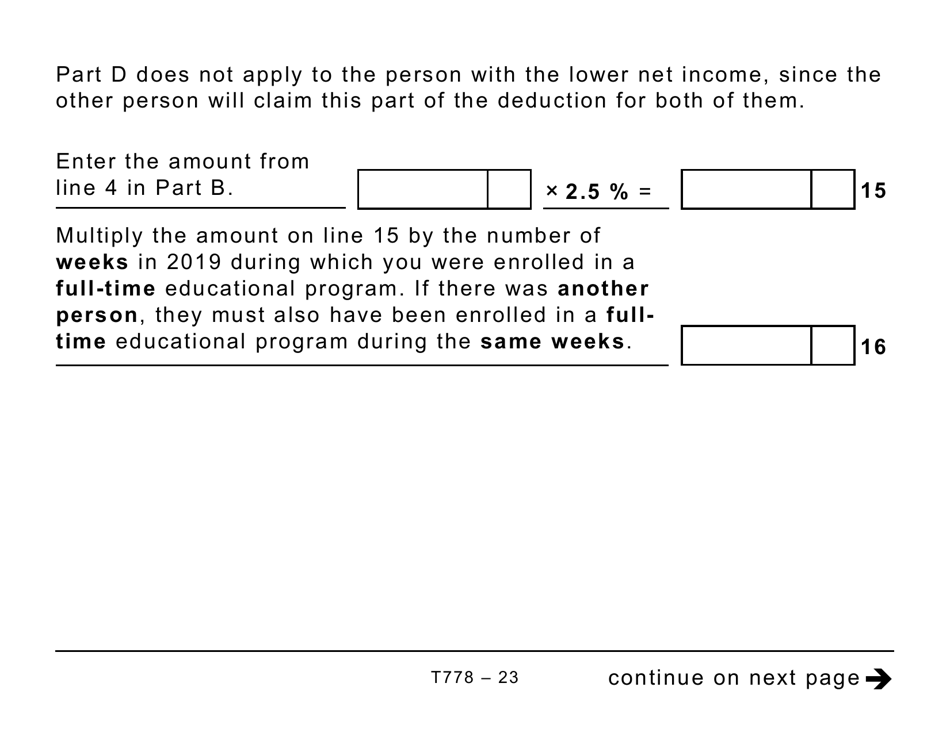

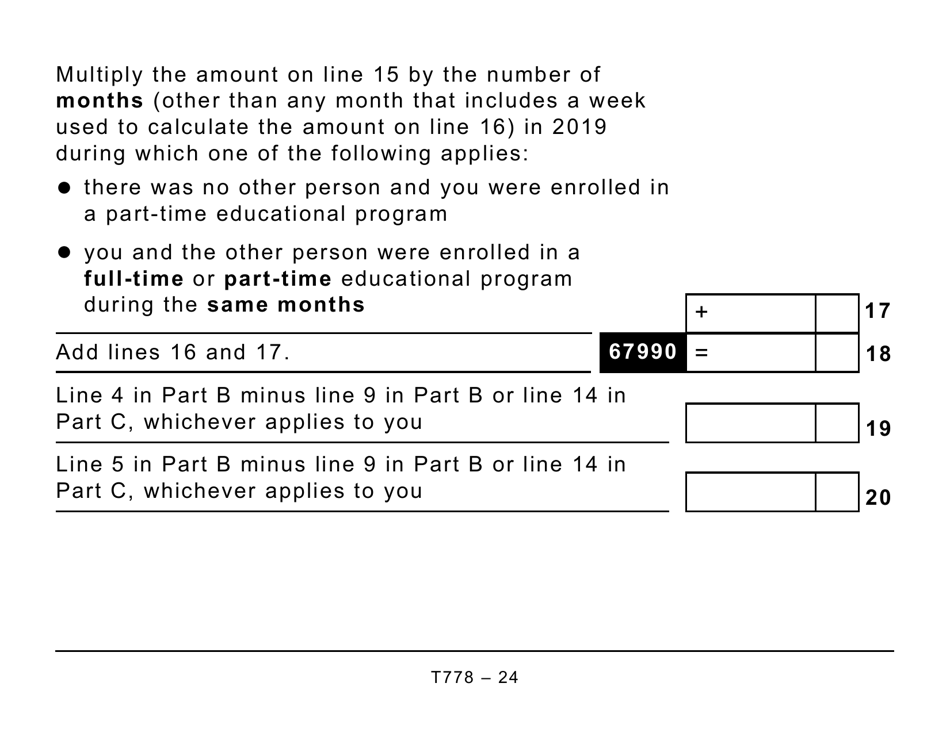

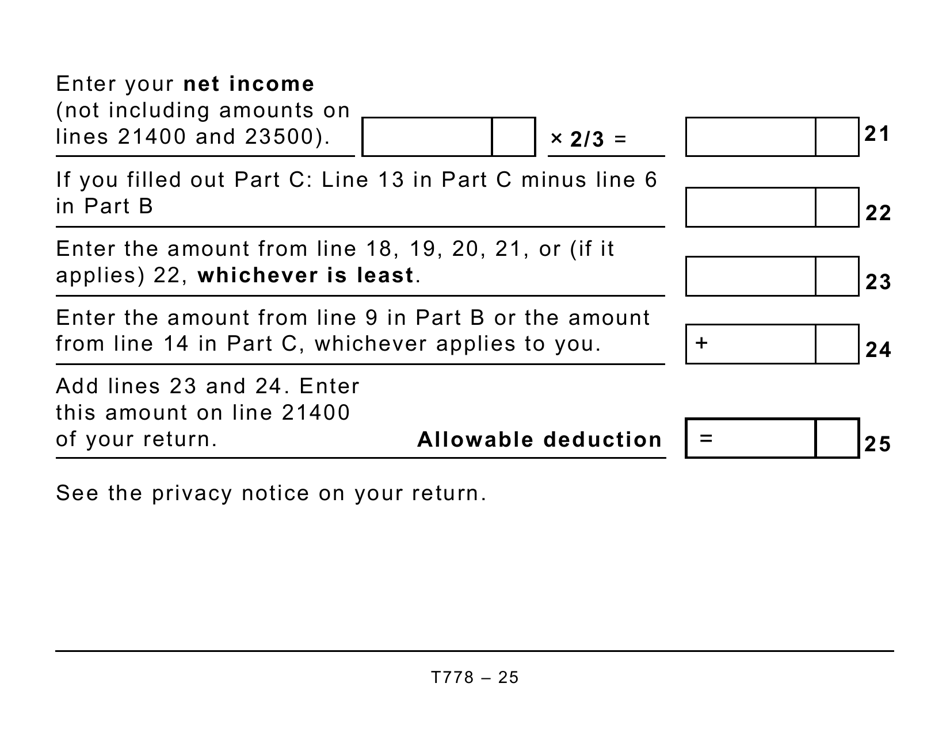

Q: How is the Child Care Expenses Deduction calculated?

A: The deduction is calculated by multiplying the eligible child care expenses by the applicable percentage (which depends on the taxpayer's income) and subtracting any reimbursements or subsidies received.

Q: When should I file Form T778?

A: Form T778 should be filed with your annual income tax return for the year in which the child care expenses were incurred.

Q: Can I claim child care expenses for previous years?

A: Under certain circumstances, you may be able to claim child care expenses from previous years by requesting an adjustment to your previous year's tax return.

Q: Do I need to submit receipts with Form T778?

A: You should keep your receipts as proof of your child care expenses, but you do not have to submit them with your tax return. However, you may need to provide them if requested by the CRA for verification purposes.