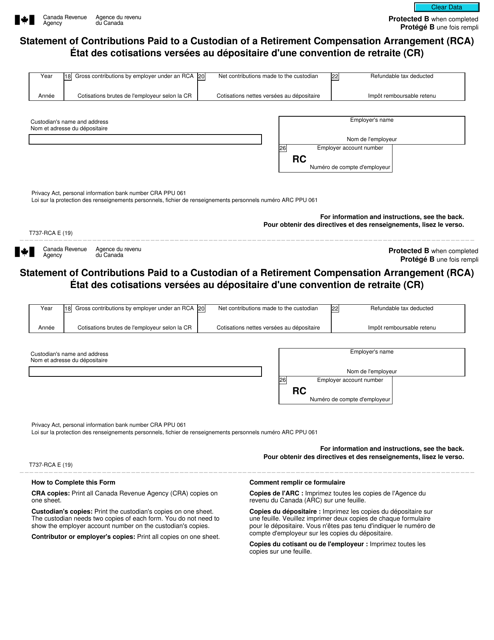

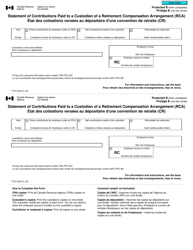

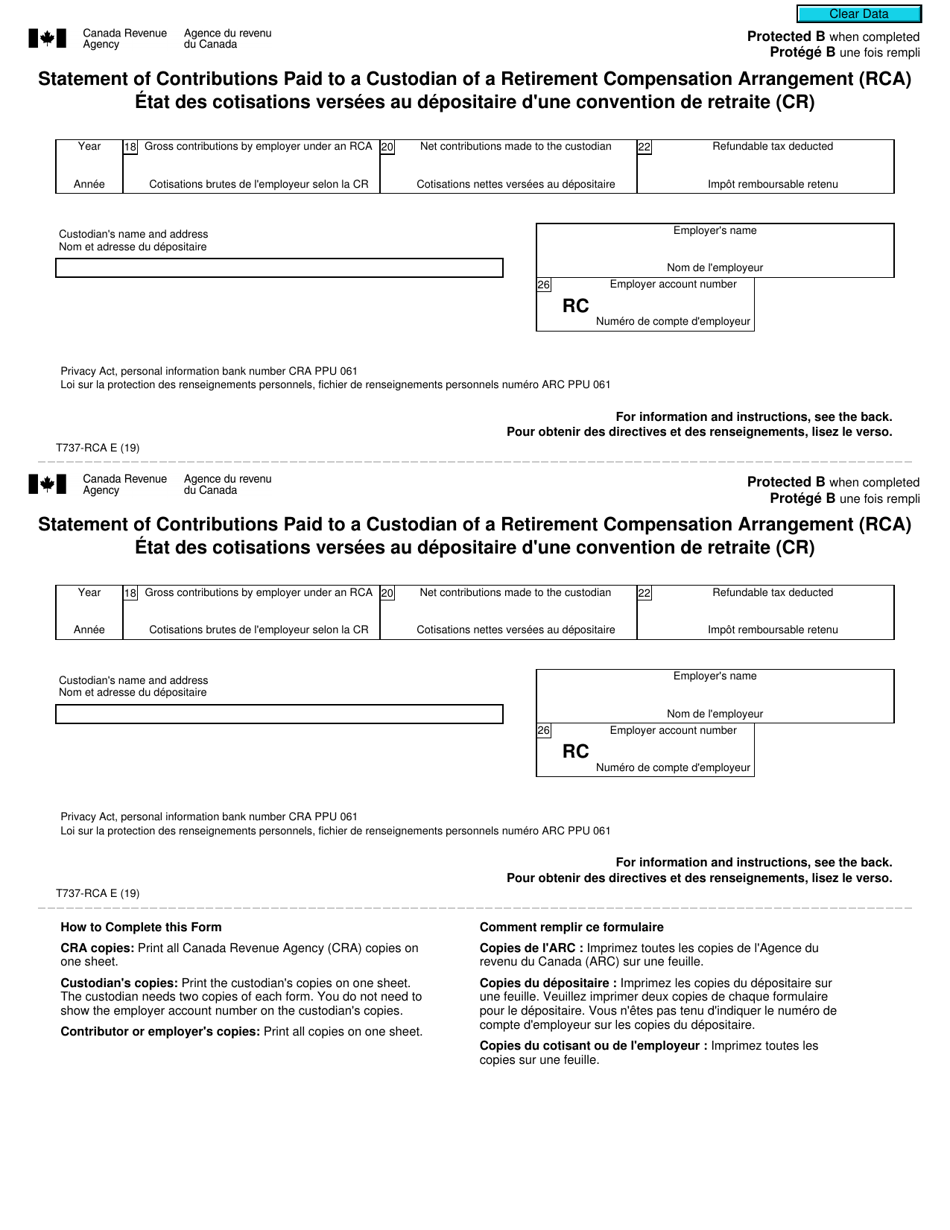

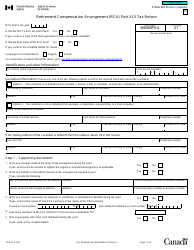

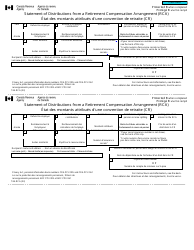

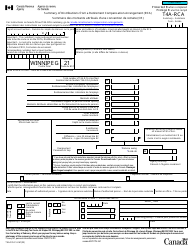

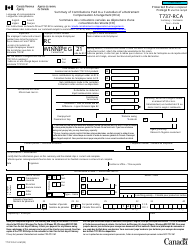

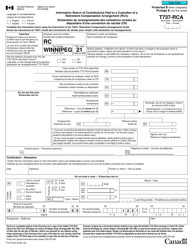

Form T737-RCA Statement of Contributions Paid to a Custodian of a Retirement Compensation Arrangement (Rca) - Canada (English / French)

Form T737-RCA is used in Canada to report the contributions that have been paid to a custodian of a Retirement Compensation Arrangement (RCA). RCA is a specialized type of pension plan for certain highly compensated employees. This form is used to provide the necessary information to the Canada Revenue Agency (CRA) regarding these contributions.

The employer or payer files the Form T737-RCA Statement of Contributions Paid to a Custodian of a Retirement Compensation Arrangement (RCA) in Canada.

FAQ

Q: What is Form T737-RCA?

A: Form T737-RCA is a statement of contributions paid to a custodian of a Retirement Compensation Arrangement (RCA) in Canada.

Q: Who needs to file Form T737-RCA?

A: Anyone who has made contributions to a custodian of an RCA in Canada needs to file Form T737-RCA.

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of retirement savings plan for highly compensated employees in Canada.

Q: What information is required on Form T737-RCA?

A: Form T737-RCA requires information about the custodian of the RCA, the contributor, and the contributions made to the RCA.

Q: Is Form T737-RCA available in both English and French?

A: Yes, Form T737-RCA is available in both English and French.

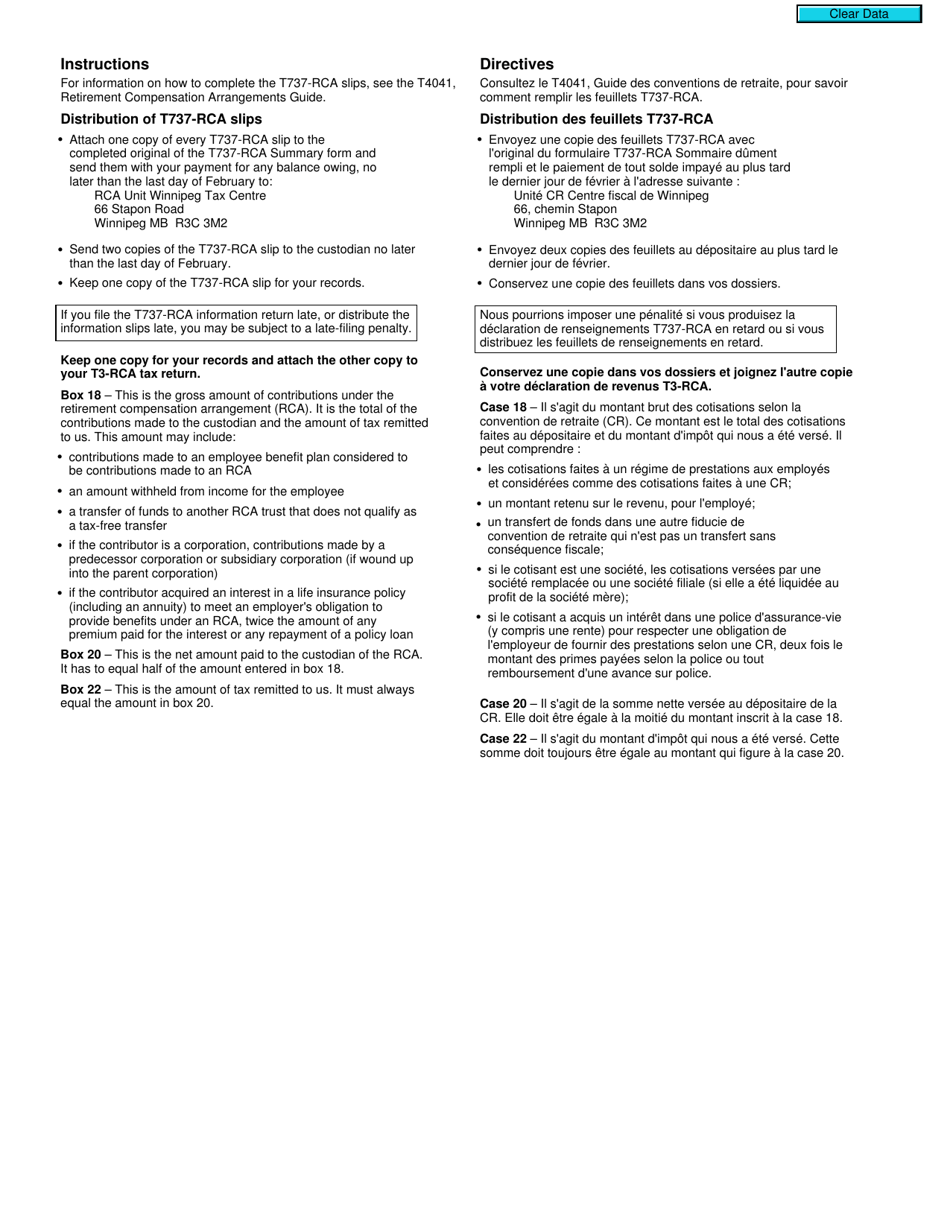

Q: When is the deadline to file Form T737-RCA?

A: The deadline to file Form T737-RCA is within 90 days after the end of the tax year in which the contributions were made.