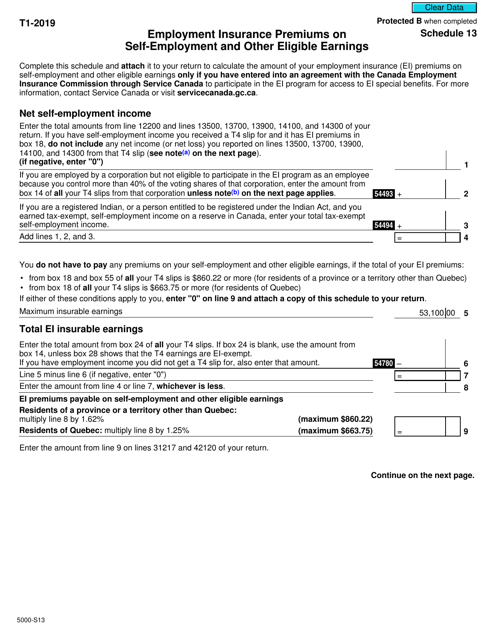

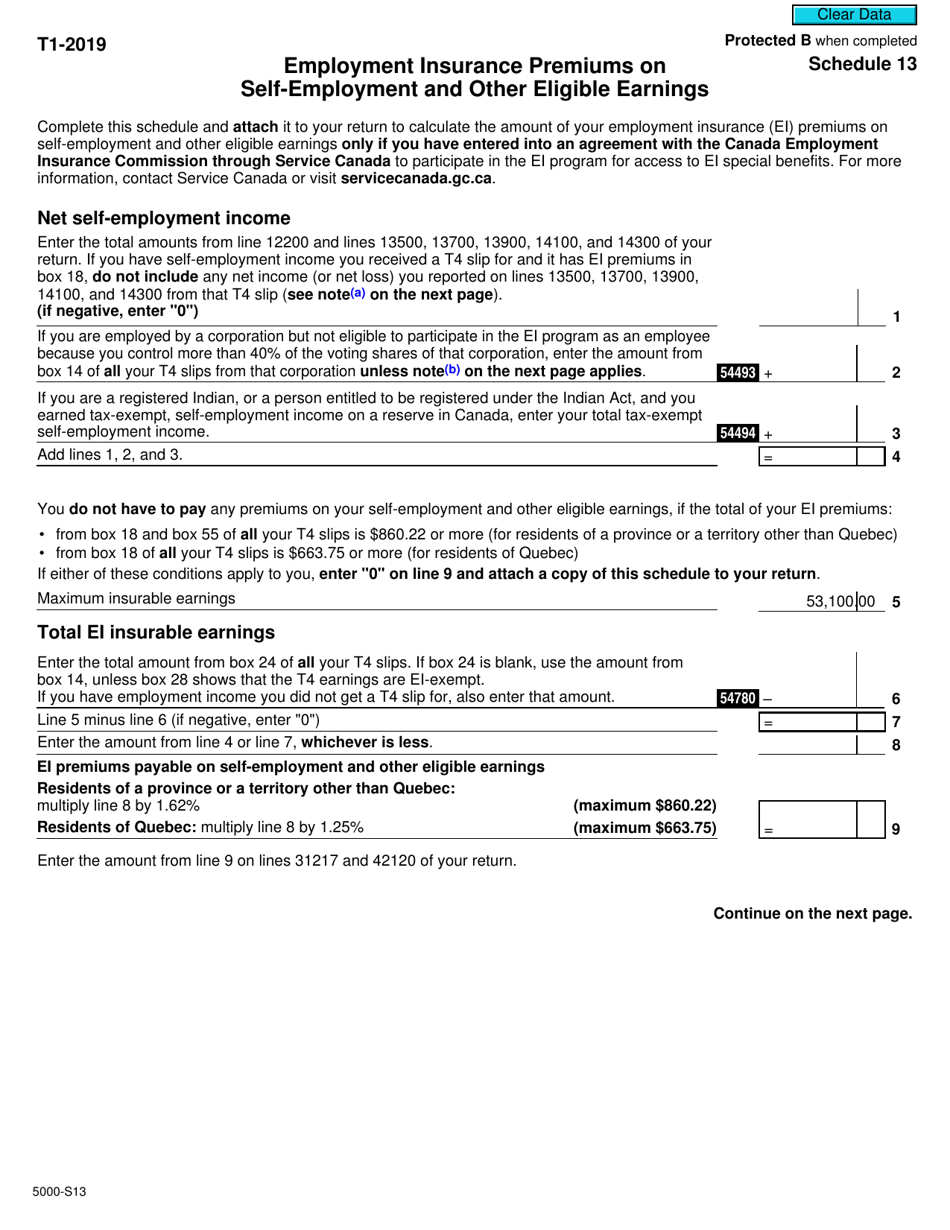

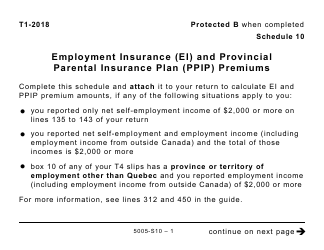

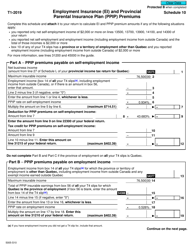

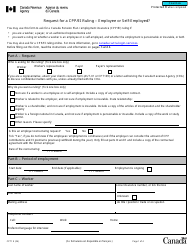

Form 5000-S13 Schedule 13 Employment Insurance Premiums on Self-employment and Other Eligible Earnings - Canada

Form 5000-S13 Schedule 13 Employment Insurance Premiums on Self-employment and Other Eligible Earnings is used in Canada to report and calculate the Employment Insurance premiums that individuals must pay on their self-employment and other eligible earnings.

The self-employed individuals in Canada file the Form 5000-S13 Schedule 13 for Employment Insurance Premiums on Self-employment and Other Eligible Earnings.

FAQ

Q: What is Form 5000-S13 Schedule 13?

A: Form 5000-S13 Schedule 13 is a tax form used in Canada to report employment insurance premiums on self-employment and other eligible earnings.

Q: Who needs to complete Form 5000-S13 Schedule 13?

A: Self-employed individuals and those with other eligible earnings in Canada need to complete Form 5000-S13 Schedule 13.

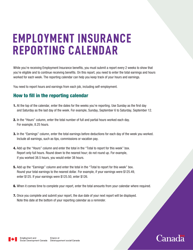

Q: What are employment insurance premiums?

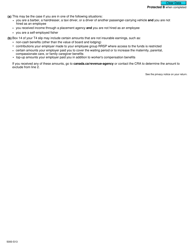

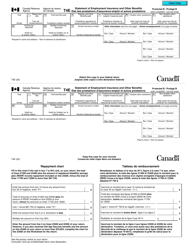

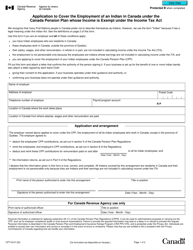

A: Employment insurance premiums are contributions made by employees and employers to fund the employment insurance program in Canada.

Q: What are self-employment and other eligible earnings?

A: Self-employment earnings are income earned through self-employment, while other eligible earnings include certain types of employment income.

Q: Why do I need to report employment insurance premiums on self-employment and other eligible earnings?

A: Reporting employment insurance premiums ensures that you are fulfilling your obligations to contribute to the employment insurance program in Canada.

Q: When is the deadline to submit Form 5000-S13 Schedule 13?

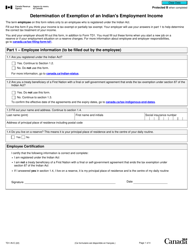

A: The deadline to submit Form 5000-S13 Schedule 13 is generally April 30th of the year following the tax year being reported.

Q: What happens if I don't complete Form 5000-S13 Schedule 13?

A: Failure to complete Form 5000-S13 Schedule 13 and pay the required employment insurance premiums may result in penalties or other consequences set by the CRA.

Q: Can I claim a deduction for employment insurance premiums on self-employment and other eligible earnings?

A: Yes, you may be eligible to claim a deduction for employment insurance premiums on your self-employment and other eligible earnings.