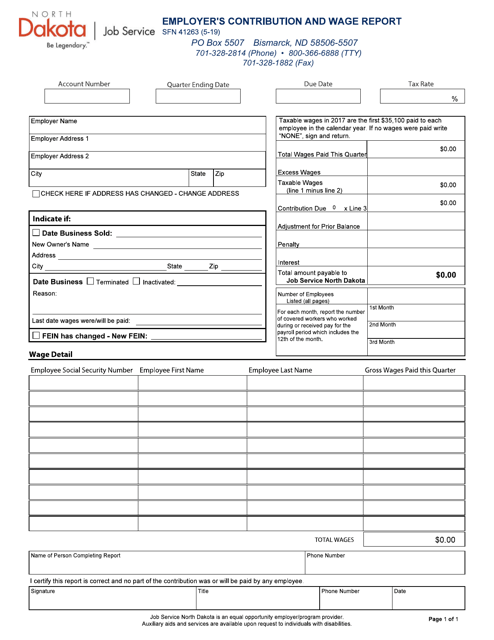

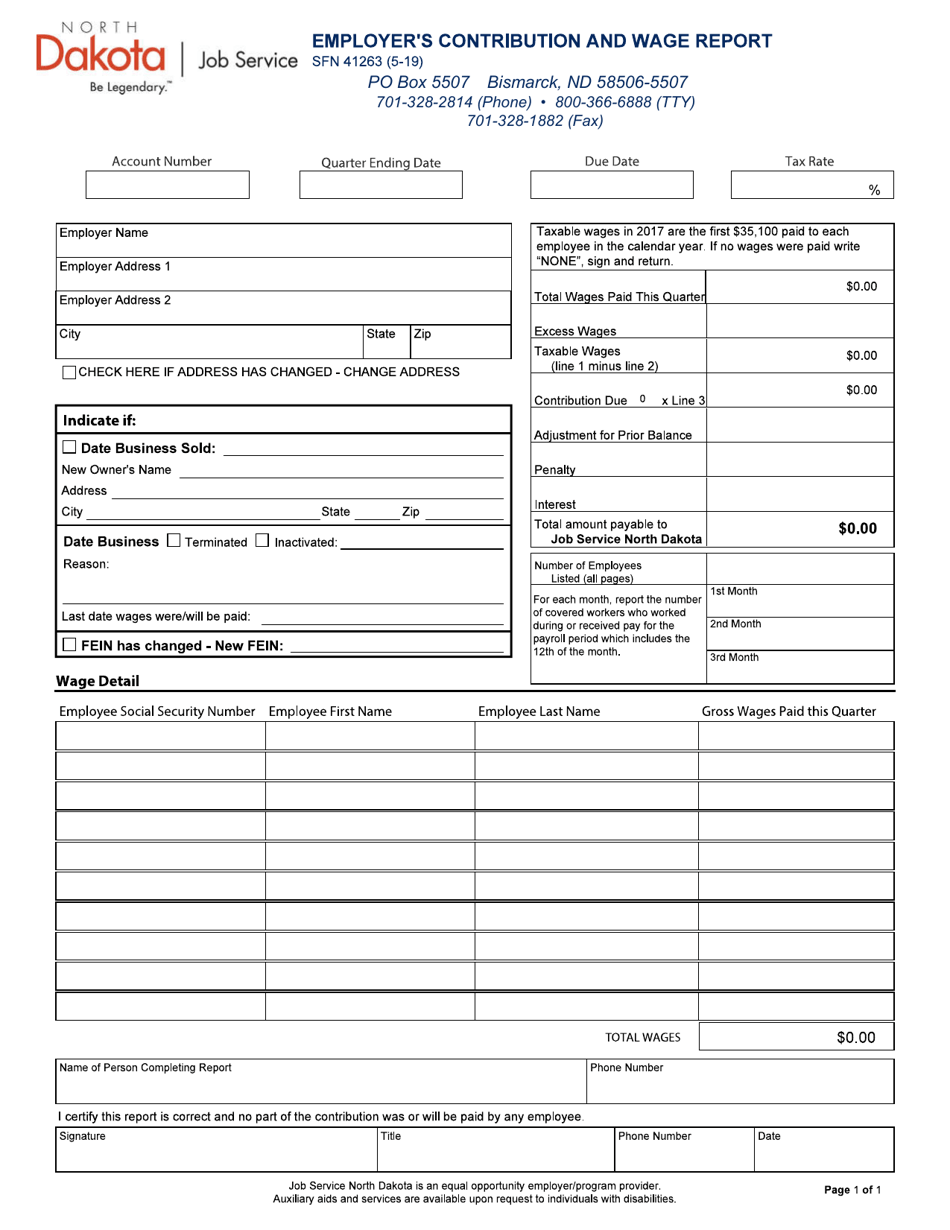

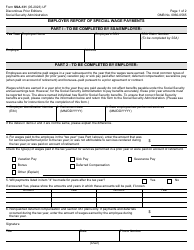

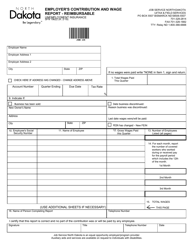

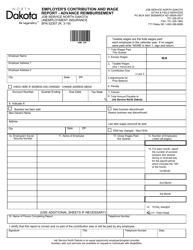

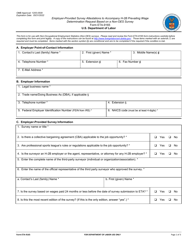

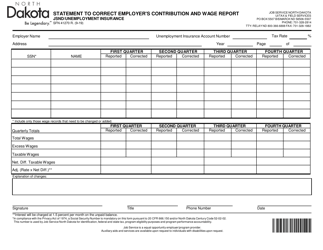

Form SFN41263 Employer's Contribution and Wage Report - North Dakota

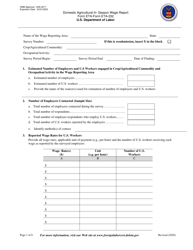

What Is Form SFN41263?

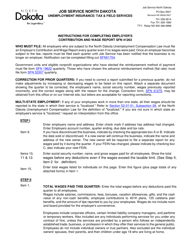

This is a legal form that was released by the Job Service North Dakota - a government authority operating within North Dakota. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form SFN41263?

A: Form SFN41263 is an Employer's Contribution and Wage Report specific to North Dakota.

Q: Who needs to file Form SFN41263?

A: Employers in North Dakota need to file Form SFN41263.

Q: What is the purpose of Form SFN41263?

A: Form SFN41263 is used to report an employer's contributions and wages for taxation and unemployment insurance purposes.

Q: What information is required on Form SFN41263?

A: Form SFN41263 requires information such as the employer's identification number, employee wages, and contribution amounts.

Q: When is Form SFN41263 due?

A: Form SFN41263 is due quarterly, with specific deadlines varying each year. Employers should consult the North Dakota Department of Labor and Human Rights for the current year's deadlines.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Job Service North Dakota;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN41263 by clicking the link below or browse more documents and templates provided by the Job Service North Dakota.