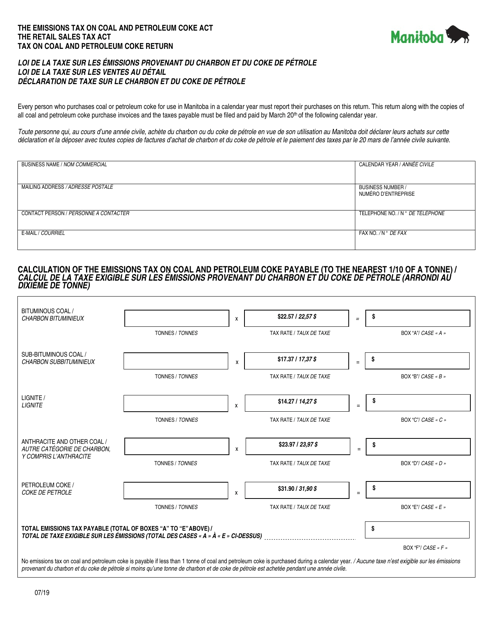

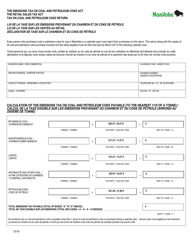

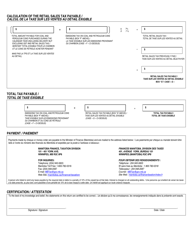

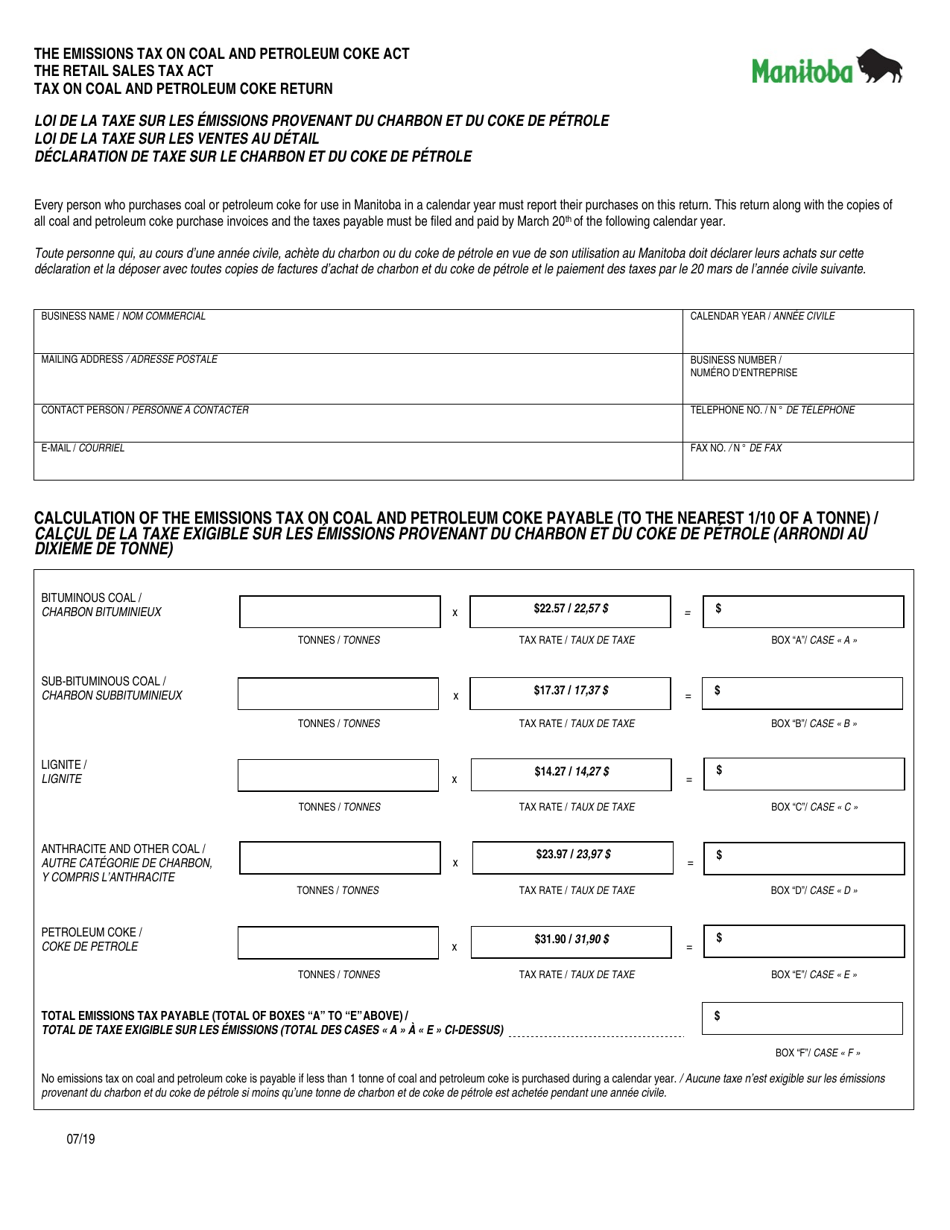

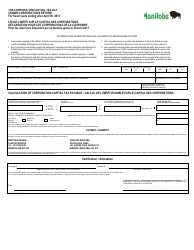

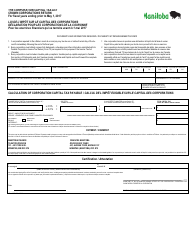

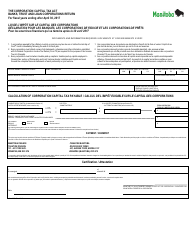

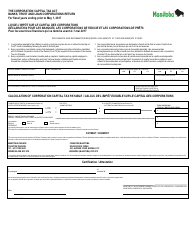

Tax on Coal and Petroleum Coke Return - Manitoba, Canada (English / French)

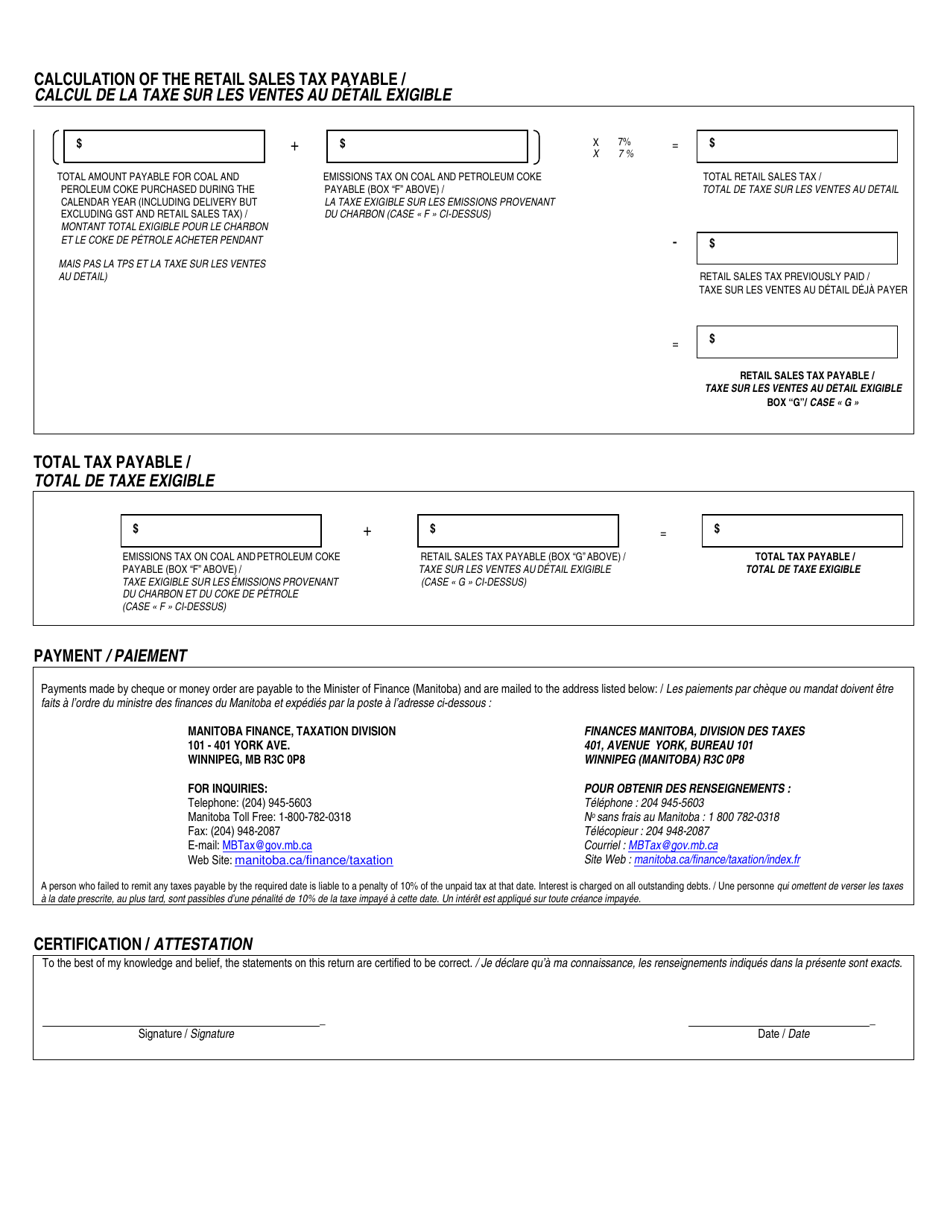

The Tax on Coal and Petroleum Coke Return in Manitoba, Canada is a form that taxpayers use to report and pay the tax owed on the sale, use, or consumption of coal and petroleum coke. This tax is levied by the government of Manitoba in order to generate revenue for the province. The form is available in both English and French to accommodate the bilingual population of Manitoba.

The tax on coal and petroleum coke return in Manitoba, Canada, is filed by the individuals or businesses that are responsible for using or selling these products. The return can be filed in both English and French.

FAQ

Q: What is the tax on coal and petroleum coke in Manitoba?

A: The tax on coal and petroleum coke in Manitoba is called the Coal and Petroleum Coke Tax.

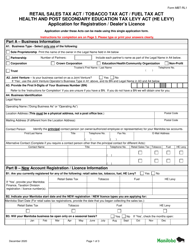

Q: Who is responsible for paying the tax?

A: The tax is generally paid by the supplier of the coal or petroleum coke.

Q: How much is the tax on coal and petroleum coke?

A: The tax rate varies depending on the type and grade of coal or petroleum coke.

Q: Are there any exemptions or rebates for the tax?

A: There are certain exemptions and rebates available for the tax, such as for agricultural products or if the coal or petroleum coke is used for a specific purpose.