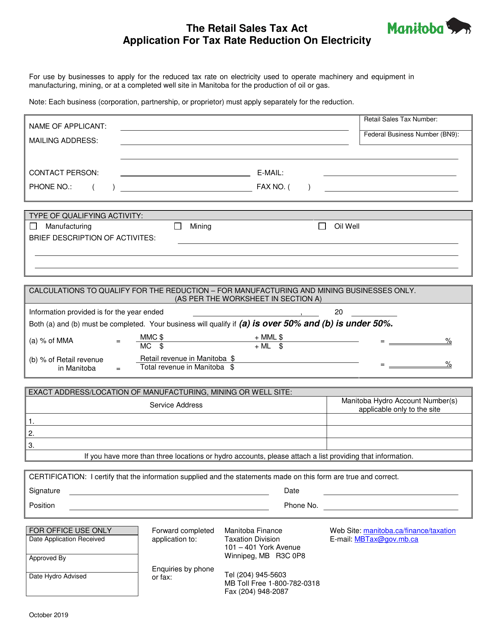

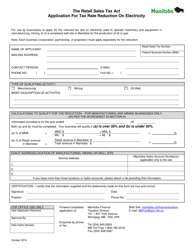

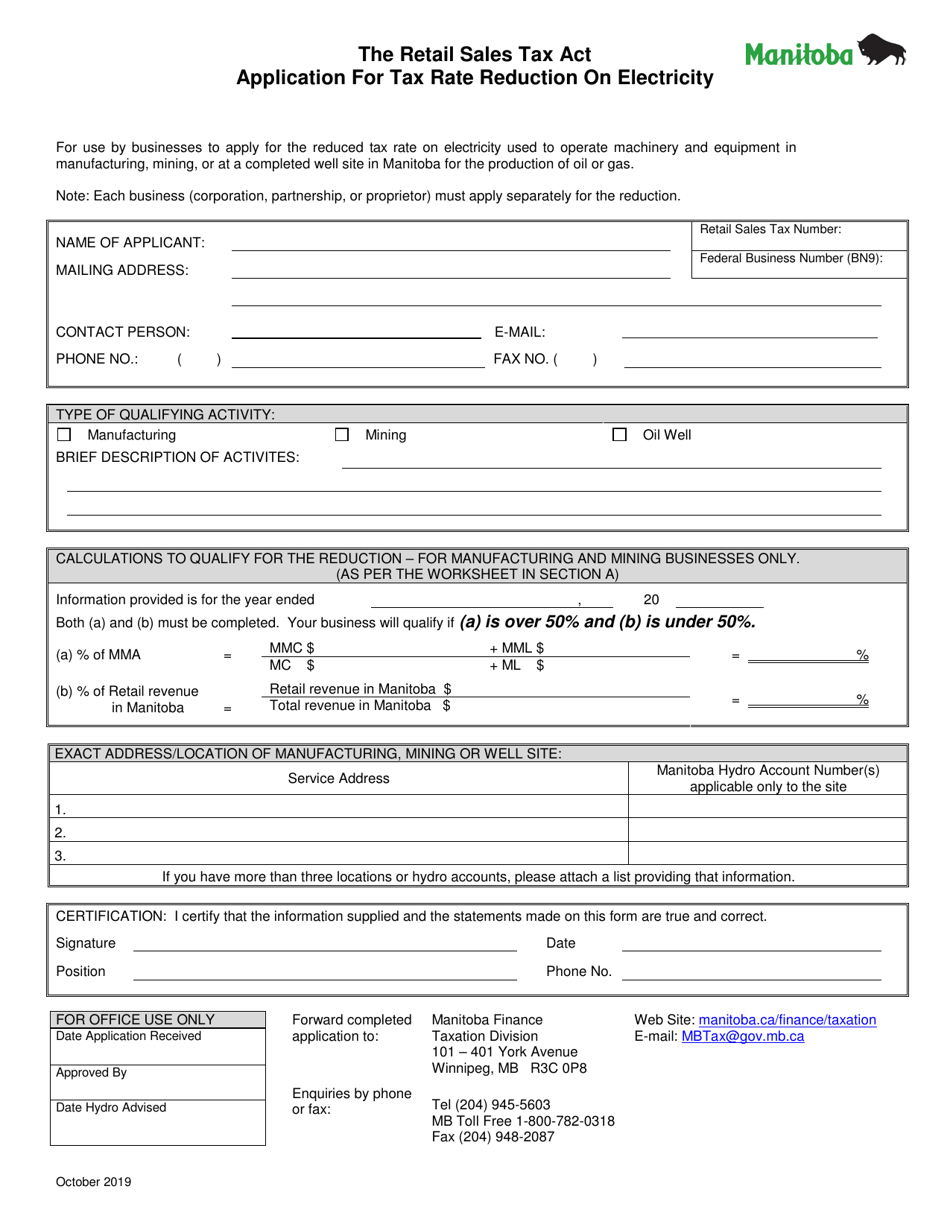

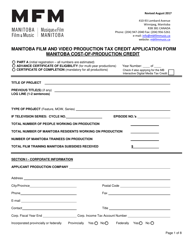

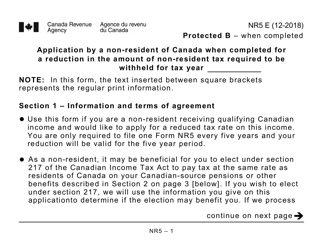

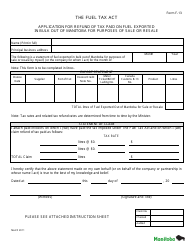

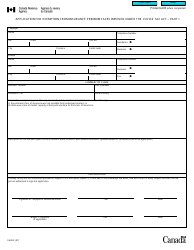

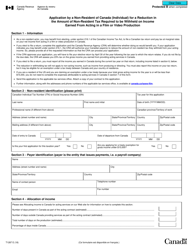

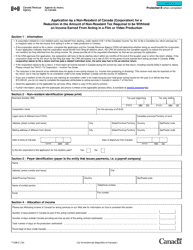

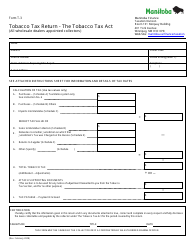

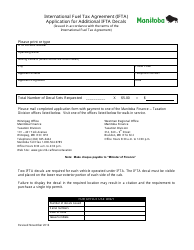

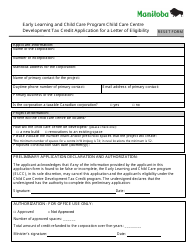

Application for Tax Rate Reduction on Electricity - Manitoba, Canada

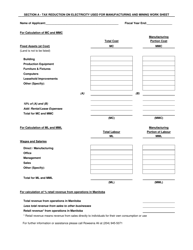

The Application for Tax Rate Reduction on Electricity in Manitoba, Canada is used to apply for a reduced tax rate on electricity consumption. This can help individuals or businesses lower their tax liability for electricity expenses.

In Manitoba, Canada, the application for tax rate reduction on electricity is usually filed by the electricity service provider or distributor.

FAQ

Q: What is the application for tax rate reduction on electricity?

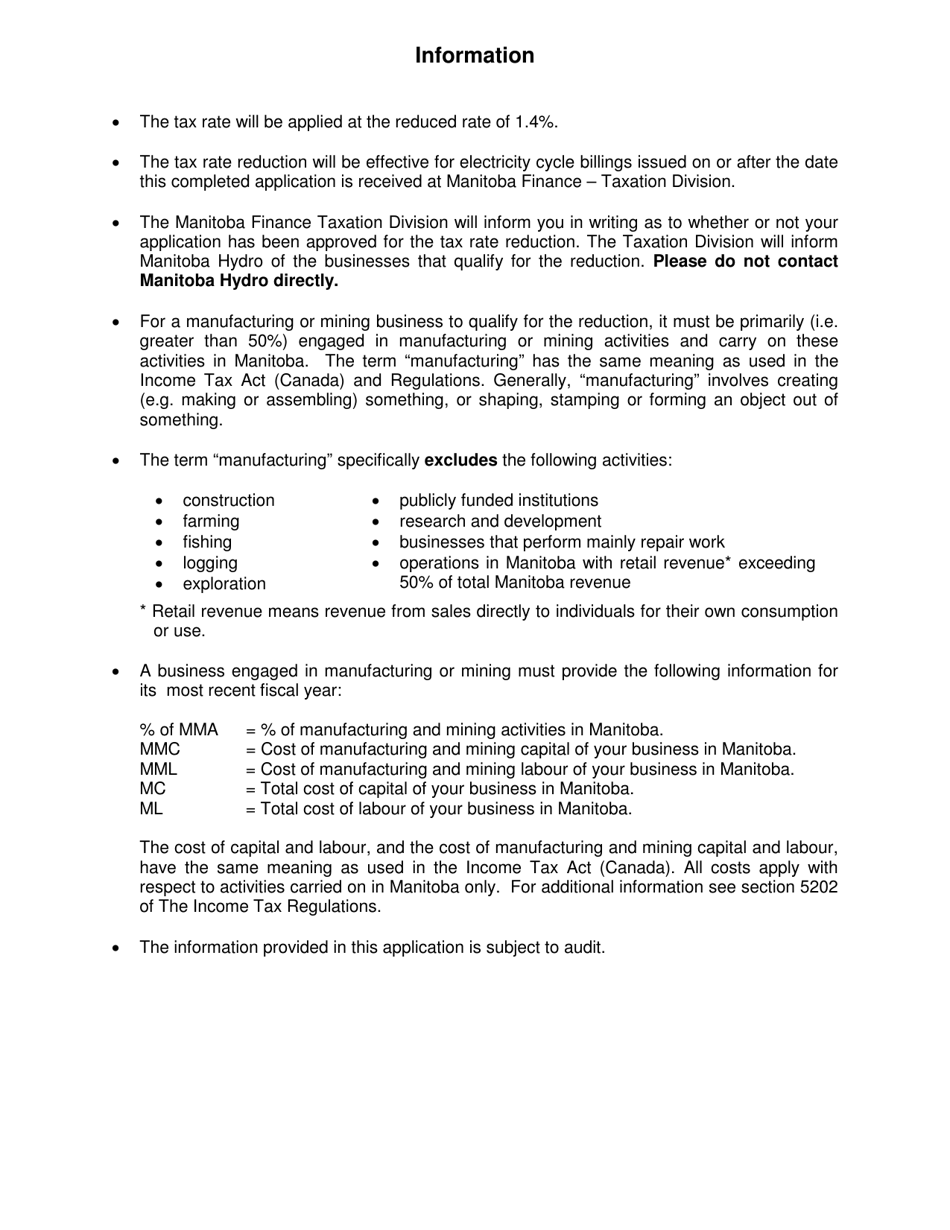

A: The application for tax rate reduction on electricity is a process to request a lower tax rate on electricity expenses in Manitoba, Canada.

Q: Who can apply for a tax rate reduction on electricity?

A: Any individual or business in Manitoba, Canada can apply for a tax rate reduction on electricity.

Q: Why would someone apply for a tax rate reduction on electricity?

A: People apply for a tax rate reduction on electricity to reduce their expenses and save money on taxes associated with electricity usage.

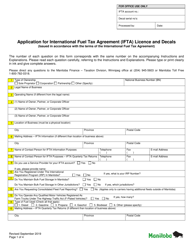

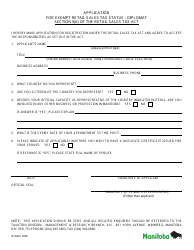

Q: How can someone apply for a tax rate reduction on electricity?

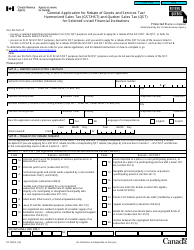

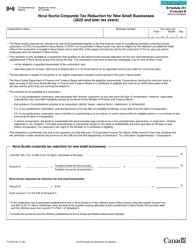

A: To apply for a tax rate reduction on electricity, individuals or businesses need to complete and submit the appropriate application form to the relevant tax authorities in Manitoba, Canada.

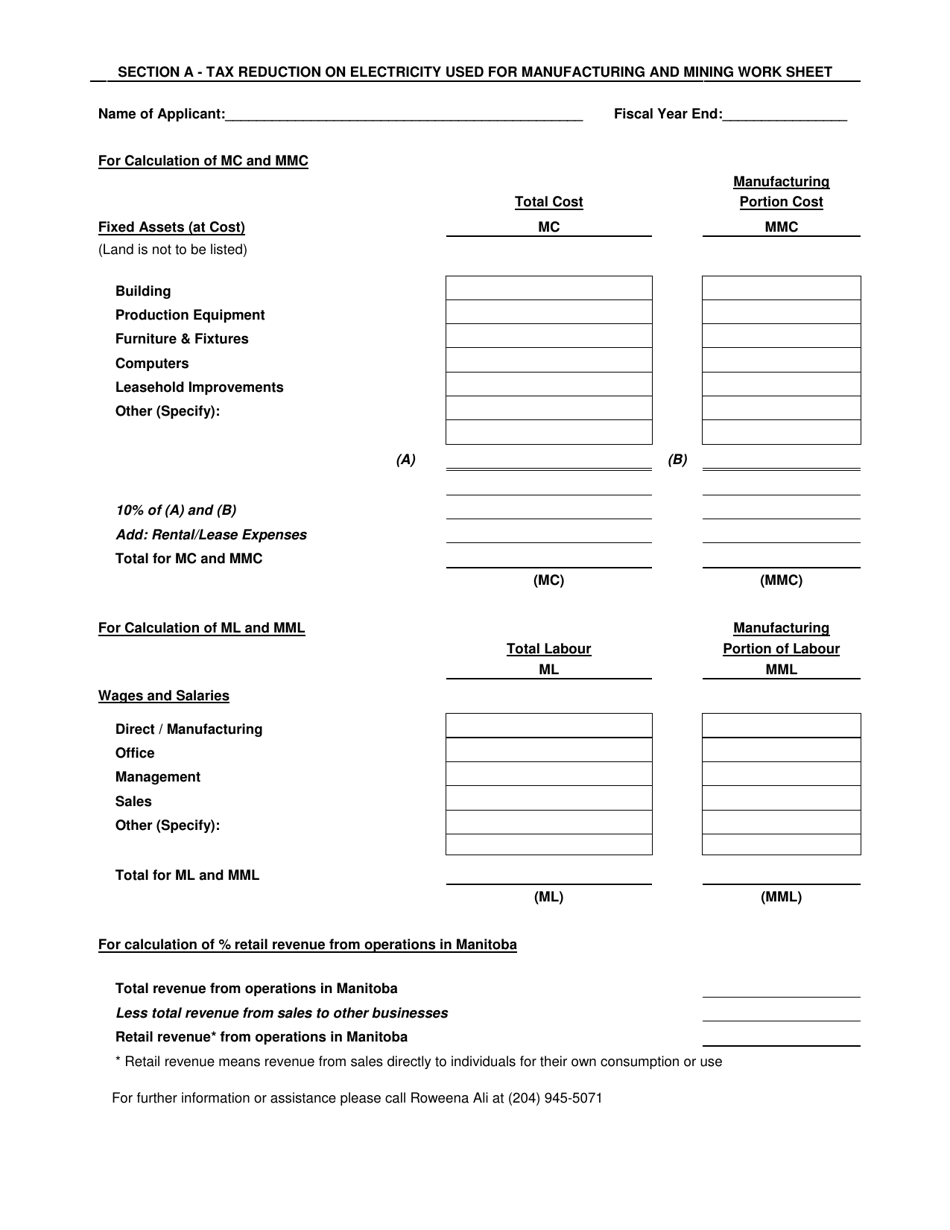

Q: What documents or information are required for the application?

A: The specific documents and information required may vary, but typically it includes details about the electricity usage, proof of payment, and any supporting documentation requested by the tax authorities.

Q: Is there a deadline for submitting the application?

A: The deadline for submitting the application for tax rate reduction on electricity may vary. It is recommended to check with the tax authorities or refer to the application form for the specific deadline.

Q: How long does it take to receive a decision on the application?

A: The time it takes to receive a decision on the application for tax rate reduction on electricity varies. It depends on the processing time of the tax authorities and the complexity of the application.

Q: Can the application be denied?

A: Yes, the application for tax rate reduction on electricity can be denied if it does not meet the eligibility criteria or if the required documents and information are inadequate.

Q: What happens if the application is approved?

A: If the application for tax rate reduction on electricity is approved, the taxpayer will benefit from a lower tax rate on their electricity expenses, resulting in potential cost savings.

Q: Can the tax rate reduction be applied retroactively?

A: In some cases, the tax rate reduction on electricity can be applied retroactively, depending on the specific rules and regulations set by the tax authorities.