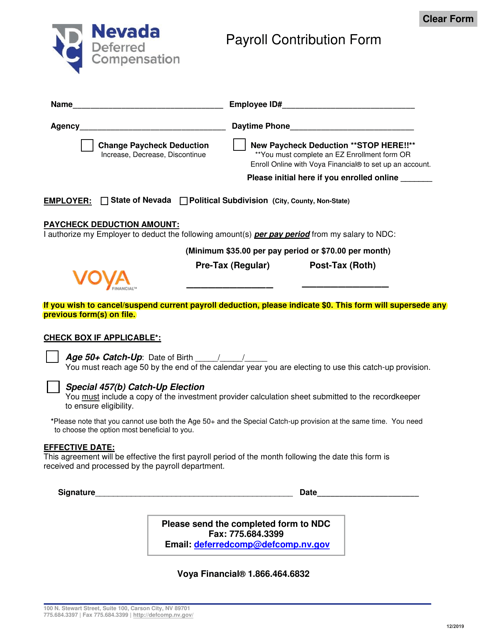

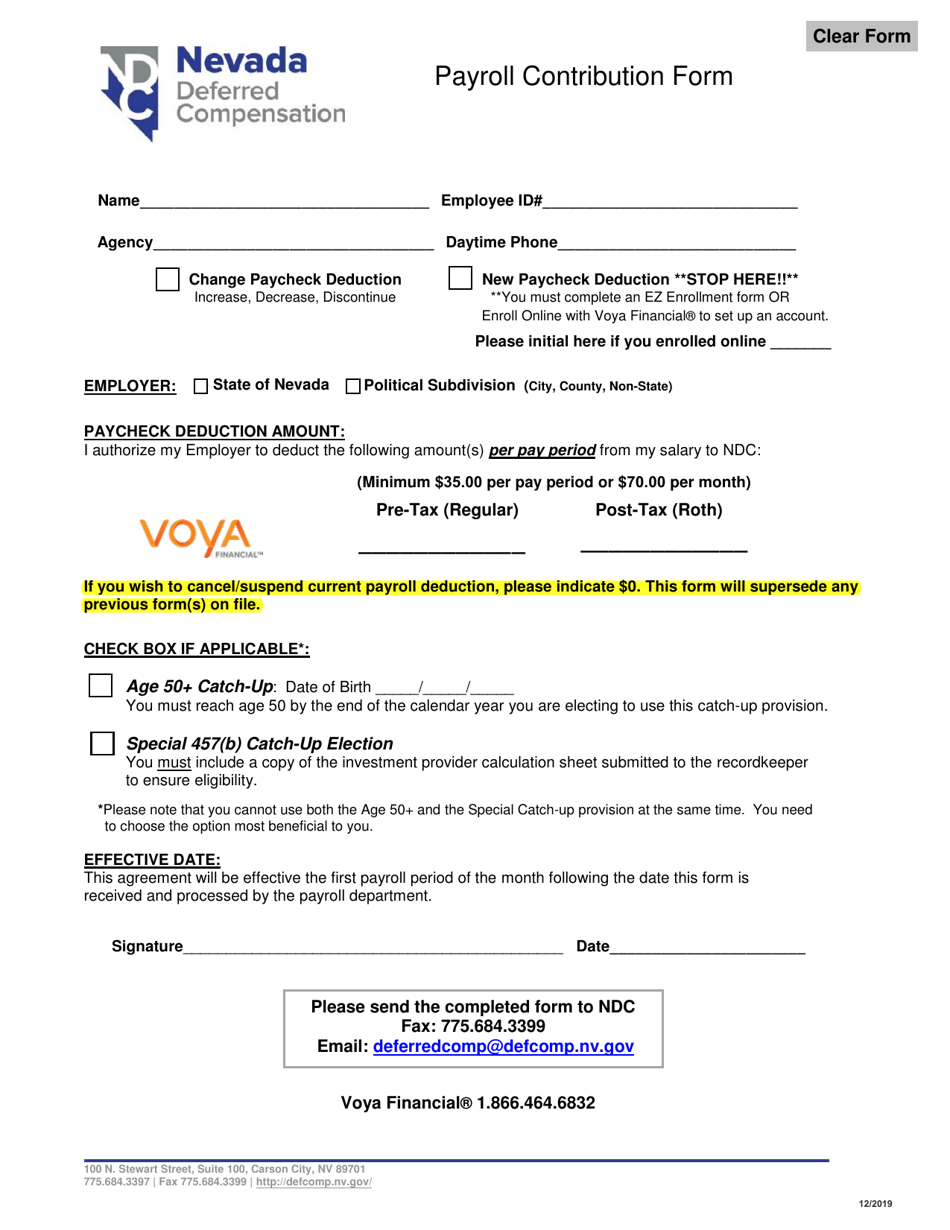

Payroll Contribution Form - Nevada

Payroll Contribution Form is a legal document that was released by the Nevada Department of Employment, Training and Rehabilitation - a government authority operating within Nevada.

FAQ

Q: What is a payroll contribution form?

A: A payroll contribution form is a document used to authorize deductions from an employee's wages for a specific purpose.

Q: Why would I need a payroll contribution form in Nevada?

A: You may need a payroll contribution form in Nevada if you want to contribute to a specific organization or program, such as a charity or political campaign, through automatic payroll deductions.

Q: How can I obtain a payroll contribution form in Nevada?

A: You can obtain a payroll contribution form from the organization or program you wish to contribute to. They will typically provide the form for you to fill out and submit to your employer.

Q: Can I choose not to participate in payroll deductions?

A: Yes, participation in payroll deductions is usually voluntary. If you do not wish to contribute through automatic payroll deductions, you can opt out by not submitting a payroll contribution form.

Q: Is there a limit to the amount I can contribute through payroll deductions?

A: The specific limit on the amount you can contribute through payroll deductions may vary depending on the organization or program. Some may impose a maximum limit, while others may not have any restrictions.

Q: Can I change or cancel my payroll deductions?

A: Yes, you can typically change or cancel your payroll deductions by submitting a new payroll contribution form to your employer. Make sure to follow any deadlines or guidelines provided by the organization or program you are contributing to.

Q: Are there any legal requirements for payroll contribution forms in Nevada?

A: There may be specific legal requirements for payroll contribution forms in Nevada, such as disclosure requirements or restrictions on certain types of deductions. It is important to familiarize yourself with these requirements to ensure compliance.

Q: Can my employer refuse to process my payroll contribution form?

A: In general, employers are required to process valid payroll contribution forms as long as they comply with legal requirements and the employer is capable of implementing the deductions. However, there may be limited circumstances where an employer can refuse to process a form.

Q: What should I do if I have a dispute about my payroll deductions?

A: If you have a dispute about your payroll deductions, you should first try to resolve the issue directly with your employer. If that does not resolve the dispute, you may need to seek legal advice or file a complaint with the appropriate government agency.

Q: Is a payroll contribution form the same as a payroll deduction authorization form?

A: Yes, a payroll contribution form is often referred to as a payroll deduction authorization form. They both serve the purpose of authorizing deductions from an employee's wages, typically for a specific purpose.

Form Details:

- Released on December 1, 2019;

- The latest edition currently provided by the Nevada Department of Employment, Training and Rehabilitation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Employment, Training and Rehabilitation.