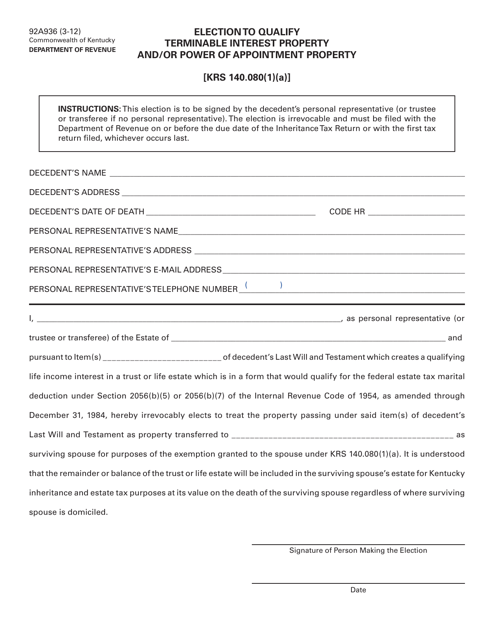

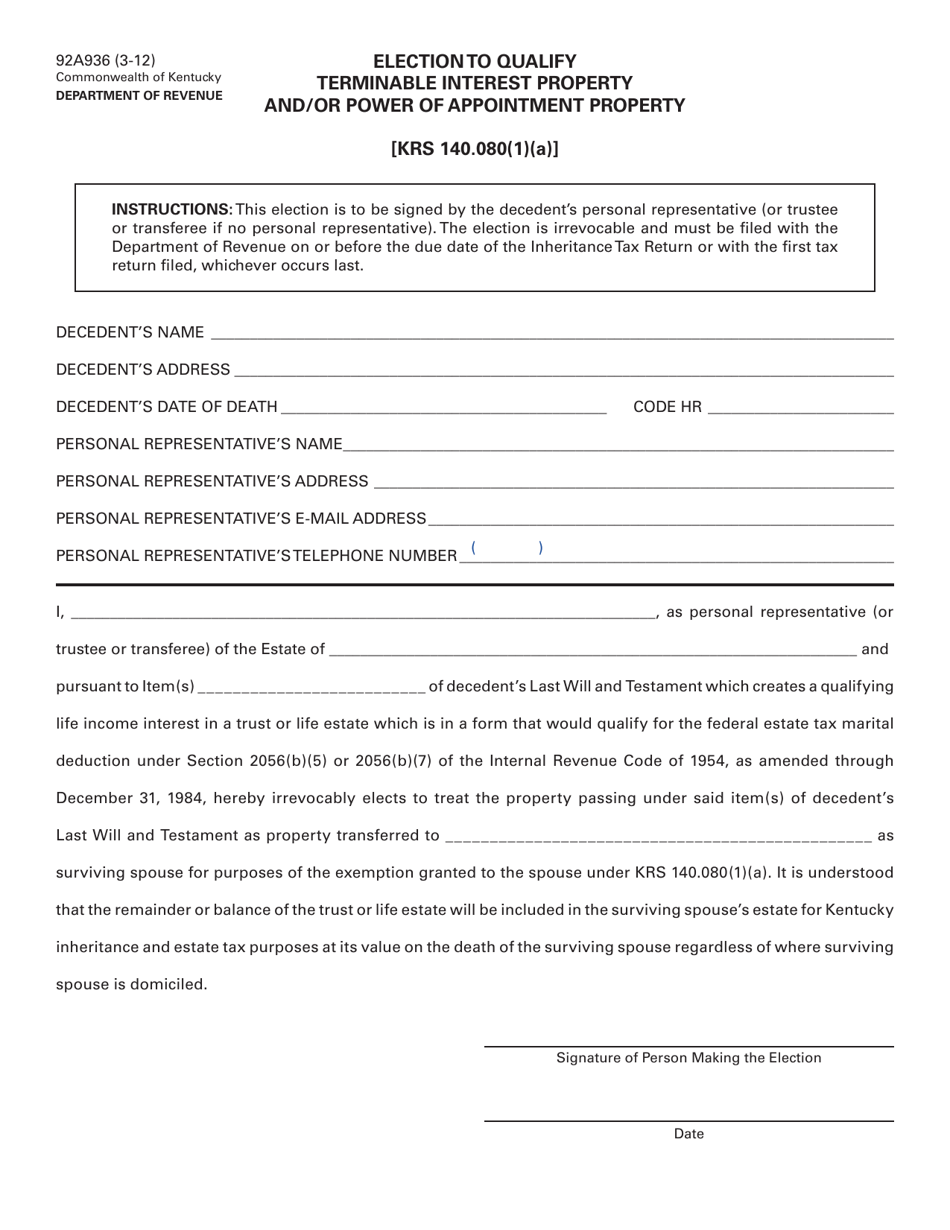

Form 92A936 Election to Qualify Terminable Interest Property and / or Power of Appointment Property - Kentucky

What Is Form 92A936?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 92A936?

A: Form 92A936 is a form used in Kentucky for electing to qualify terminable interest property and/or power of appointment property.

Q: What is terminable interest property?

A: Terminable interest property is property that will terminate or fail to qualify for a marital deduction under federal estate tax laws.

Q: What is power of appointment property?

A: Power of appointment property is property where a person has the power to direct who will be the owner of the property.

Q: When should Form 92A936 be filed?

A: Form 92A936 should be filed within nine months after the decedent's date of death or within six months after the date of qualification of a domiciliary personal representative.

Q: Who should file Form 92A936?

A: The trustee or personal representative should file Form 92A936 if they want to qualify terminable interest property and/or power of appointment property.

Form Details:

- Released on March 1, 2012;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 92A936 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.