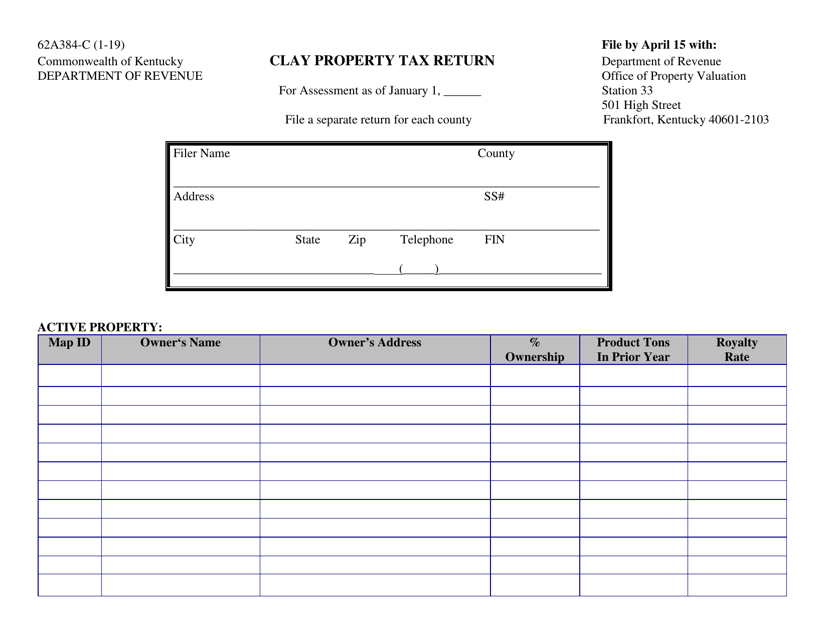

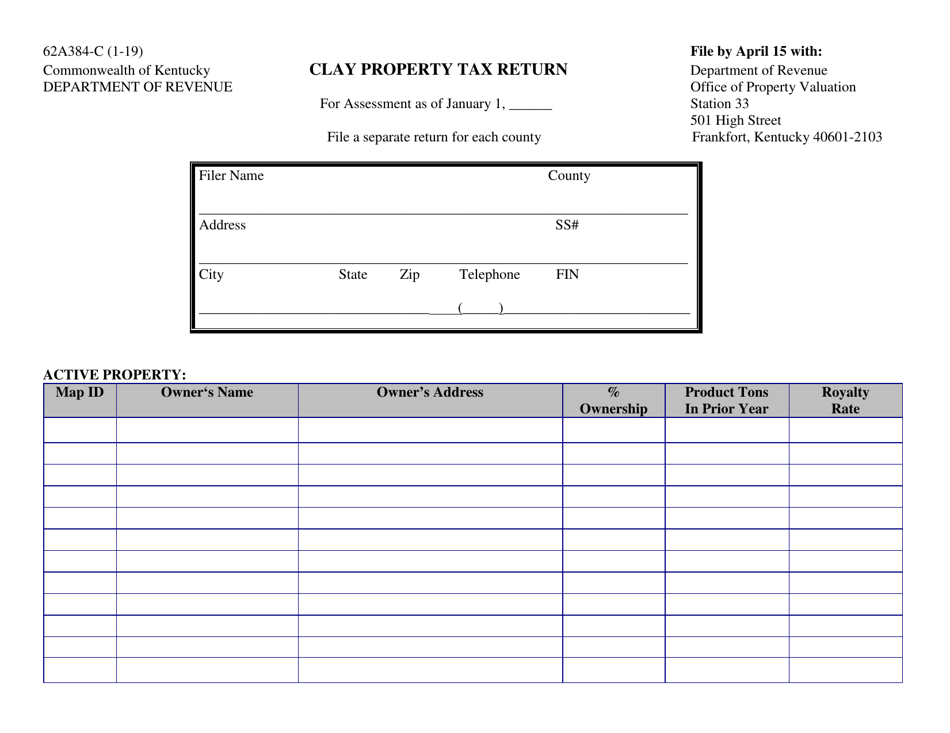

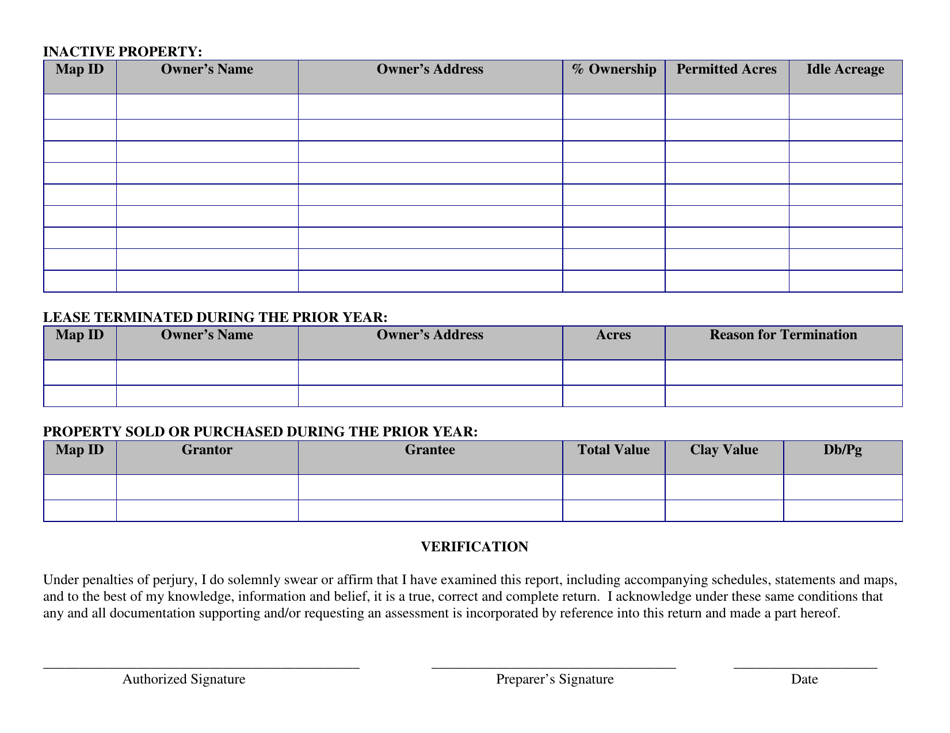

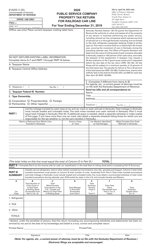

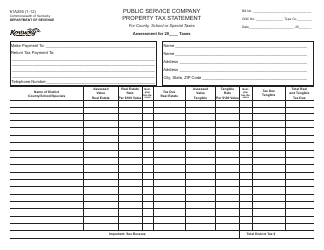

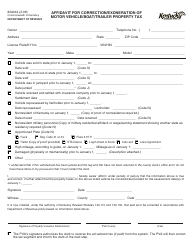

Form 62A384-C Clay Property Tax Return - Kentucky

What Is Form 62A384-C?

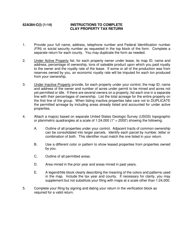

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 62A384-C?

A: Form 62A384-C is the Clay Property Tax Return in Kentucky.

Q: Who needs to file Form 62A384-C?

A: Property owners in Clay County, Kentucky need to file Form 62A384-C.

Q: What is the purpose of Form 62A384-C?

A: Form 62A384-C is used for reporting and paying property taxes in Clay County, Kentucky.

Q: How often do I need to file Form 62A384-C?

A: Form 62A384-C needs to be filed annually by the specified deadline set by the local tax authorities.

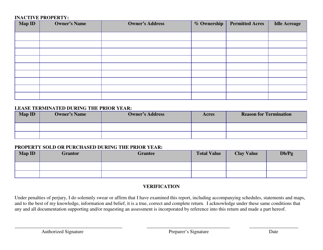

Q: What information do I need to complete Form 62A384-C?

A: You will typically need property information, such as the address and legal description, as well as details about the property's value and any exemptions.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 62A384-C by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.