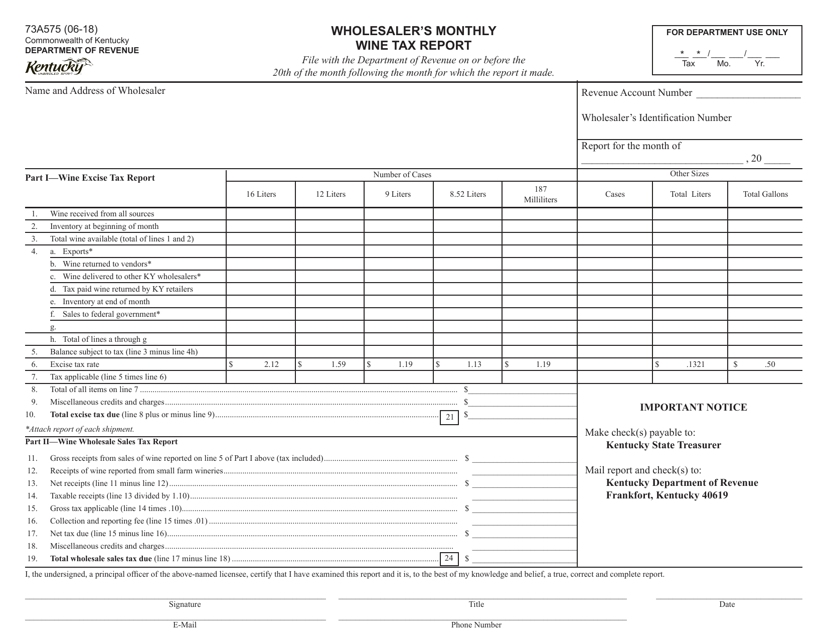

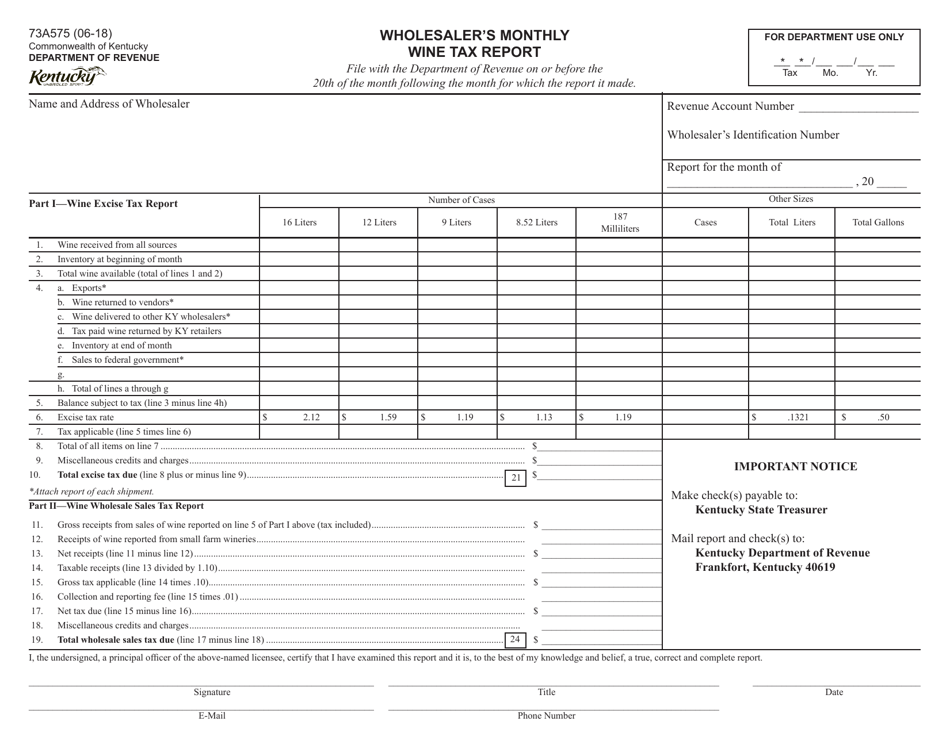

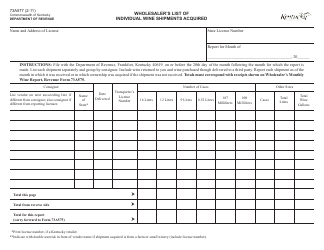

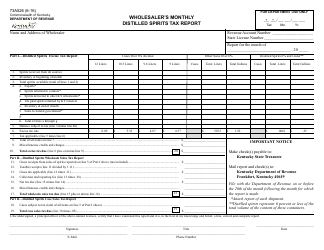

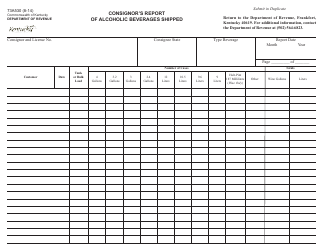

Form 73A575 Wholesaler's Monthly Wine Tax Report - Kentucky

What Is Form 73A575?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A575?

A: Form 73A575 is the Wholesaler's Monthly Wine Tax Report in Kentucky.

Q: Who needs to file Form 73A575?

A: Wholesalers in Kentucky who sell wine need to file Form 73A575.

Q: What is the purpose of Form 73A575?

A: Form 73A575 is used to report and pay monthly wine taxes for wholesalers in Kentucky.

Q: How often do I need to file Form 73A575?

A: Form 73A575 needs to be filed monthly by wholesalers in Kentucky.

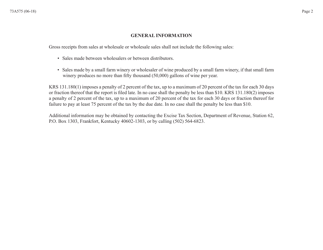

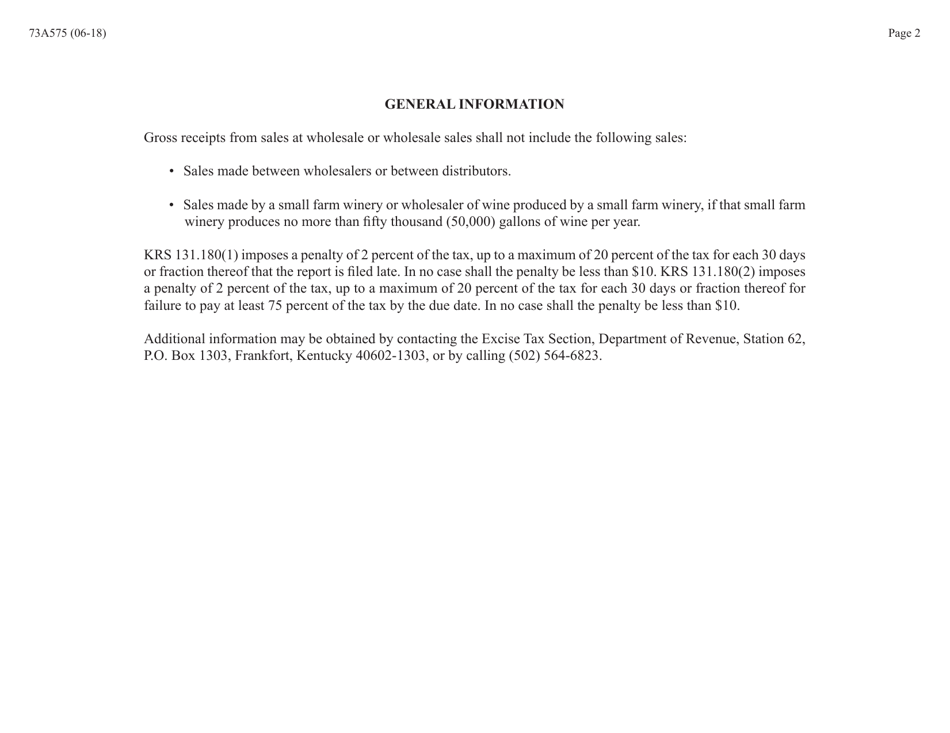

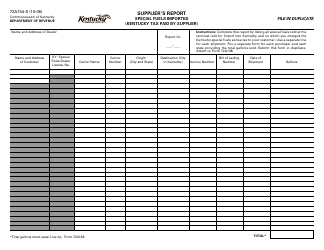

Q: Are there any penalties for not filing Form 73A575?

A: Yes, there are penalties for not filing or late filing of Form 73A575. Penalties can include fines and interest charges.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A575 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.