This version of the form is not currently in use and is provided for reference only. Download this version of

Form BI-75

for the current year.

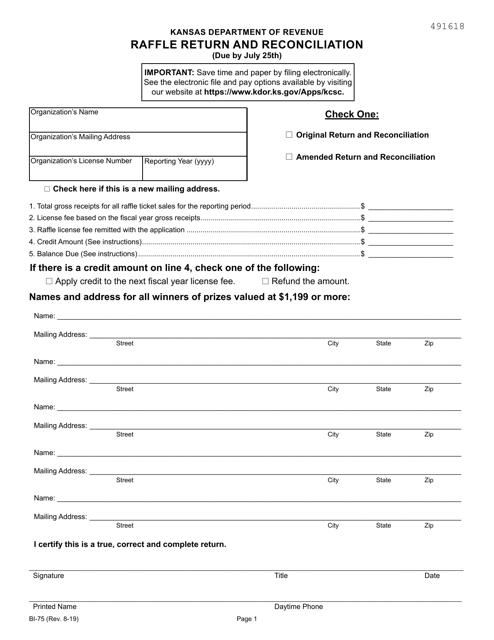

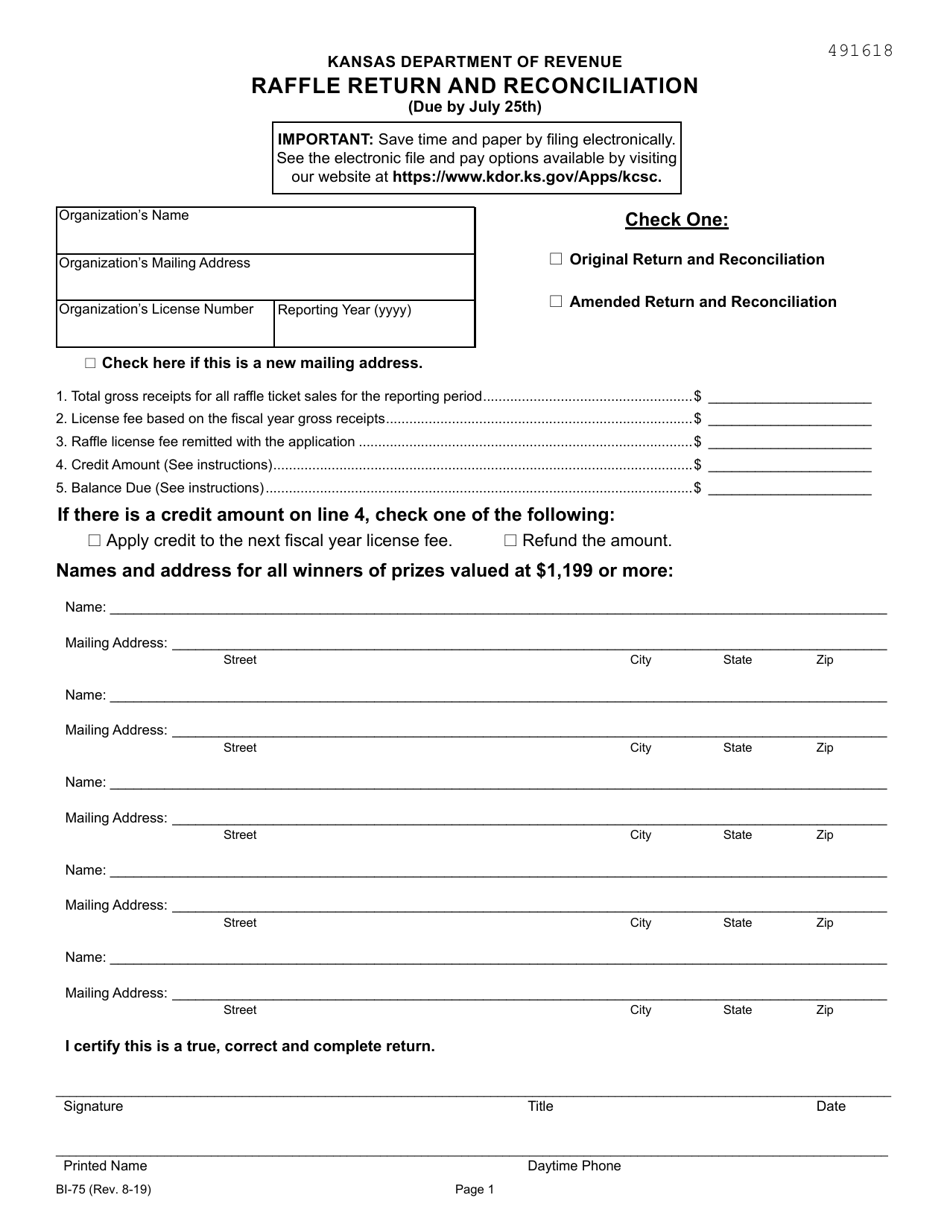

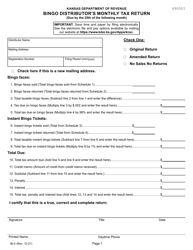

Form BI-75 Raffle Return and Reconciliation - Kansas

What Is Form BI-75?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BI-75?

A: Form BI-75 is the Raffle Return and Reconciliation form for raffles conducted in Kansas.

Q: Who needs to file Form BI-75?

A: Those who have conducted a raffle in Kansas need to file Form BI-75.

Q: What is the purpose of Form BI-75?

A: Form BI-75 is used to report the details of the raffle and reconcile the raffle proceeds.

Q: When is Form BI-75 due?

A: Form BI-75 is due within 30 days after the raffle is conducted.

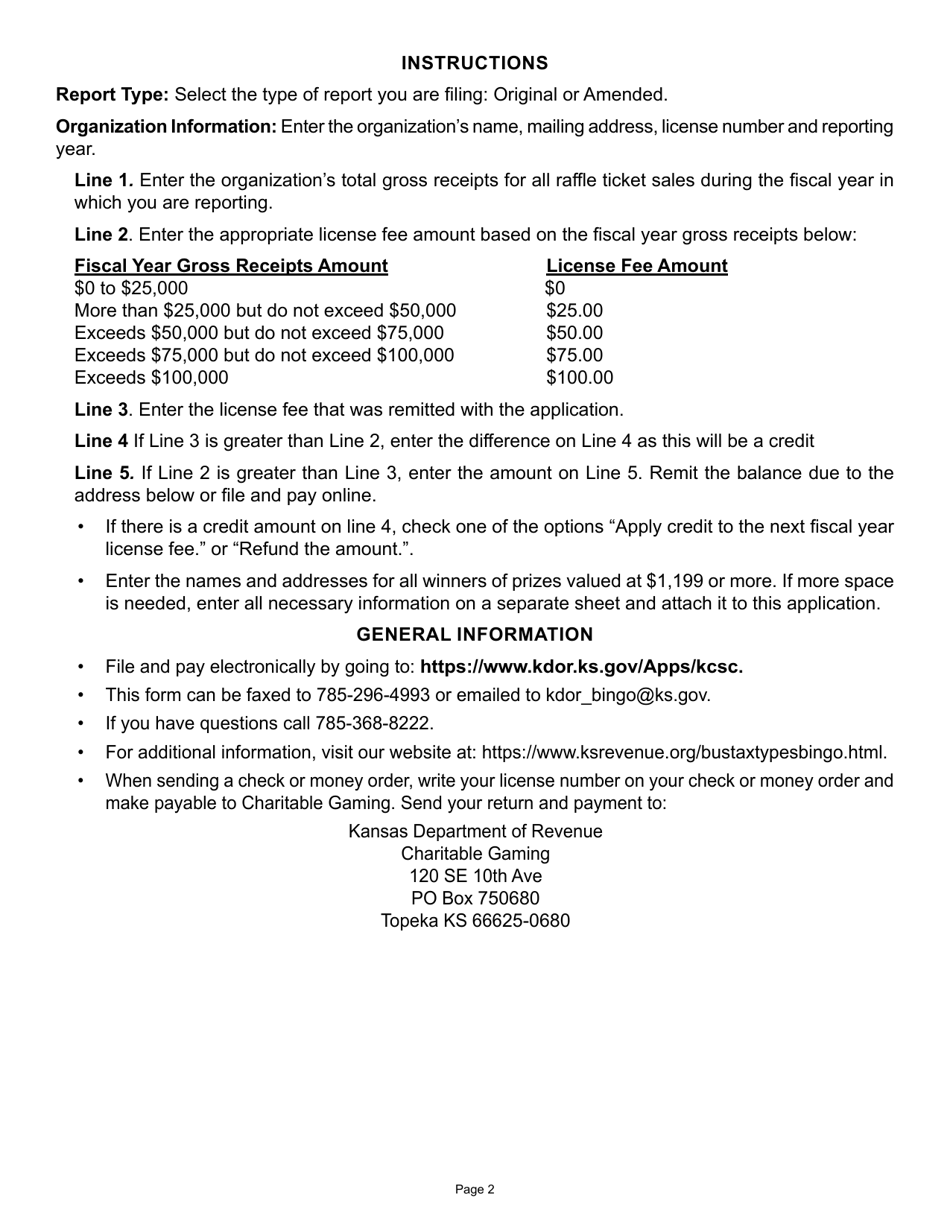

Q: What information do I need to provide on Form BI-75?

A: You need to provide details about the raffle proceeds, expenses, prizes awarded, and the charitable organization conducting the raffle.

Q: Are there any fees associated with filing Form BI-75?

A: Yes, there is a $20 filing fee for each raffle conducted.

Q: Are there any penalties for not filing Form BI-75?

A: Failure to file Form BI-75 or filing it late may result in penalties and interest charges.

Q: Can I file Form BI-75 electronically?

A: Currently, Form BI-75 cannot be filed electronically. It must be filed by mail.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BI-75 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.