This version of the form is not currently in use and is provided for reference only. Download this version of

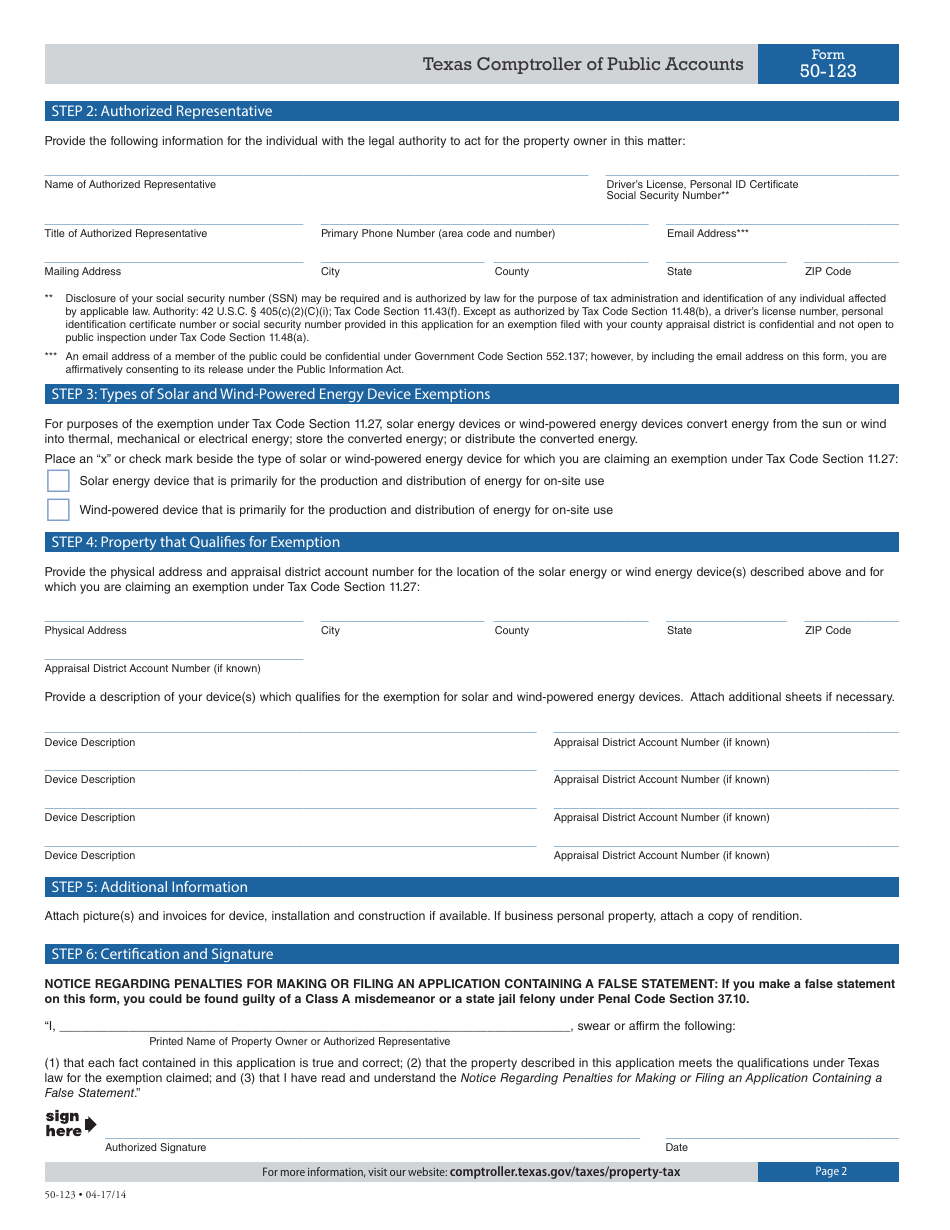

Form 50-123

for the current year.

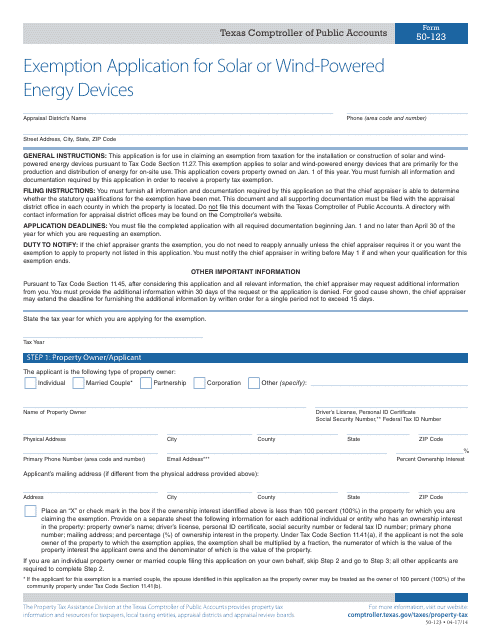

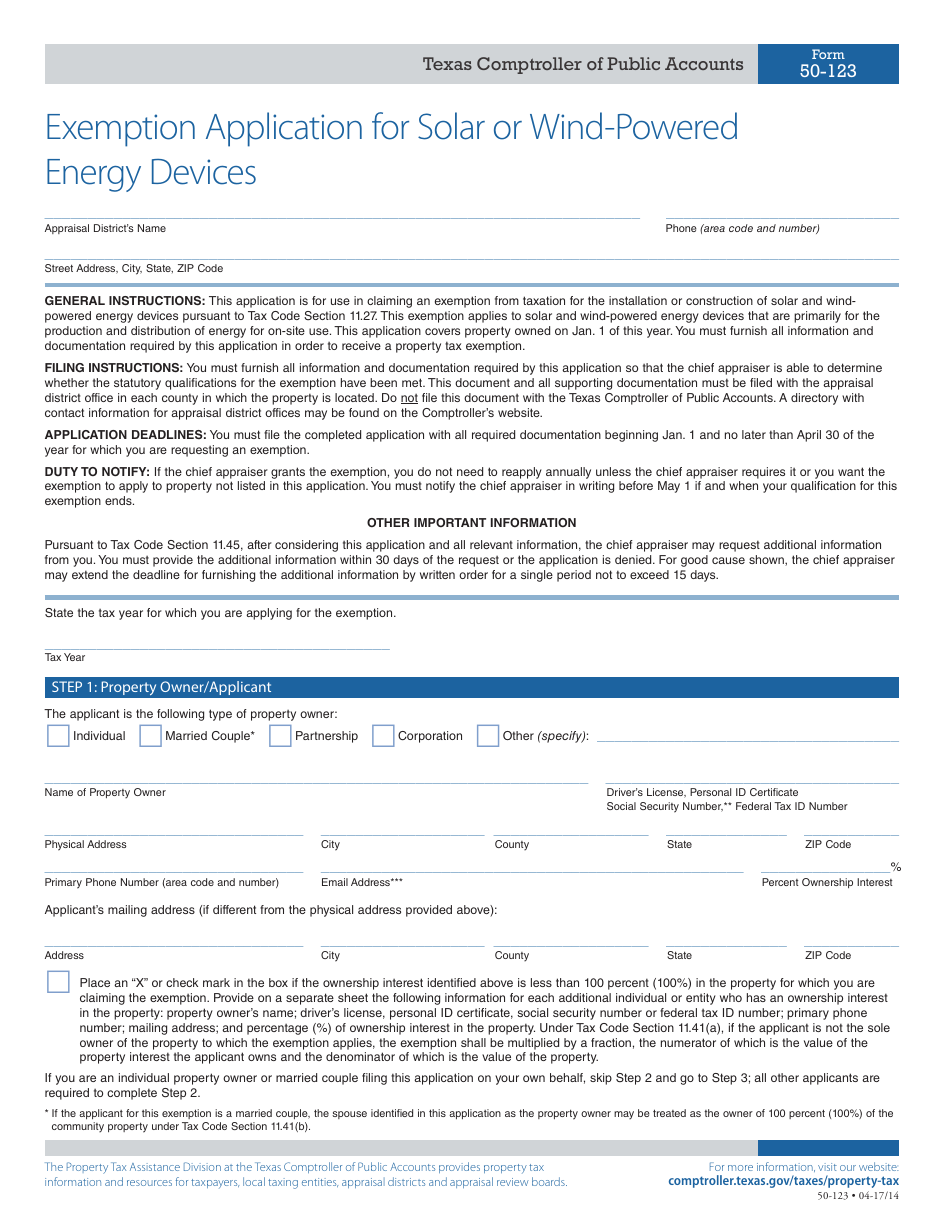

Form 50-123 Exemption Application for Solar or Wind-Powered Energy Devices - Texas

What Is Form 50-123?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-123?

A: Form 50-123 is an Exemption Application for Solar or Wind-Powered Energy Devices in Texas.

Q: Who needs to fill out Form 50-123?

A: Anyone who wants to apply for an exemption for their solar or wind-powered energy devices in Texas needs to fill out Form 50-123.

Q: What is the purpose of Form 50-123?

A: The purpose of Form 50-123 is to request an exemption from property taxes on solar or wind-powered energy devices.

Q: What are solar or wind-powered energy devices?

A: Solar or wind-powered energy devices are equipment or systems that use solar or wind to generate energy, such as solar panels or wind turbines.

Q: How long does the exemption last?

A: The exemption for solar or wind-powered energy devices in Texas lasts for 10 years.

Q: Are there any fees associated with the exemption application?

A: No, there are no fees associated with filing the exemption application.

Q: Can I apply for the exemption if I already have solar or wind-powered energy devices?

A: Yes, you can apply for the exemption even if you already have solar or wind-powered energy devices.

Q: Is the exemption available for commercial properties?

A: Yes, the exemption is available for both residential and commercial properties.

Q: What supporting documentation do I need to submit with the application?

A: You need to submit documentation such as invoices, receipts, or contracts to prove the purchase and installation of the solar or wind-powered energy devices.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-123 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.