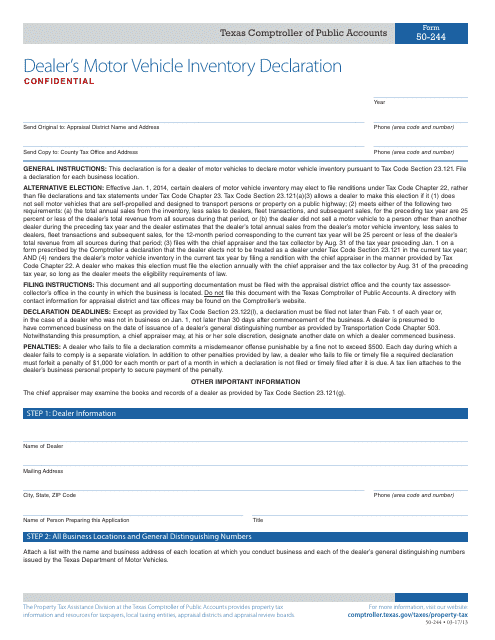

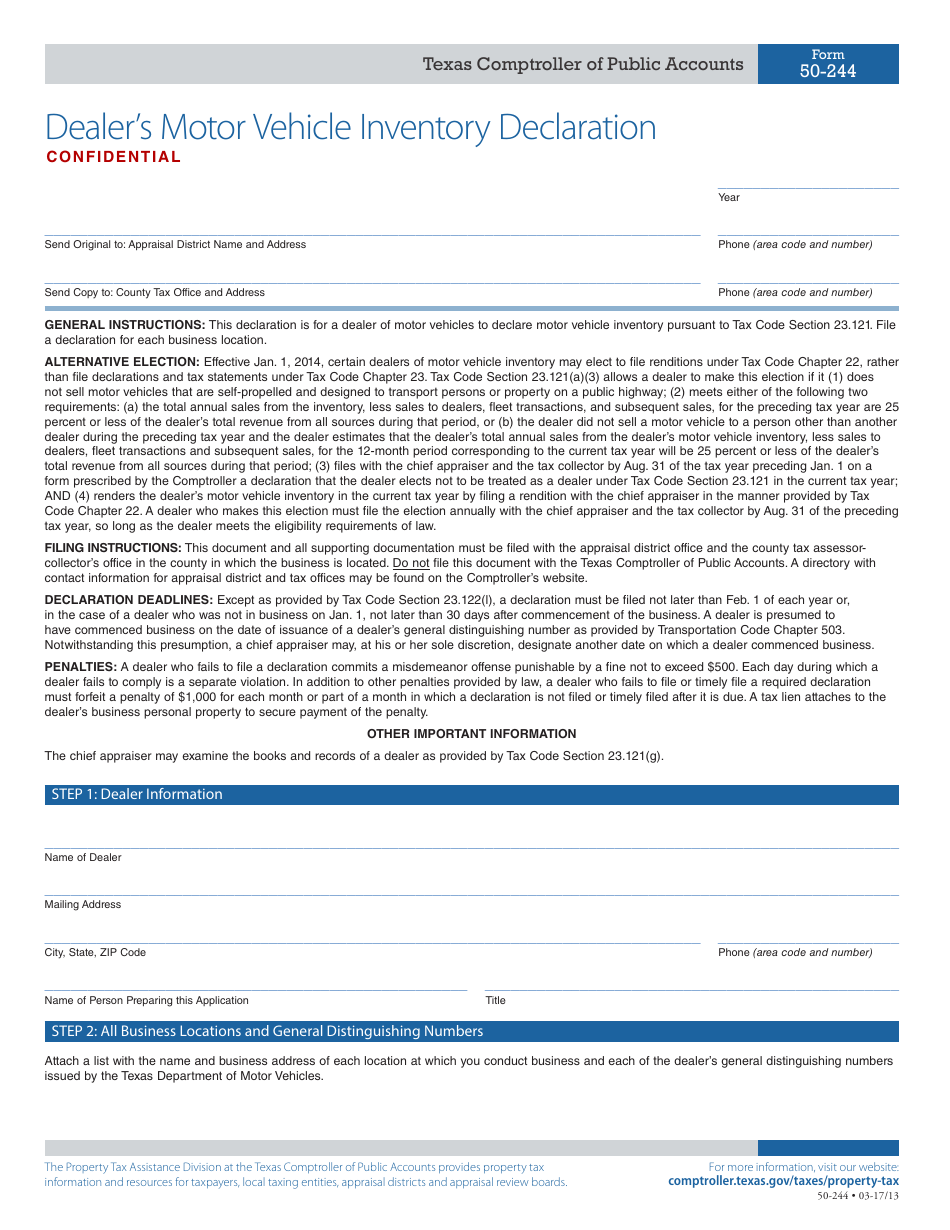

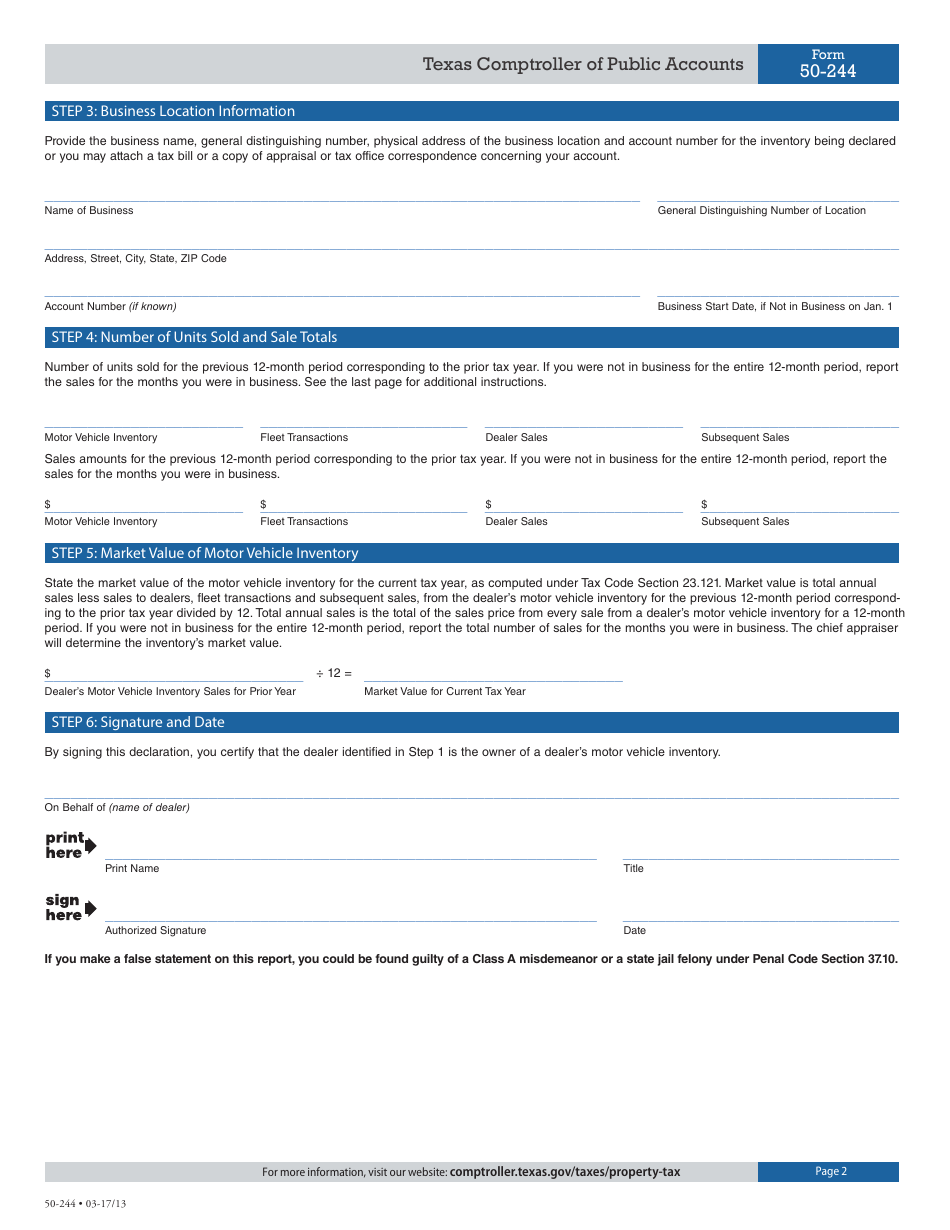

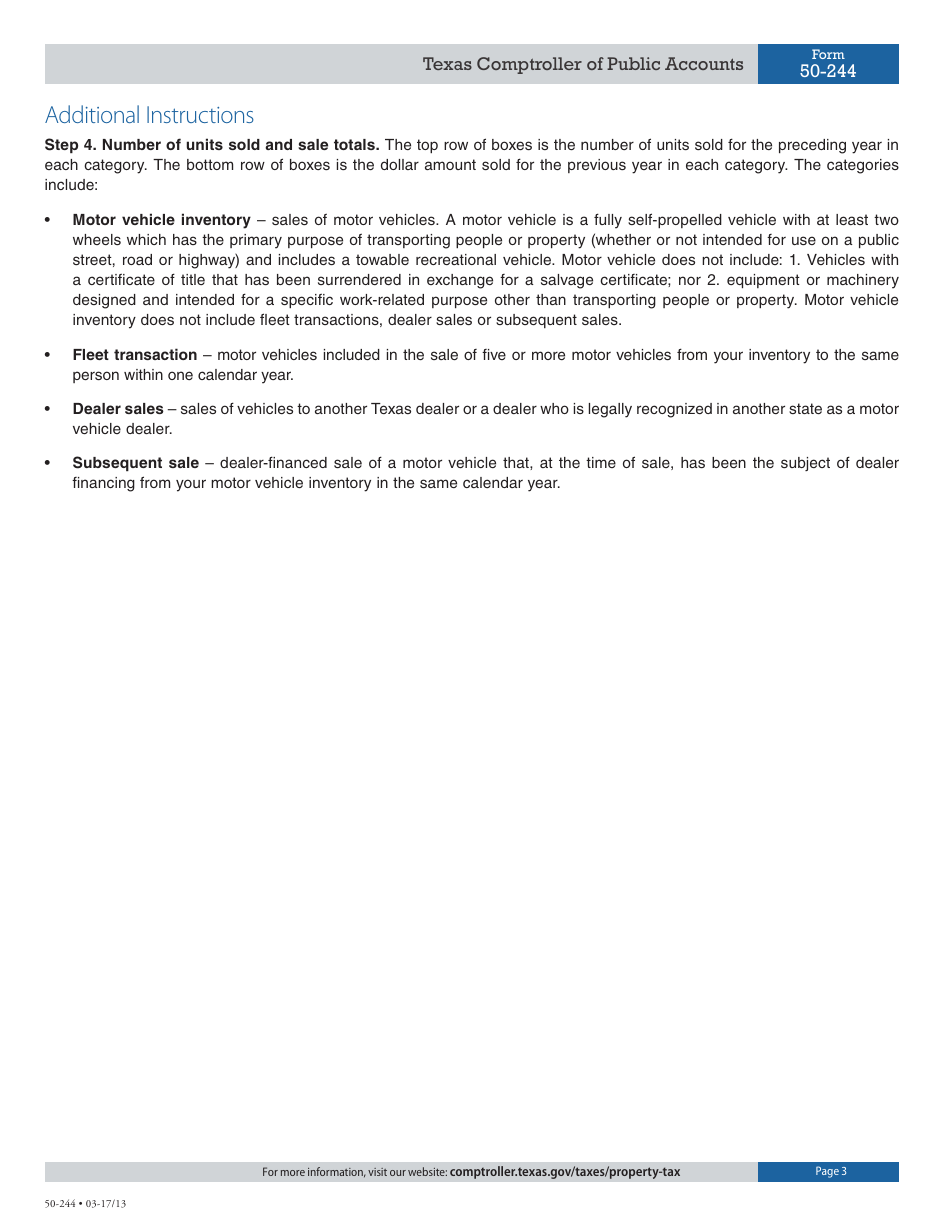

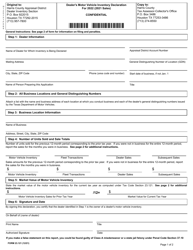

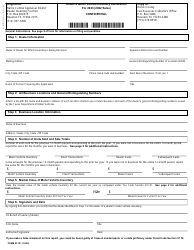

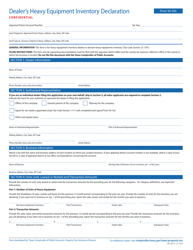

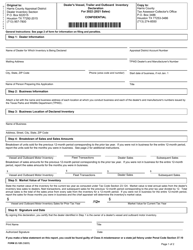

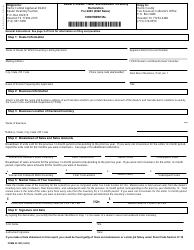

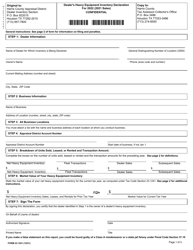

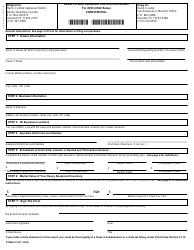

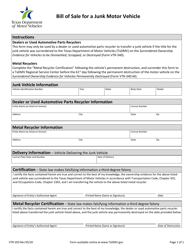

Form 50-244 Dealer's Motor Vehicle Inventory Declaration - Texas

What Is Form 50-244?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-244?

A: Form 50-244 is the Dealer's Motor Vehicle Inventory Declaration in Texas.

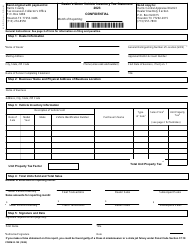

Q: Who needs to file Form 50-244?

A: Dealers of motor vehicles in Texas need to file Form 50-244.

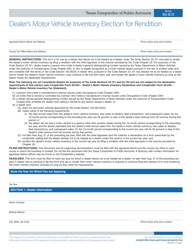

Q: What is the purpose of Form 50-244?

A: The purpose of Form 50-244 is to report the inventory of motor vehicles held for sale by a dealer in Texas.

Q: When do dealers need to file Form 50-244?

A: Dealers in Texas need to file Form 50-244 annually, by April 30th.

Q: Are there any penalties for not filing Form 50-244?

A: Yes, failure to file Form 50-244 or filing a false or fraudulent form may result in penalties and interest.

Q: Is there a fee for filing Form 50-244?

A: No, there is no fee for filing Form 50-244.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-244 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.