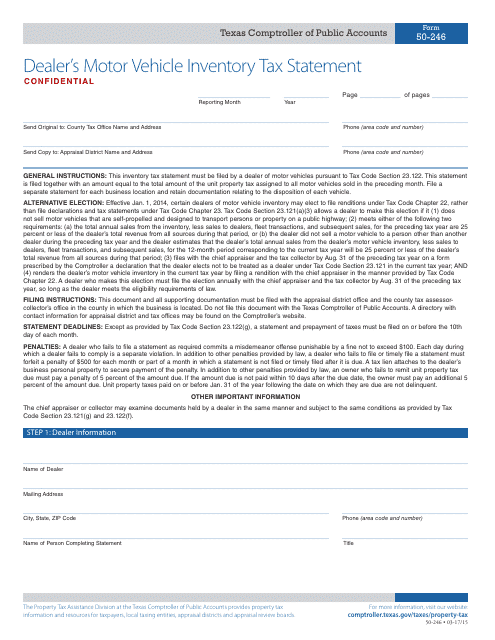

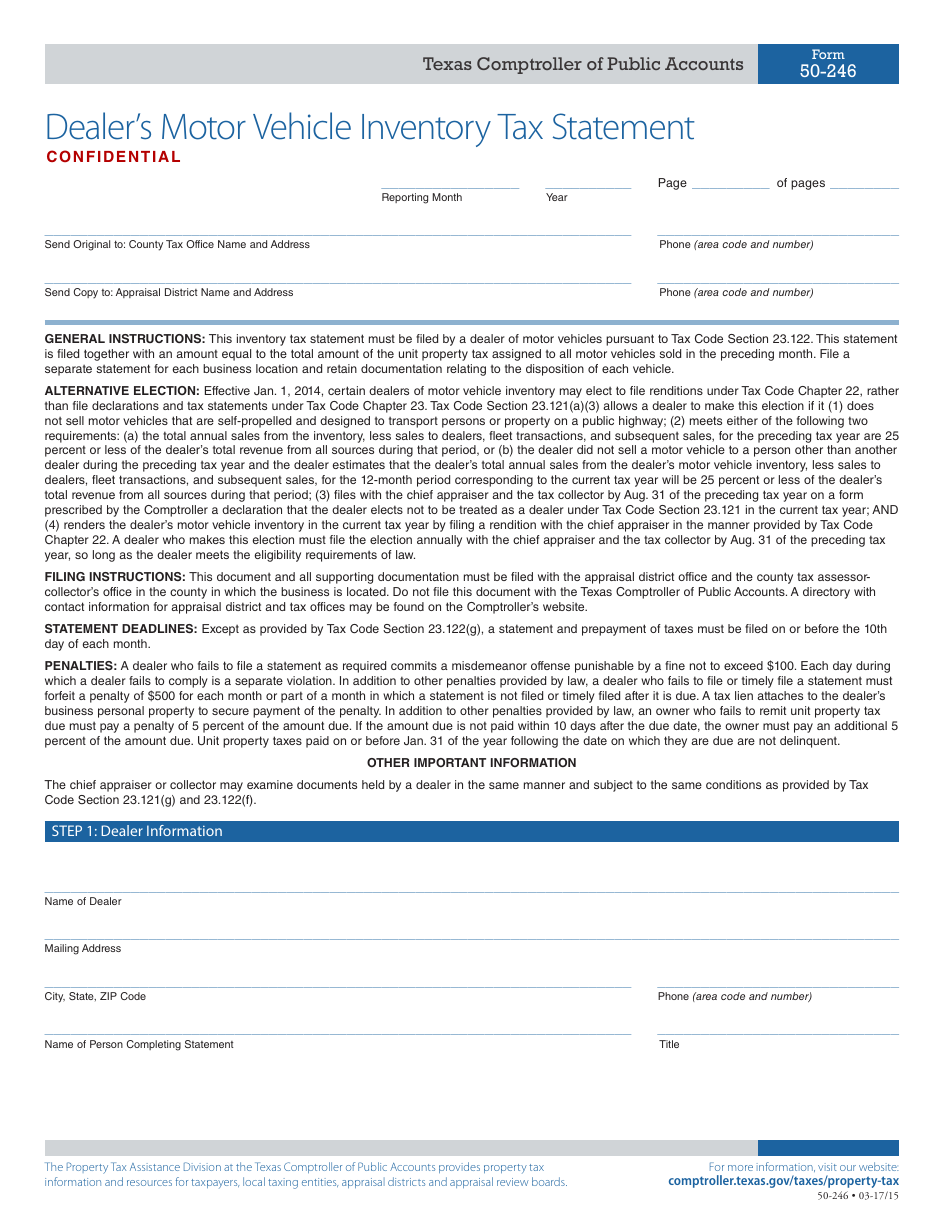

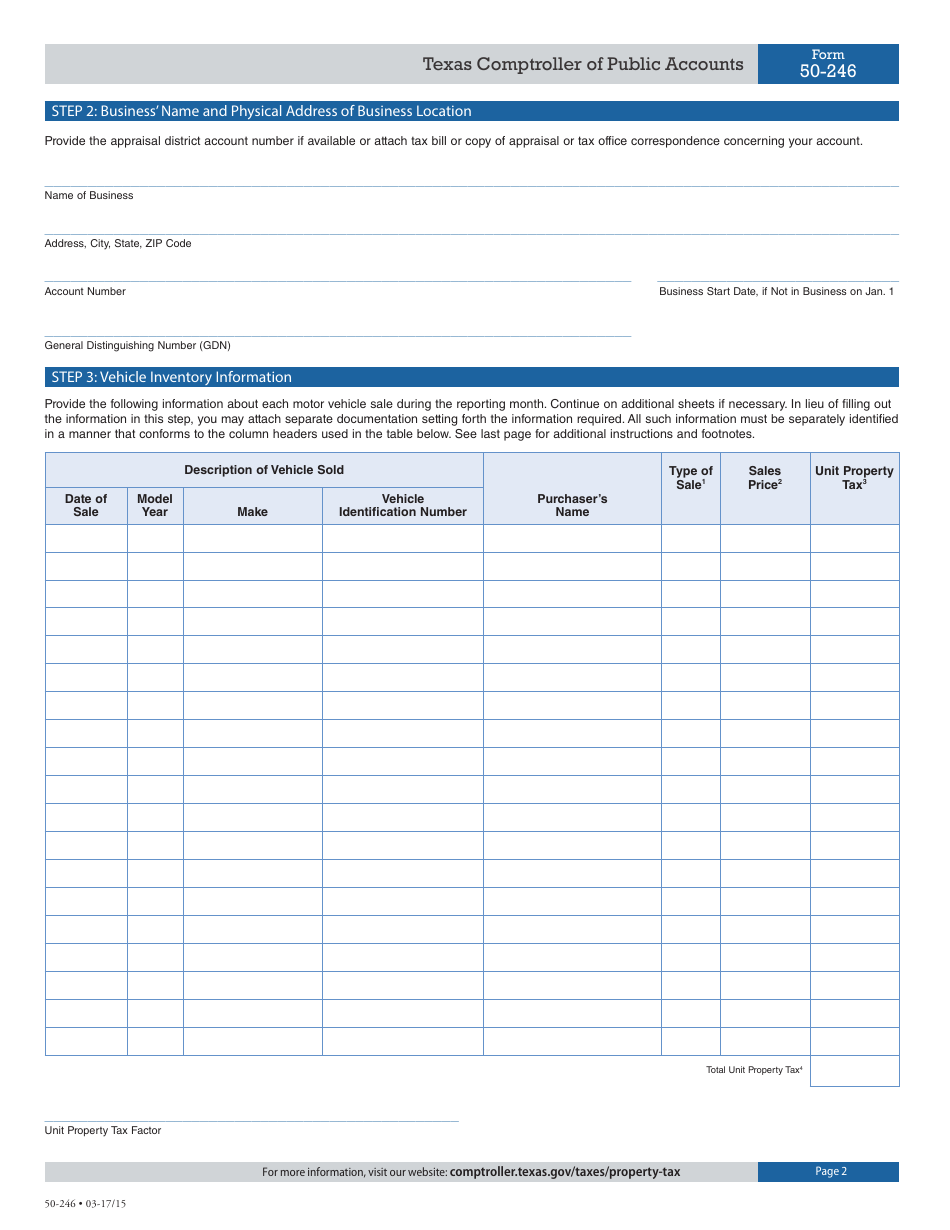

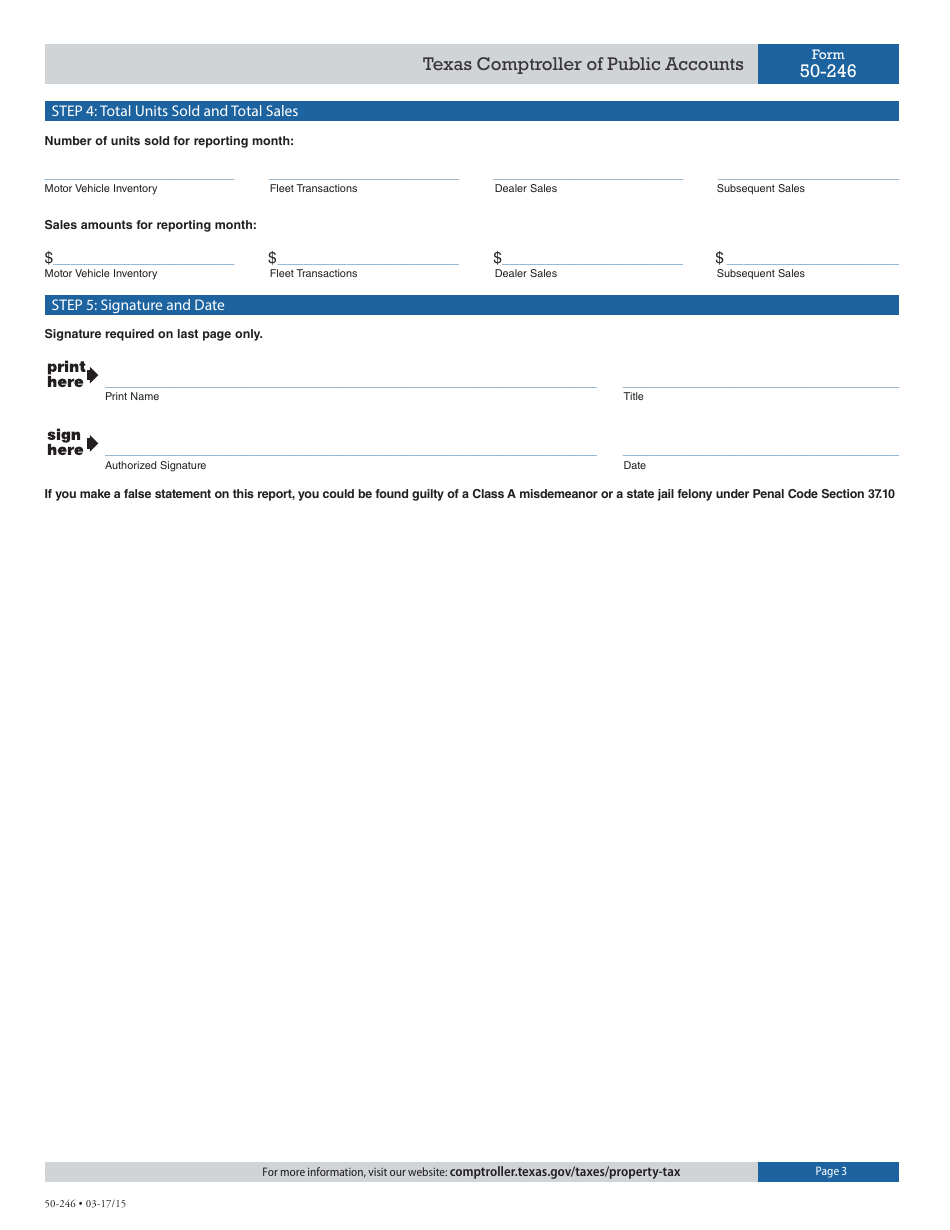

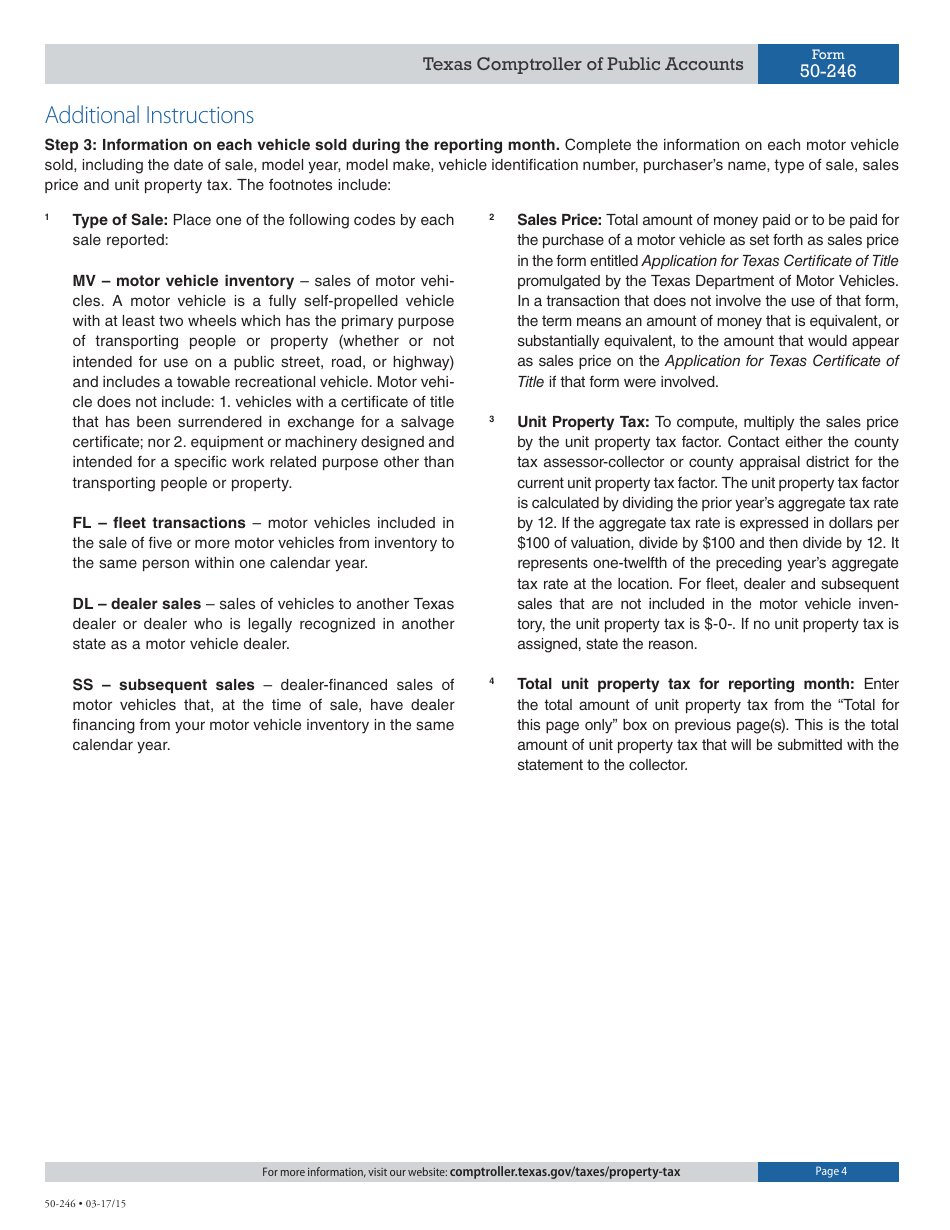

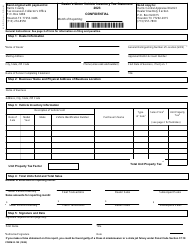

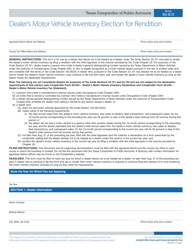

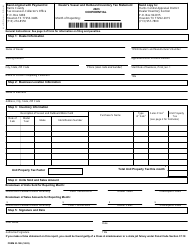

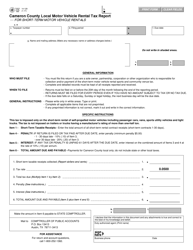

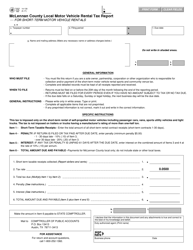

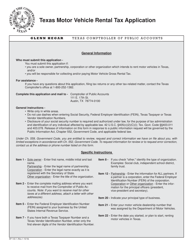

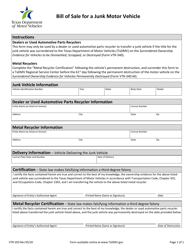

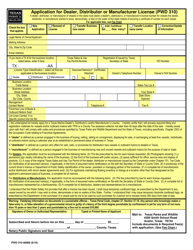

Form 50-246 Dealer's Motor Vehicle Inventory Tax Statement - Texas

What Is Form 50-246?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-246?

A: Form 50-246 is the Dealer's Motor Vehicle InventoryTax Statement in Texas.

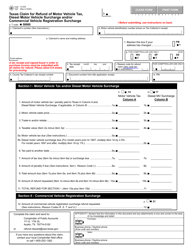

Q: Who needs to file Form 50-246?

A: Dealers of motor vehicles in Texas need to file Form 50-246.

Q: What is the purpose of Form 50-246?

A: The purpose of Form 50-246 is to report the inventory of motor vehicles held for sale in Texas by dealers and to calculate the inventory tax due.

Q: When is Form 50-246 due?

A: Form 50-246 is generally due on April 30th of each year.

Q: Are there any penalties for not filing Form 50-246?

A: Yes, there are penalties for not filing Form 50-246, including interest charges and possible legal actions.

Q: Do I need to attach any documents with Form 50-246?

A: No, you do not need to attach any documents with Form 50-246, but you should keep supporting documentation for your records.

Q: Is Form 50-246 specific to Texas only?

A: Yes, Form 50-246 is specific to Texas, and it is used to report motor vehicle inventory held for sale within the state.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-246 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.