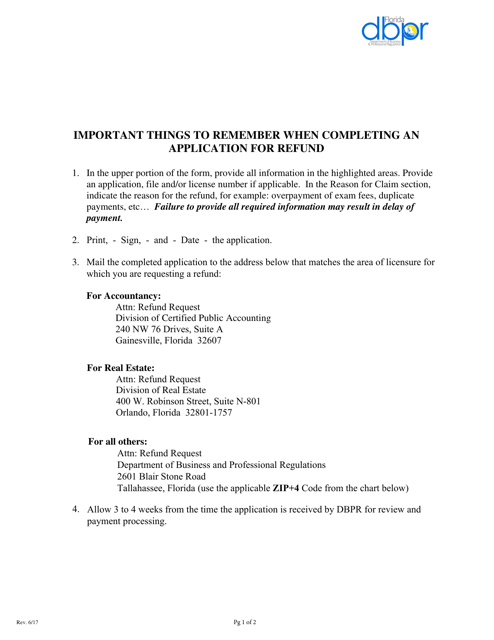

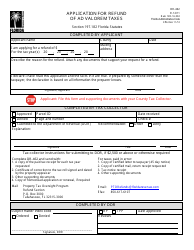

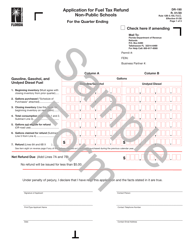

Form BPR AA-4 Application for Refund - Florida

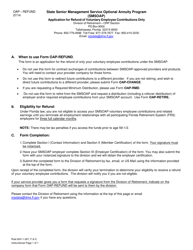

What Is Form BPR AA-4?

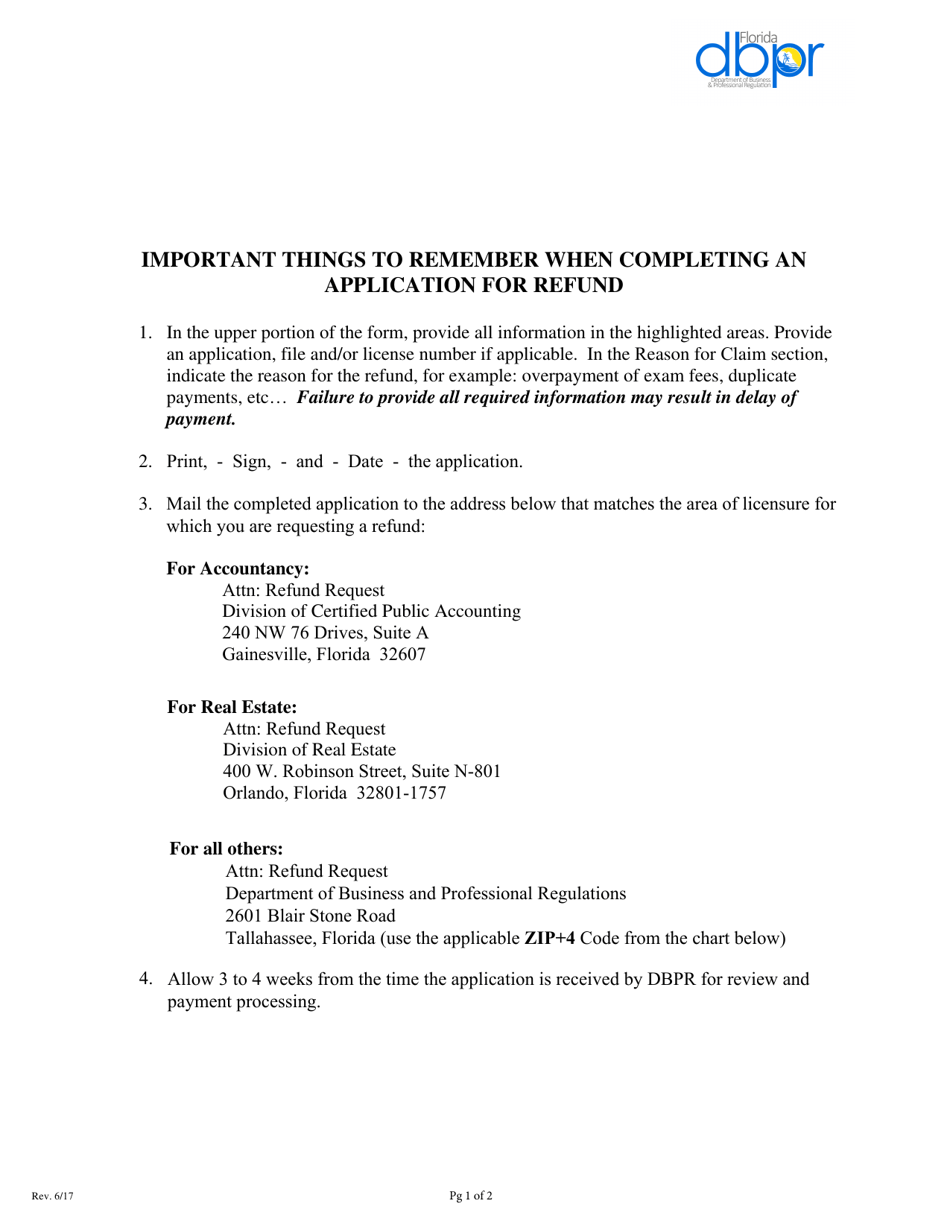

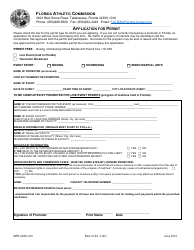

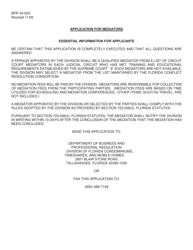

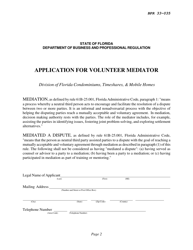

This is a legal form that was released by the Florida Department of Business & Professional Regulation - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BPR AA-4?

A: Form BPR AA-4 is an application for refund in the state of Florida.

Q: What is the purpose of Form BPR AA-4?

A: The purpose of Form BPR AA-4 is to apply for a refund in the state of Florida.

Q: Who can use Form BPR AA-4?

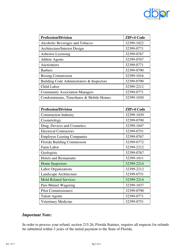

A: Form BPR AA-4 can be used by individuals or businesses who are eligible for a refund in the state of Florida.

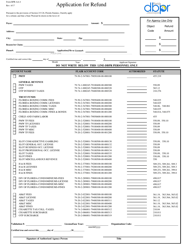

Q: What information do I need to provide on Form BPR AA-4?

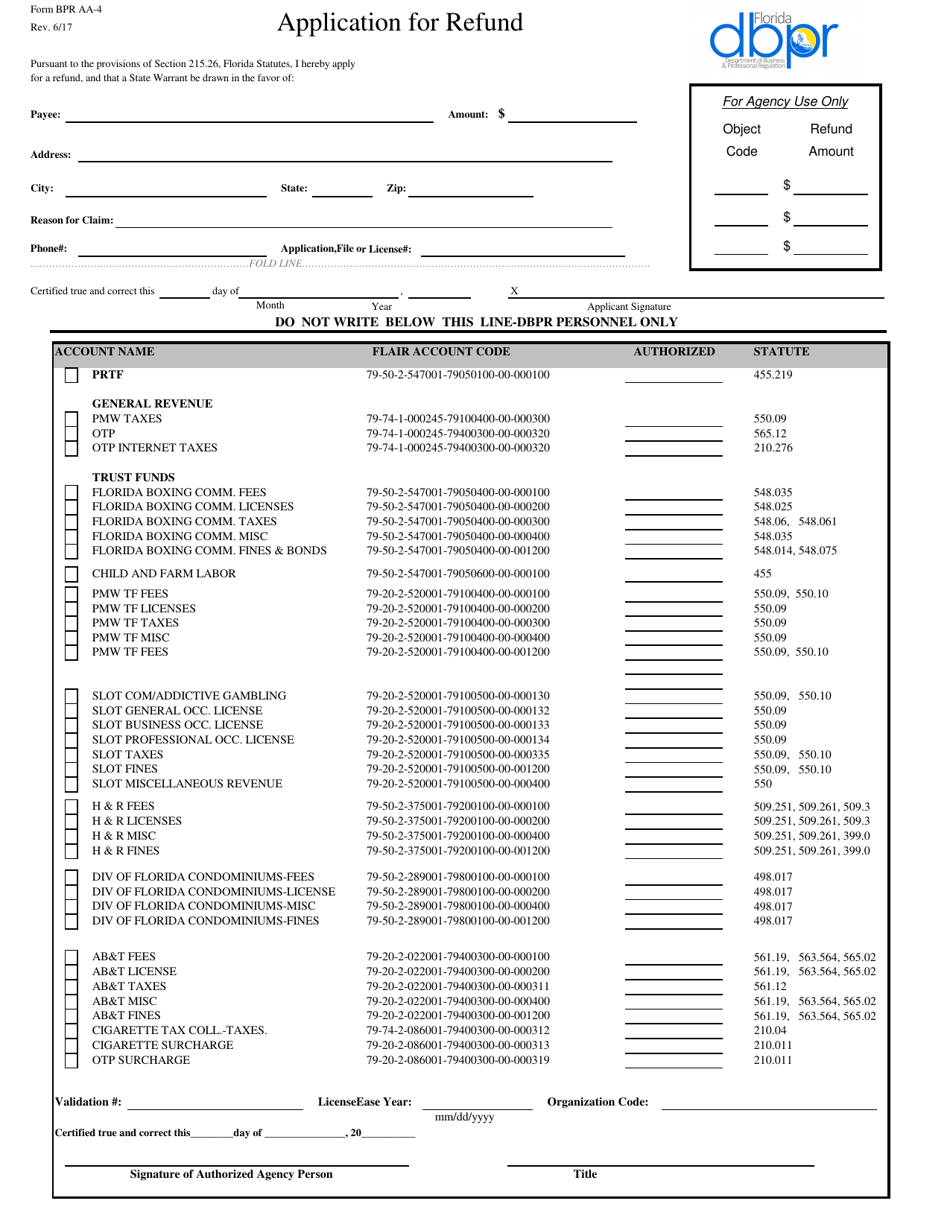

A: You will need to provide your personal or business information, details of the tax paid, and the reason for the refund.

Q: Is there a deadline to submit Form BPR AA-4?

A: Yes, Form BPR AA-4 must be submitted within four years from the date the tax was paid.

Q: How long does it take to process a refund with Form BPR AA-4?

A: The processing time for a refund with Form BPR AA-4 varies, but it typically takes about eight weeks.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Florida Department of Business & Professional Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BPR AA-4 by clicking the link below or browse more documents and templates provided by the Florida Department of Business & Professional Regulation.