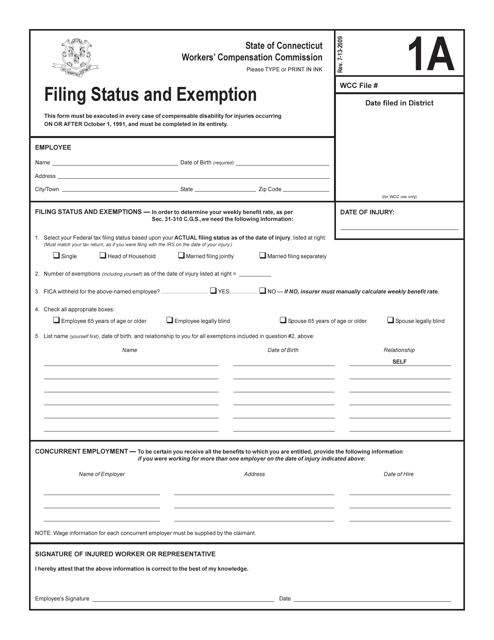

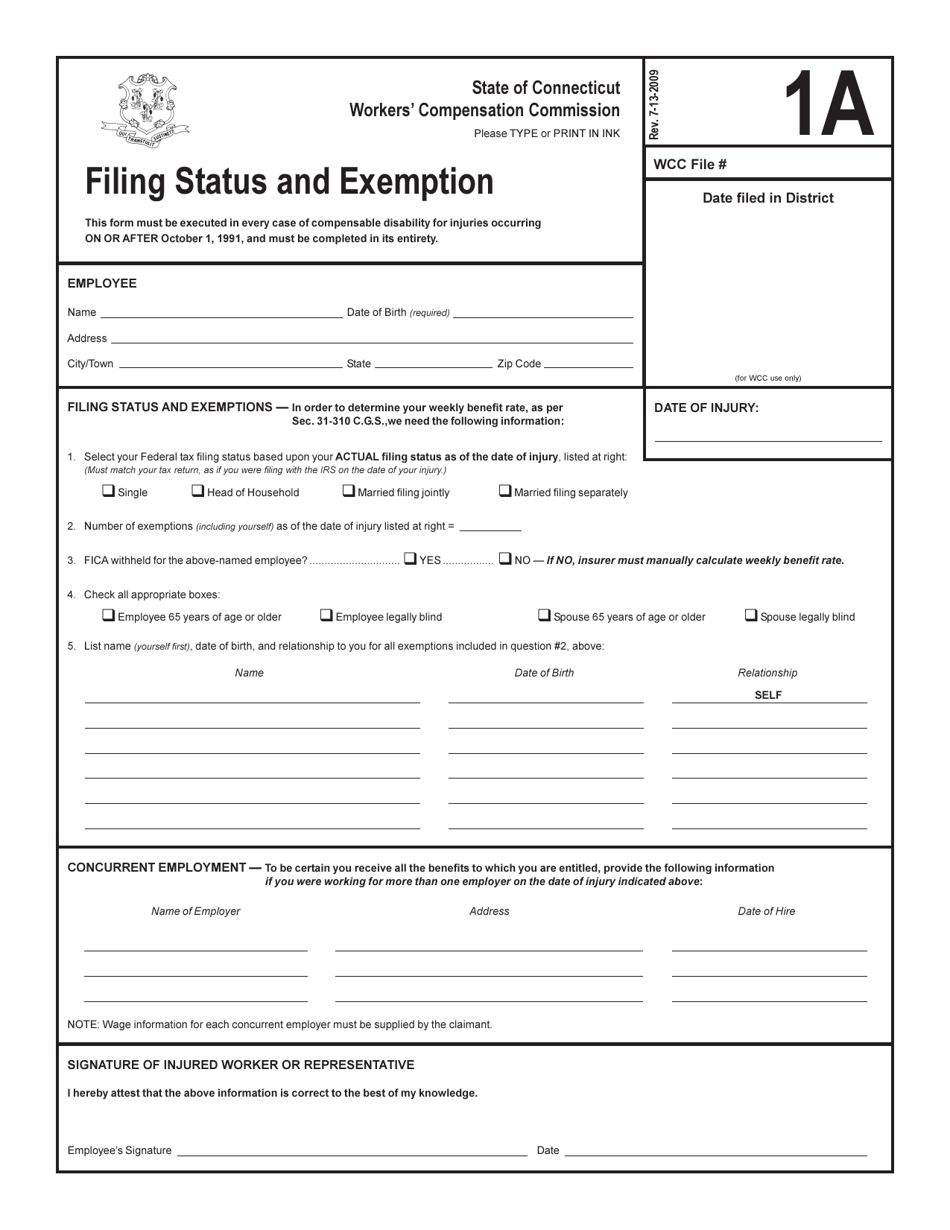

Form 1A Filing Status and Exemption - Connecticut

What Is Form 1A?

This is a legal form that was released by the Connecticut Workers' Compensation Commission - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 1A?

A: The Form 1A is a tax form used in Connecticut to declare your filing status and claim exemptions.

Q: What is a filing status?

A: Filing status refers to the tax category you fit into, such as single, married filing jointly, or head of household.

Q: What are exemptions?

A: Exemptions are allowances that reduce your taxable income, such as claiming dependents.

Q: How do I determine my filing status?

A: Your filing status is determined by your marital status on the last day of the tax year.

Q: How many exemptions can I claim?

A: You can claim one exemption for yourself and one exemption for each qualified dependent.

Q: What is the deadline for filing Form 1A?

A: The deadline for filing Form 1A in Connecticut is April 15th, or the same as the federal tax deadline.

Form Details:

- Released on July 13, 2009;

- The latest edition provided by the Connecticut Workers' Compensation Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1A by clicking the link below or browse more documents and templates provided by the Connecticut Workers' Compensation Commission.