This version of the form is not currently in use and is provided for reference only. Download this version of

Form MT-05A

for the current year.

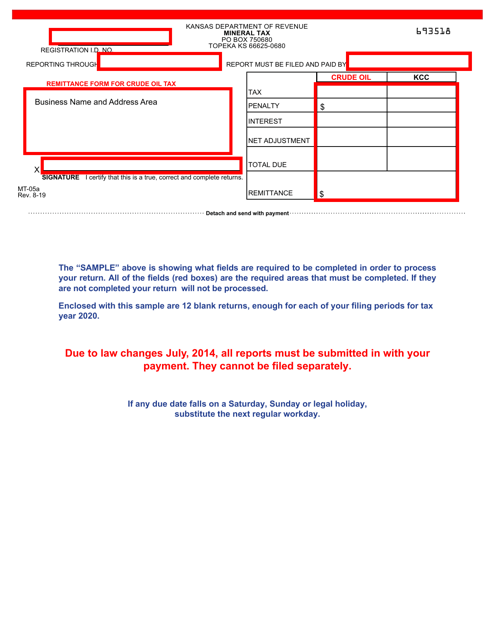

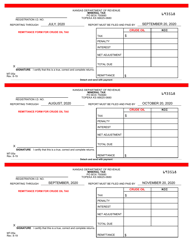

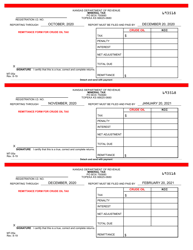

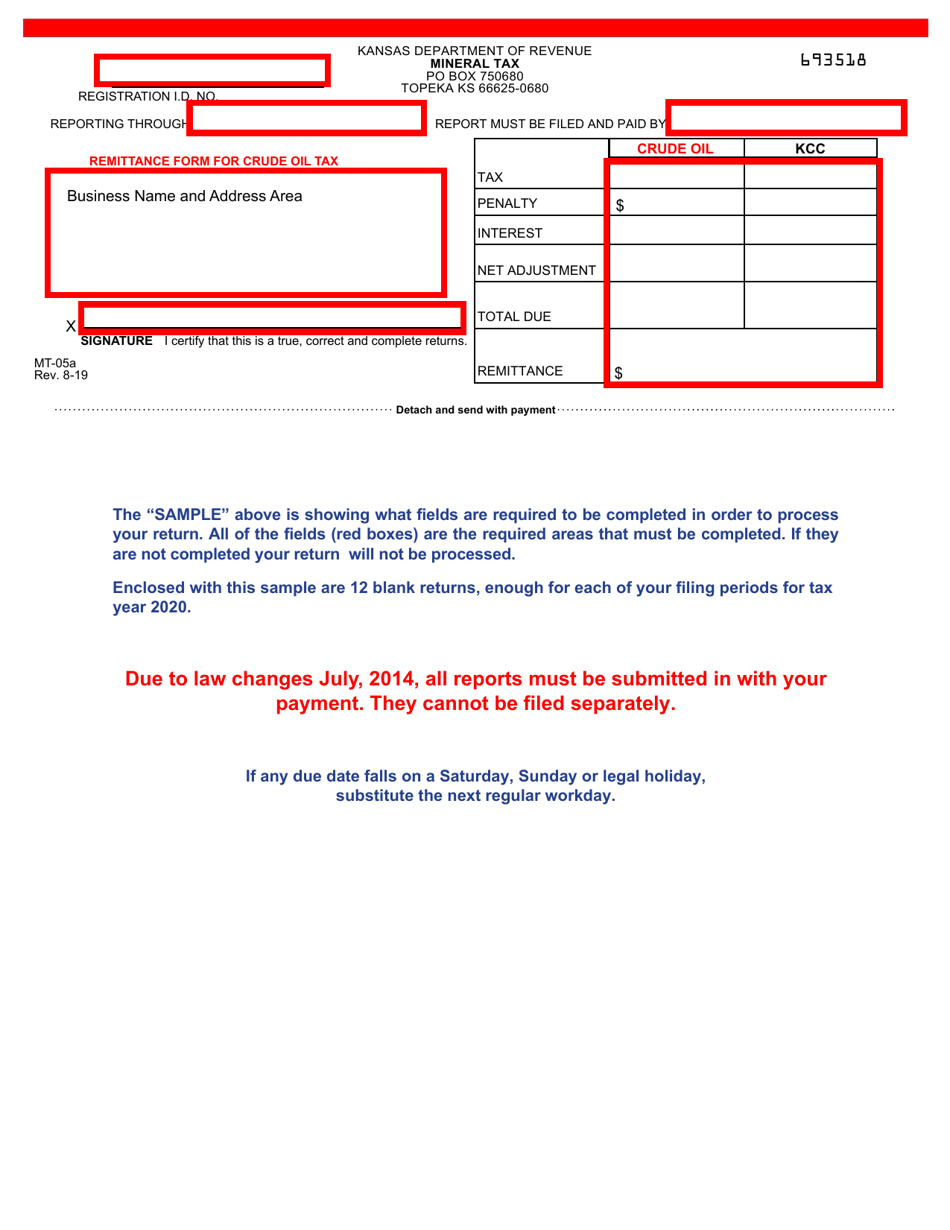

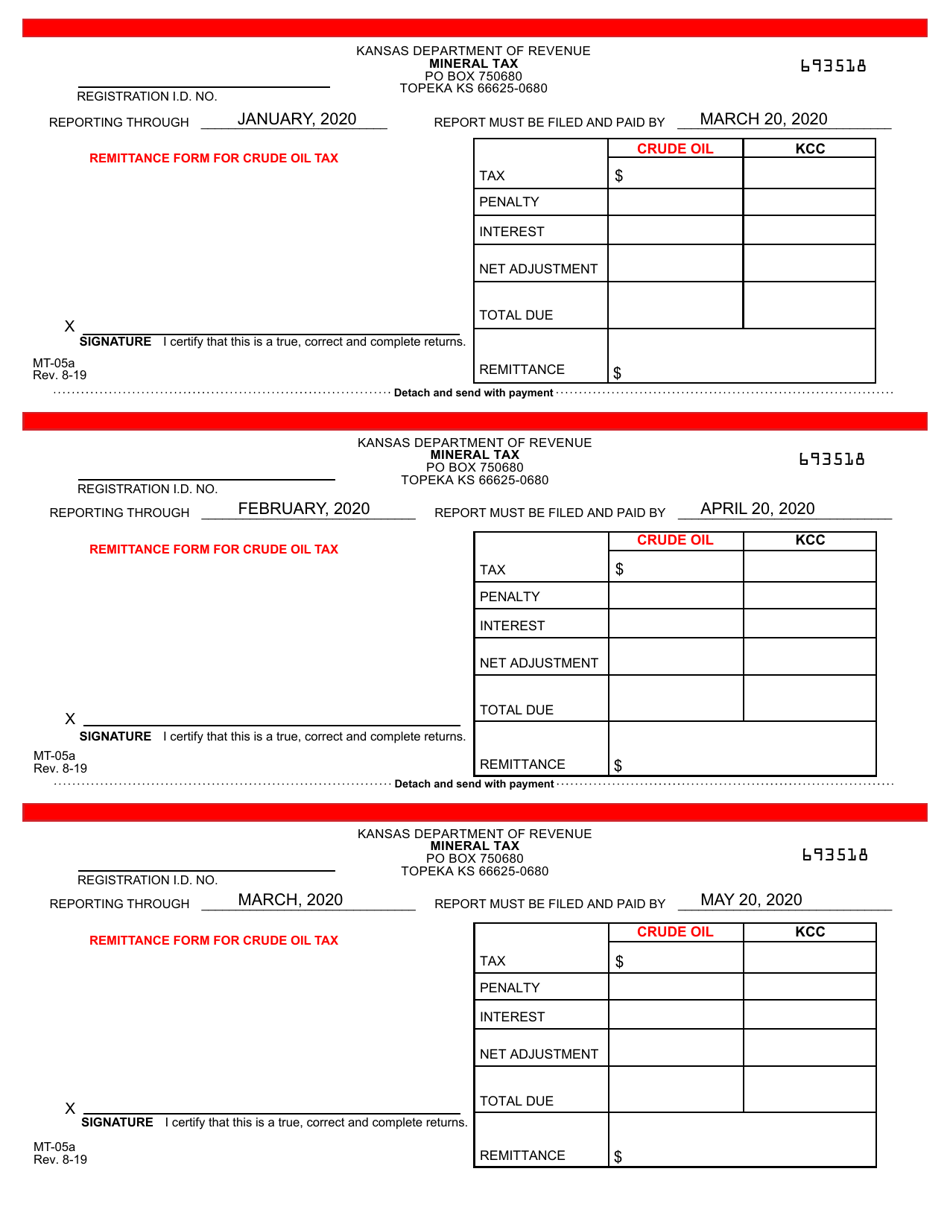

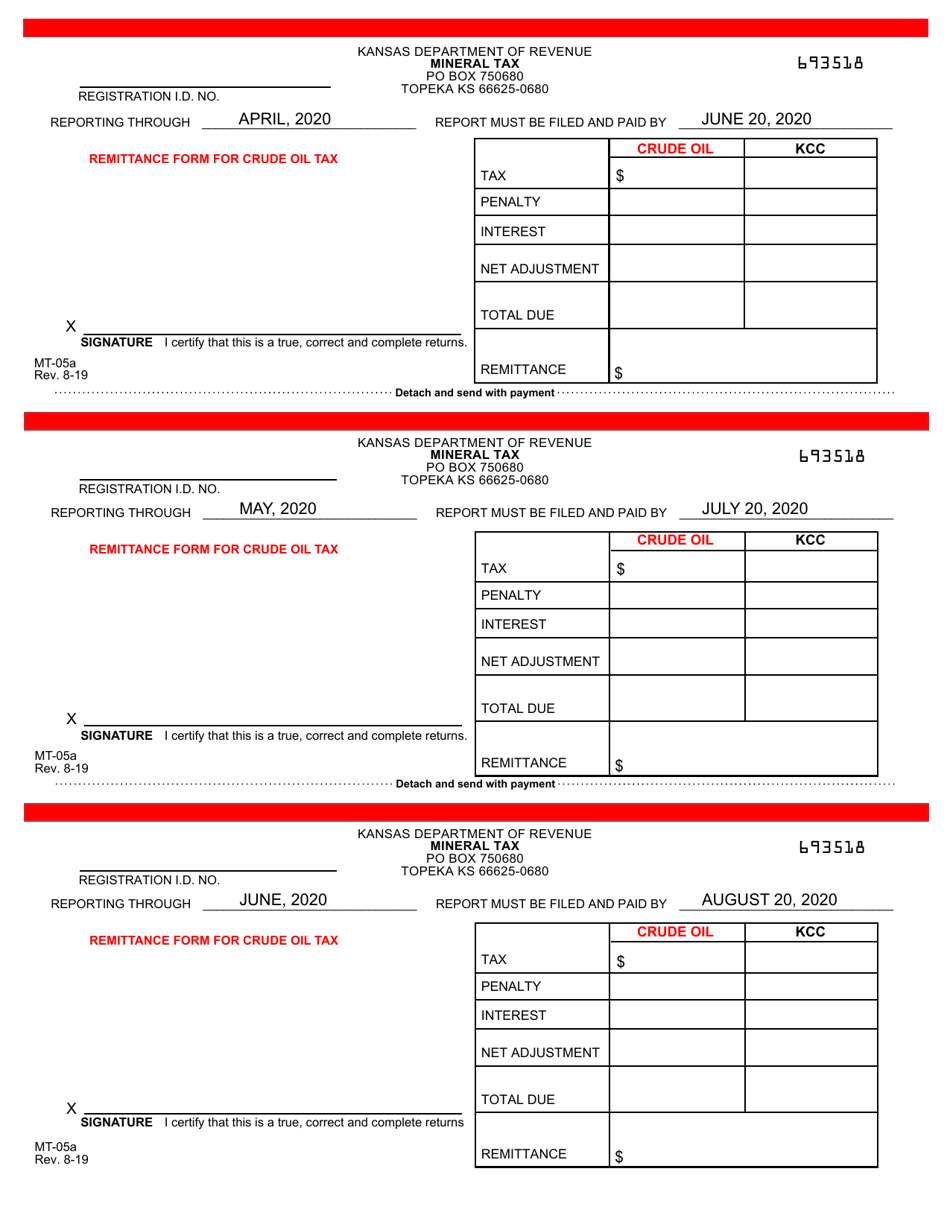

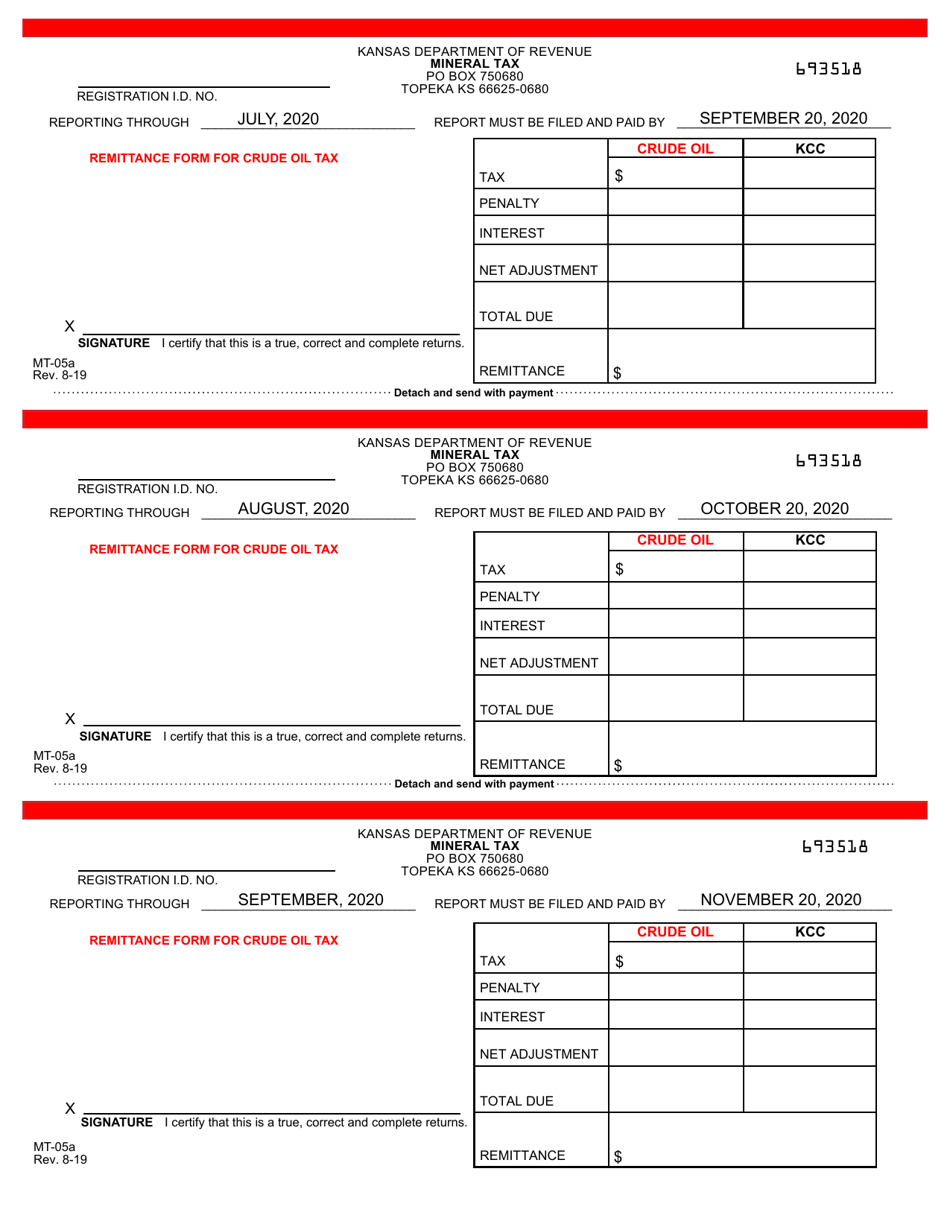

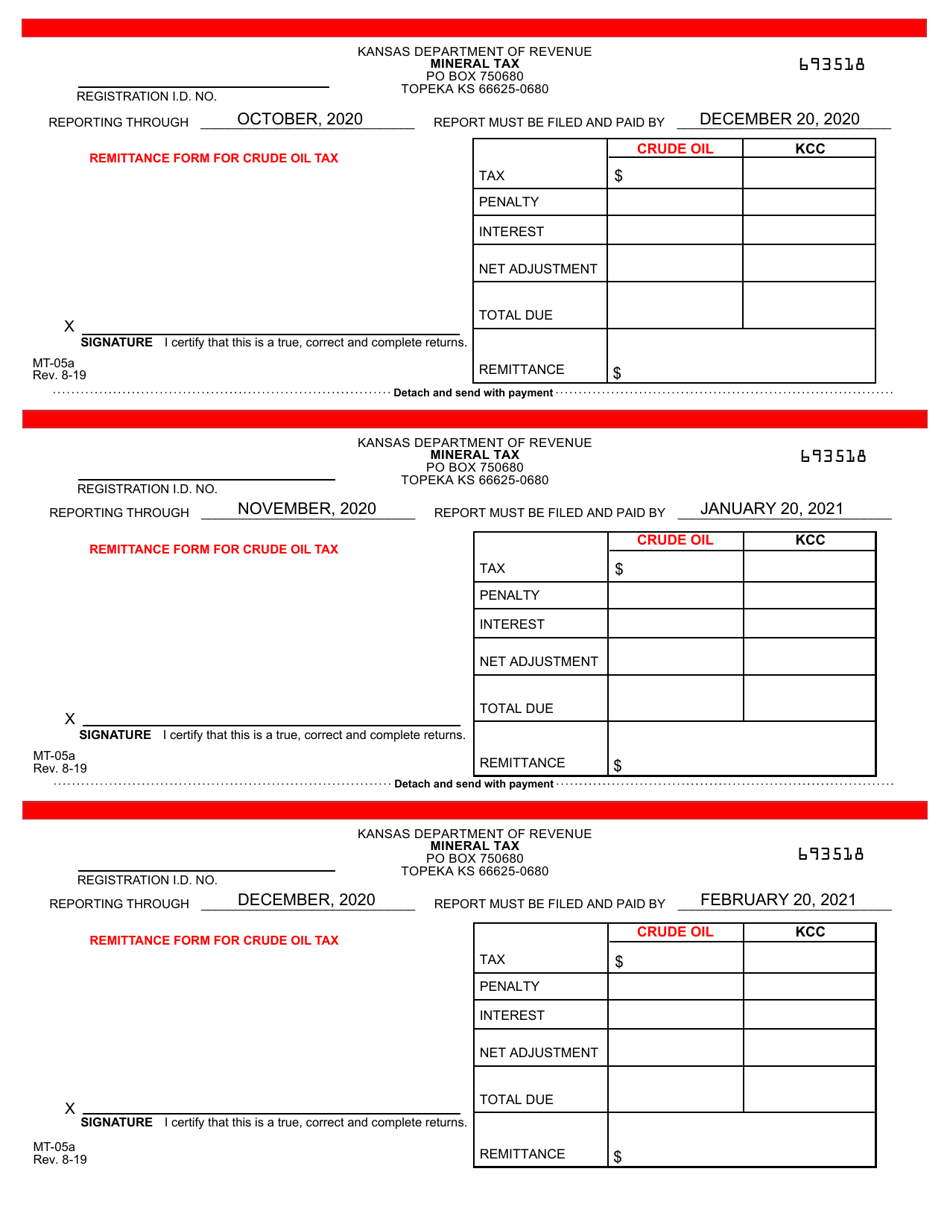

Form MT-05A Mineral Tax Return - Crude Oil - Kansas

What Is Form MT-05A?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-05A?

A: Form MT-05A is a mineral tax return specifically for reporting crude oil production in the state of Kansas.

Q: Who needs to file Form MT-05A?

A: Operators or producers of crude oil in Kansas need to file Form MT-05A.

Q: What information do I need to complete Form MT-05A?

A: You will need to provide information about the production and sales of crude oil, including the well number, quantity produced, and value of sales.

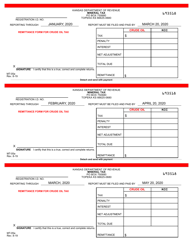

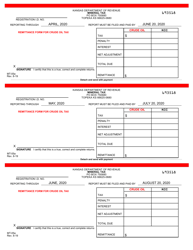

Q: When is Form MT-05A due?

A: Form MT-05A is due on or before the 25th day of the month following the end of the reporting period.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MT-05A by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.