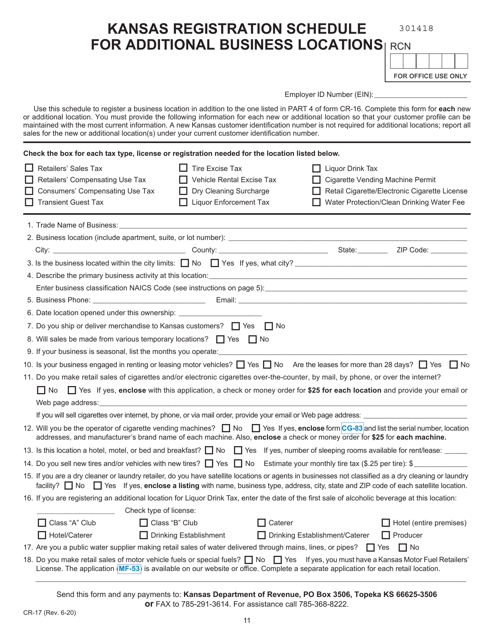

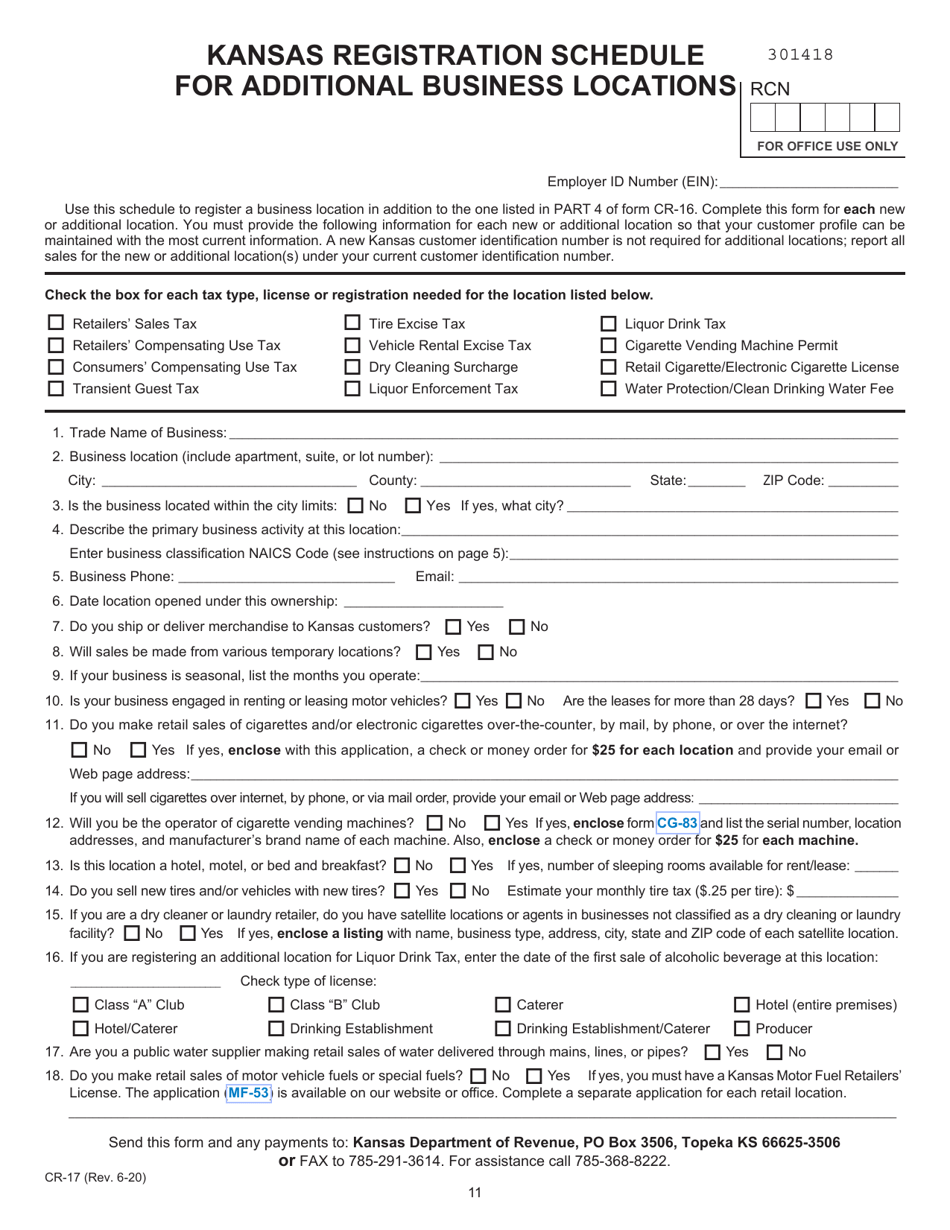

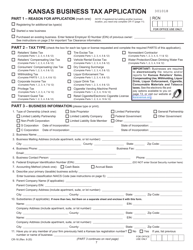

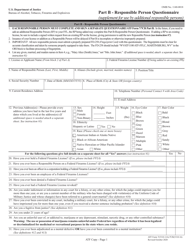

Form CR-17 Kansas Registration Schedule for Additional Business Locations - Kansas

What Is Form CR-17?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-17?

A: Form CR-17 is the Kansas Registration Schedule for Additional Business Locations.

Q: What is the purpose of Form CR-17?

A: The purpose of Form CR-17 is to register additional business locations in the state of Kansas.

Q: Who needs to file Form CR-17?

A: Any business that has additional locations in Kansas needs to file Form CR-17.

Q: Is there a fee to file Form CR-17?

A: Yes, there is a fee associated with filing Form CR-17. The fee amount may vary.

Q: What information is required on Form CR-17?

A: Form CR-17 requires information about the additional business locations, including the address and other details.

Q: When should Form CR-17 be filed?

A: Form CR-17 should be filed within 30 days of establishing an additional business location in Kansas.

Q: What happens if I don't file Form CR-17?

A: Failure to file Form CR-17 may result in penalties and other legal consequences.

Q: Can Form CR-17 be amended?

A: Yes, if there are any changes to the information provided on Form CR-17, an amended form should be filed.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-17 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.