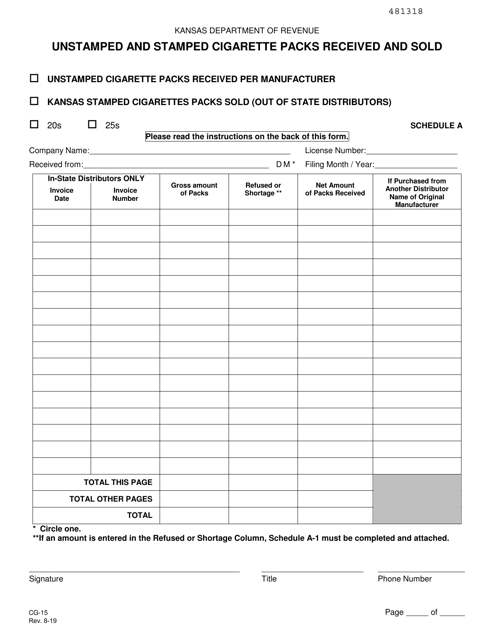

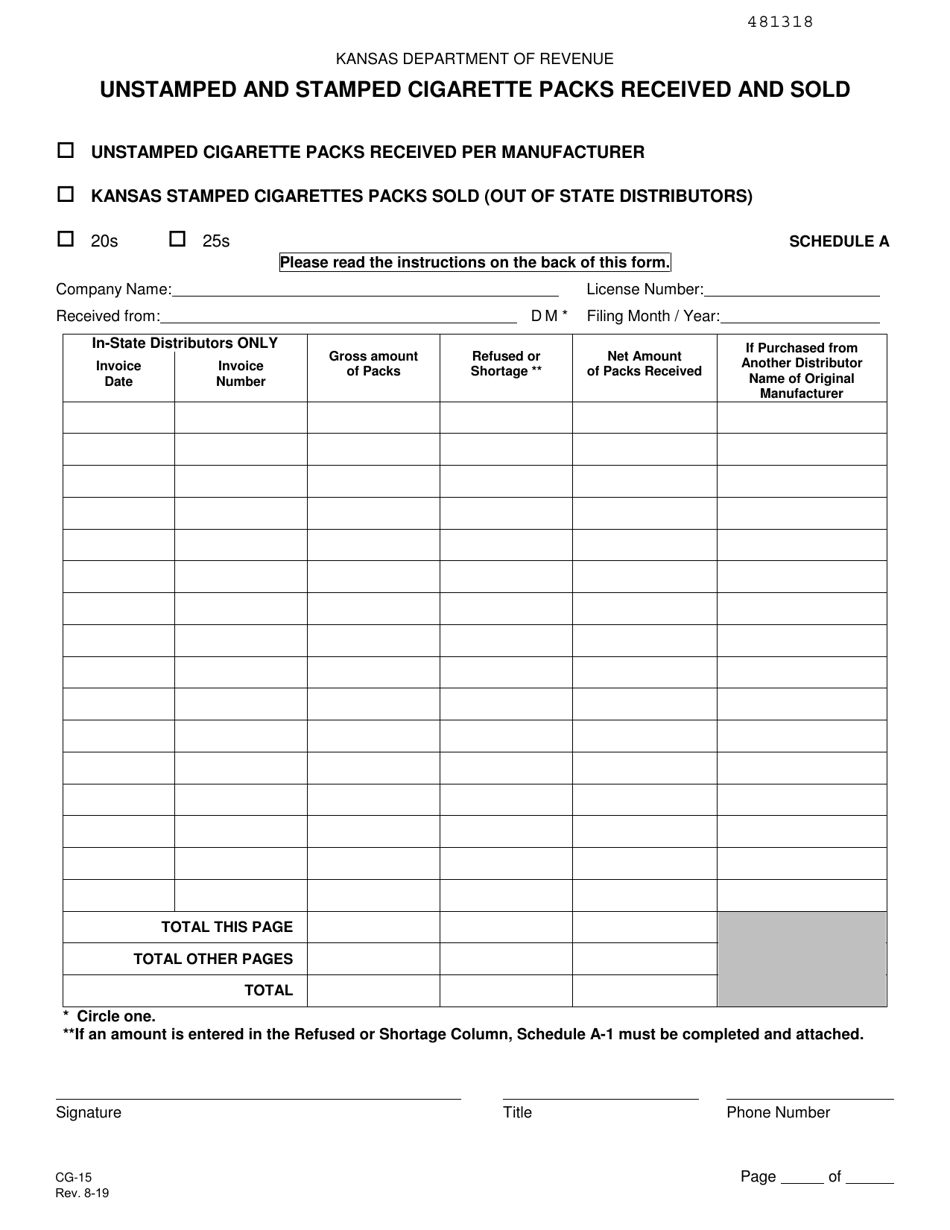

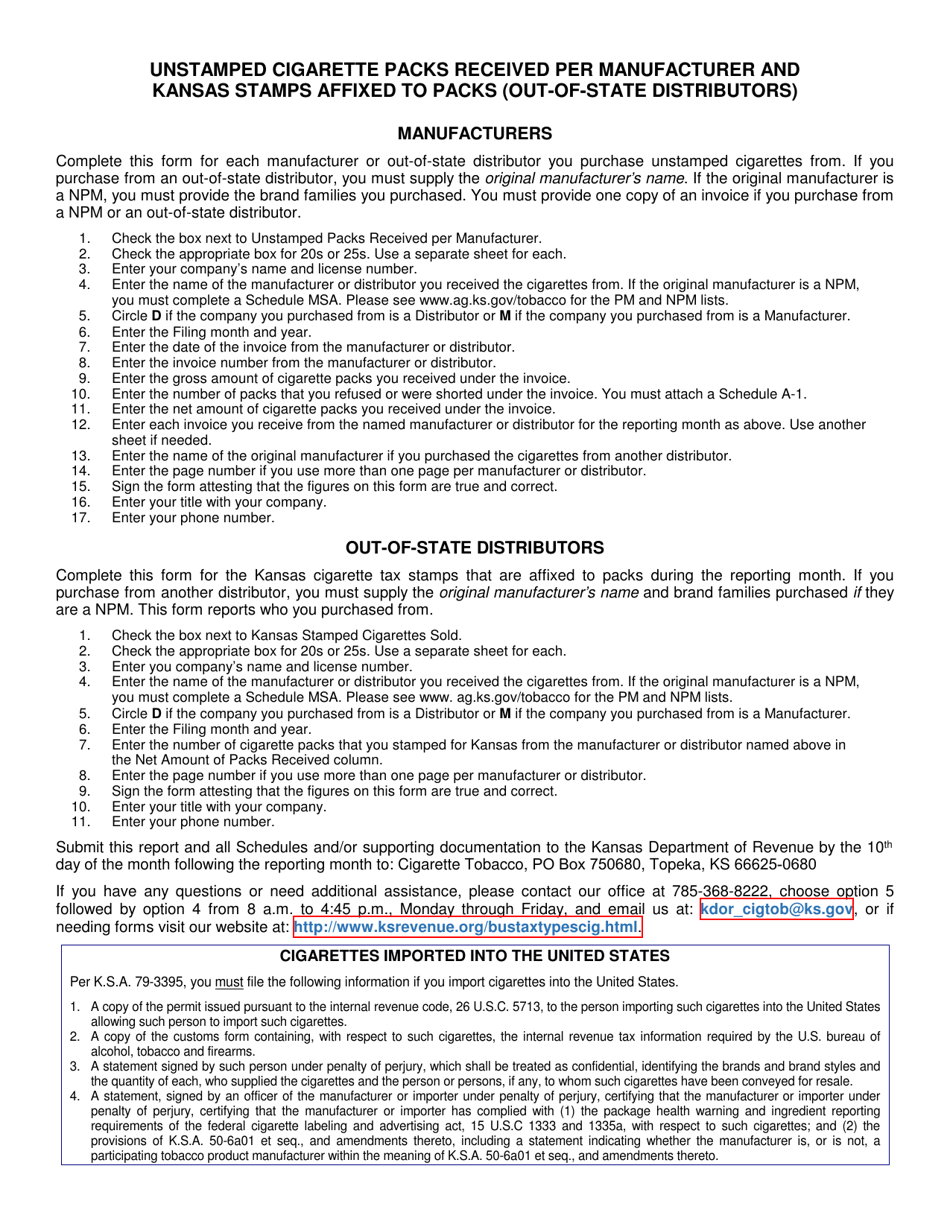

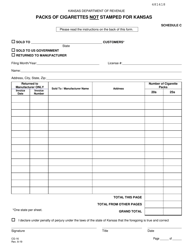

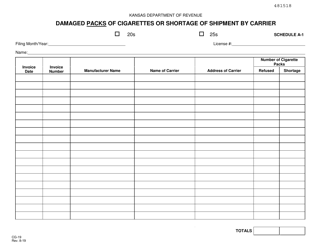

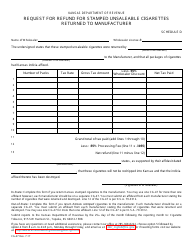

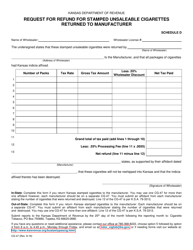

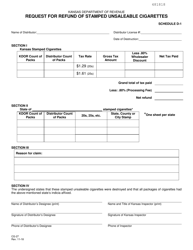

Form CG-15 Schedule A Unstamped and Stamped Cigarette Packs Received and Sold - Kansas

What Is Form CG-15 Schedule A?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CG-15 Schedule A?

A: Form CG-15 Schedule A is a form used to report the receipt and sale of unstamped and stamped cigarette packs.

Q: What does 'unstamped' and 'stamped' mean in this context?

A: 'Unstamped' refers to cigarette packs that do not have the required tax stamps affixed, while 'stamped' refers to cigarette packs that have the proper tax stamps.

Q: Who needs to fill out Form CG-15 Schedule A?

A: Any person or entity in Kansas who receives or sells unstamped or stamped cigarette packs needs to fill out this form.

Q: When is Form CG-15 Schedule A due?

A: Form CG-15 Schedule A is due on the 25th day of the month following the reporting period.

Q: What information is required on Form CG-15 Schedule A?

A: Some of the required information includes the name and address of the recipient or seller, the quantity of unstamped and stamped packs received or sold, and the amount of tax paid.

Q: Are there any penalties for not filing Form CG-15 Schedule A?

A: Yes, failure to file this form or filing it late may result in penalties and interest.

Q: Is there a fee to file Form CG-15 Schedule A?

A: No, there is no fee to file this form.

Q: Can I request an extension to file Form CG-15 Schedule A?

A: Yes, you can request an extension by contacting the Kansas Department of Revenue.

Q: What should I do with Form CG-15 Schedule A once it is completed?

A: Once completed, you should keep a copy of the form for your records and submit the original to the Kansas Department of Revenue.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CG-15 Schedule A by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.