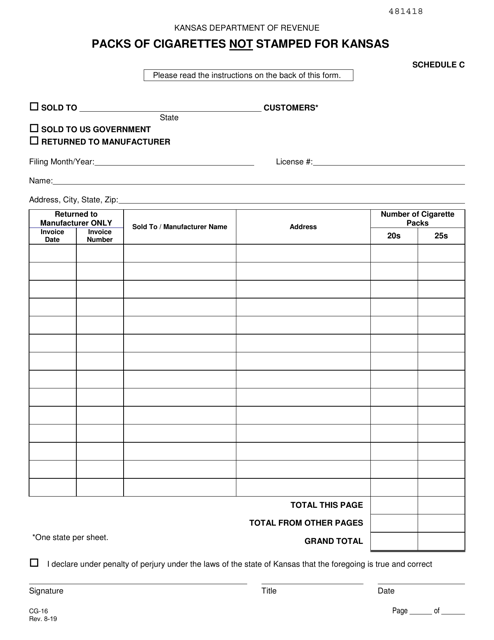

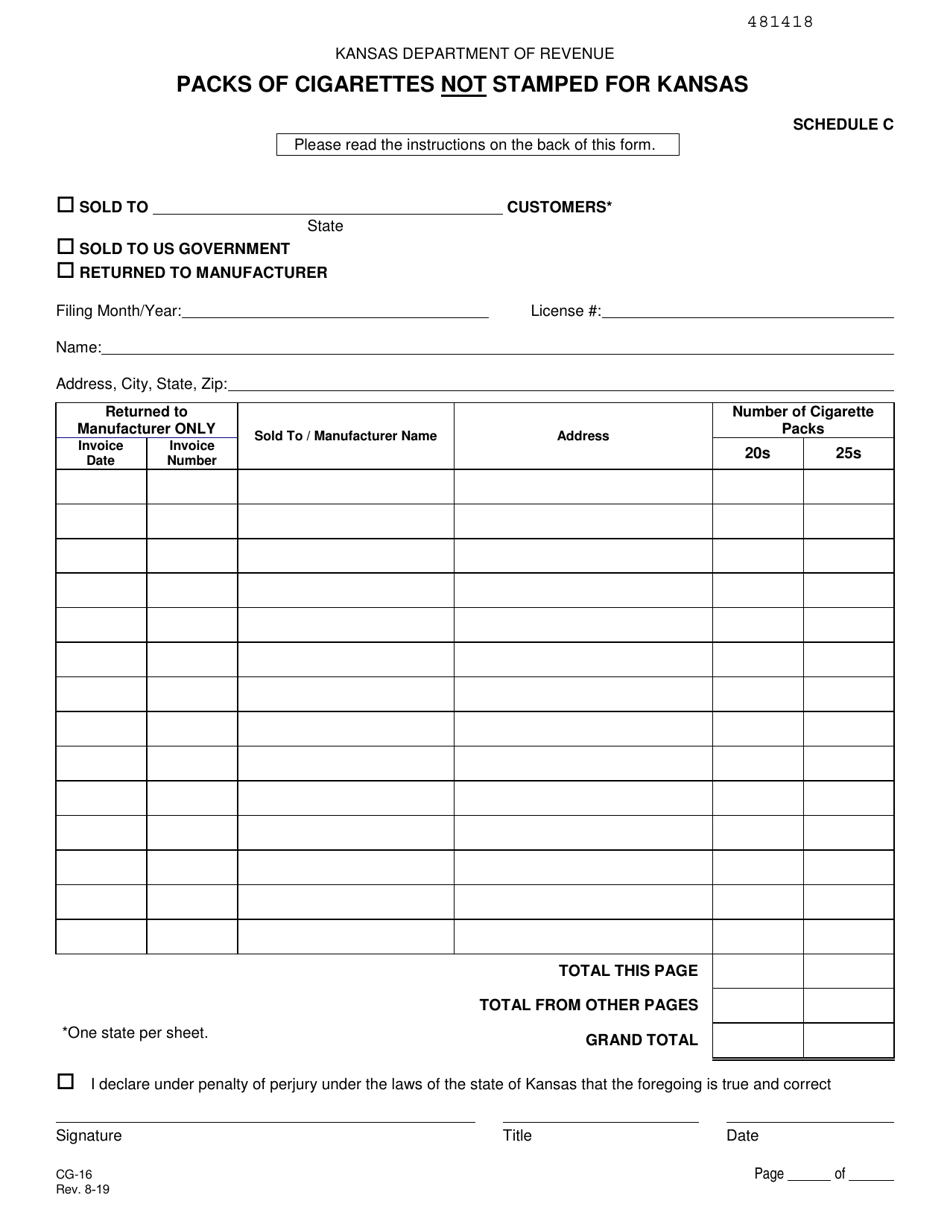

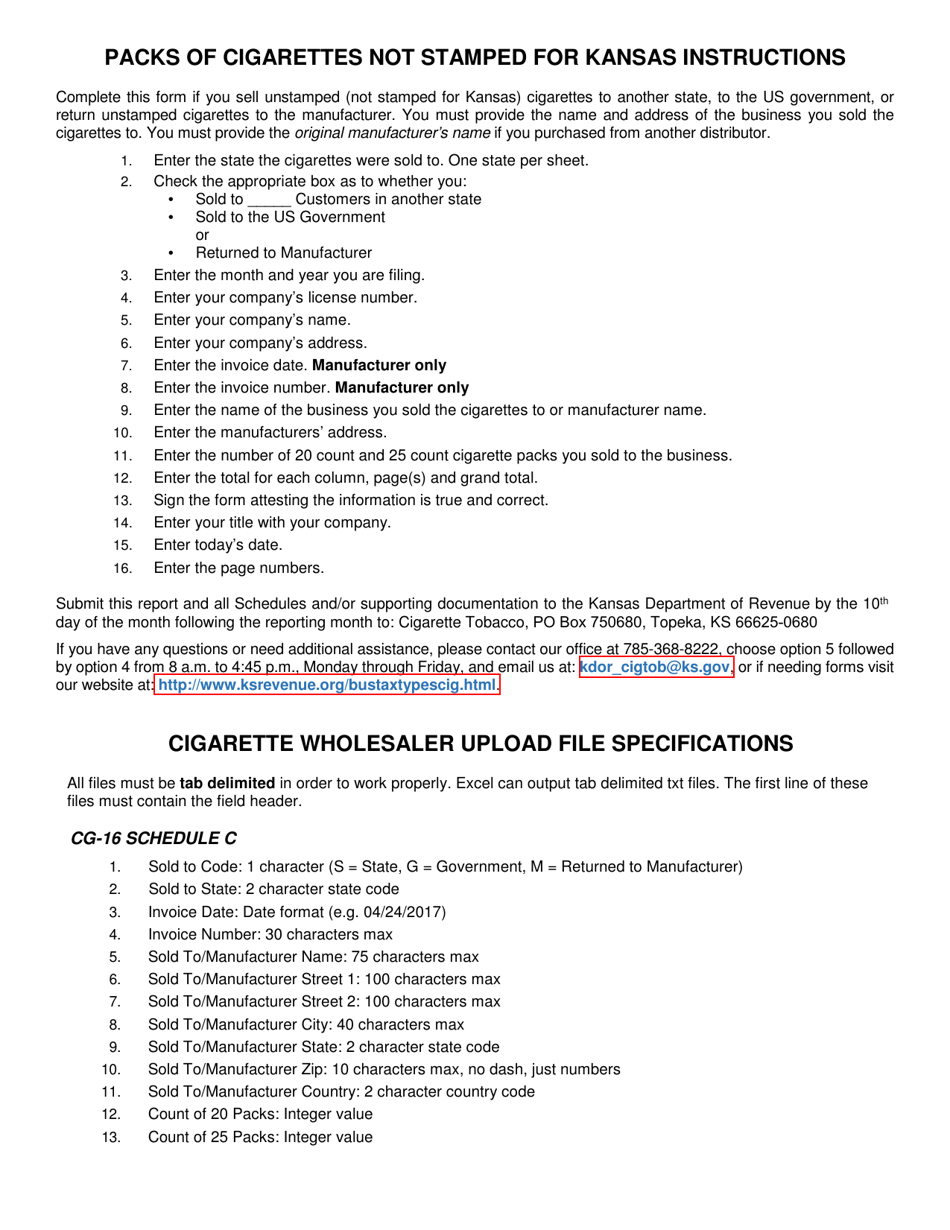

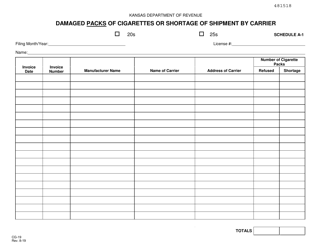

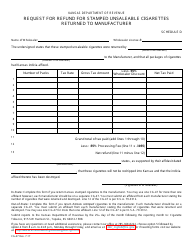

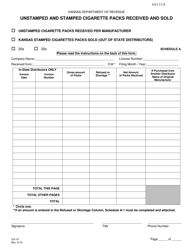

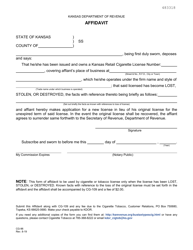

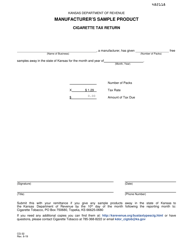

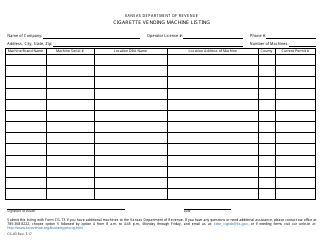

Form CG-16 Schedule C Packs of Cigarettes Not Stamped for Kansas - Kansas

What Is Form CG-16 Schedule C?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

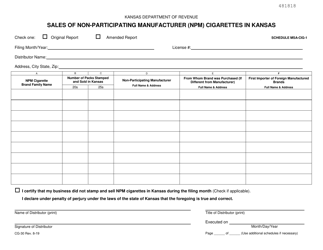

Q: What is Form CG-16 Schedule C?

A: Form CG-16 Schedule C is a form used for reporting packs of cigarettes not stamped for Kansas.

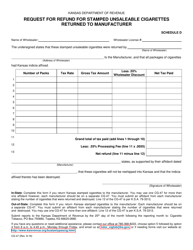

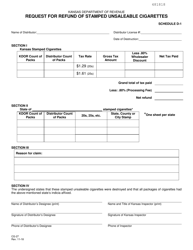

Q: What does 'not stamped for Kansas' mean?

A: 'Not stamped for Kansas' refers to packs of cigarettes that do not have the required Kansas cigarette tax stamp.

Q: Why do cigarettes need to be stamped for Kansas?

A: Cigarettes need to be stamped for Kansas in order to comply with the state's cigarette tax laws and regulations.

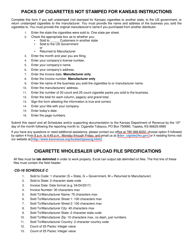

Q: What information is required on Form CG-16 Schedule C?

A: Form CG-16 Schedule C requires information such as the brand and quantity of cigarettes not stamped for Kansas.

Q: How do I report packs of cigarettes not stamped for Kansas?

A: You can report packs of cigarettes not stamped for Kansas by completing and submitting Form CG-16 Schedule C.

Q: Are there penalties for possessing or selling cigarettes not stamped for Kansas?

A: Yes, there can be penalties for possessing or selling cigarettes not stamped for Kansas, as it is a violation of the state's cigarette tax laws.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CG-16 Schedule C by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.