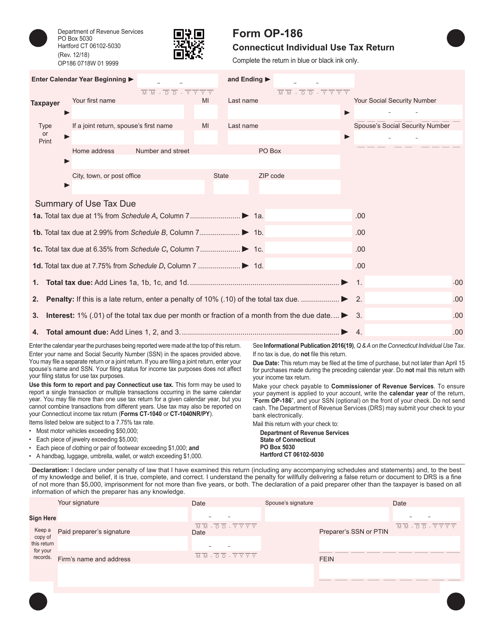

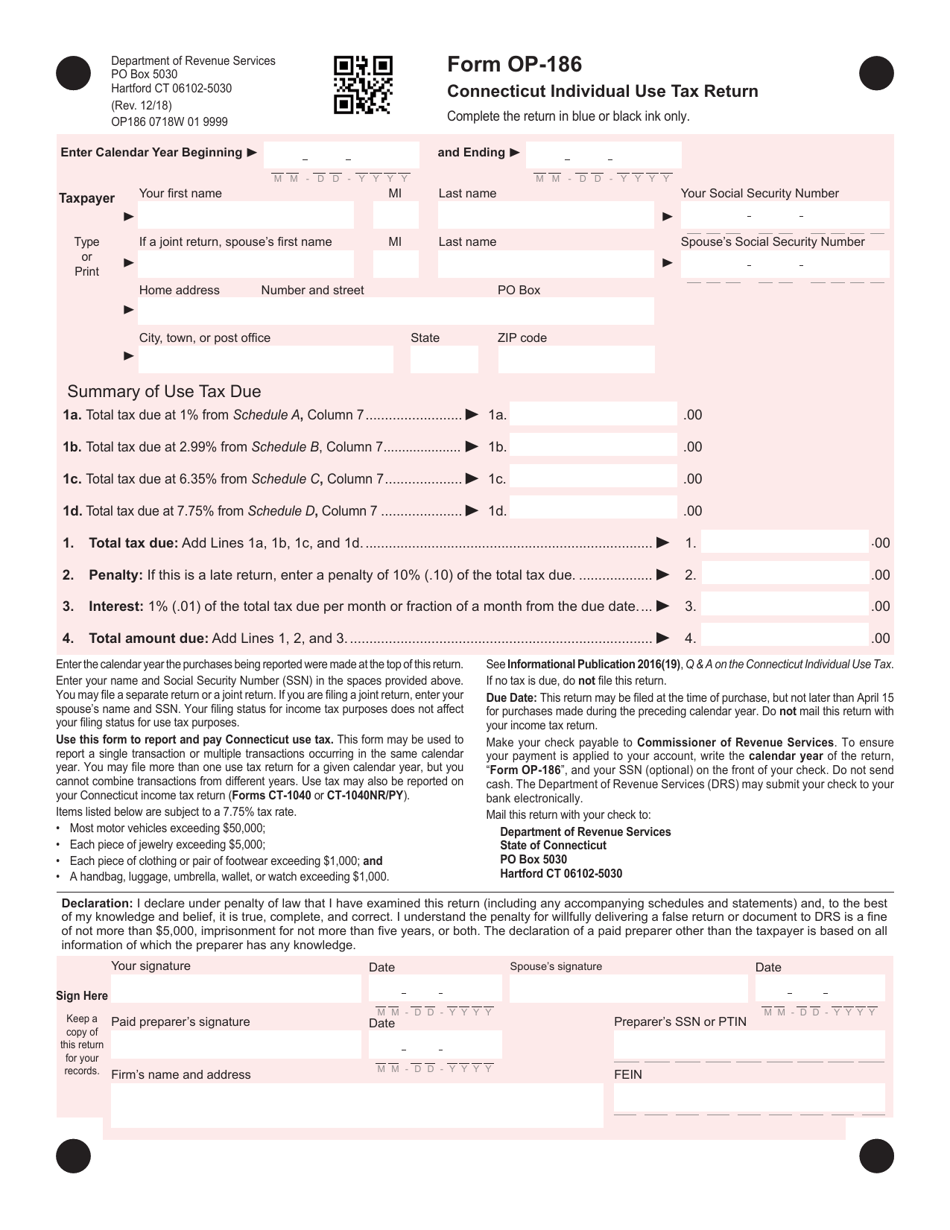

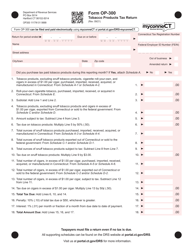

Form OP-186 Connecticut Individual Use Tax Return - Connecticut

What Is Form OP-186?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OP-186 form?

A: The OP-186 form is the Connecticut Individual Use Tax Return.

Q: Who needs to file the OP-186 form?

A: Individuals in Connecticut who need to report and pay use tax on items purchased or used without paying sales tax.

Q: What is use tax?

A: Use tax is a tax on items purchased for use, storage, or consumption in the state of Connecticut when sales tax was not paid.

Q: When is the OP-186 form due?

A: The due date for the OP-186 form is the same as the due date for the Connecticut income tax return, typically April 15th.

Q: What should I include with the OP-186 form?

A: You should include any supporting documentation, such as receipts or invoices, to substantiate your use tax liability.

Q: Can I file the OP-186 form electronically?

A: Yes, you can file the OP-186 form electronically using the Connecticut Taxpayer Service Center.

Q: What happens if I don't file the OP-186 form?

A: If you are required to file the OP-186 form and fail to do so, you may be subject to penalties and interest on any unpaid use tax.

Q: Can I claim a refund of use tax on the OP-186 form?

A: No, the OP-186 form is only used to report and pay use tax. If you believe you have overpaid use tax, you may need to file an amended return or seek a credit or refund through the Connecticut Department of Revenue Services.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OP-186 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.