This version of the form is not currently in use and is provided for reference only. Download this version of

Form IVT-1 (State Form 56305)

for the current year.

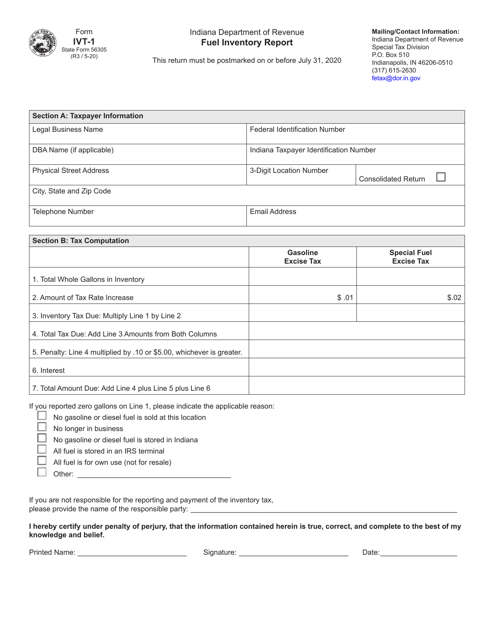

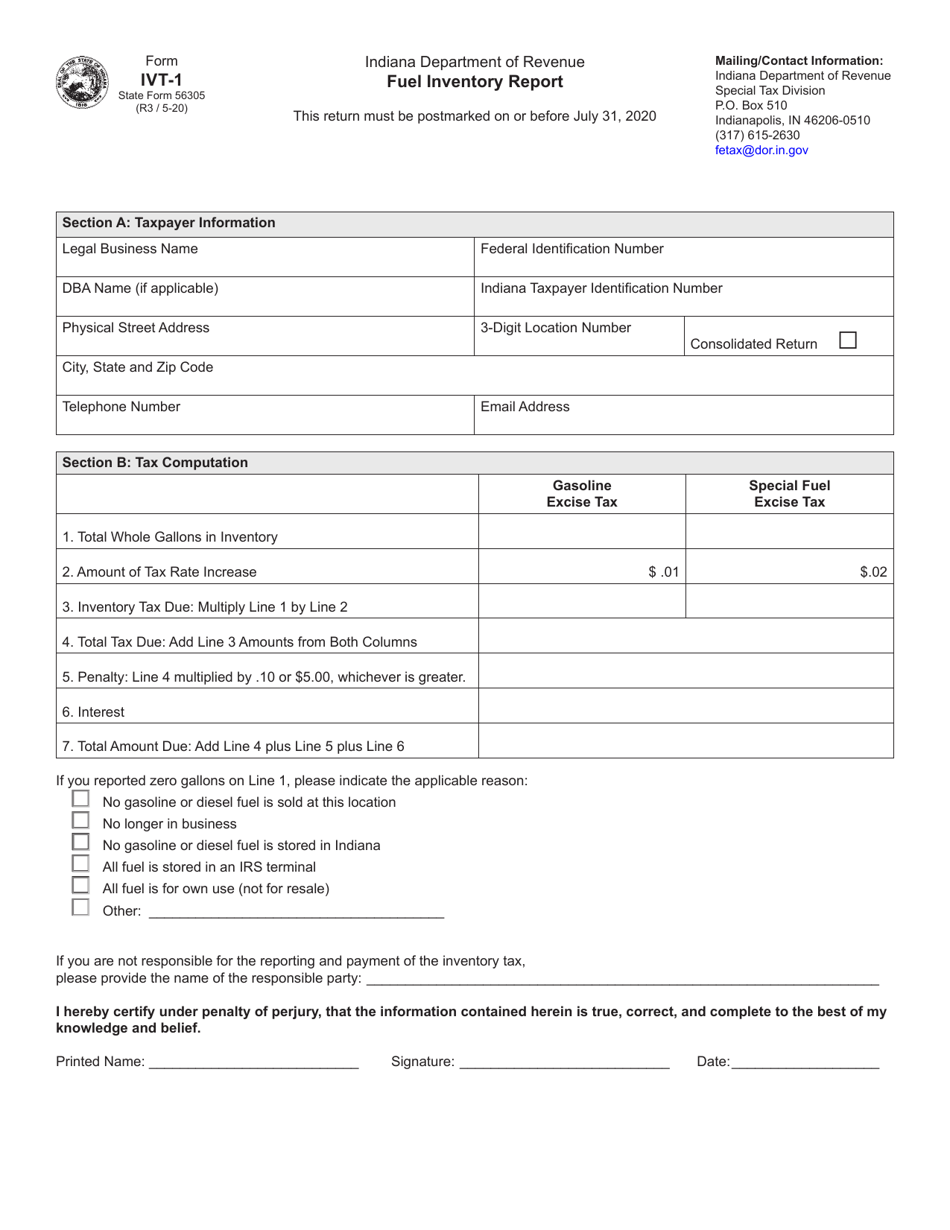

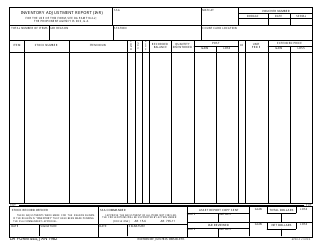

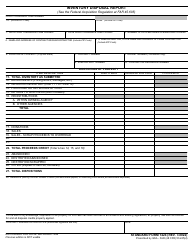

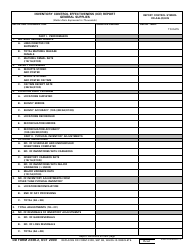

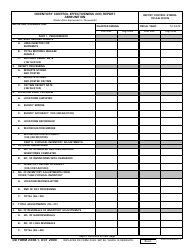

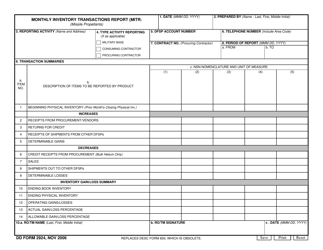

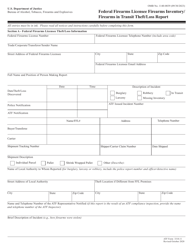

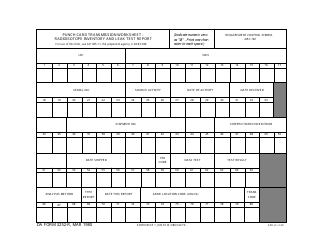

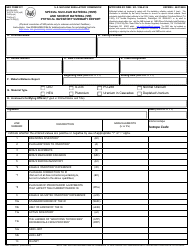

Form IVT-1 (State Form 56305) Fuel Inventory Report - Indiana

What Is Form IVT-1 (State Form 56305)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

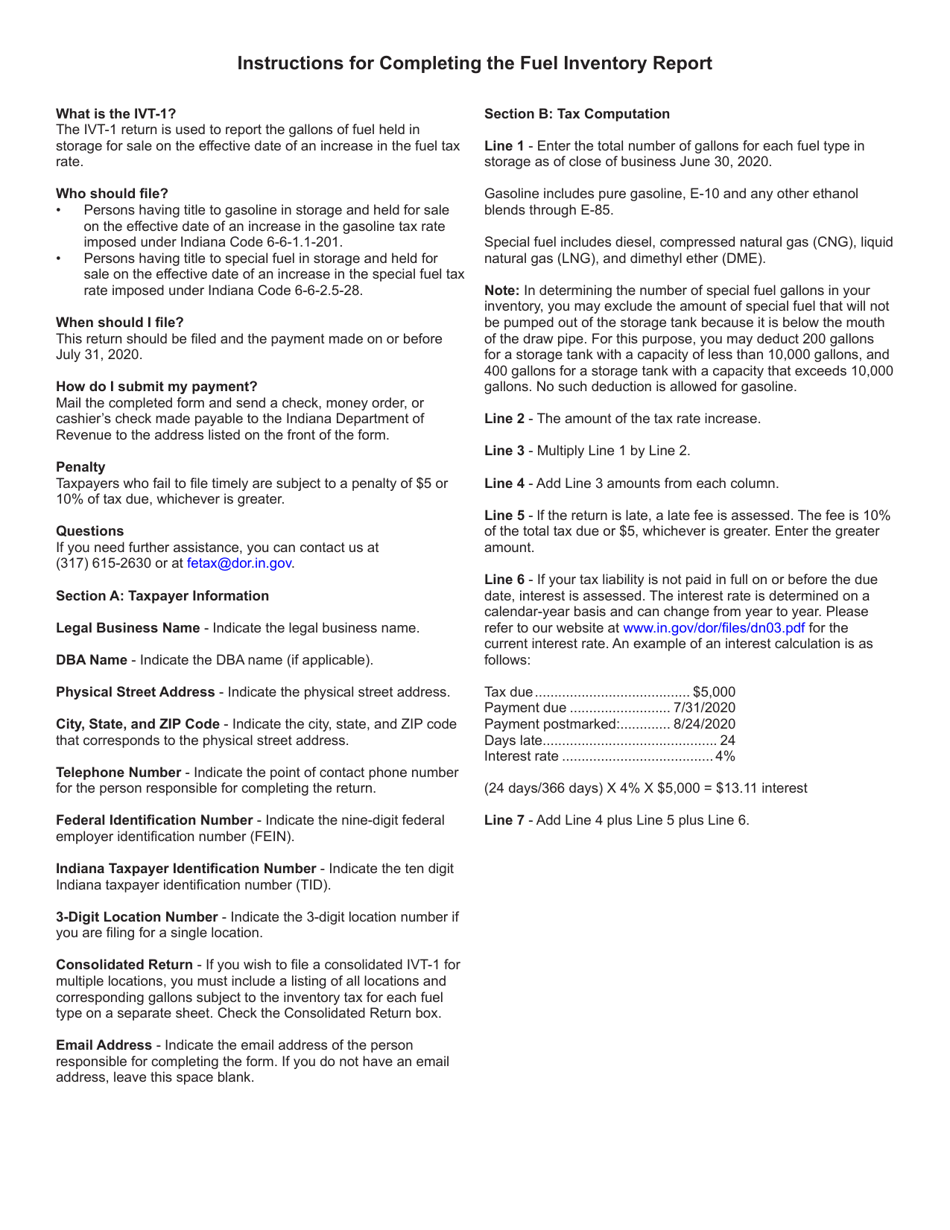

Q: What is Form IVT-1?

A: Form IVT-1 is the Fuel Inventory Report used in Indiana.

Q: What is the purpose of Form IVT-1?

A: The purpose of Form IVT-1 is to report fuel inventory in Indiana.

Q: Who needs to file Form IVT-1?

A: Any person or entity that is required to report fuel inventory in Indiana needs to file Form IVT-1.

Q: When is the deadline to file Form IVT-1?

A: The deadline to file Form IVT-1 is typically on or before the 20th day of each month following the reporting period.

Q: Are there any penalties for late filing of Form IVT-1?

A: Yes, there are penalties for late filing of Form IVT-1, including potential fines and interest charges.

Q: What information is required on Form IVT-1?

A: Form IVT-1 requires you to provide information such as the beginning and ending inventory amounts, fuel types, and total gallons.

Q: Do I need to keep a copy of Form IVT-1 for my records?

A: Yes, it is recommended to keep a copy of Form IVT-1 for your records in case of any future audits or inquiries.

Q: Who should I contact if I have questions about Form IVT-1?

A: You can contact the Indiana Department of Revenue for any questions or concerns regarding Form IVT-1.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IVT-1 (State Form 56305) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.