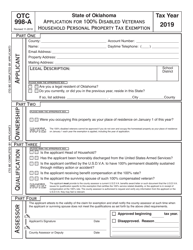

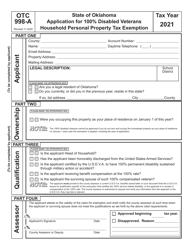

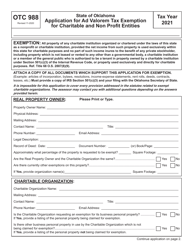

This version of the form is not currently in use and is provided for reference only. Download this version of

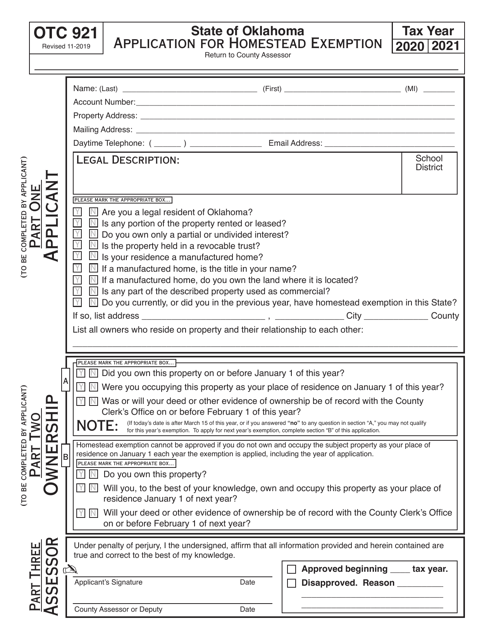

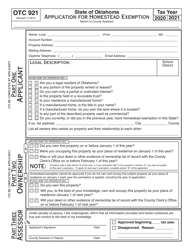

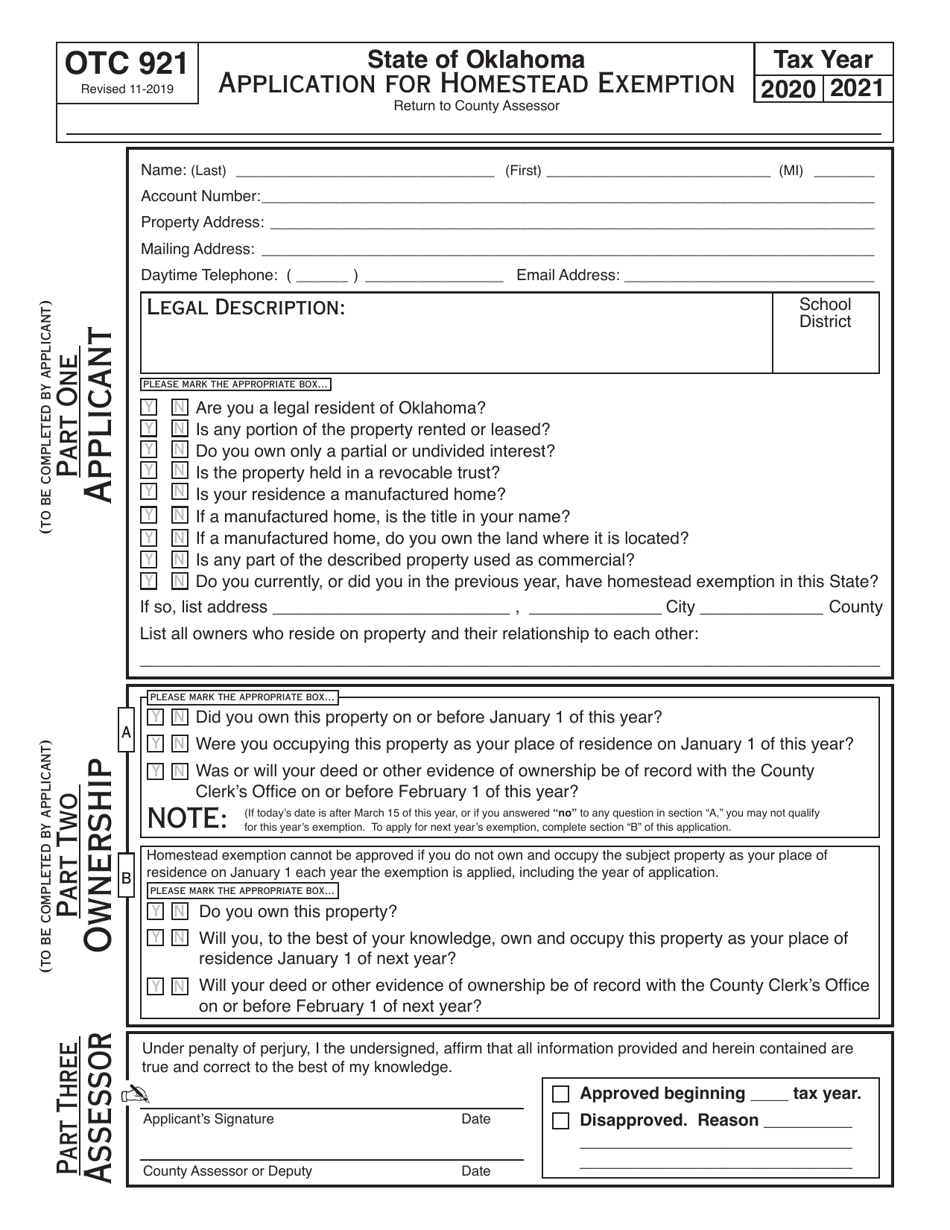

OTC Form 921

for the current year.

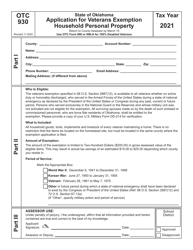

OTC Form 921 Application for Homestead Exemption - Oklahoma

What Is OTC Form 921?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

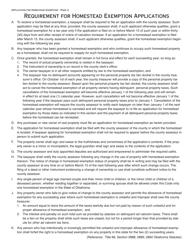

Q: What is OTC Form 921?

A: OTC Form 921 is the Application for Homestead Exemption in Oklahoma.

Q: What is a homestead exemption?

A: A homestead exemption is a tax benefit granted to homeowners that reduces the taxable value of their property.

Q: Who is eligible to file OTC Form 921?

A: Homeowners in Oklahoma who occupy their property as their primary residence may be eligible to file OTC Form 921.

Q: What are the benefits of filing OTC Form 921?

A: By filing OTC Form 921, homeowners can reduce their property taxes by exempting a portion of their home's value from taxation.

Q: When is the deadline to file OTC Form 921?

A: The deadline to file OTC Form 921 is March 15th of each year.

Q: Do I need to reapply for homestead exemption every year?

A: No, once you have been approved for homestead exemption, you do not need to reapply every year unless there is a change in ownership or occupancy.

Q: Are there any income requirements for homestead exemption in Oklahoma?

A: No, there are no income requirements for homestead exemption in Oklahoma.

Q: What documents do I need to include with OTC Form 921?

A: You will typically need to include a copy of your driver's license or identification card, proof of your Oklahoma residency, and proof of ownership of the property.

Q: Who should I contact for more information about OTC Form 921?

A: For more information about OTC Form 921 and homestead exemption in Oklahoma, you can contact your local county assessor's office or the Oklahoma Tax Commission.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 921 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.