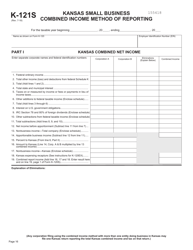

This version of the form is not currently in use and is provided for reference only. Download this version of

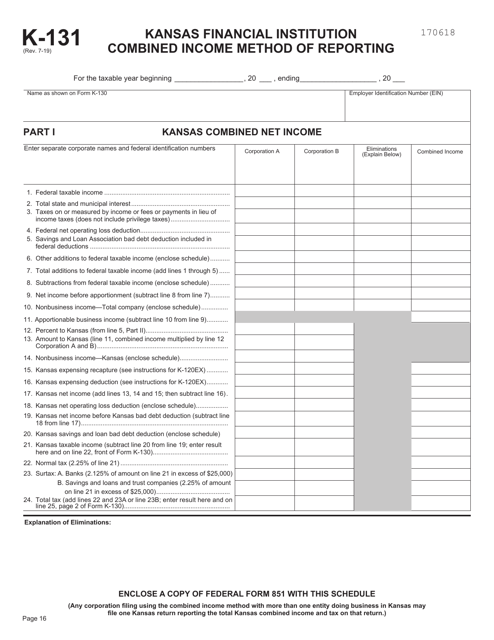

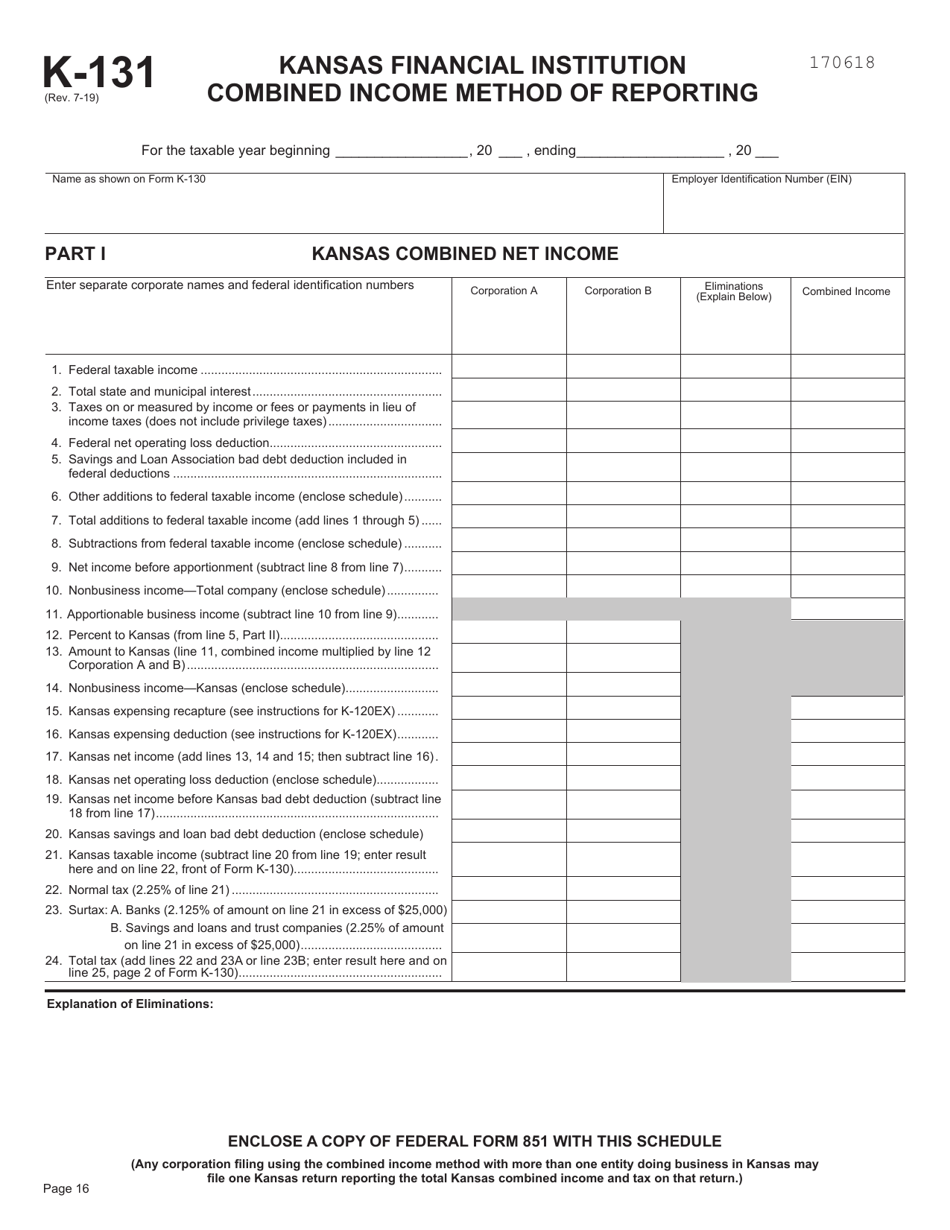

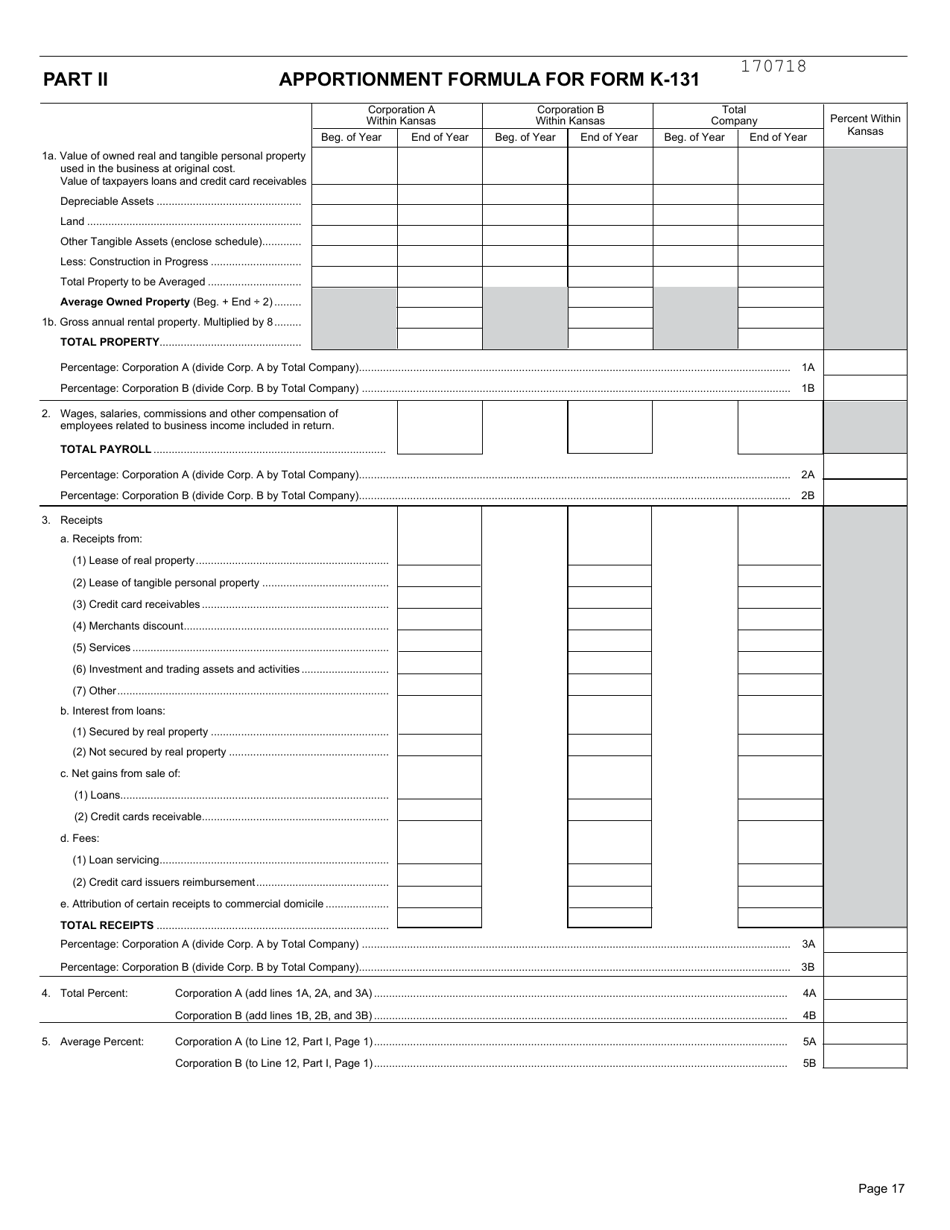

Form K-131

for the current year.

Form K-131 Kansas Financial Institution Combined Income Method of Reporting - Kansas

What Is Form K-131?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-131?

A: Form K-131 is a financial institution combined income method of reporting form for the state of Kansas.

Q: Who needs to file Form K-131?

A: Financial institutions in Kansas need to file Form K-131.

Q: What is the purpose of Form K-131?

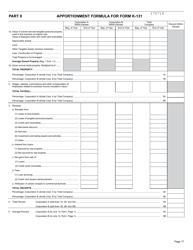

A: The purpose of Form K-131 is to report income and apportionment factors for financial institutions in Kansas.

Q: What is the combined income method of reporting?

A: The combined income method of reporting is a method used to determine the income of a financial institution based on a combination of the institution's federal taxable income and apportionment factors.

Q: Are all financial institutions required to use the combined income method of reporting?

A: No, not all financial institutions are required to use the combined income method of reporting. Some financial institutions may qualify for alternative methods of reporting.

Q: When is the deadline for filing Form K-131?

A: The deadline for filing Form K-131 is generally the same as the deadline for filing the financial institution's federal income tax return.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-131 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.