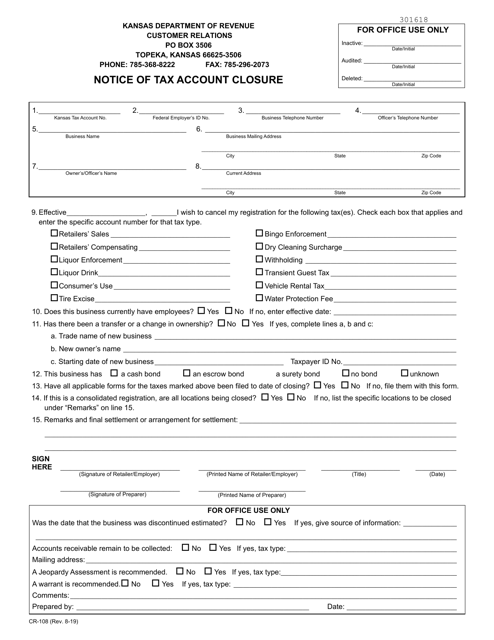

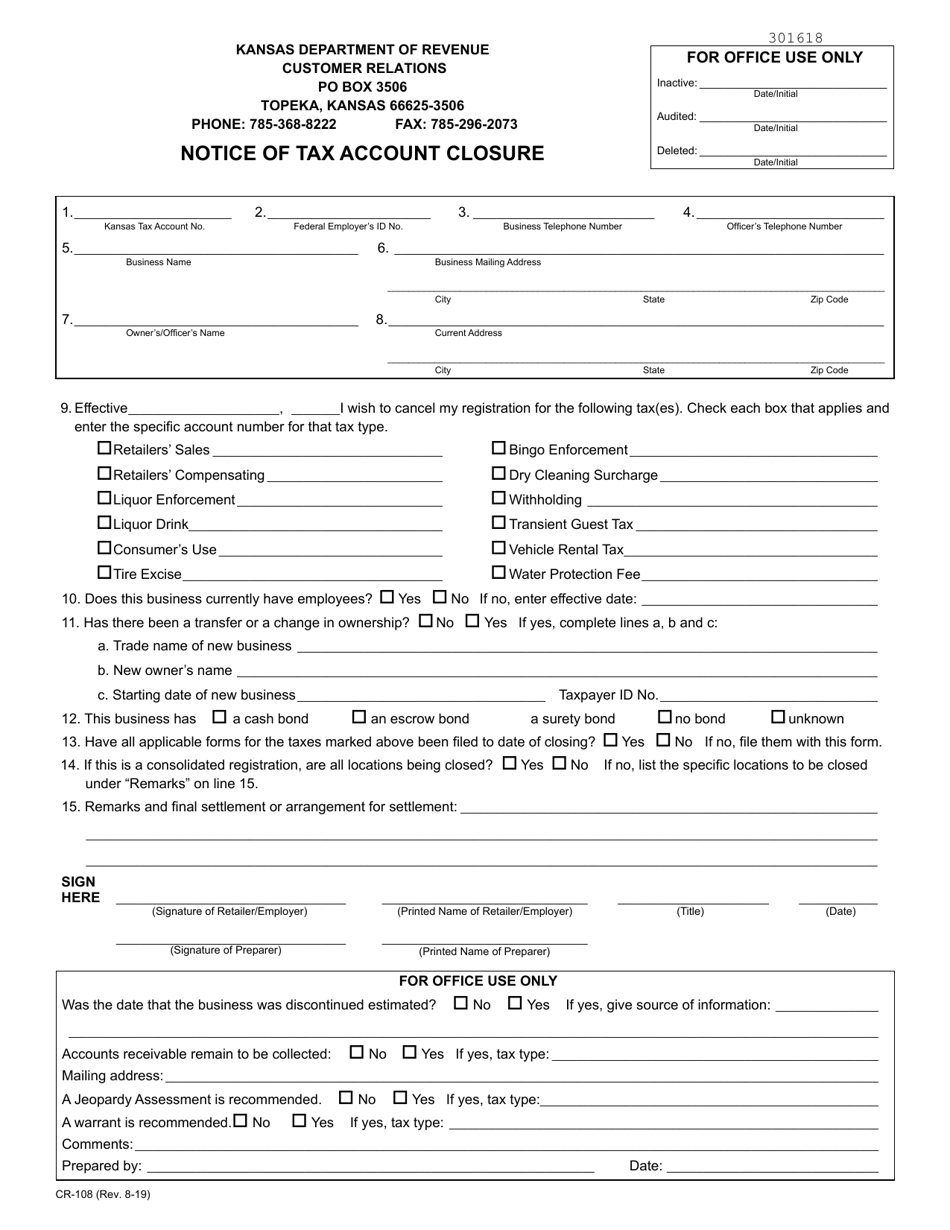

Form CR-108 Notice of Tax Account Closure - Kansas

What Is Form CR-108?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-108?

A: Form CR-108 is the Notice of Tax Account Closure for the state of Kansas.

Q: Who needs to file Form CR-108?

A: Form CR-108 needs to be filed by individuals or businesses who are closing their tax accounts in Kansas.

Q: When should Form CR-108 be filed?

A: Form CR-108 should be filed within 15 days of closing the tax account.

Q: Are there any fees associated with filing Form CR-108?

A: No, there are no fees associated with filing Form CR-108.

Q: What information needs to be included in Form CR-108?

A: Form CR-108 requires information such as the taxpayer's name, address, tax account number, and the reason for closure.

Q: What happens after filing Form CR-108?

A: After filing Form CR-108, the Kansas Department of Revenue will process the closure of your tax account and send you a confirmation.

Q: What if I have additional questions about Form CR-108?

A: If you have additional questions about Form CR-108, you can contact the Kansas Department of Revenue for assistance.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-108 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.