This version of the form is not currently in use and is provided for reference only. Download this version of

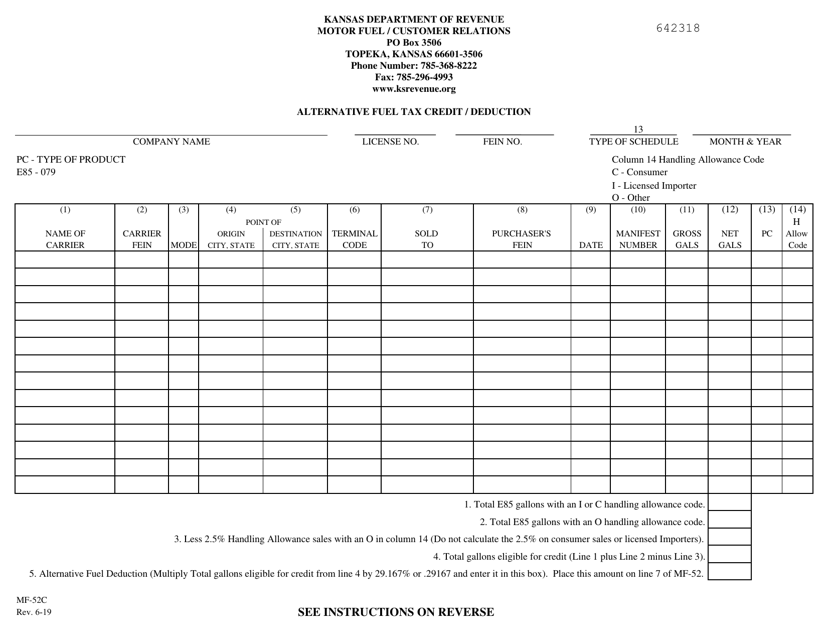

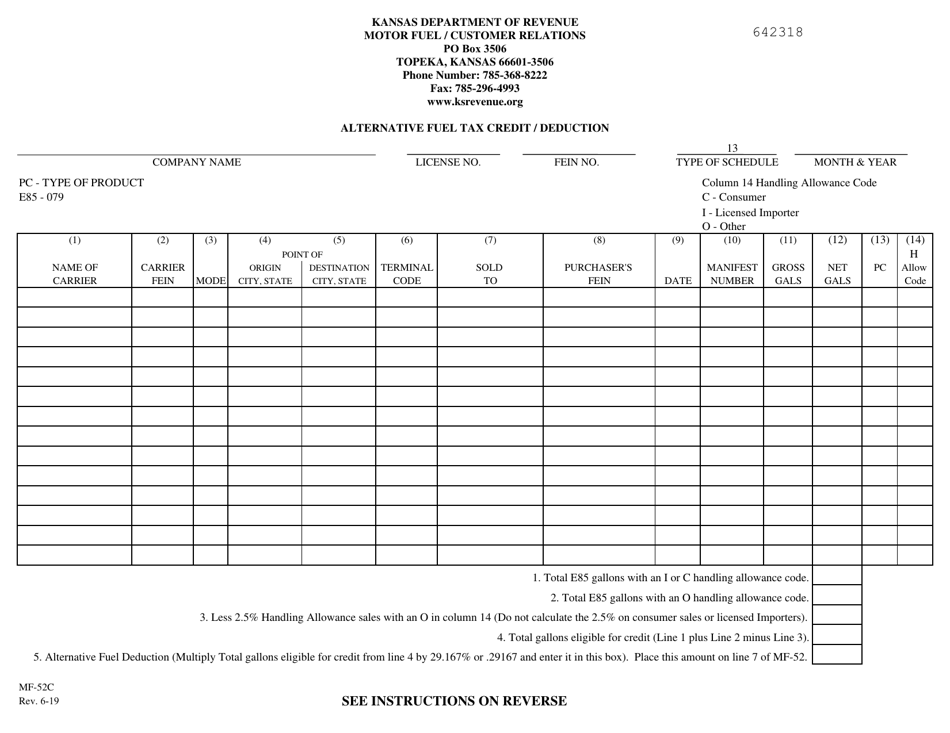

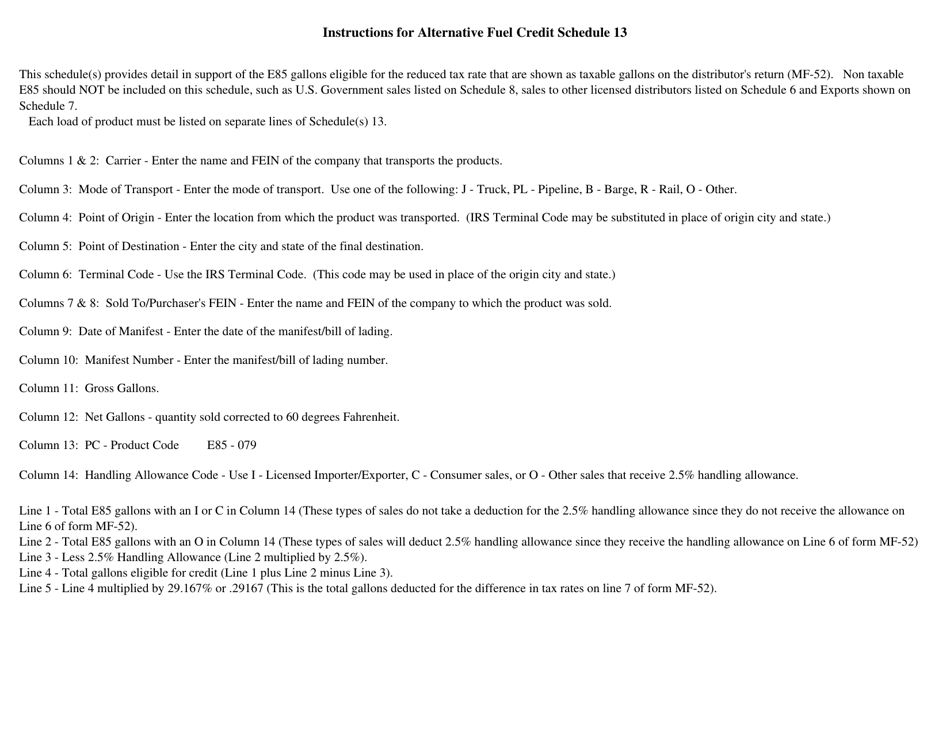

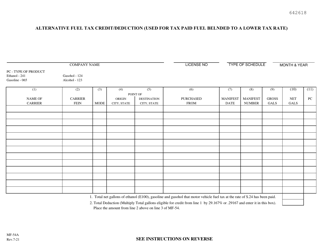

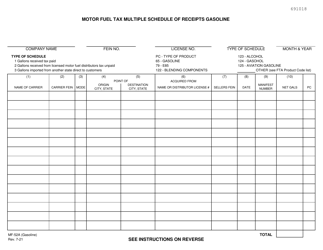

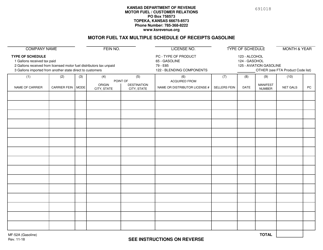

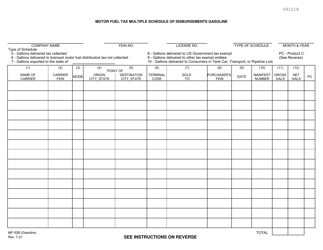

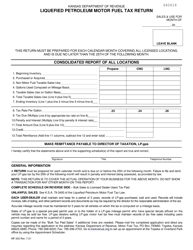

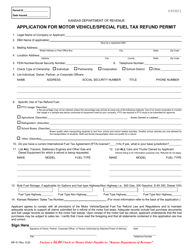

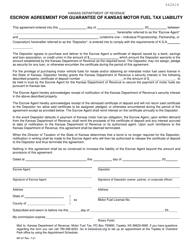

Form MF-52C Schedule 13

for the current year.

Form MF-52C Schedule 13 Alternative Fuel Tax Credit / Deduction - Kansas

What Is Form MF-52C Schedule 13?

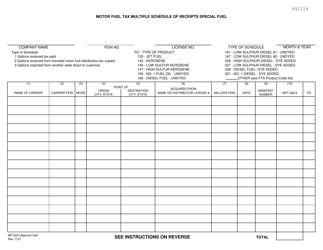

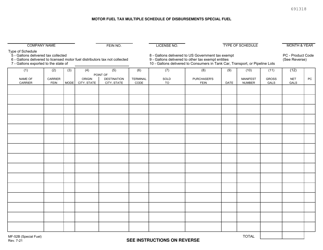

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-52C Schedule 13?

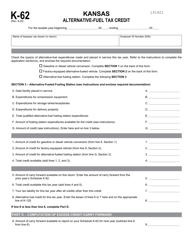

A: Form MF-52C Schedule 13 is a tax form used in Kansas to claim the Alternative Fuel Tax Credit or Deduction.

Q: What is the Alternative Fuel Tax Credit or Deduction?

A: The Alternative Fuel Tax Credit or Deduction is a tax incentive offered in Kansas to encourage the use of alternative fuels, such as biodiesel or ethanol.

Q: Who is eligible to claim the Alternative Fuel Tax Credit or Deduction?

A: Individuals, businesses, and organizations in Kansas that use alternative fuels in their vehicles or equipment may be eligible to claim this credit or deduction.

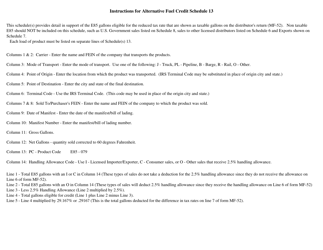

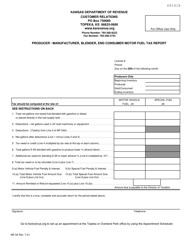

Q: How do I fill out Form MF-52C Schedule 13?

A: You will need to provide information about the type and quantity of alternative fuels used, as well as any supporting documentation such as receipts or invoices.

Q: When is the deadline to file Form MF-52C Schedule 13?

A: The deadline to file Form MF-52C Schedule 13 is typically April 15th of the following year.

Q: Can I claim the Alternative Fuel Tax Credit or Deduction if I do not live in Kansas?

A: No, the Alternative Fuel Tax Credit or Deduction is specific to Kansas residents and businesses.

Q: Is the Alternative Fuel Tax Credit or Deduction refundable?

A: Yes, the Alternative Fuel Tax Credit is refundable, meaning you may receive a refund if the credit exceeds your tax liability.

Q: What documents should I keep as proof of my Alternative Fuel Tax Credit or Deduction?

A: You should keep records such as receipts, invoices, and any other supporting documentation that shows the type and quantity of alternative fuels used.

Q: Are there any limitations or restrictions on the Alternative Fuel Tax Credit or Deduction?

A: Yes, there may be limitations or restrictions on the amount of credit or deduction that can be claimed, as well as specific requirements for eligible alternative fuels.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-52C Schedule 13 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.