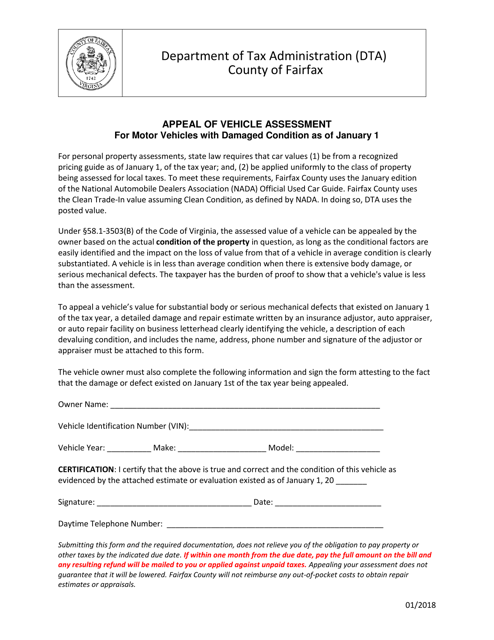

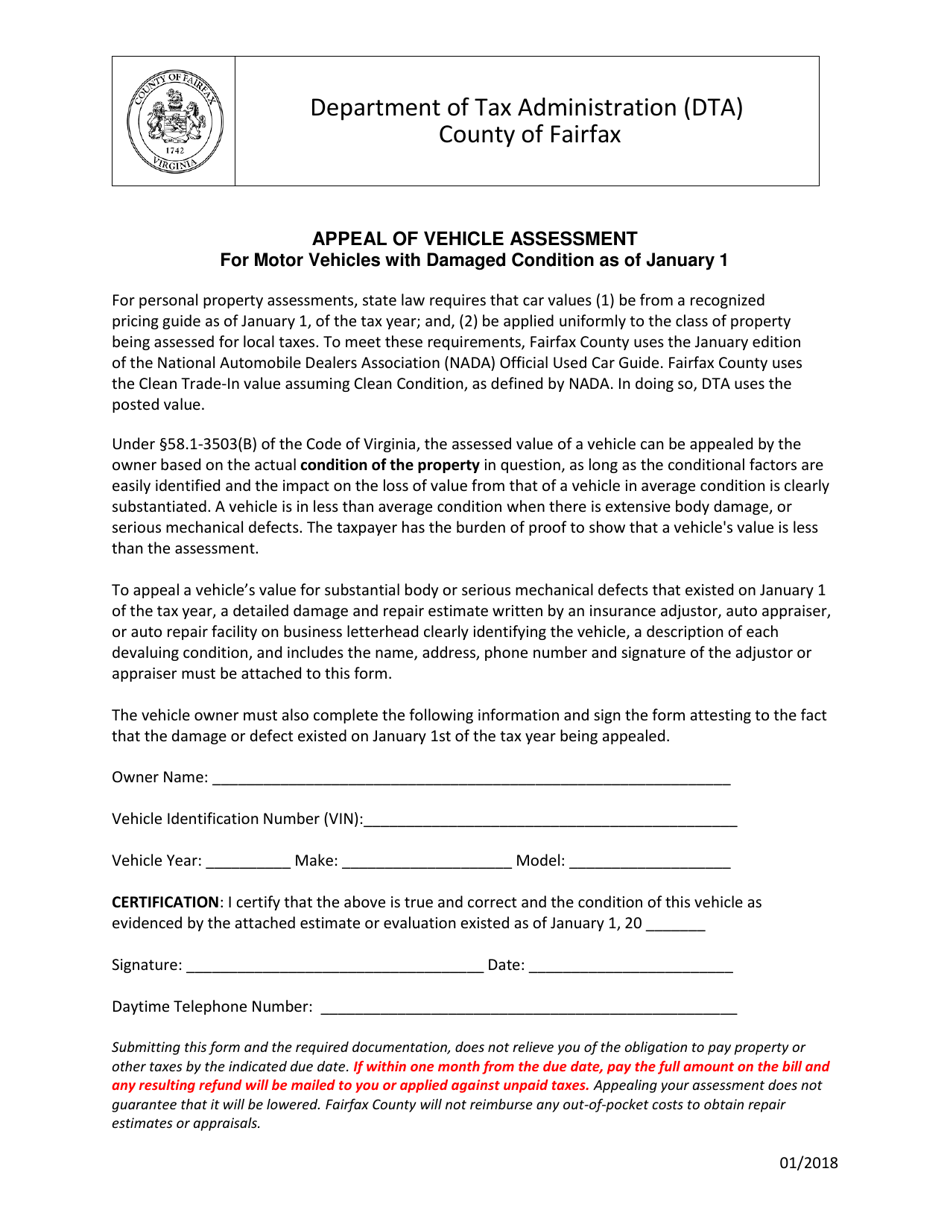

Appeal of Vehicle Assessment for Motor Vehicles With Damaged Condition as of January 1 - Fairfax County, Virginia

Appeal of Vehicle Assessment for Motor Vehicles With Damaged Condition as of January 1 is a legal document that was released by the Department of Tax Administration - Fairfax County, Virginia - a government authority operating within Virginia. The form may be used strictly within Fairfax County.

FAQ

Q: What is a Vehicle Assessment Appeal?

A: A Vehicle Assessment Appeal is a process for challenging the value assigned to a motor vehicle for tax assessment purposes.

Q: Who can appeal a Vehicle Assessment?

A: Any vehicle owner in Fairfax County, Virginia can appeal their vehicle assessment.

Q: When can I appeal a Vehicle Assessment?

A: You can appeal a Vehicle Assessment starting January 1 and before the deadline specified by the county.

Q: How can I appeal a Vehicle Assessment?

A: To appeal a Vehicle Assessment, you need to complete an appeal form and submit it to the Fairfax County Department of Tax Administration.

Q: What is the process for a Vehicle Assessment Appeal?

A: Once you submit the appeal form, the Department of Tax Administration will review your case and notify you of their decision.

Q: What are the possible outcomes of a Vehicle Assessment Appeal?

A: The Department of Tax Administration can either uphold the original assessment value, reduce the value, or increase the value based on the appeal.

Q: Are there any fees associated with a Vehicle Assessment Appeal?

A: No, there are no fees associated with filing a Vehicle Assessment Appeal.

Q: Can I appeal the decision of a Vehicle Assessment Appeal?

A: Yes, if you disagree with the Department of Tax Administration's decision, you can further appeal to the Board of Equalization.

Form Details:

- Released on January 1, 2018;

- The latest edition currently provided by the Department of Tax Administration - Fairfax County, Virginia;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Tax Administration - Fairfax County, Virginia.