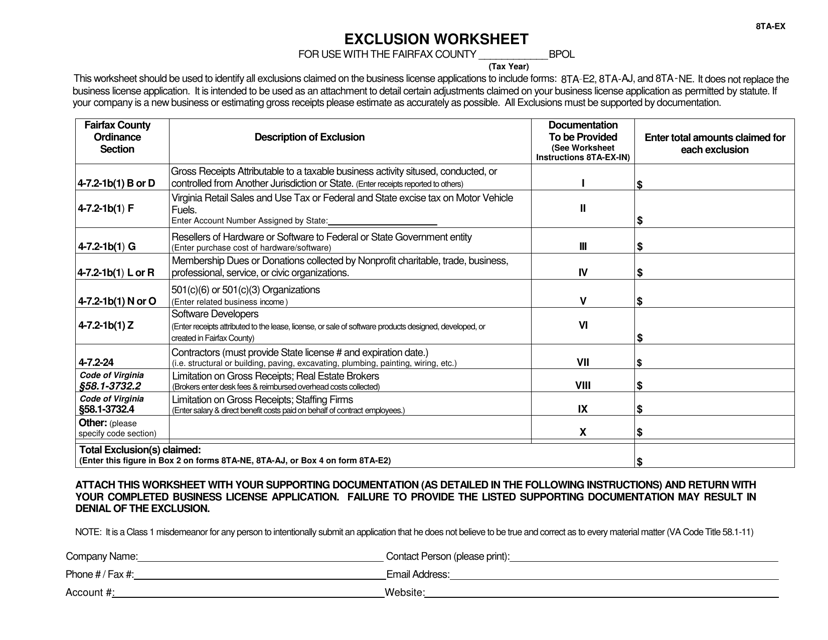

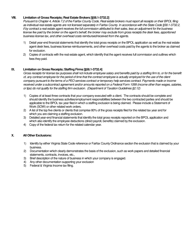

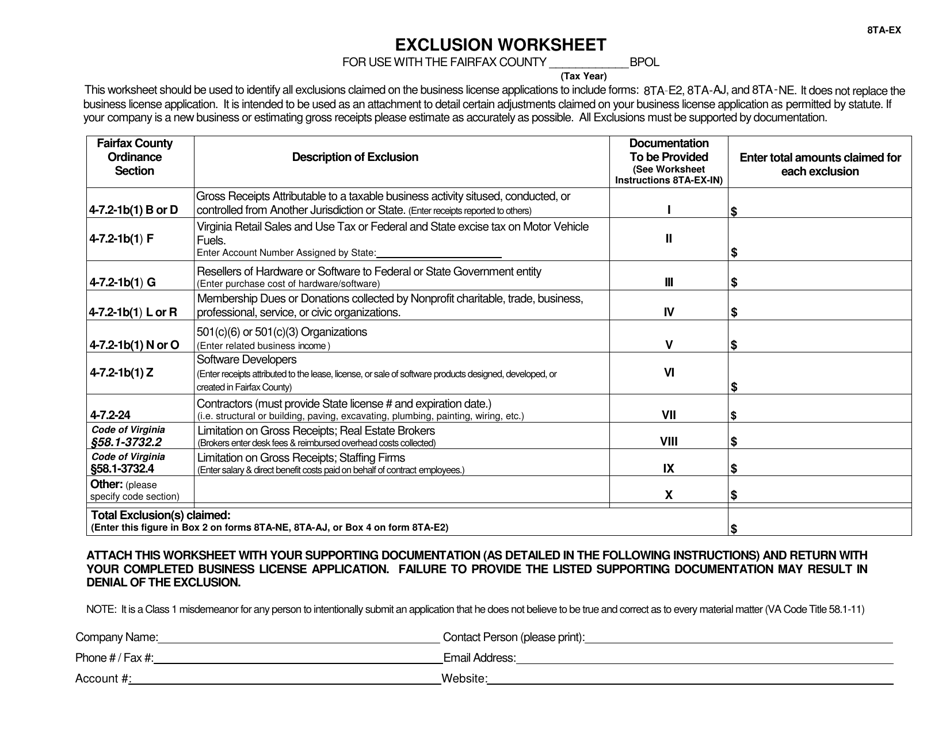

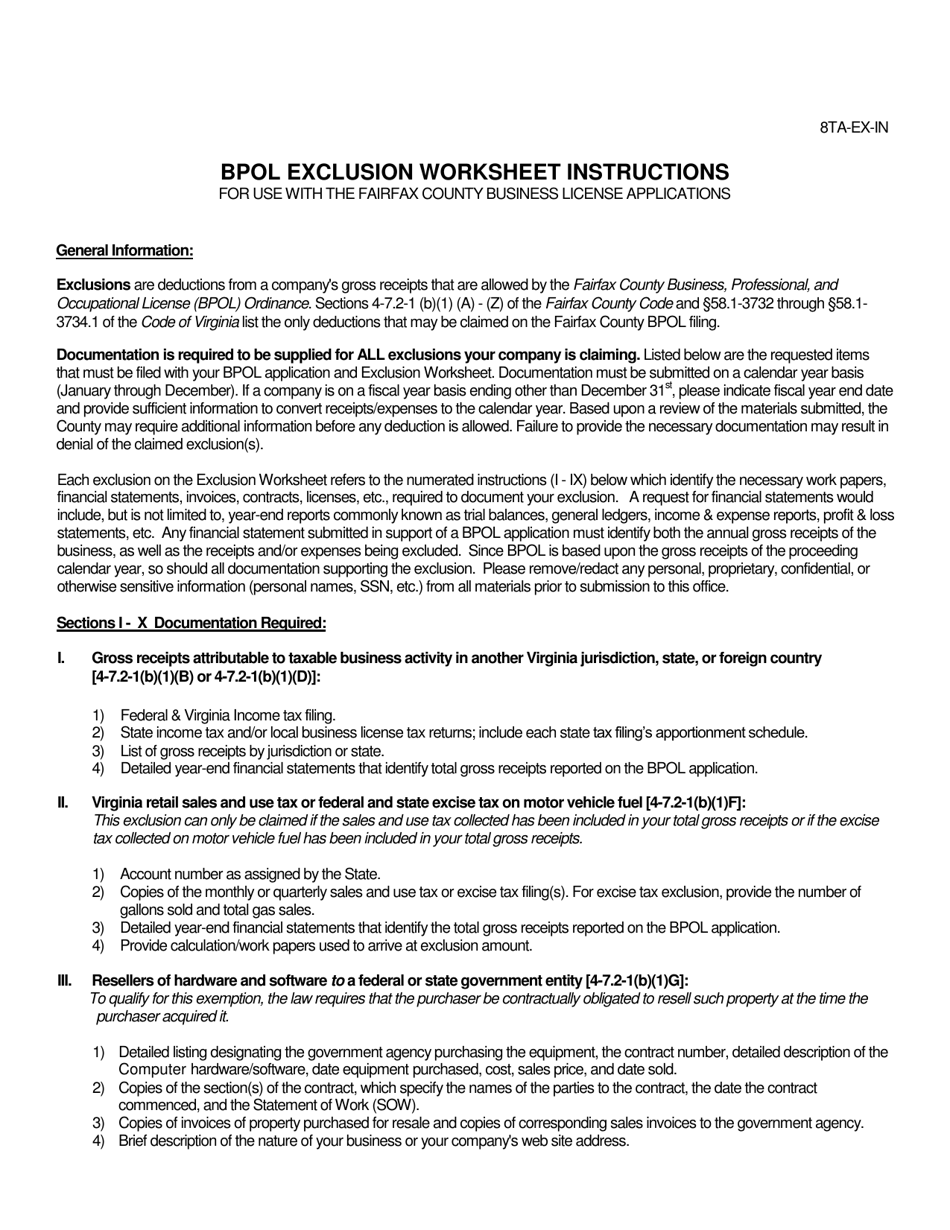

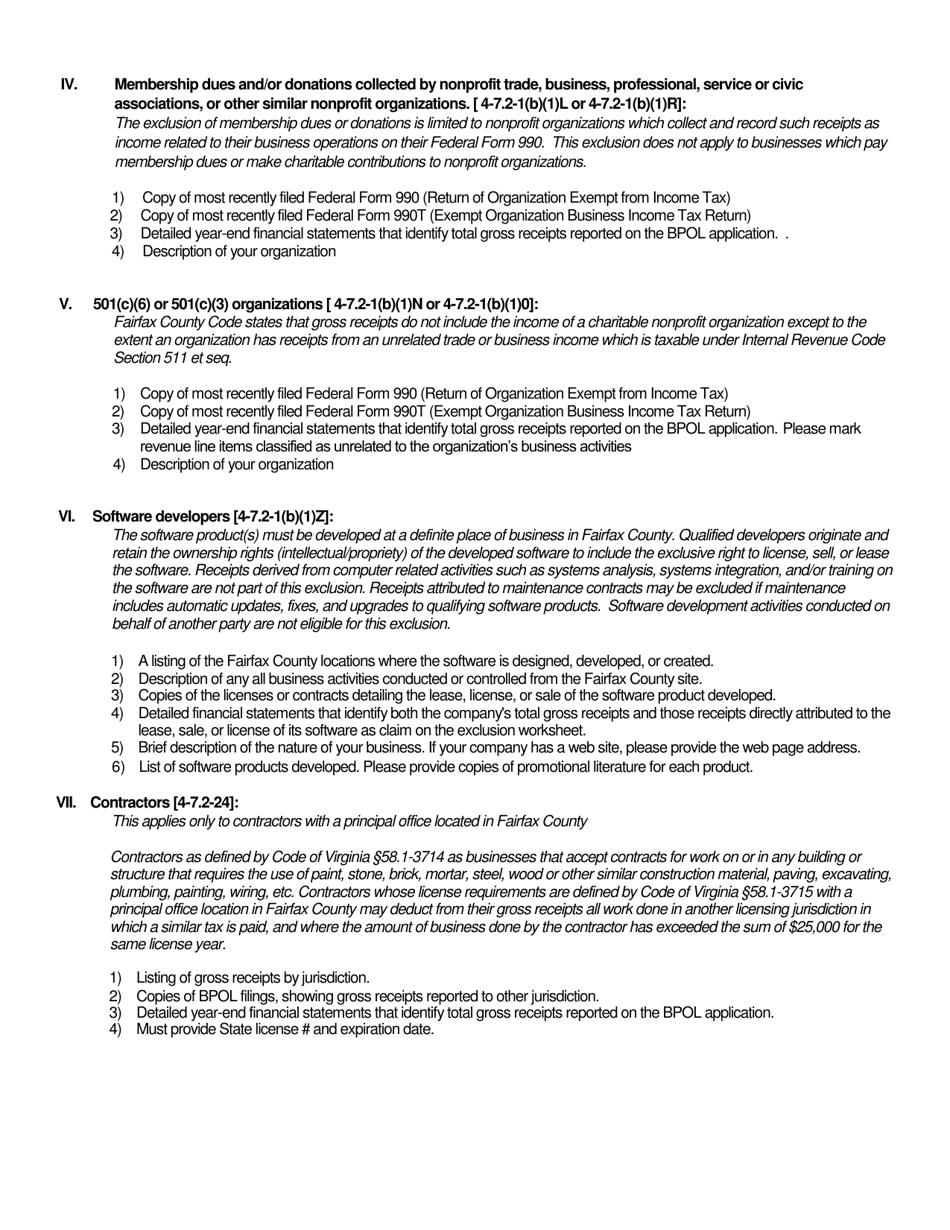

Form 8TA-EX Exclusion Worksheet - Fairfax County, Virginia

What Is Form 8TA-EX?

This is a legal form that was released by the Department of Tax Administration - Fairfax County, Virginia - a government authority operating within Virginia. The form may be used strictly within Fairfax County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

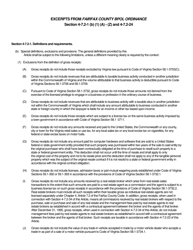

Q: What is Form 8TA-EX?

A: Form 8TA-EX is an exclusion worksheet used in Fairfax County, Virginia.

Q: What is the purpose of Form 8TA-EX?

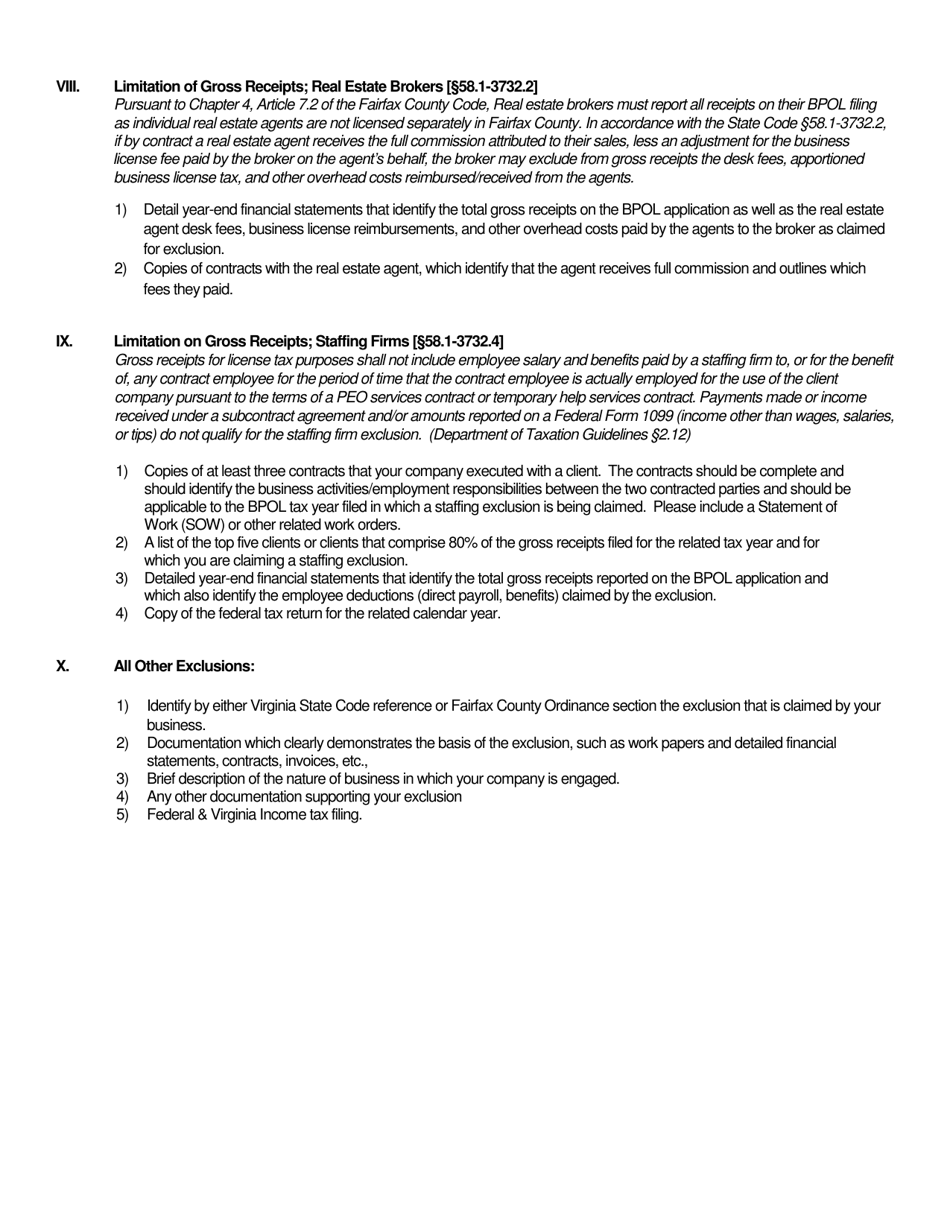

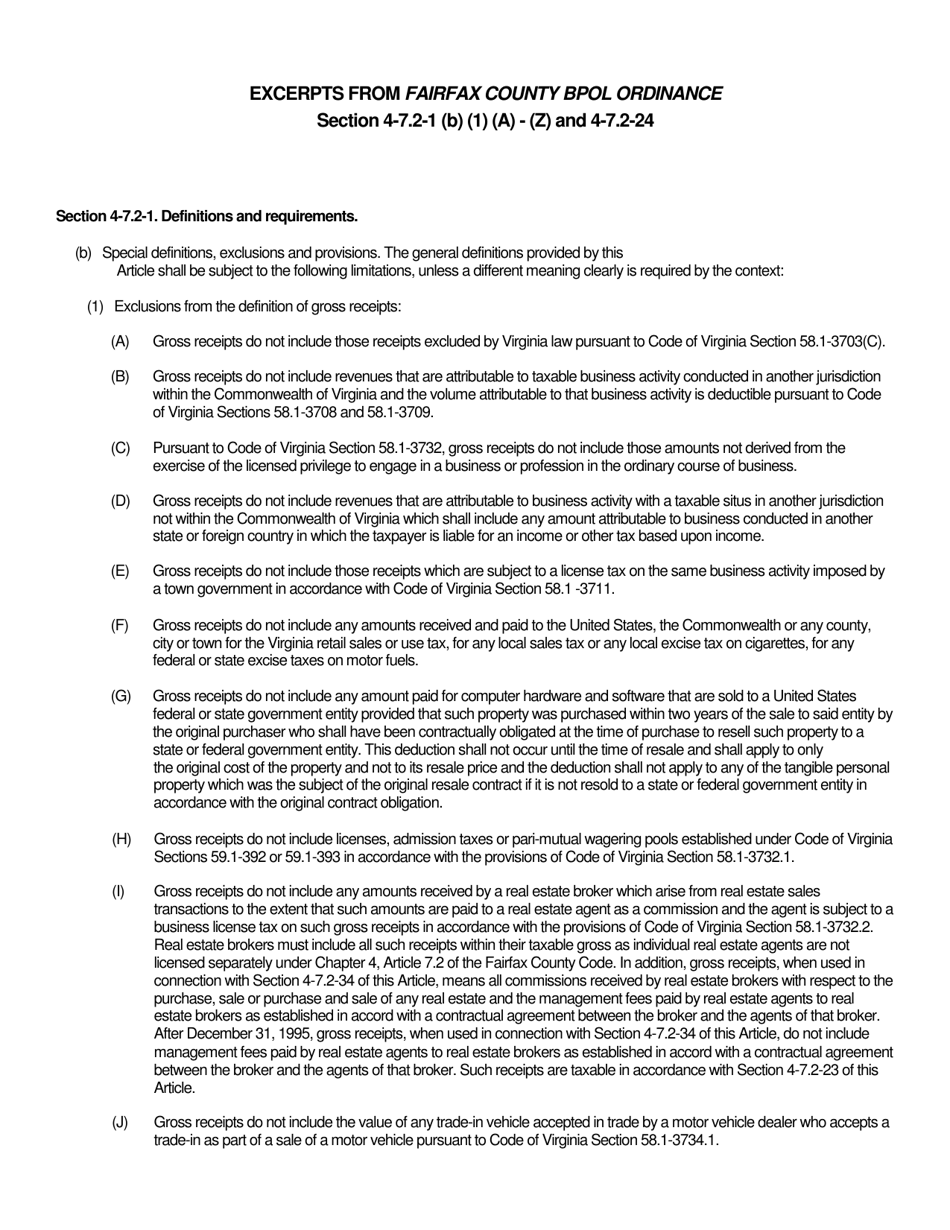

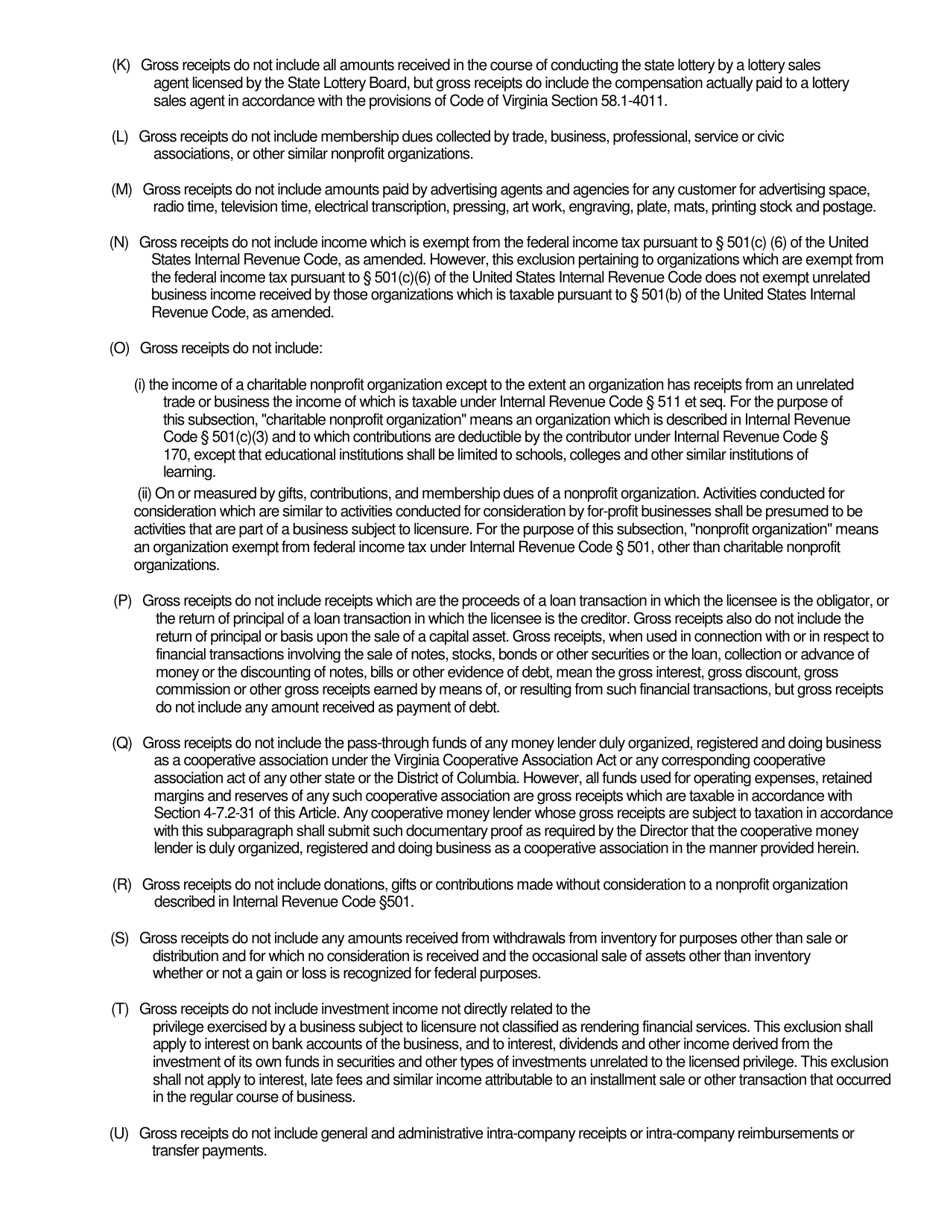

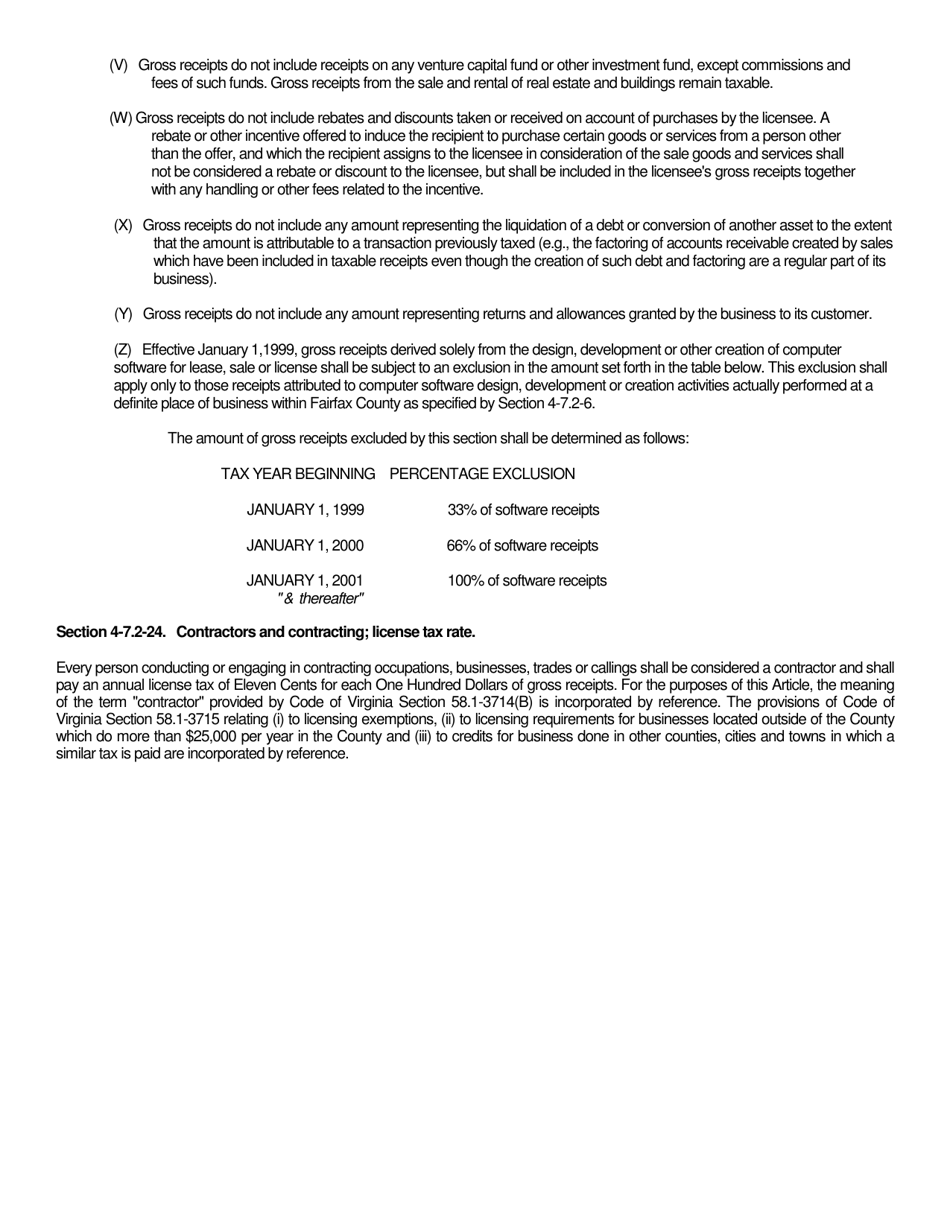

A: The purpose of Form 8TA-EX is to determine if a property is eligible for certain tax exclusions in Fairfax County, Virginia.

Q: Who uses Form 8TA-EX?

A: Property owners in Fairfax County, Virginia use Form 8TA-EX.

Q: What does the Form 8TA-EX determine?

A: Form 8TA-EX determines whether a property is eligible for tax exclusions in Fairfax County, Virginia.

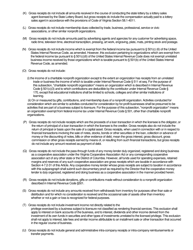

Q: Are there any fees associated with Form 8TA-EX?

A: There are no fees associated with submitting Form 8TA-EX in Fairfax County, Virginia.

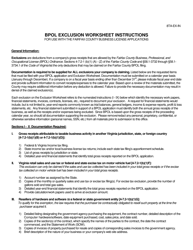

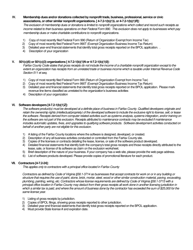

Q: What are some common tax exclusions in Fairfax County?

A: Some common tax exclusions in Fairfax County include the elderly and disabled tax relief program, veterans and surviving spouses tax relief program, and agricultural and forestal district program.

Q: How long does it take to process Form 8TA-EX?

A: The processing time for Form 8TA-EX in Fairfax County, Virginia varies, but generally takes several weeks.

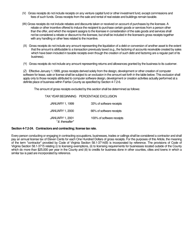

Q: What should I do if my property is not eligible for tax exclusions?

A: If your property is not eligible for tax exclusions, you will need to pay the full property tax amount.

Q: Can I appeal the decision on Form 8TA-EX?

A: Yes, if you disagree with the decision on Form 8TA-EX, you can file an appeal with the local tax assessment office in Fairfax County, Virginia.

Form Details:

- The latest edition provided by the Department of Tax Administration - Fairfax County, Virginia;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 8TA-EX by clicking the link below or browse more documents and templates provided by the Department of Tax Administration - Fairfax County, Virginia.