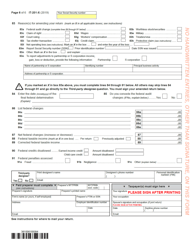

This version of the form is not currently in use and is provided for reference only. Download this version of

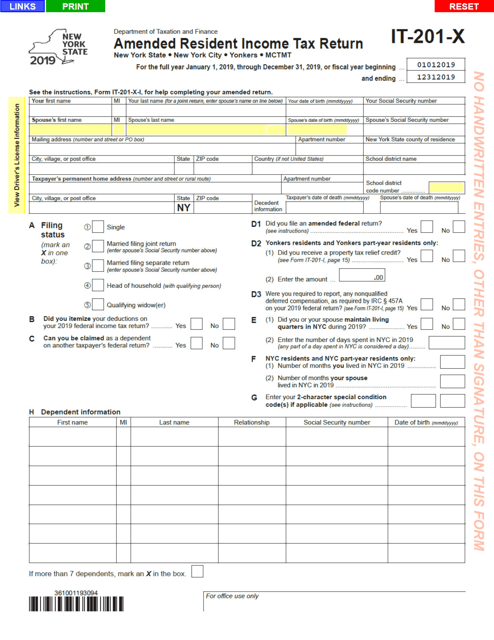

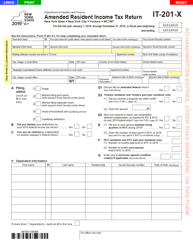

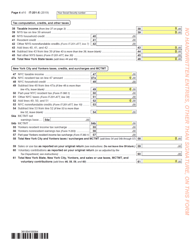

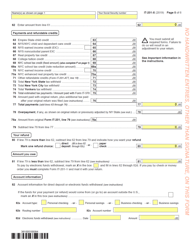

Form IT-201-X

for the current year.

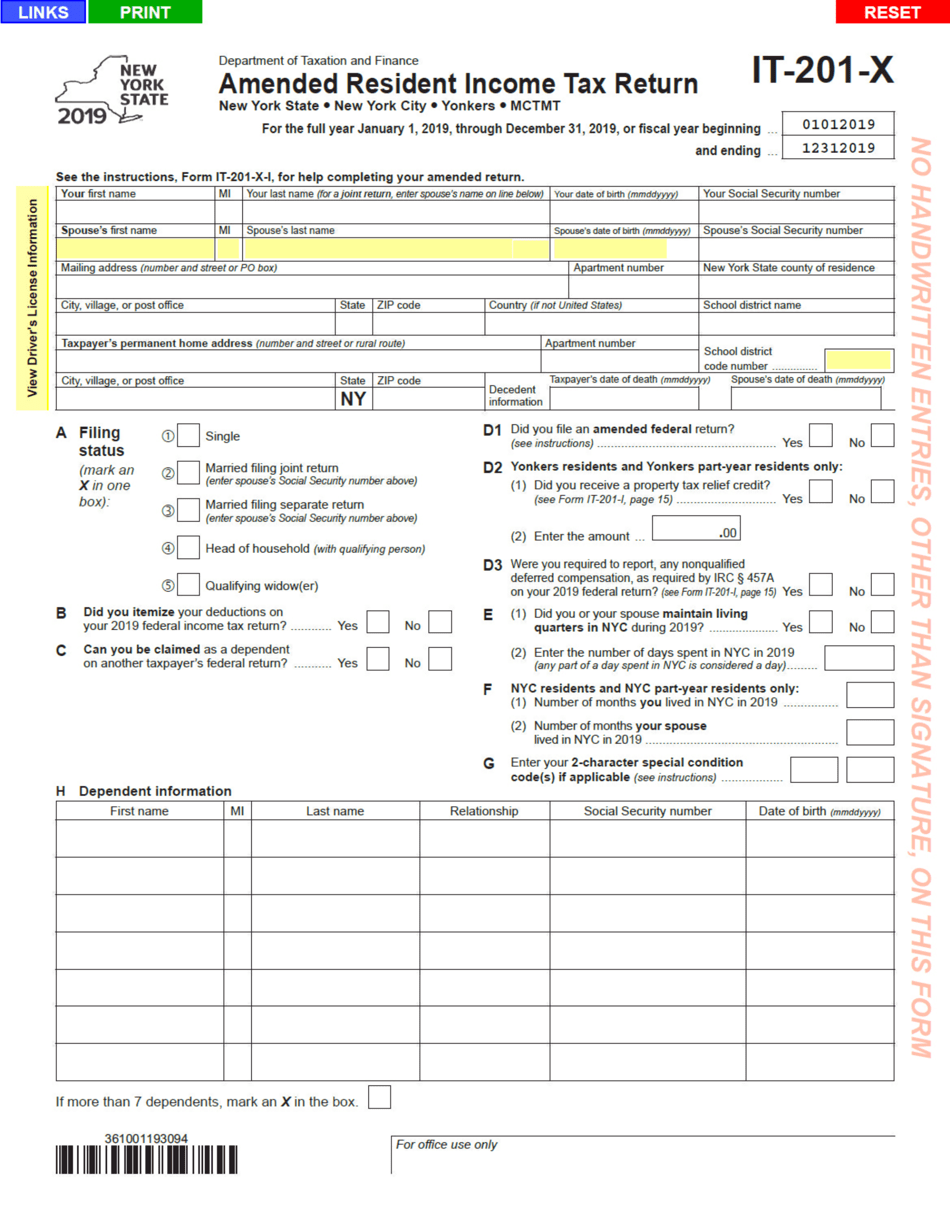

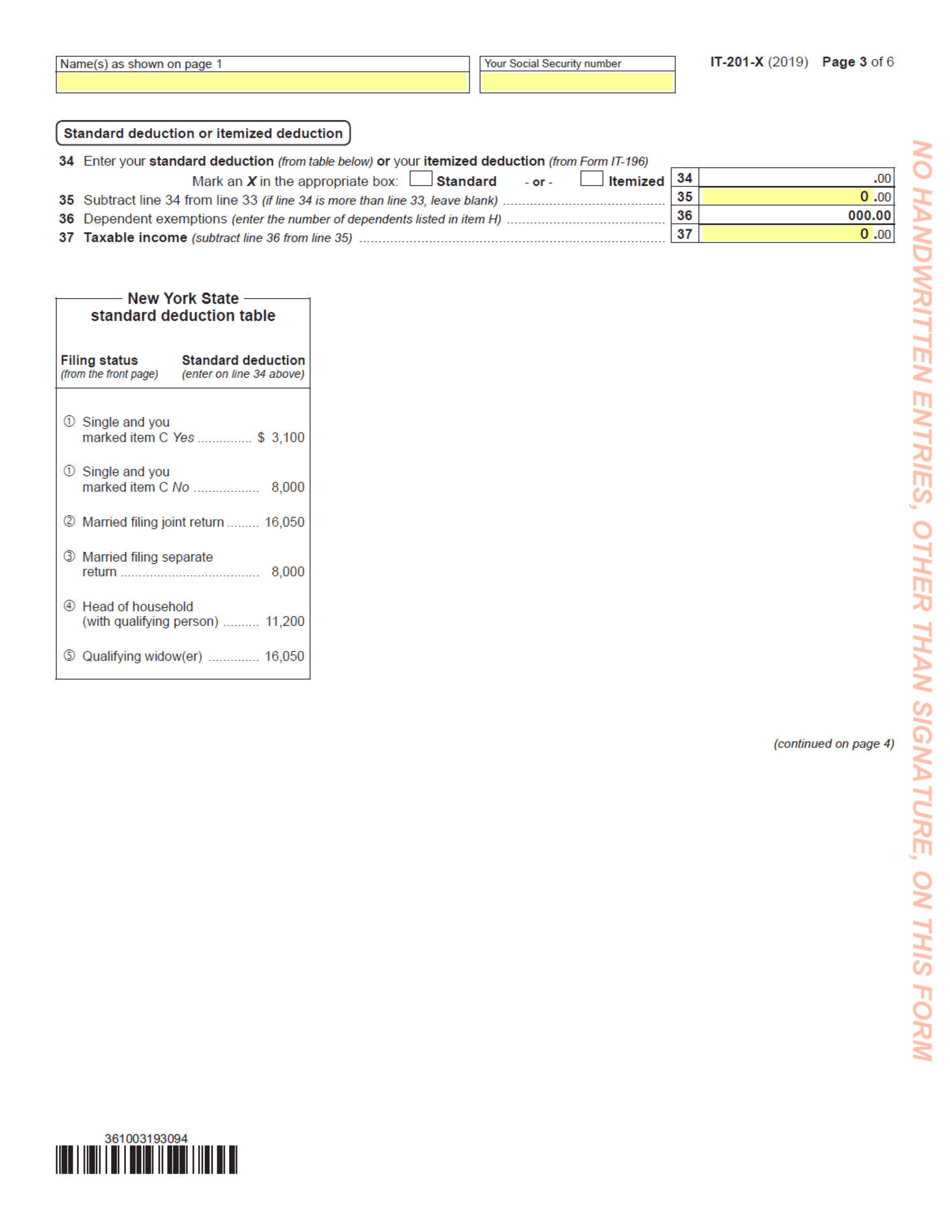

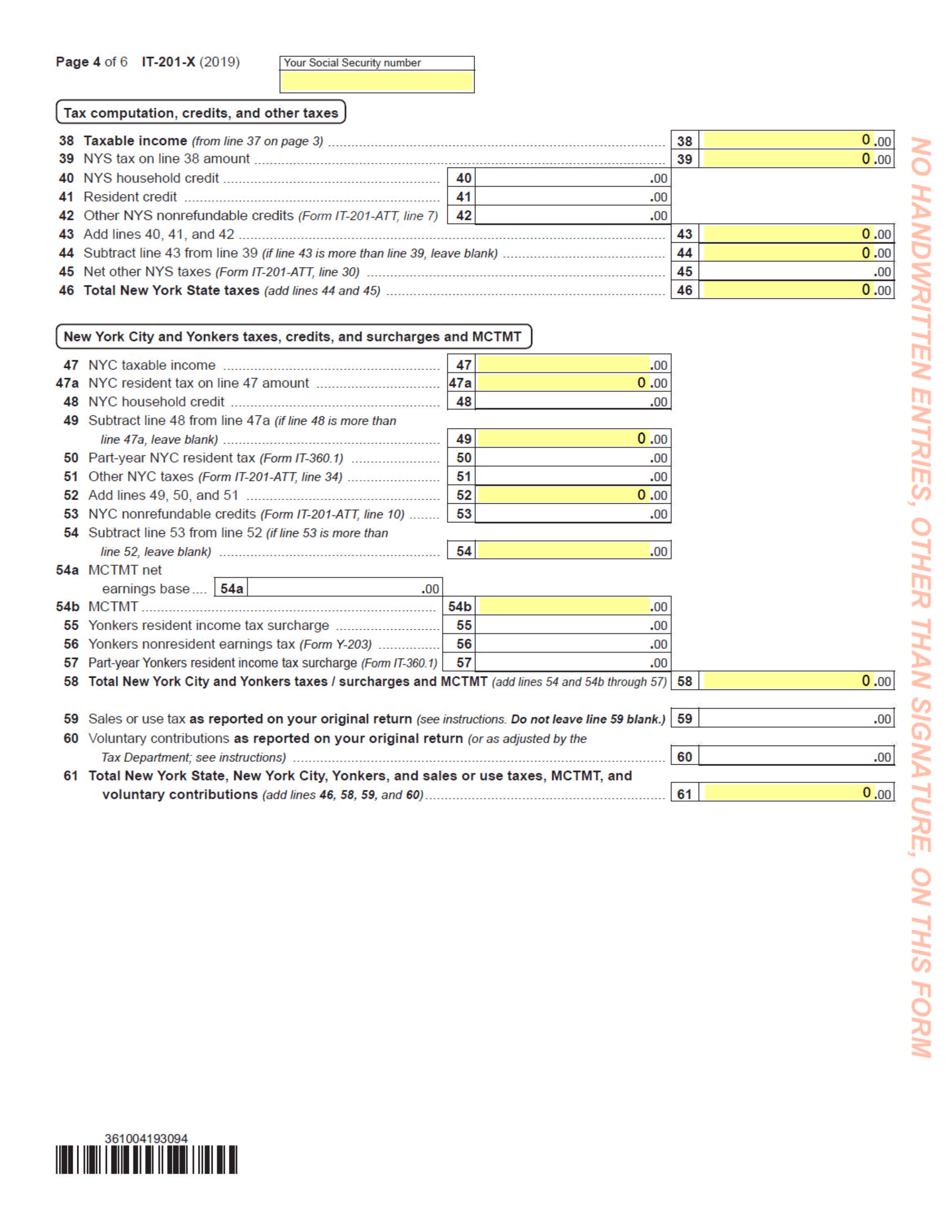

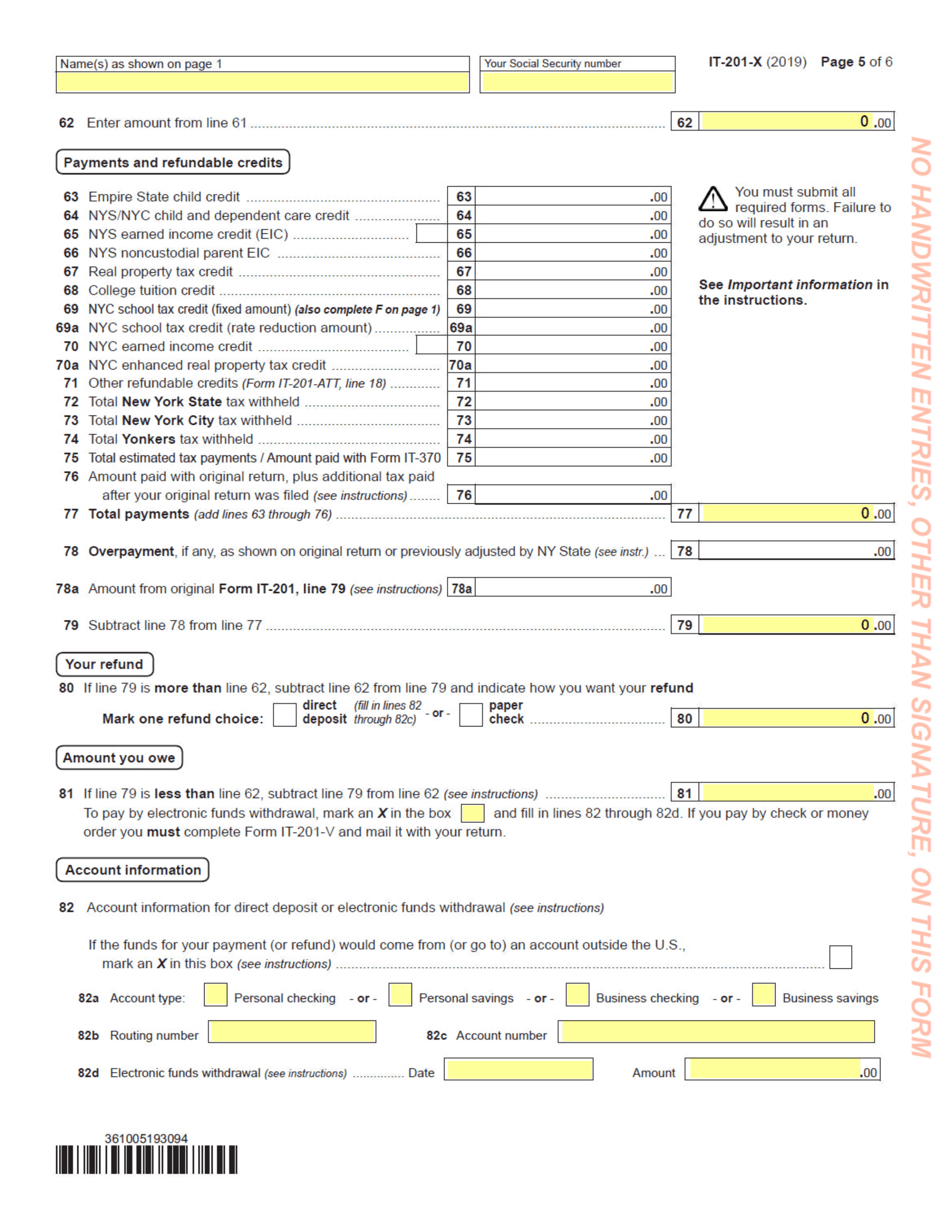

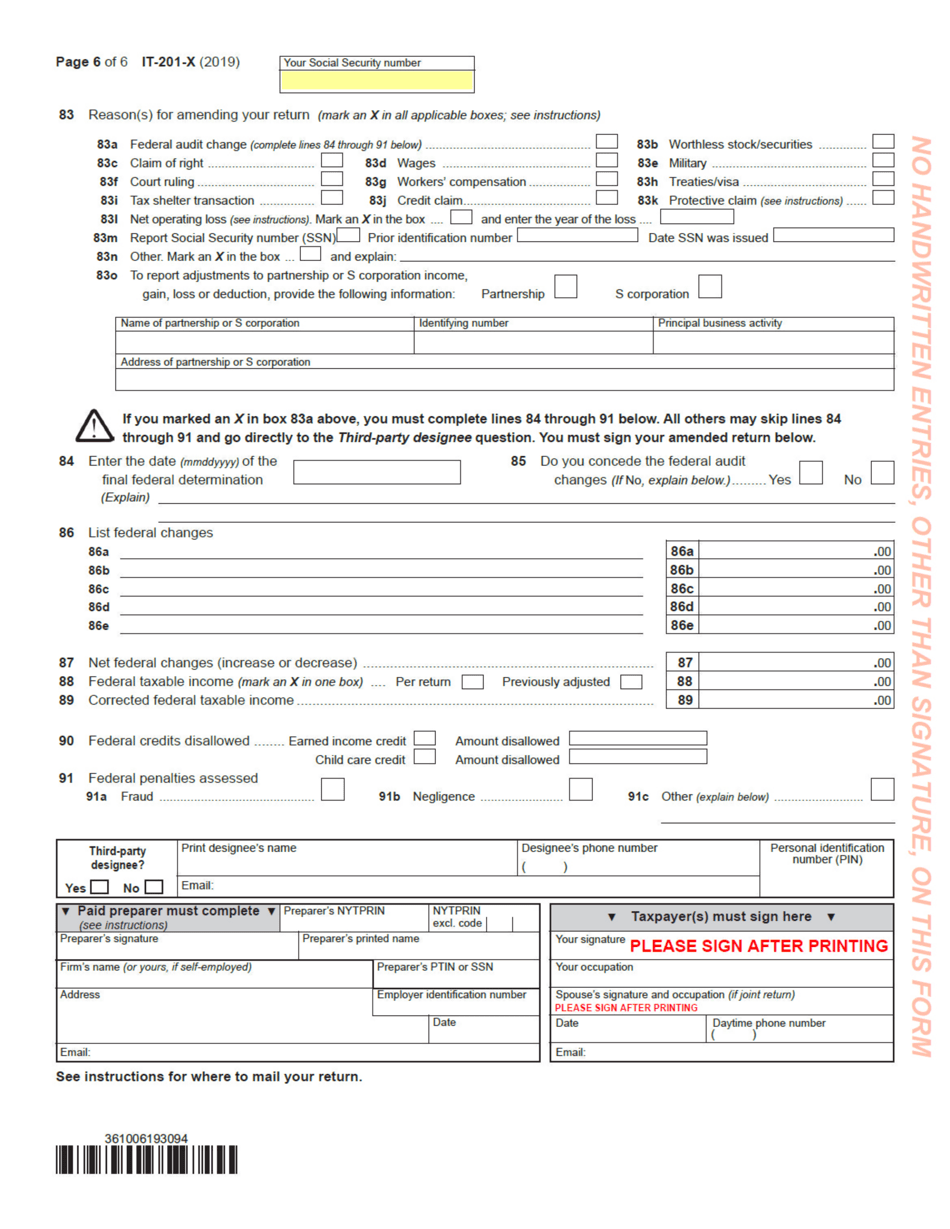

Form IT-201-X Amended Resident Income Tax Return - New York

What Is Form IT-201-X?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-201-X?

A: Form IT-201-X is the Amended Resident Income Tax Return for New York.

Q: Who needs to file Form IT-201-X?

A: Anyone who needs to correct or amend their previously filed New York resident income tax return should file Form IT-201-X.

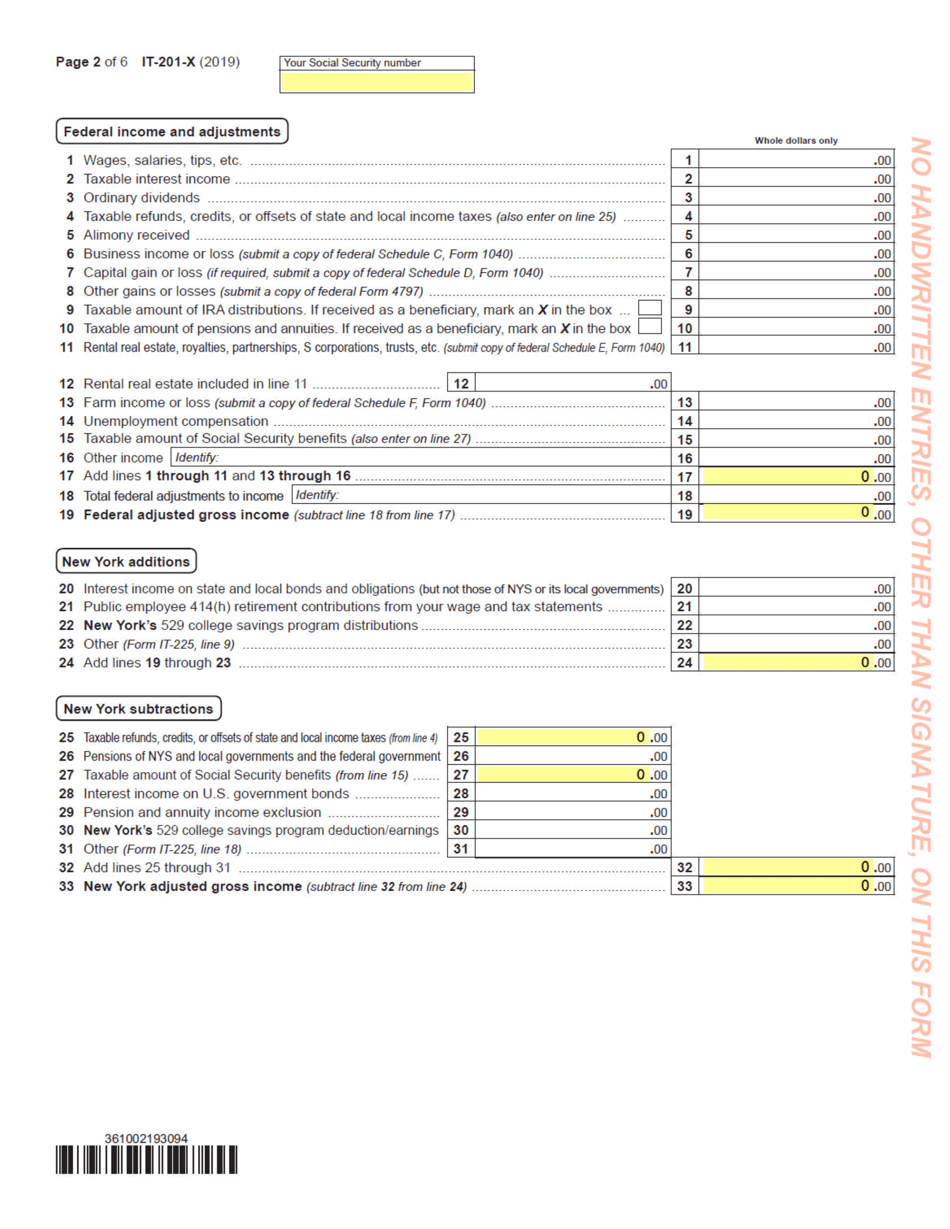

Q: What information do I need to complete Form IT-201-X?

A: You will need your original Form IT-201, as well as any supporting documentation for the changes you are making.

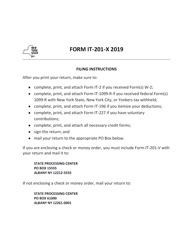

Q: Can I e-file Form IT-201-X?

A: No, Form IT-201-X must be filed by mail.

Q: Is there a deadline to file Form IT-201-X?

A: Yes, you must file Form IT-201-X within three years from the original due date of the return or within two years from the date you paid the tax, whichever is later.

Q: What should I do if I owe additional tax after filing Form IT-201-X?

A: You should include payment for any additional tax owed with your amended return.

Q: What should I do if I made a mistake on my amended return?

A: If you realize you made a mistake on your amended return, you should file another Form IT-201-X to correct the error.

Q: Is there a fee for filing Form IT-201-X?

A: No, there is no fee for filing Form IT-201-X.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-201-X by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.